Four key takeaways from Chinese consumer sentiment in October - Charts of the Week

Real estate, spending behaviors, service industry, and job market

“Charts of the Week” is Baiguan’s series that features key data points to help you quickly grasp the general state of affairs in China in just a few minutes. We handpick the highlights of the data charts from a variety of sources, analyzing and delivering insights trusted by 100+ top institutional and corporate clients worldwide at BigOne Lab. Don’t forget to subscribe before you continue reading!

1. Households are still in a “wait-and-see” mode

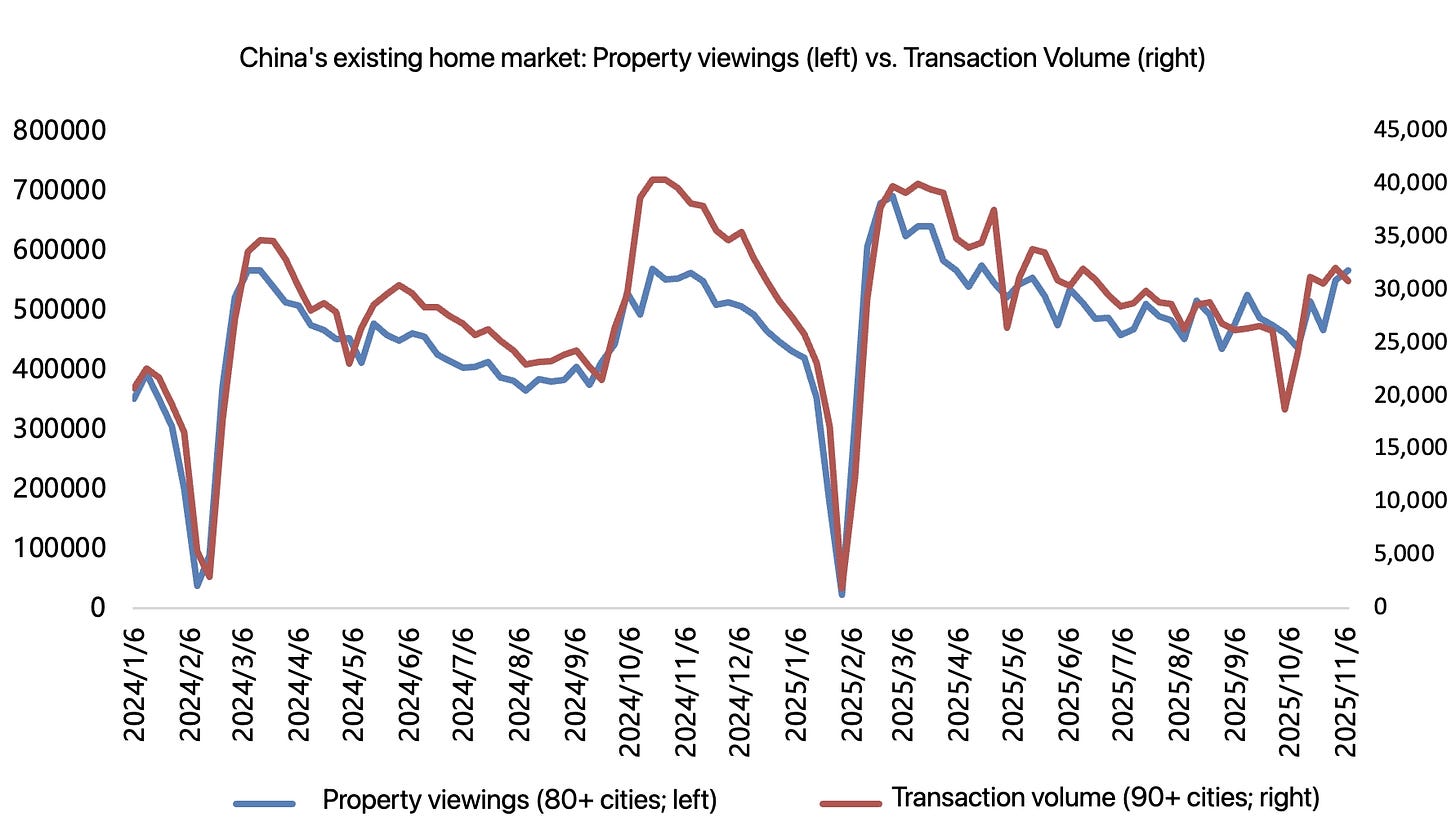

Transaction volumes have weakened since October (partially due to the high bases last year). In the 45th week of 2025 (Nov 1-8), second-hand home sales across 90+ cities in China dropped 16.3% year-over-year (vs. 16.2% decline in the prior week) and fell 4% week-over-week.

