Is China's local government stimulus effective in boosting consumption?

Initial changes in the catering industry and companies (Yum China, Luckin Coffee and Starbucks), post-government consumption stimulus

The catering industry is struggling this year.

Amid a general downgrade in consumption, competition has intensified, closure rates have soared, and price wars are fierce. Tianyancha data shows that in the first half of this year, 1.347 million new catering-related enterprises were registered in China, while 1.056 million were deregistered or revoked. The catering markets in metropolitan cities like Beijing and Shanghai have led the contractions - local statistical bureau data indicates that from January to August this year, Beijing's catering revenue decreased by 4.6% year-on-year. Over the same period, Shanghai's retail sales of accommodation and catering decreased by 4.7% year-on-year. In the first half of 2024, Beijing's large-scale (annual revenue over 10 million yuan) catering industry saw a total profit of 180 million yuan, a year-on-year decrease of 88.8%, with a profit margin as low as 0.37%.

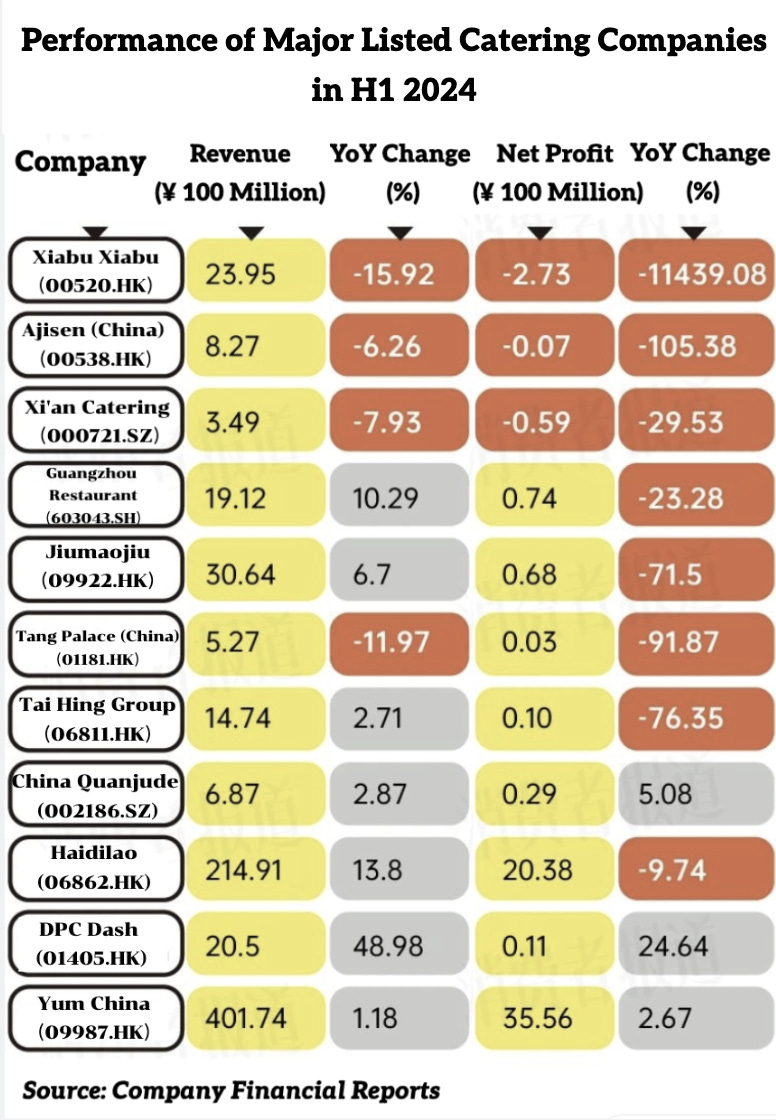

Even leading companies in the catering industry are not immune; several listed companies reported heavily pressured profit performance in the first half of 2024, mainly due to a decline in customer spending per order.

The launch of consumption vouchers by local goverment to rescue the businesses

The launch of consumption vouchers by the local government in Shanghai serves as a strategic measure to stimulate consumer demand and support industries. Shanghai has allocated 500 million yuan ($74 million) for consumption vouchers to boost spending in catering, accommodation, movies, and sports sectors. The breakdown is 360 million yuan for catering, 90 million yuan for accommodation, 30 million yuan for movies, and 20 million yuan for sports.

Haitong Securities estimates that if the vouchers have a redemption rate between 70%-95% and a related consumption multiplier of 3.5-5 times, the 500 million yuan worth of vouchers could potentially stimulate 12-24 billion yuan in consumer spending, accounting for 0.8%-1.6% of Shanghai's total retail sales in the accommodation and catering industry for 2023.

