What China National Holiday Data Reveals? — Charts of the Week

China's consumers are changing — where are the growth opportunities?

“Charts of the Week” is Baiguan’s series that features key data points to help you quickly grasp the general state of affairs in China in just a few minutes. We handpick the highlights of the data charts from a variety of sources, analyzing and delivering insights trusted by 100+ top institutional and corporate clients worldwide at BigOne Lab. Don’t forget to subscribe before you continue reading!

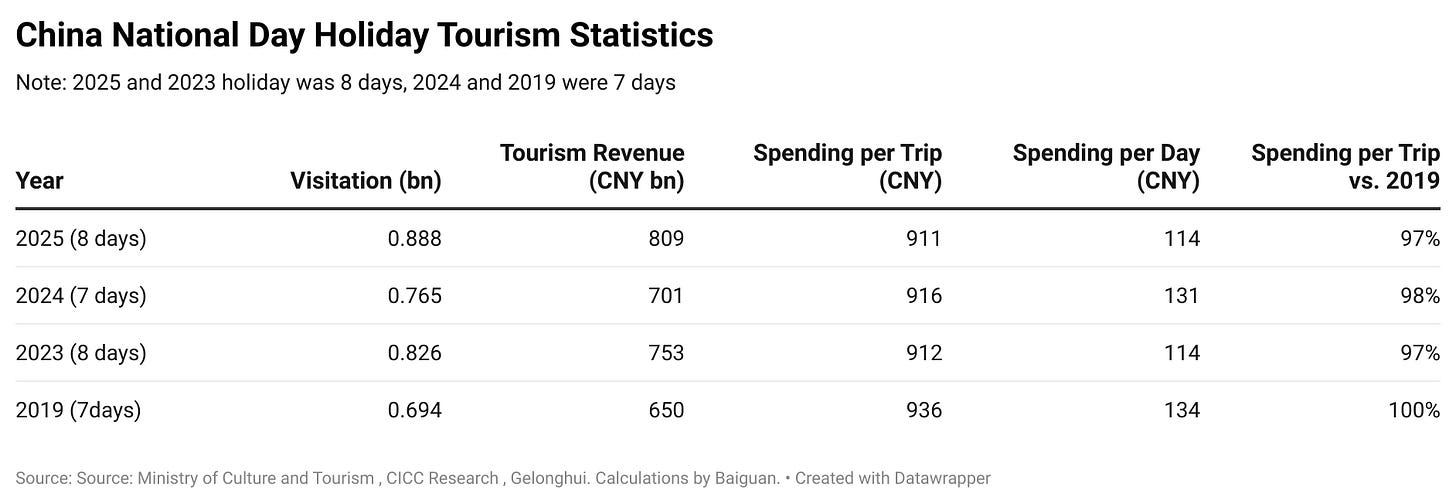

The 2025 National Day “Golden Week” holiday, the first major consumption checkpoint for 2025 H2, has concluded. Unlike last year’s holiday, which followed a significant stock market rally and fresh stimulus packages, this year’s arrived in a more normalized and still deflationary environment.

The data from this 8-day holiday (compared to 7 days in 2024) provides a crucial look into the current state of household confidence and spending habits.

Let’s look at a few key data points in today’s newsletter.

Overall observation: Travel volume hits new highs, but spending per trip declines

At first glance, the holiday was a resounding success. China saw a total of 888 million domestic trips, and tourism revenue reached over 809 billion RMB. When adjusted for the extra day this year, the daily average number of trips still showed solid growth compared to last year.

However, average spending per trip barely grew compared to the 2024 holiday despite the extra day and remains below pre-pandemic levels. This suggests that while the desire to travel is strong, consumers are keeping a closer eye on their wallets, a theme of “responsible spending“ that has persisted since 2023.

