"Charts of the Week" is Baiguan's series that features key data points to help you quickly grasp the general state of affairs in China in just a few minutes. We handpick the highlights of the data charts from a variety of sources, analyzing and delivering insights trusted by 100+ top institutional and corporate clients worldwide at BigOne Lab. Don't forget to subscribe before you continue reading!

In this week’s charts, we return to the fundamental question: how are the two main pillars of China’s consumer confidence — wealth effect (real estate) and income expectations (job market) — holding up?

Overall job market

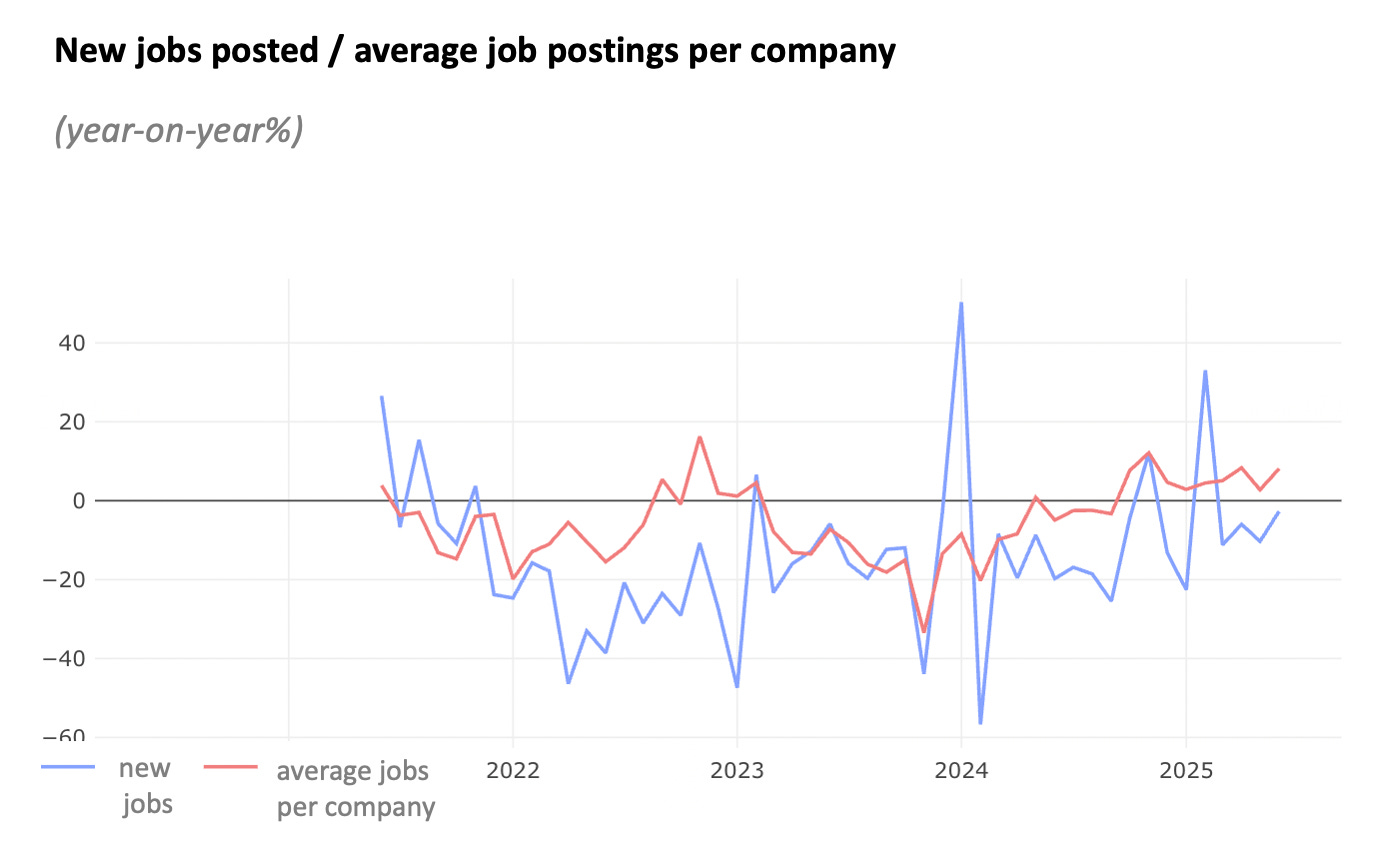

Overall, the job market continues to show a stabilizing trend, with average job postings per company (red line) growing 8% year-on-year in June. This suggests that for companies still in operation, the bottom was likely reached around late 2024, followed by a gradual and steady recovery since.

