The 'iPhone moment' for smartglasses?

China's exponential growth of AR/AI smartglasses sales is here

*Disclaimer: this post is not sponsored by any company mentioned

The Signal

If you are looking for the next breakout consumer product in China, AI/AR smart glasses might finally be it.

For years, smart glasses were dismissed as pricey prototypes or novelties for tech YouTubers—not daily necessities for average consumers. Apple Vision Pro, while impressive, remains too heavy, too expensive, and too weird to wear in public.

But a shift has occurred.

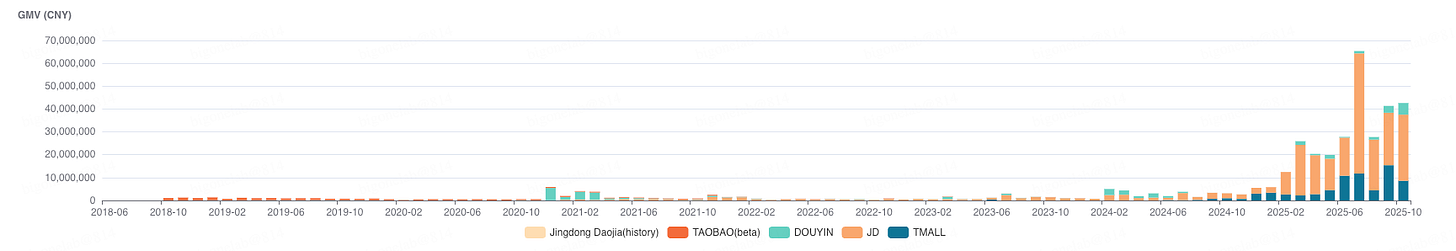

Data from BigOne Lab, Baiguan’s parent company, suggests we are witnessing the early innings of a platform shift. Since the second half of 2025, online sales of smart glasses have seen exponential growth, driven by new rollouts from market leaders like Xiaomi.

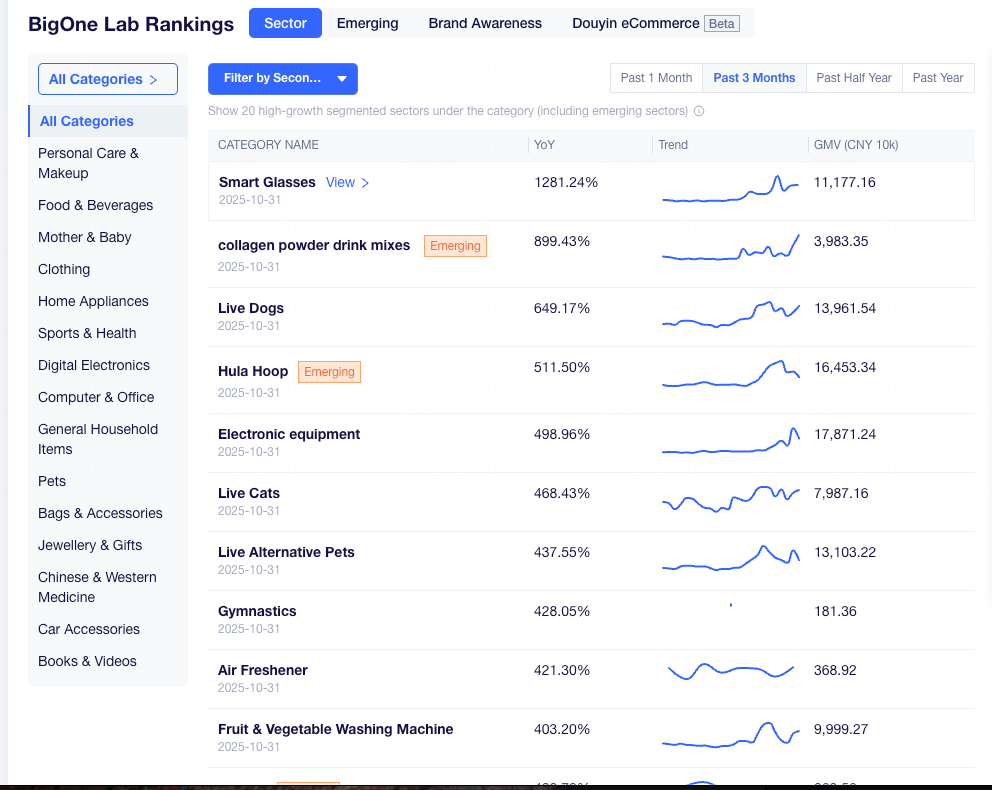

According to our tracking across major e-commerce platforms, smart glasses have consistently topped sales charts over the past three months, recording the fastest year-on-year growth across all categories.

From Niche to Mass Market

Why is this happening now?

As smartphone innovation stalls and hardware becomes a commodity, consumers are hungry for a new interface.

More importantly, affordability has materially improved in recent years. Decent AI glasses in China now retail for around just 1,500–3,000 RMB ($212–$424 USD). This is competitive when compared with overseas market leaders such as Meta’s latest Ray-Ban glasses (which are not officially sold in mainland China), which start around $299 USD for Gen1, over $400 for Gen 2, and $799 for the newest model that was launched this year. Manufacturing costs will likely decrease further in the long term as economies of scale kick in, thanks to China’s supply chain.

Battery life, camera quality, and, most importantly, real-world applications have also greatly improved. Beyond standard features like recording POV videos, real-time AI translation, navigation, and audio control, China has unlocked a unique but high-frequency use case: payments.

This September, Xiaomi AI Glasses received a firmware update adding the Alipay “look-and-pay” function. Users simply speak a command to the built-in voice assistant, look at a QR code, and the payment is confirmed via voice.

In a country where QR codes are everywhere, the ability to “look and pay” is a game-changer.

China’s national subsidy for consumer electronics has also lowered the bar for purchase. As demand for other consumer electronics like smartphones and home appliances slows while the subsidy effect fades, smart glasses could be starting their run as the next fastest-growing hardware category. These factors are colliding to turn a niche toy into an emerging mass-market product.

Behind the paywall, we continue to walk through the competitive landscape of AI/AR smart glasses in China, including current market leaders, their latest online sales, and supply chain beneficiaries.