China's anti-extravagance mandates hit restaurants and liquor sectors

What happened and how severe is the impact on sales?

What happened?

Recently, China has renewed its anti-extravagance and anti-alcohol campaigns, a move that is significantly reshaping the offline catering, dining, and alcohol industries.

In May, the newly revised "Regulations on Promoting Frugality and Opposing Waste in Party and Government Organizations 党政机关厉行节约反对浪费条例" was released, enforcing restrictions on extravagant and wasteful practices among government officials and staff, including strict controls on conference fees, promoting energy-saving technologies, and, most influentially, curbing luxury consumption such as alcohol and expensive dishes during receptions.

Although anti-alcohol and anti-extravagance policies have been implemented in China before (as early as 2012's "八项规定 Eight-Point Regulation," a set of rules aimed at instilling more discipline among CCP members to tackle "practices of extravagance, formalism, and bureaucracy"), many call this latest order the "strictest ever."

For instance, for the first time, the mandate has been broadened to include some eligible public institutions , in addition to government officials.

But what makes it the "strictest ever" is that some local governments, or even some state-owned enterprises (SOEs), have pushed the mandate to the "overdone" side.

China's policy landscape often functions like a "pendulum", figuratively speaking. Directives from the highest levels of government—initially aimed at correcting lavish practices, such as the notorious drinking culture at business banquets—can get magnified when they reach the institutions responsible for implementation. This tendency to over-enforce often prompts local authorities, particularly in smaller towns and remote districts, to adopt the "safest option" by implementing the strictest possible measures. This approach guarantees compliance and minimizes the risk of unintended political repercussions, even if it leads to exaggerated impacts on the ground.

For instance, the original order from the central government—"no alcohol during working hours"—was interpreted by some local authorities as "a 24-hour alcohol ban on working days", with some even requiring pre-approval to drink during weekends or holidays.

In some cases, public receptions were conflated with private gatherings, resulting in rules like "report any meal with more than three people" or "private alcohol consumption requires prior approval." In extreme cases, gatherings with more than two people were subject to registration and approval requirements.

This has prompted many civil service workers, government staff, and even SOE employees—the so-called "within the system 体制内" group—to act with extreme caution for fear of being perceived as violating the rules and jeopardizing their careers.

Restaurants and alcohol consumption have become the most heavily impacted businesses

China's catering revenue in June grew by only 0.9%, according to National Bureau of Statistics, a drop of 5 percentage points from the previous month. This is also the lowest growth rate for catering revenue since 2023.

Meanwhile, the retail sales of tobacco and alcohol—another sector heavily driven by business related banquets and gift-giving—saw a rare decline. In June, sales totaled 51.6 billion RMB, down 0.7%, compared to an 11.2% year-on-year increase in May.

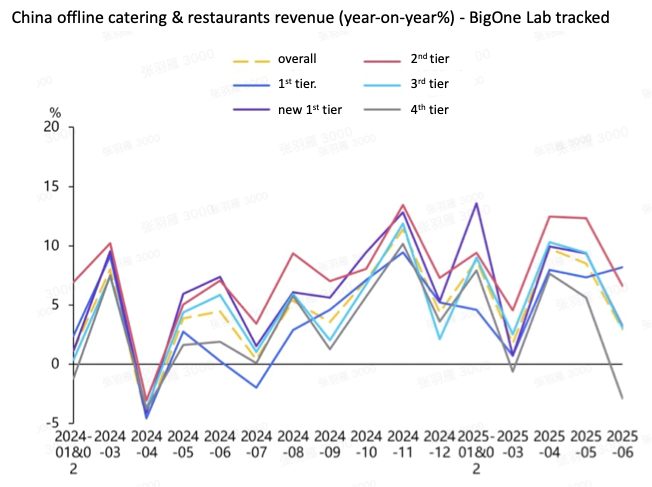

The slowdown in catering revenue was most pronounced in lower-tier cities. Unlike metropolises, where dining consumption is more diversified, restaurants in smaller towns—especially those hosting high-end business banquets—are more dependent on company funded consumption, either directly through business spending or indirectly through personal spending by government, public sectors and SOE employees.

For instance, as Caixin reported:

Song Yang, a restaurant owner, said that in his county—where the population is small and the social structure relatively simple—"Although small restaurants don't rely on official spending, if you want to have a meal with friends who work in the government or SOEs, they don't dare come out due to the 'alcohol ban'. Some of my peers have already started giving staff time off." [caixin]

According to the offline catering and restaurant revenue data we track, while first-tier cities (Beijing, Shanghai, Guangzhou, and Shenzhen) performed relatively well in terms of revenue growth, smaller cities experienced a rapid deceleration.

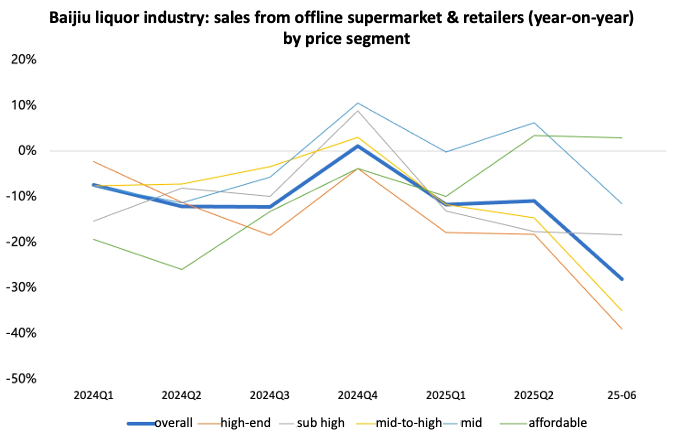

Baijiu, often referred to as "China's national liquor" due to its historical association with business banquets and its symbolism of social status and wealth, saw a year-on-year decline in offline sales revenue in June—except for products in the affordable price range. High-end and mid-to-high-end segments recorded steeper declines than the overall industry, as consumers turned away from funded banquets as well as other "legitimate but better-to-avoid" social occasions—even personal gatherings such as birthdays, anniversaries, and get-togethers with friends.

Key reflections

Behind the paywall, I will continue with some reflections on the latest developments in the anti-extravagance mandate, the June offline sales data for major liquor brands, and the implications for the market going forward.

*Our proprietary data tracks a nationwide sample of liquor stores, supermarkets, convenience stores, and restaurants to reflect offline consumption trends in China. For institutional clients interested in more in-depth analysis, please contact us, and we will connect you with the right team.