However, the total number of new jobs (blue line) — positions that appeared for the first time this month — still declined year-on-year, indicating that pressure remains.

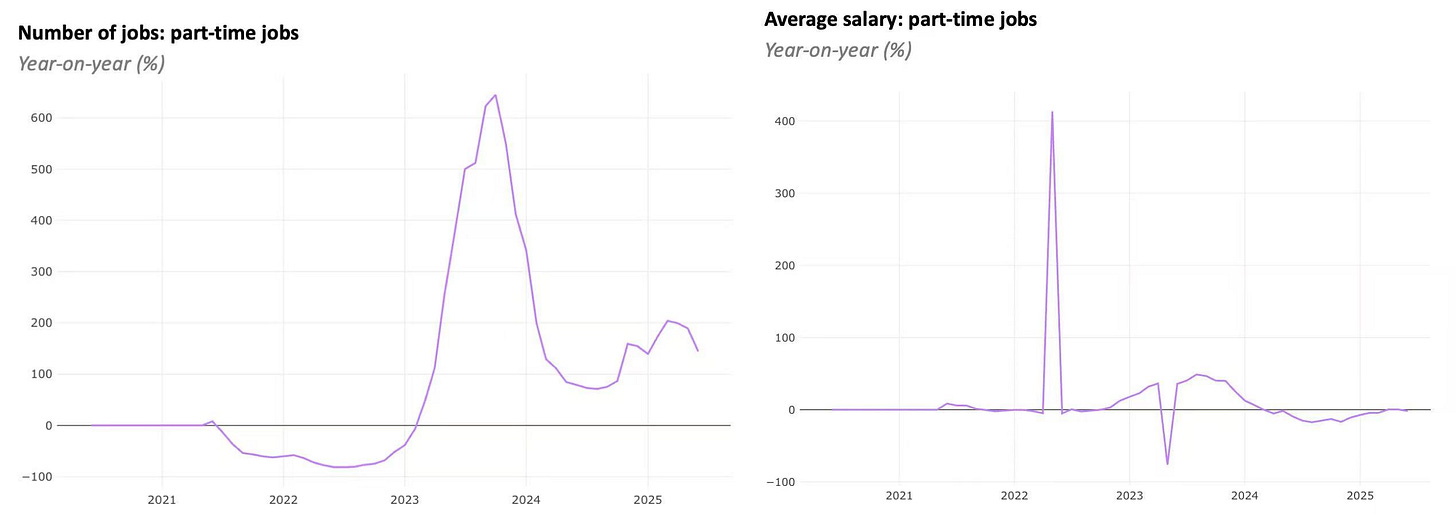

Meanwhile, part-time job postings (left chart) have continued to increase year-on-year in 2024, following an already high base in 2023 when China emerged from Covid lockdowns, facing widespread labor shortages. The less stable forms of "flexible employment" — including part-time jobs and gig work — have become the new norm for some.

Yet despite the growing number of part-time roles in Q2 this year, average wages for part-time jobs (right chart) have barely increased.

