Why IF Coconut Water won China by not acting like a beverage company

34% market share: lessons for market entrants

Overseas brands are losing their competitive edge in China. Bolstered by the nation's ascendant economy and industries, surging domestic confidence means foreign labels no longer automatically signify superior quality or elevated status. Instead, deeply insightful local players —armed with robust manufacturing, agile operations, and an intimate grasp of Chinese consumers—are capturing significant market share. We've explored how local brand Proya outmaneuvered global giant L'Oreal, and why Starbucks faltered badly in China – primarily its failure to adapt locally. While localization sounds straightforward, executing it effectively demands meticulous consumer insight and seamless integration across product development, operations, and marketing.

Against this backdrop, today's article highlights a successful overseas counterpoint: IF Coconut Water. Remarkably, this Thai brand has held China's coconut water crown for five consecutive years, commanding a staggering 34% market share in 2023. I'll decode IF's winning strategy through the timeless Chinese framework of "天时地利人和" (Timeliness, Geographic Advantage, Human Harmony).

天时 (Timeliness): Luckin Coffee's popular "生椰拿铁/Coconut Latte" and Vita Coco's widespread ads successfully educated Chinese consumers about coconut beverages, paving the way for IF's entry.

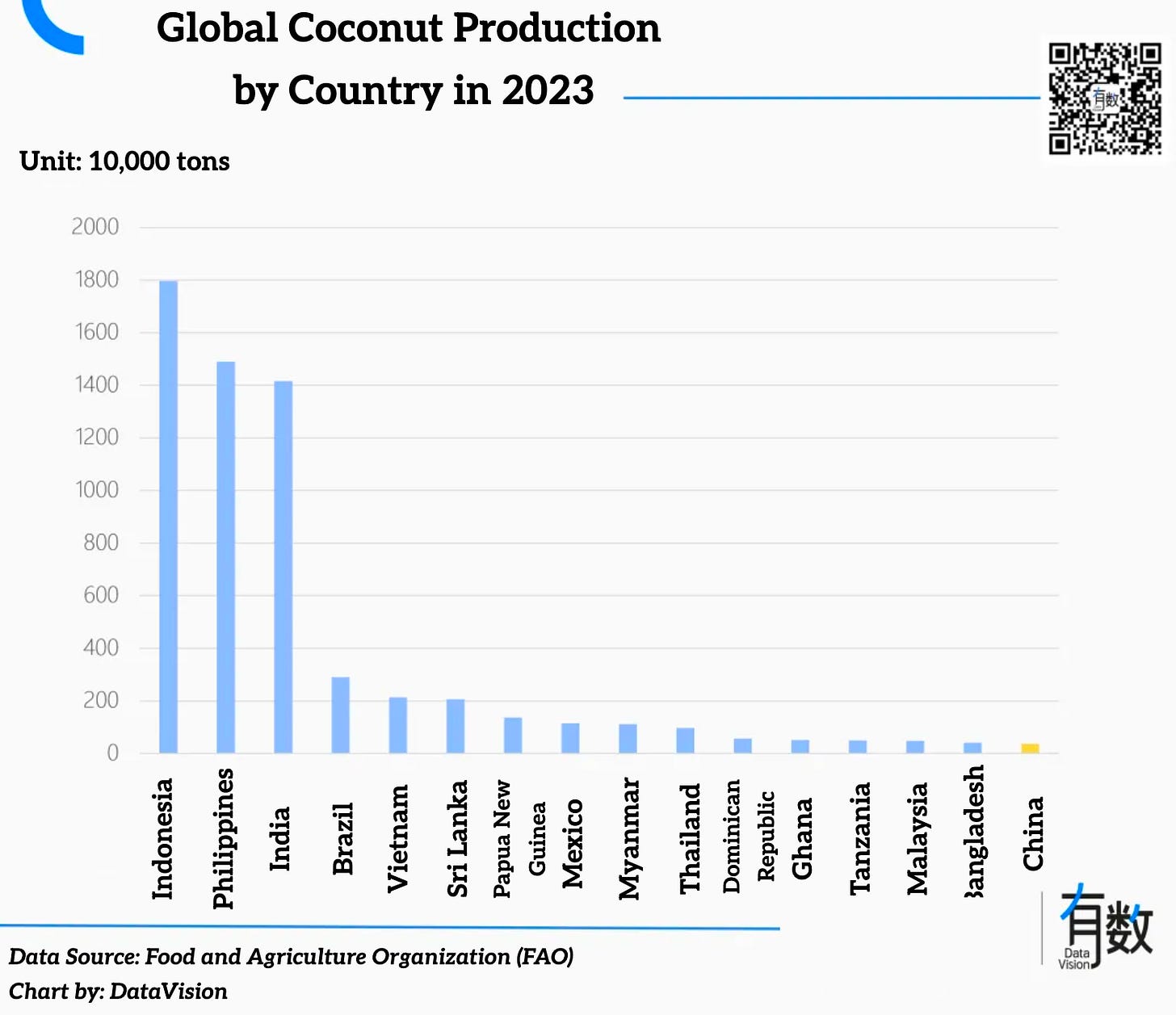

地利 (Geographic Advantage): IF exploited a unique market gap: high Chinese demand for a product (coconut water) the country couldn't easily produce. Large beverage giants overlooked this niche, and other competitors just met difficulties, leaving the space open.

