In today's article, we continue to delve into investment opportunities in the summer economy (we talked about softdrinks, beer and sportswear industry and major players in the previous article). We now turn our attention to a sector that has captured the hearts of China's youth: the fresh-made tea and coffee industry.

In previous Baiguan articles, we've explored various facets of this dynamic market: We've examined the "bubble tea-ification" trend in China's coffee culture, with Luckin Coffee leading the charge. We've marveled at the innovative fusion of coffee with a traditional luxury: Luckin's Moutai latte. We've also delved into the wellness economy, where the incorporation of Chinese medicine into fresh-made tea has become a trend.

China's beverage market is currently in a price war, with numerous brands resorting to aggressive discounting to bolster sales volumes. Amidst this, Luckin Coffee stands out for its strategic ability to leverage cost-effective, high-margin products to sustain growth and enhance profitability, setting a new benchmark in the industry.

We will address several key questions that investors are interested in:

Is there still room for growth in China's coffee market? What is the future growth engine of the industry?

Can Luckin keep increasing their profit margins?

Now that Starbucks has a new leader in China, are they competing better with Luckin?

Fresh-made tea and coffee industry: Robust order growth fueled by store efficiency, not aggressive store expansion

First let me explain why we choose Meituan, the largest O2O platform in China, as a critical channel to track China's fresh-made tea and coffee industry:

Most tea & coffee brands have >85% of their stores offering Meituan delivery services

For brands that disclosed GMV, such as Goodme, MIXUE, and Cha Panda, the contribution of Meituan delivery to GMV exceeds 25%; also based on our channel checks, Meituan delivery accounted 15%+ of Luckin Coffee’s total GMV.

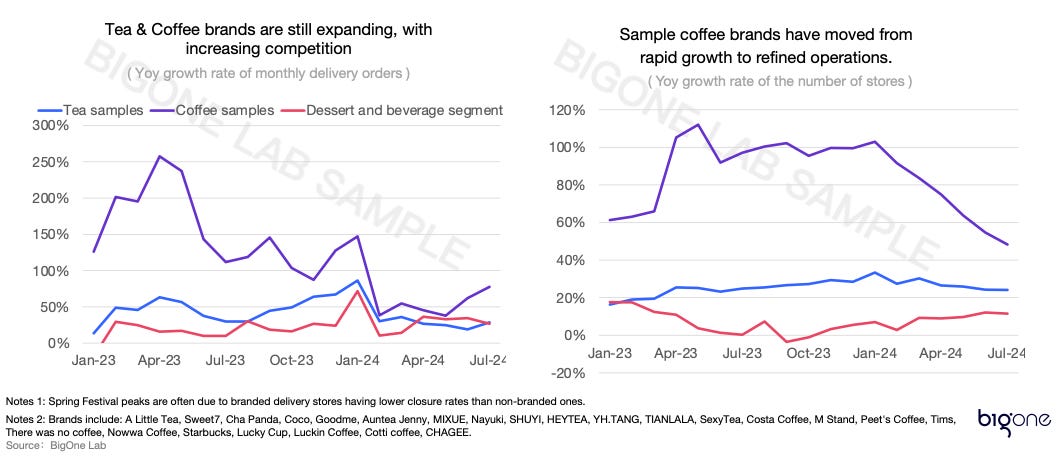

Based on Bigone's exclusive data of Meituan, the order of dessert & beverage segment still grows over 30% YoY, outpacing the food sector. However, the growth engine has shifted from store expansion to store efficiency operations. Looking at the right chart, we can see that the growth rate of the number of coffee stores has slowed down since early 2024, from 100% to 50%.

Industry Trend 1: Tier-level sinking continues, with MIXUE maintaining a strong position

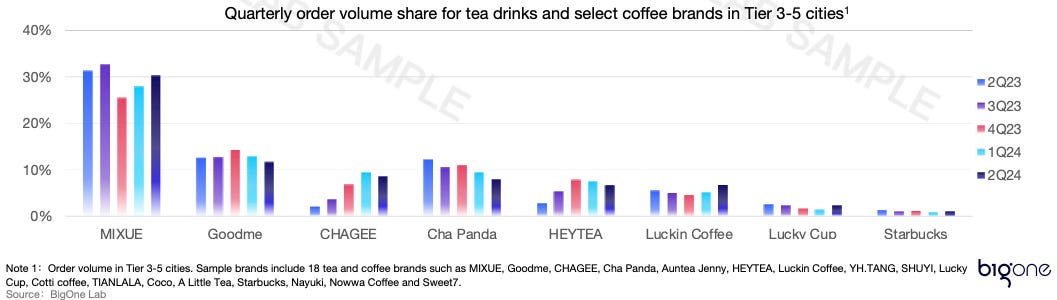

The proportion of orders originating from lower-tier cities is steadily increasing, signifying a persistent trend of consumption gravitating towards these emerging markets. Within this dynamic expansion, MIXUE’s position remains strong, while CHAGEE and HEYTEA have slightly lost market share this year. Goodme and Cha Panda also show signs of fatigue.

Industry Trend 2: Brands adjust pricing in response to consumer downgrading

To address consumer downgrading, many tea and coffee brands have reduced prices since the start of the year. AOV has been declining, with a 3% drop from November 2023 to January 2024, and a slight improvement to a 1% decrease by April.

Notably, the price reduction among coffee brands has been more significant than that of tea brands, indicating more intense competitive landscape.

Based on BigOne Lab tracked Douyin group-buy data, Starbucks followed the price cut trend from May, but unfortunately did not realize a MoM increase in sales.

MIXUE leads the competition in fresh-made tea industry

In terms of GMV, MIXUE leads but isn't far ahead. CHAGEE has risen to second place, followed by Goodme, Cha Panda, and HEYTEA. When it comes to cup volume, MIXUE dominates the competition, consistently capturing an increasing market share. The significant rise in order volume market share suggests an aggressive expansion and a growing presence in consumer purchasing habits.