Listing prices continue their downward trend, offering no evidence that a price floor has been reached.

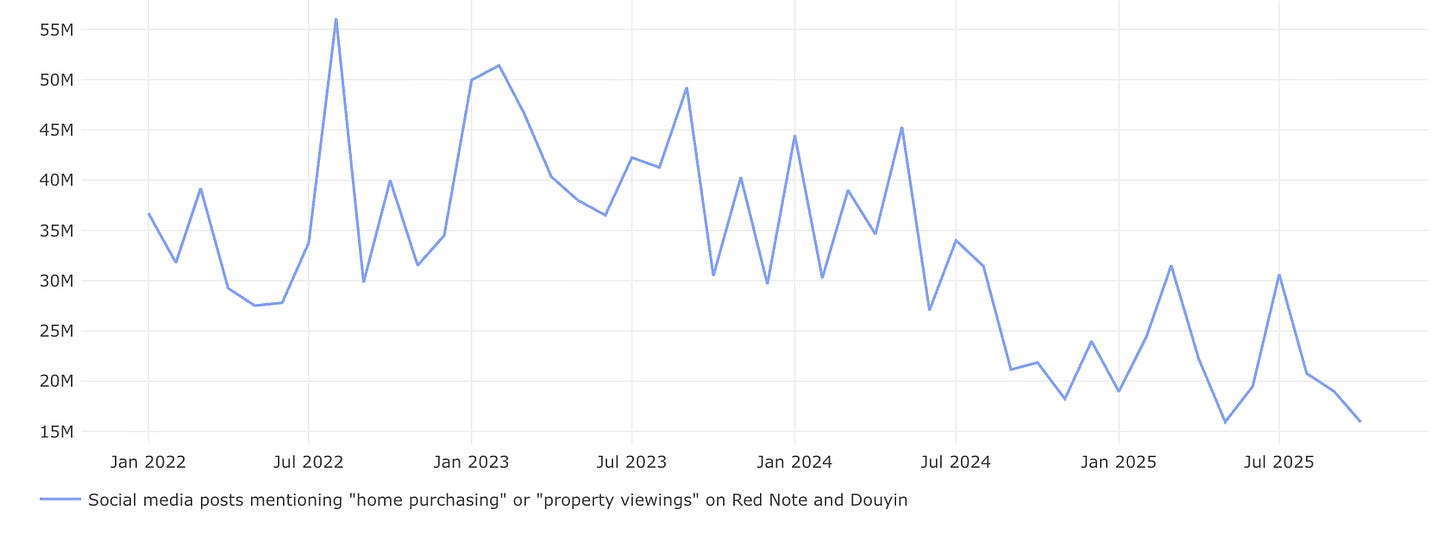

Social media activity confirms the continued caution among prospective buyers: Discussions about “home purchasing” and “property viewings” saw a noticeable drop on Douyin and Red Note, with the trend extending into October and indicating that households are still largely in a “wait-and-see” mode.