人和 (Human Harmony): IF operates a lean, asset-light model: it outsources all production and uses major distributors for sales/marketing. Functioning more like a brand agency, it focuses solely on buzzworthy tactics (e.g., signing Xiao Zhan, co-branding with Luckin Coffee and Pop Mart) to boost awareness and support distributor sales.

Below is the translation of the full article by DataVision. This article reveals how a small but sophisticated foreign brand excelled in China's competitive market through masterful localization, offering actionable insights for consumer brands entering China.

Recently, Thai coconut water company IFBH filed for an IPO in Hong Kong, reporting annual revenues of ¥1.16 billion (~$161 million)—approximately 4.7% of Bright Dairy’s, 2.5% of Nongfu Spring’s, and just 0.3% of Coca-Cola’s.

However, with only 46 employees, IFBH boasts a remarkable per capita revenue of ¥25.21 million, surpassing Kweichow Moutai by 5.3 times, Coconut Palm Group by 30 times, and matching the peak efficiency levels of Pinduoduo.

While IF may not be the most renowned or profitable beverage brand, it exemplifies the role of a proficient intermediary of nature’s bounty.

A benchmark for an asset-light business model

In China, IF remains a relatively obscure brand, but in Thailand, it’s a household name. Founder Pongsakorn Pongsak, 45, hails from a prominent family; his father established the Suwan Group, which spans textiles, luxury hotels, and golf courses, reflecting the diversified industrial landscape of Southeast Asia.

A hands-on heir, Pongsakorn briefly rotated through the family business post-graduation before founding General Beverage (GB) in 2011, a beverage OEM company. In 2013, he launched IFBH, focusing exclusively on IF coconut water. By 2017, IF had entered the Chinese mainland market through e-commerce channels.

Timing is everything. IF’s entry into the Chinese market coincided perfectly with a growing consumer shift toward healthier, low-fat, low-sugar beverages. In contrast, Coca-Cola’s 2012 acquisition of coconut water brand Zico proved premature; by 2020, it had discontinued the brand due to lackluster sales.

In 2021, Luckin Coffee’s coconut latte sold over 100 million cups, revitalizing the coconut category. Tea brands began incorporating coconut more frequently than traditional flavors like grape or strawberry. Between 2019 and 2024, China’s coconut market experienced a staggering compound annual growth rate of 82.9%.

Since 2020, IF has consistently led the Chinese market, achieving a 34% market share last year—over seven times that of second-place Vita Coco.

Despite leading the market, IF’s annual revenue of ¥1.16 billion underscores the niche nature of the coconut water segment. What truly warrants attention, however, is IF’s remarkably high efficiency per employee—driven by an ultra-lean, asset-light operating model:

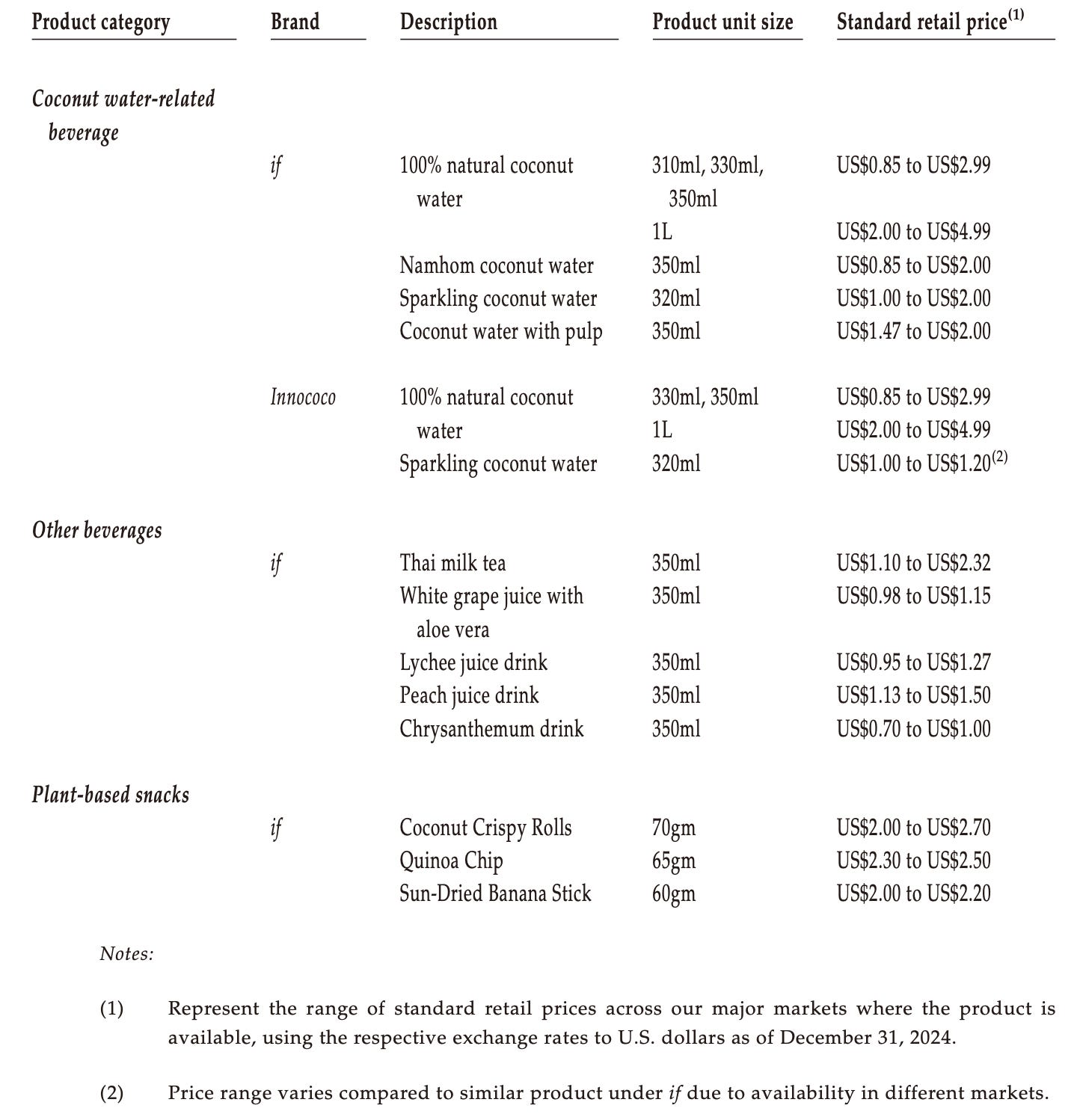

Highly simplified business structure. A staggering 95.6% of revenue comes from a single product line: IF coconut water, differentiated only by packaging and size. Other beverages and snacks in the portfolio are negligible.

Extreme asset-light approach. IF owns neither factories nor warehousing or logistics infrastructure. Instead, production is fully outsourced to General Beverage—a contract manufacturing firm founded by Pongsak Pongsak himself. On the distribution side, sales are handled entirely by major wholesalers.

According to its IPO prospectus, IF derives 97.6% of its sales from its top five distributors.

The company’s streamlined product line and asset-light model translate into an exceptionally lean team. As of the 2024 year-end, IF operated with just 46 employees: three senior executives based in Singapore, 20 sales staff, five in R&D, six in warehousing and logistics, and 12 in administration and HR.

Handing off production and sales often comes at the cost of giving up control over high-margin parts of the value chain. That’s why both bottled drink and tea chains tend to internalize as many steps as possible.

However, IF’s fully outsourced model hasn’t just fended off copycats—it has delivered exceptional operational efficiency.

The secret lies in the coconut itself.

Thriving along the Tropic of Cancer

As the Chinese saying goes, “Oranges are sweet south of the Huai River, but bitter to the north”—a reminder that agriculture is deeply shaped by geography.

For instance, Java Island comprises only 7% of Indonesia’s land but houses over half its population—not due to industriousness, but because its rice fields yield nine harvests every two years.

Similarly, Arabica beans—the cornerstone of premium coffee—require a rare combination of high altitude, abundant rainfall, and fertile soil. Despite China’s vast territory, only Yunnan meets these conditions, accounting for 98% of the country’s total coffee output.

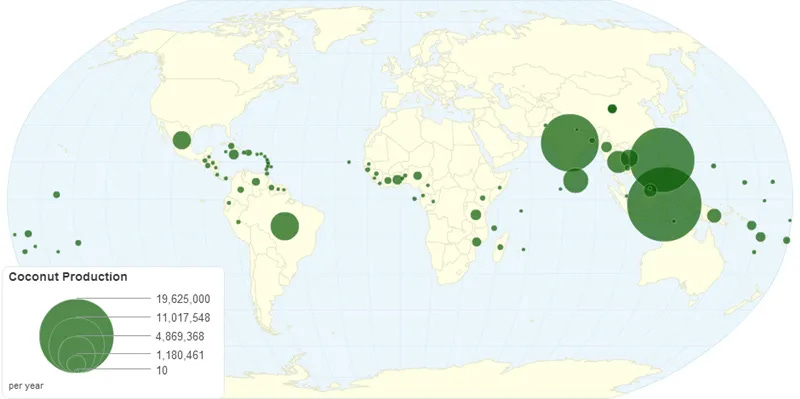

Coconuts follow a similar logic. Native to Southeast Asia, they thrive almost exclusively between the Tropics of Cancer and Capricorn. Of the world’s top 10 coconut-producing countries, eight are in Southeast Asia.