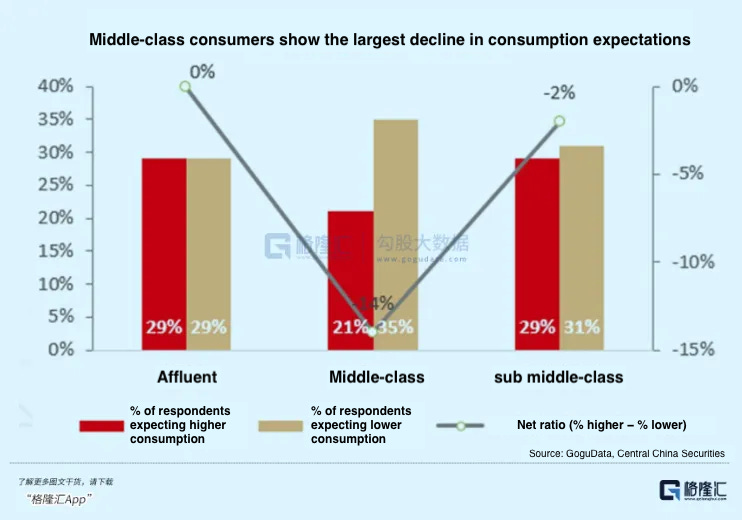

The lackluster per-trip spending can be partly explained by declining consumption expectations among middle-class consumers. According to a survey by GuruClub, an investment research platform in China, middle-class households — defined as families with a monthly income above 20,000 CNY — account for only 8% of total households but contribute to over 55% of total consumer spending. This group has seen the sharpest decline in consumption expectations.

The slowdown is also linked to a shift in traveler behavior, especially among the post-95 generation, which now makes up the largest share of tourists in China. Rather than traditional hotel stays, many are choosing more affordable, experience-driven alternatives, even including camping. During the holiday, tent rental orders surged 410% year-on-year. [GuruClub]

However, this doesn’t mean that China’s consumer sectors lack bright spots. In particular, the following themes offer structural opportunities for investors:

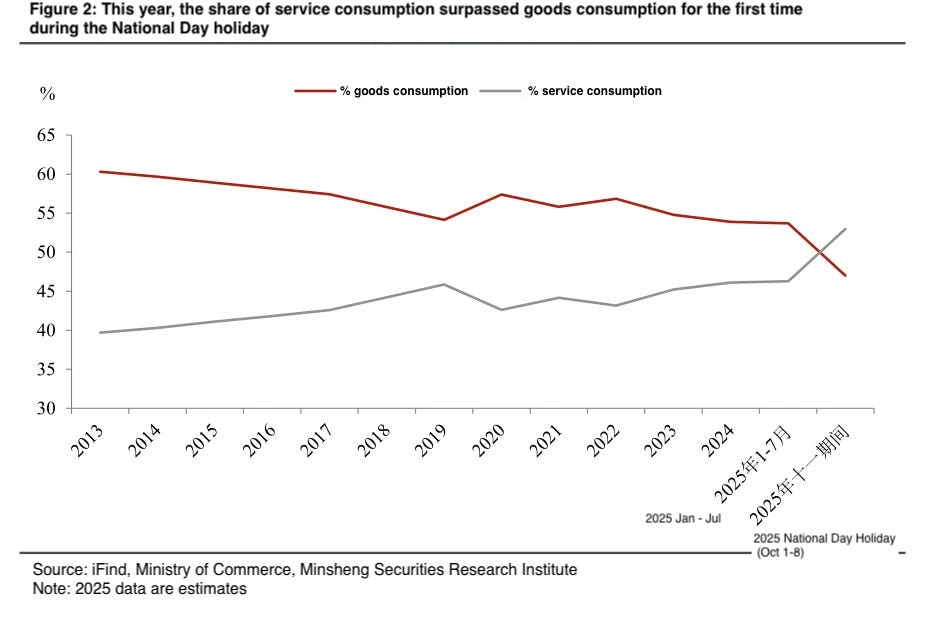

Service over goods

During China’s 2025 National Day holiday, service consumption outpaced goods consumption, growing 7.6% year-on-year. This marks part of a broader trend in which consumers increasingly prioritize unique experiences over material goods or luxury accommodations.

According to estimates from Minsheng Securities, service consumption accounted for a larger share of total spending than goods consumption for the first time during this year’s eight-day National Day holiday.

To get a sense of what is offered, you are welcome to check out this older post in the same series: Charts of the Week. You can also get free access by sharing us.