Income expectations

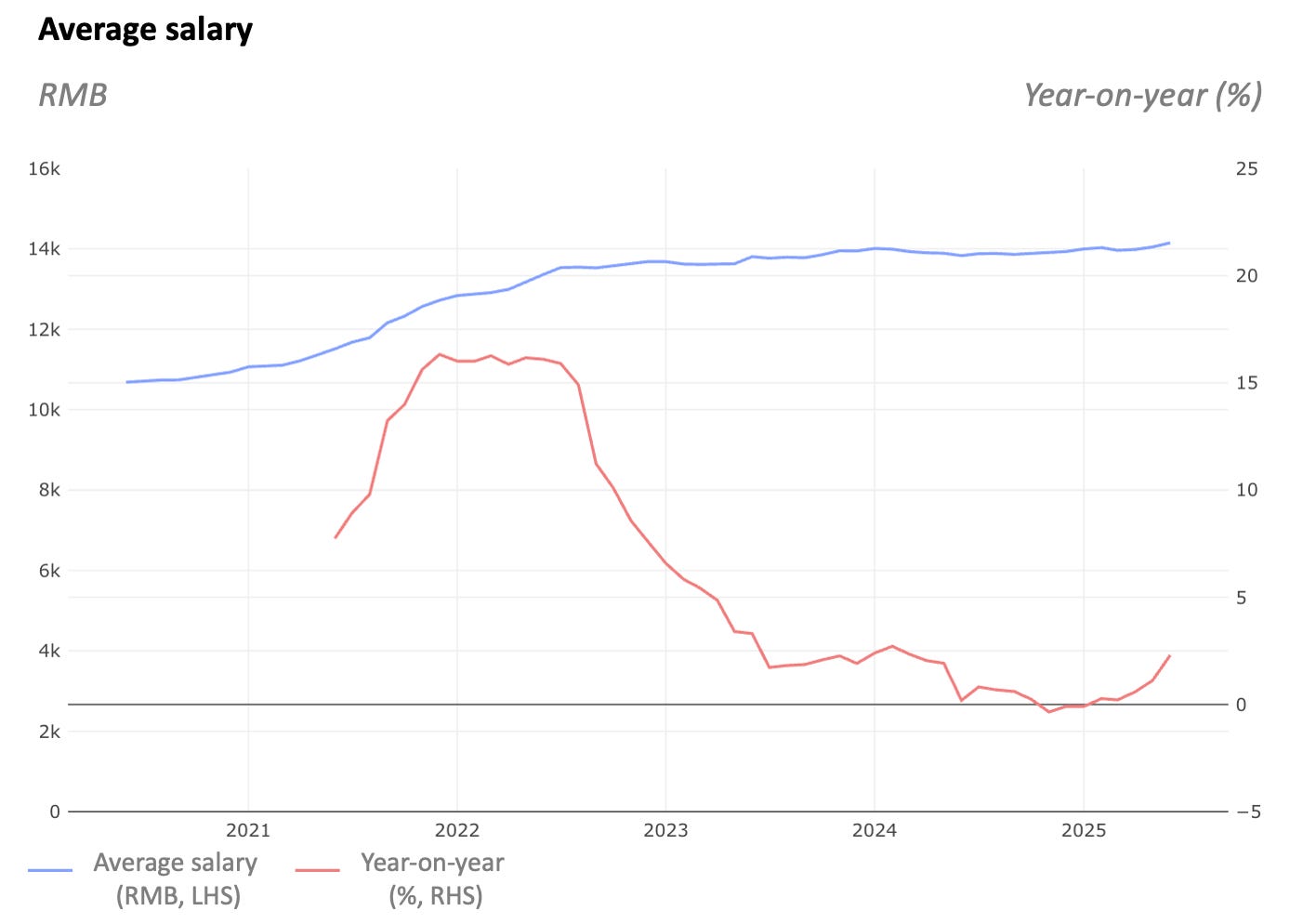

The average salary, based on job postings tracked across major online recruitment platforms in China, rose 2.3% year-on-year in June — a modest pickup compared to previous months.

Since February (after the Chinese New Year), average wages have shown a slow but steady recovery.