Residents can claim these vouchers on platforms like WeChat, Alipay, UnionPay, and Meituan at designated times. The vouchers are available in denominations that provide discounts for spending over specific amounts: 60 yuan for spending over 200 yuan, 160 yuan for spending over 400 yuan, 240 yuan for spending over 600 yuan, and 400 yuan for spending over 900 yuan.

The effect on consumer spending is evident. According to the official release, since the launch of Shanghai's catering consumption voucher campaign, offline catering consumption has seen a year-on-year increase of 11.4%. The city's commercial areas have also experienced a 10% year-on-year growth in daily average passenger flow. Despite a sluggish start to the year for Shanghai's service industry, especially in catering and accommodation, the release of consumption vouchers in late September led to a 3.2% year-on-year increase in citywide consumption during the National Day period, with double-digit growth in offline catering, including a significant increase in regular meals. Lately, when I dine out on weekends, I've noticed a significant increase in the number of people waiting in line outside restaurants, with a particularly long queue at high-end restaurants.

A greater leverage effect due to the design of the policy, which is more effective than direct cash distribution

The Shanghai municipal government allocated 500 million yuan this time for consumer vouchers, which is half the amount of 2022 (500 million yuan vs. 1 billion yuan), but has generated greater leverage effect. In 2022, the Shanghai voucher campaign had a municipal financial investment of 1 billion yuan, with a 97% redemption rate, driving consumer spending of 3.506 billion yuan, with a leverage ratio of nearly 3.71 times. The 2024 policy is even more effective, with each 1 yuan subsidy generating 4.2 yuan in consumption (source).

Mainly due to careful design and strategic distribution by the government:

Distribution Strategy: The distribution strategy of vouchers is carefully timed before the National Day holiday to increase interest in using vouchers during the vacation period.

Scarcity Marketing to Boost Awareness: Vouchers are distributed in batches, with limited quantities per batch, leading consumers to set alarms to "snatch" them. This strategy has increased the awareness of vouchers. According to social sentiment data collected by BigOne Lab, the heat around Shanghai's consumer vouchers has been rising since September, peaking in November, far exceeding the heat of the 2022 voucher campaign.

Interestingly, the popularity of consumption vouchers has led to a spontaneous trading market on platforms like Xianyu, Alibaba's second-hand transaction platform in China. Some individuals are willing to pay around 10-30 yuan to acquire vouchers they were unable to secure.

Short Validity Period and Larger Denominations: Compared to other countries or regions, Shanghai's consumer vouchers have a shorter validity period, with dining vouchers lasting seven days and movie and sports vouchers valid for 24 hours, urging consumers to redeem them quickly (those in Japan last for eight months, and those in Taiwan for six months). At the same time, the vouchers include larger denominations, such as a 400 yuan discount for spending over 900 yuan, which can promote high-end catering consumption and group consumption.

Not just Shanghai, but many provinces/cities across China are distributing consumption vouchers to boost the economy. For instance, since mid-to-late September, Sichuan has invested over 400 million yuan, with 300 million yuan for home furnishing and 100 million yuan for local specialties like Sichuan liquor, tea, and cuisine. Announced in November, Guangzhou is set to issue 100 million yuan in government vouchers to stimulate the catering sector.

Local government stimulus has led to significant increases in sales volume and prices since Oct

According to BigOne Lab's catering index, the policy has had an immediate effect. Nationally, the average sales of catering stores saw year-on-year growth of 7% in October and 11% in November, a significant acceleration compared to the 4% growth in September, before the vouchers were distributed. The main drivers of this growth are mid-tier cities and smaller businesses—sales growth in new first-tier and second-tier cities outpaced that of first-tier cities and third to fourth-tier cities. For larger businesses above quota, the average sales had been weak year-on-year up to October, but turned positive in November, albeit with a smaller increase than the overall average.

After the rollout of consumption vouchers, the average catering price nationwide rebounded. Nationwide ASP had been declining since mid-2024, with first-tier cities experiencing a drop as early as Q3 2023, and a much deeper decrease compared to other city tiers. According to Canyin88, in the past year, over a third of Shanghai's high-end restaurants have exited the market. After the vouchers began to be distributed, the nationwide ASP turned positive in October (+1%) and November (+3%). Although first-tier cities still saw a year-on-year decline, the rate of decrease narrowed in October and November.

In the remainder of this article, we'll examine the sales performance—encompassing both online (delivery) and offline (in-store) consumption—as well as operational strategies of major Chinese catering listed companies, such as Yum China (which operates KFC and Pizza Hut), Luckin Coffee, and Starbucks China. This exclusive content is reserved for our paid subscribers.