Why do policies decide your returns in China education stocks?

Four data snapshots of the sector’s next swing

BigOne Lab, our parent company, maintains granular, real-time coverage of China’s after-school tutoring market, with EDU and TAL as its core focus. We are one of the few data providers able to track virtually all revenue tied to the two giants’ education services, giving investors a two-month lead on upcoming earnings.

Today, however, we set the companies aside and spotlight a handful of striking societal signals in our data—signals that foreshadow both the near-term volatility and the long-term trajectory of China’s education industry. These signals may have very close ties to investment decisions in this sector. Continue reading to find out why.

Short-term: Policy whack-a-mole and anxious parents

Xi’an's clamp-down on the after-school tutoring sector since March 2025

By the end of June, summer-enrolment cash flow for both New Oriental and TAL in Xi’an, the millennium-old capital of Shaanxi Province, had been cut roughly in half versus the same point last year, based on our tracked data.

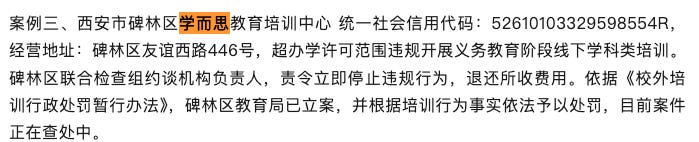

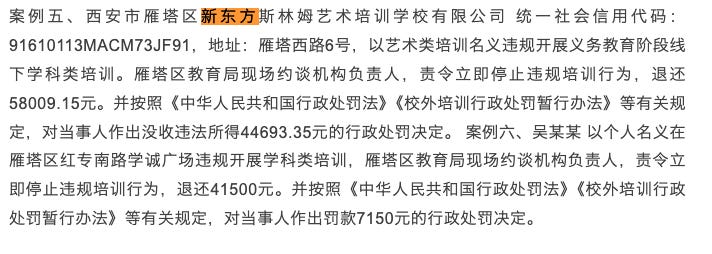

The immediate trigger was the city-wide clamp-down that began in late March. From 27 March 2025, the Xi’an Education Bureau issued a barrage of notices listing punitive actions against off-campus tutoring. Within 72 hours five districts—including Gaoxin, Beilin, Chan-Ba, Yanta, and Lianhu—publicized 25 cases of non-compliant academic training, with well-known brands such as TAL, New Oriental, and Pingxingxian called out by name.

Many physical classes were either suspended or pushed online; yet our conversations with customer-service teams show that enrolments never actually stopped—they simply migrated to private links distributed directly to parents via closed channels.

Hangzhou’s mandated weekends simply rerouted students to after-school tutors.

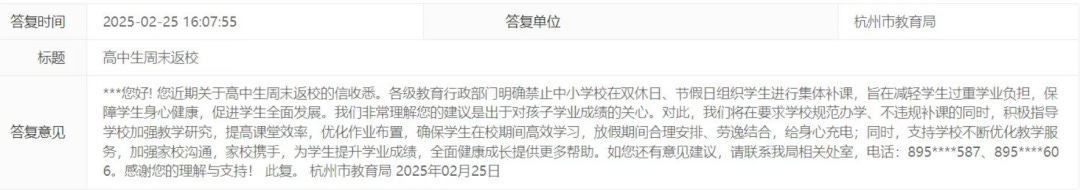

In February 2025, the Hangzhou Education Bureau issued a directive ordering the city’s Grade 10 and 11 students to observe a strict two-day weekend beginning with the spring term. “No weekend, holiday, or vacation tutoring, on or off campus, in any form,” the notice read.

The market’s response? Based on our tracked data, New Oriental’s Hangzhou revenue mix for high-school tutoring jumped to 18 % of the company’s spring-term total, up from 12 % a year earlier.

Taken together, these episodes illustrate an iron law of China’s education market: every policy triggers a workaround, and parents’ anxiety about the gaokao keeps their wallets open and their children’s calendars full. The stated goal of “double reduction” is to lighten both homework and after-school burdens; in practice, the road is long, and a simple crackdown seems to breed only more creative evasion.

Next, we will examine the long-term forces every investor in China’s education sector must watch: shifting industrial and labor policies, and relentless demographic change. This content is exclusively available for our paid subscribers.