2. Toward premiumization: premium discretionary brands see rebounds

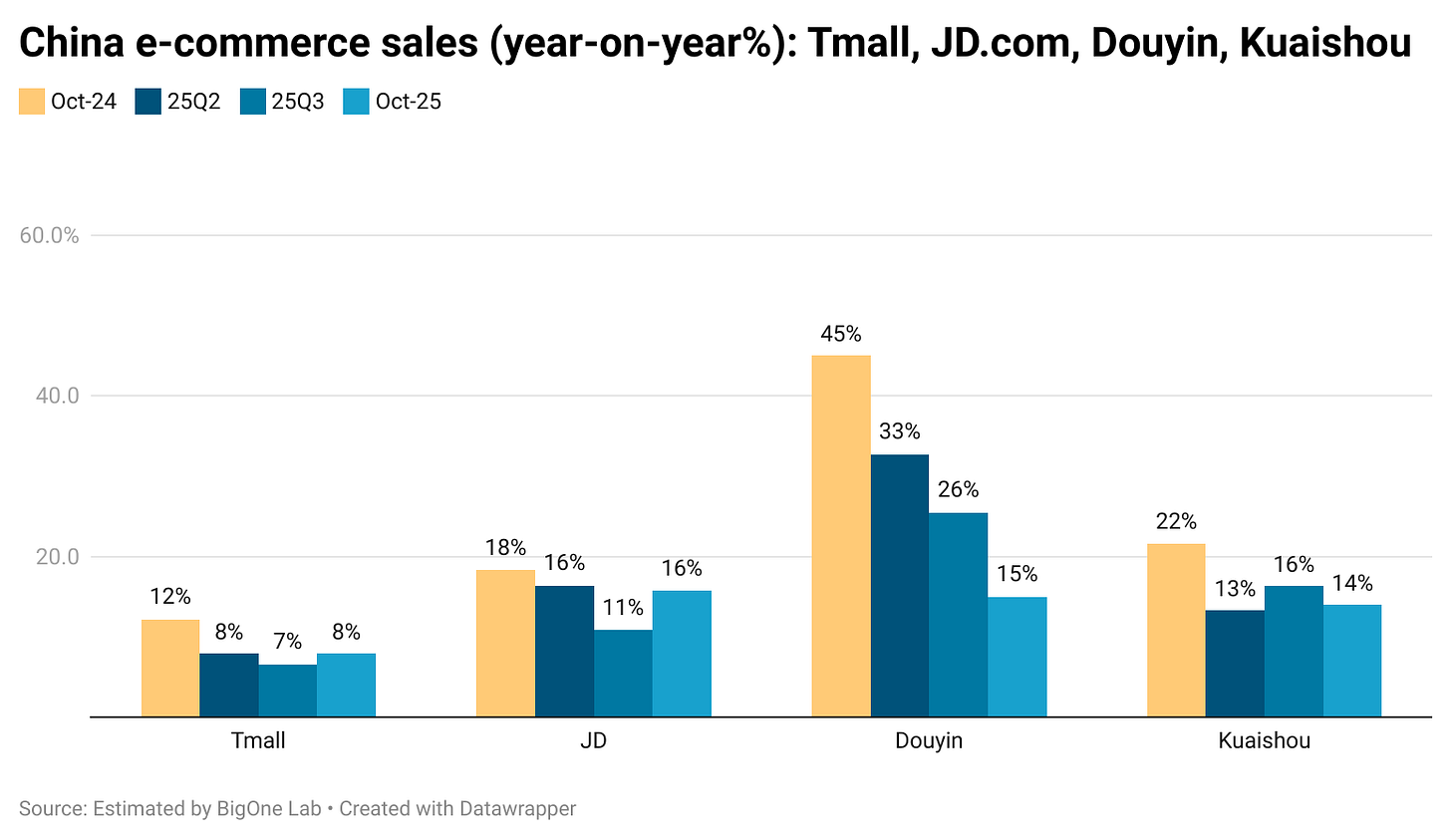

China’s biggest annual e-commerce sales event, the “11.11” (Singles’ Day), kicked off in October this year. But so far, online sales in October have been relatively flat compared to last October. Live-streaming sales on Douyin have noticeably slowed down after the explosive growth in previous years.

However, due to the mismatch of the promotion period and strategies this year versus last year, it’s better to wait for the November data to fully judge this year’s “11.11” sales.

