China consumer market opportunities 2024 - Charts of the Week

Subtitle: Essential trends and opportunities in China's consumer market in 14 charts

*This post is our premium content. Thank you for being a valued paid subscriber.

Welcome back, dear readers at Baiguan! We hope everyone had a great Chinese New Year holiday and had a chance to enjoy some time off. In 2023, total retail sales grew by 7.2%. While concerns about "consumption downgrade" arise as consumers shift towards more cost-effective options, questions still remain about the opportunities and high-growth sectors that will shape 2024. In today's "Charts of the Week" series, we will provide an update on the essential trends and opportunities in China's consumer market.

High-growth consumer sectors

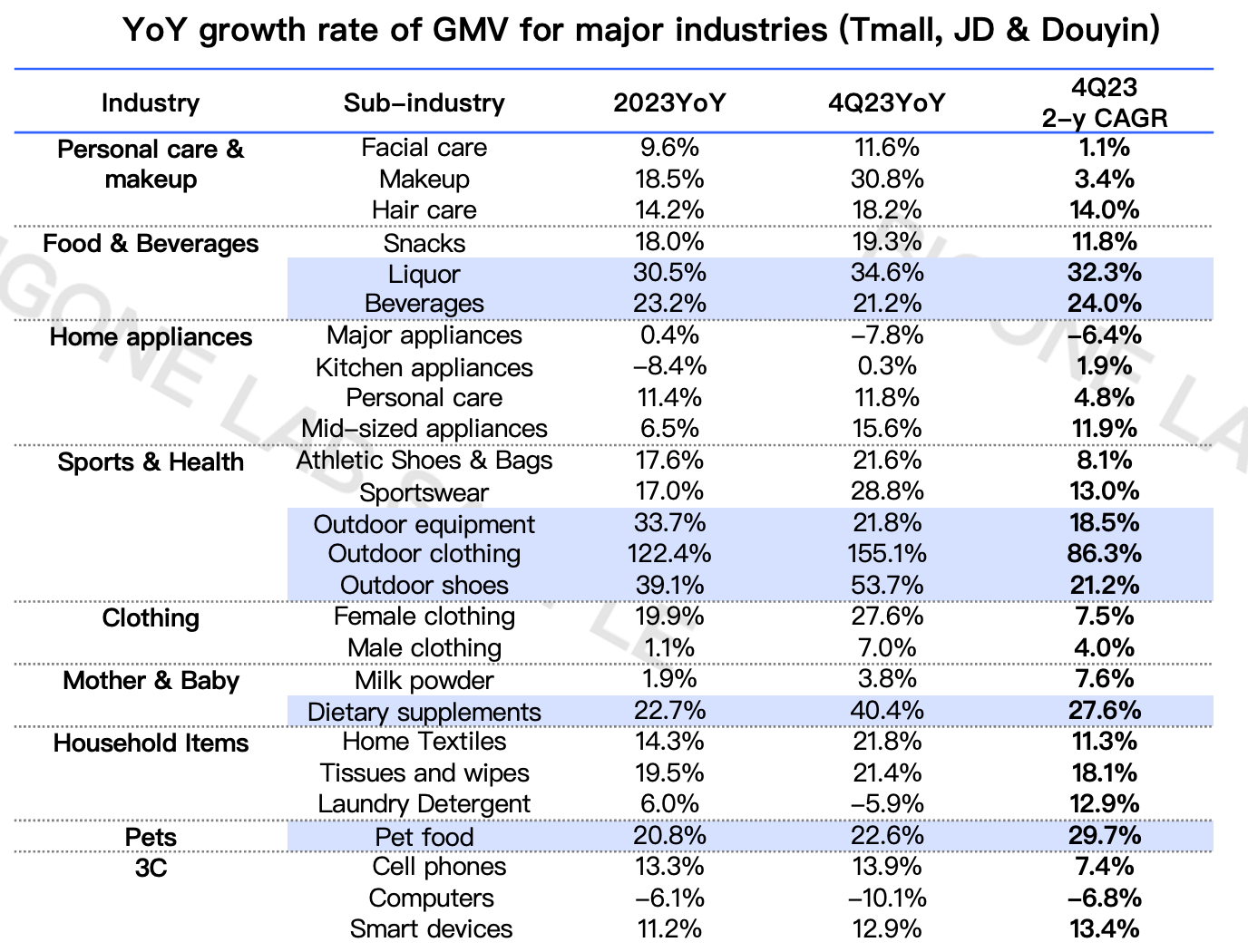

The GMV across major e-commerce platforms including Tmall, JD, Douyin, and Kuaishou grew 11% in Q4 2024, accelerating from the previous quarter.