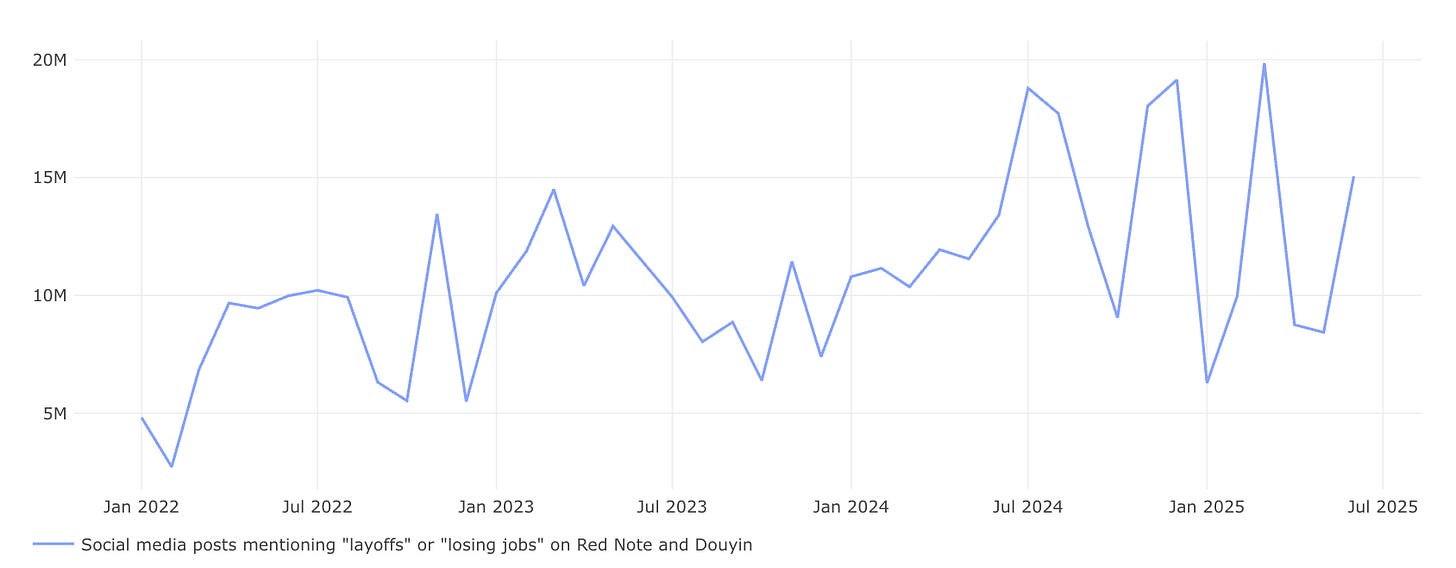

However, perceptions of job security still haven’t hit bottom. On social media, discussions and engagement with posts mentioning keywords like “layoffs” and “losing jobs” have picked up again since H2 2024 — with another noticeable increase this June.

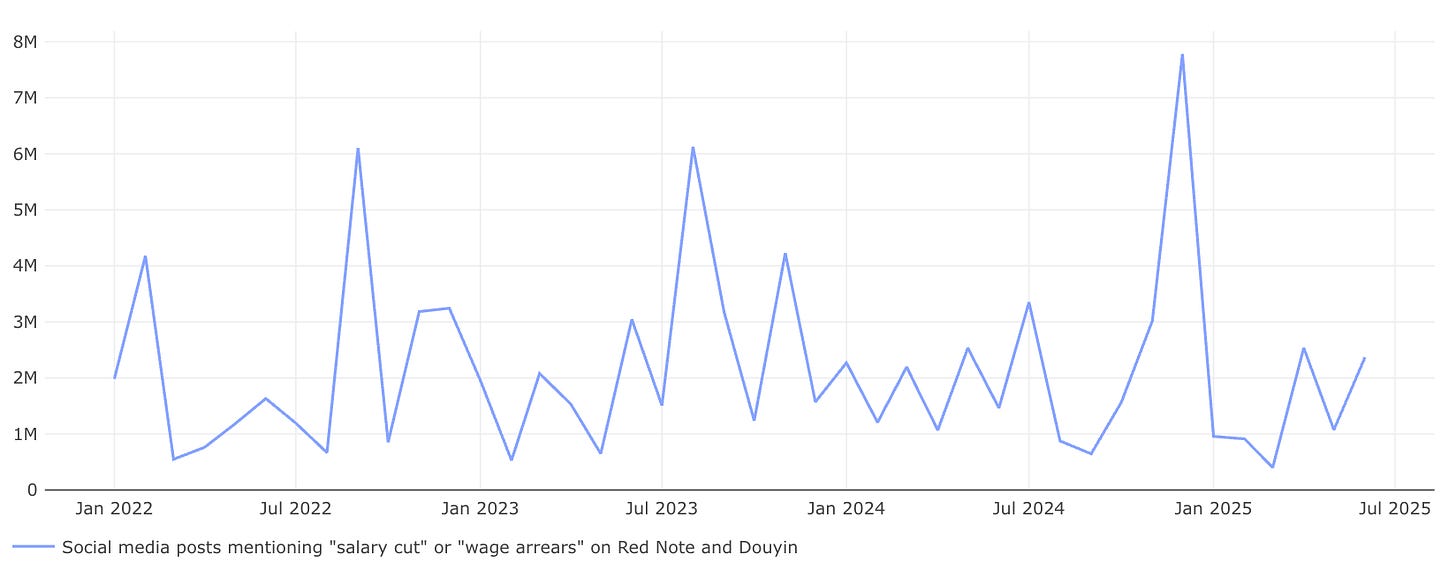

By contrast, mentions of “salary cuts” and “wage arrears” have remained relatively muted since February.

In short, companies that have survived are recovering steadily, but concerns around job stability persist, and income growth remains weak — still trailing behind broader indicators like retail sales, which rose 5% year-on-year from January to May.

Real estate

Continue reading for the latest on existing home sales and consumer sentiment around spending, investing (stock market and gold), and home-buying intentions.

To get a sense of what is offered, you are welcome to check out this older post in the same series: Charts of the Week. You can also get free access by sharing us.

For more timely discussions, consider joining our private Discord channel for paid readers. Our members include some of the most curious and professional minds in global finance, China policy, and frontier investing. They've contributed insights that are just as sharp as what we publish in our newsletters — Here’s a glimpse of the best and latest.