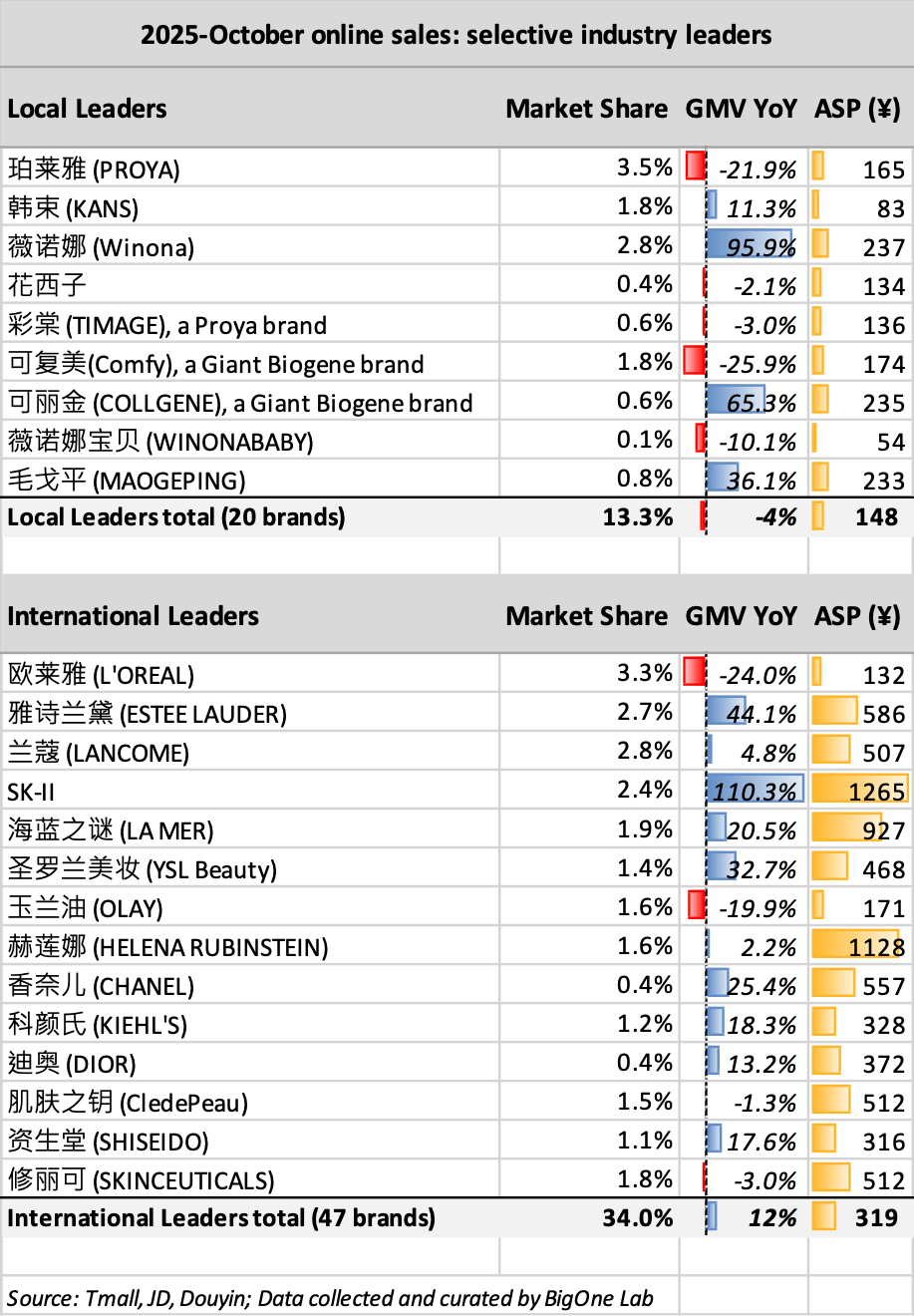

A notable counter-trend to the “trading down” narrative is the outperformance of mid-to-high-end brands. For instance, in October, domestic and more affordable skincare and makeup brands—which had outperformed foreign competitors since 2023—lagged in gross merchandise value (GMV) growth. Premium international peers, such as Estée Lauder, SK-II, and YSL Beauty, recorded stronger growth.

Among domestic leaders, only a few brands that position themselves in the mid-to-high-end segment, such as Maogeping (1318 HK), managed to outperform.

The same trend is observed in other discretionary consumer categories, such as sports products and luxury:

To get a sense of what is offered, you are welcome to check out this older post in the same series: Charts of the Week. You can also get free access by sharing us. For more timely discussions, consider joining our private Discord channel for paid readers.