Sports & Health, particularly outdoor equipment and clothing, beverages, pets, and dietary supplements for babies, remain the top growing sectors in 2023.

Deflation remained a significant concern throughout the second half of 2023. When looking at the average selling price (ASP) of major consumer sectors, most of them showed a downward trend over the past two years.

Specifically, the makeup, hair care, food & beverages, and clothing sectors exhibited a decline in prices. Within the home appliances category, personal care appliances remained stable, while other sub-sectors continued to experience a downward trend.

Notably, the mother & baby sector saw an increase in ASP, despite the record-low birth rate in China. This demonstrates that Chinese parents who are still willing to have children are adopting a more careful and high-quality approach to raising their children.

Sports & Health

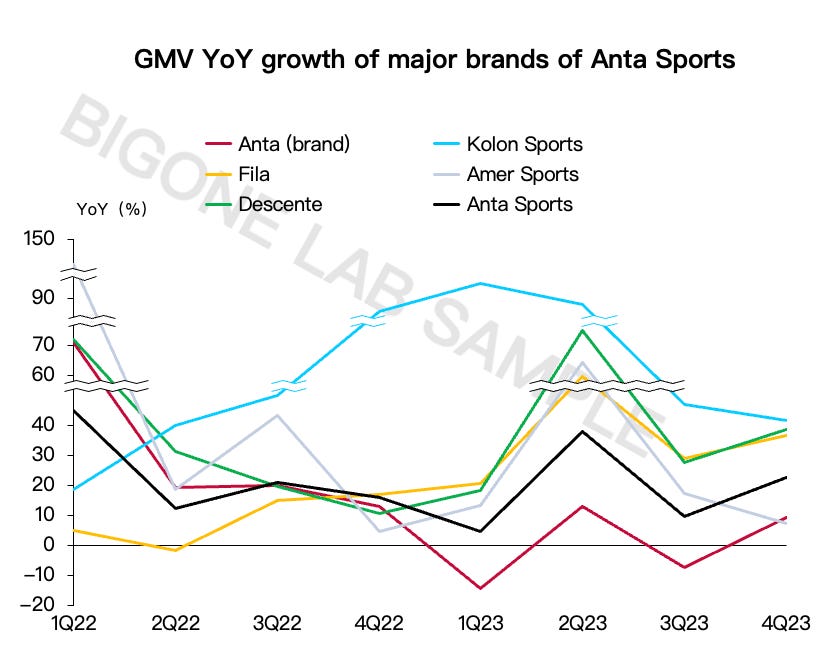

Amid the sports industry's overall high growth, Anta Sports (2020.HK) emerged as the most notable player in 2023, thanks to the success of its multi-brand strategy. During Q4 of 2023, most brands under Anta Sports experienced accelerated growth in online Gross Merchandise Volume (GMV). Notably, FILA, one of Anta's successful acquisitions, surpassed the GMV of the Anta brand.

The high-end brands under Amer Sports (acquired by Anta in 2019) were primarily driven by Arc'teryx. However, in 2023, the online sales of Arc'teryx did not experience significant acceleration, and the sales growth of other brands cooled down in the second half of the year.

The online GMV sales from Anta's direct-operated stores grew by 22% in 2023, primarily driven by Descente, Kolon, and Fila.

Continue reading to unlock our insights on other high-growth industries including Skincare & Makeup and Food beverages, and ticker names including Proya Cosmetics, Giant BioGene, Luckin Coffee, and China's baijiu liquor companies such as Kweichow Moutai and Wuliangye.

In particular, we track offline food and beverage consumption data through our nationwide payment transaction panel of convenience stores, which is a rarity in the market.

To get a sense of what is offered, you are welcome to check out this older post in the same series: Charts of the Week. You can also get free access by sharing us.