Retrieve next golden opportunity: China's pet market is ripe for a pawsitive boom

Pets are becoming the new children for young Chinese people

As any savvy businessperson knows, following the trends can lead to profitable opportunities. As demographics shift and consumer behaviors change, market dynamics often transform, revealing new "goldmines." One such emerging goldmine in China is the pet market.

Pets are the new "children"

Historically, the market for mother and baby-related products in China has been extremely lucrative. If there is one area where Chinese consumers do not hesitate before making a purchase, it is for their children. They prioritize their children's health, making no expense too great when it comes to providing the best possible products for their young ones. This tendency has often led consumers to favor foreign brands, which are perceived to have superior quality and trustworthiness.

However, recent demographic trends paint a concerning picture. In 2022, China's population began to decline as the total fertility rate fell below 1.1, ranking last in the world. The country's birth rate is on a steady decline, signaling potential challenges for the mother and baby product segment moving forward. As fewer babies are born, the demand for these products is likely to shrink.

So, what's the next "goldmine"? The answer might be a bark away. As the birth rate declines, pet ownership rates in China have skyrocketed. According to BigOne Lab’s online sales data, in 2018 sales of mother and baby products were nine times higher than pet products. However, in recent years, this gap has narrowed to roughly six times.

Similar to their approach to baby products, Chinese pet owners spare no expense in providing the best for their furry, feathery, or scaly friends. A preference for high-quality, healthy, clean, and nutritious products is emerging, and foreign brands have already started to enjoy a favorable reputation in this area.

As of April 2023, half of the top-selling pet food products in China are foreign brands, such as Royal Canin, Pro Plan, Instinct, Orijen, and Acana. In particular, foreign brands dominate the higher-end market, where the average selling price per item is over 300 CNY.

Resilient growth amidst the global crisis

Pet product sales have maintained robust growth over recent years, weathering even the economic turmoil brought on by the pandemic. It seems that nothing - not even global health crises - can weaken the Chinese love for their pets. Despite the pandemic and lockdowns, online sales of pet products have been growing at an average year-on-year speed of 30% in recent years.

Despite its robust growth, the pet product market still offers many opportunities. Established brands are competing for industry leadership positions, rapidly developing new products and services in response to consumers' new demands. According to BigOne Lab's online sales data, the top 10 brands account for less than 30% of the overall pet food market, leaving abundant room for emerging brands to grow.

China's pet market landscape

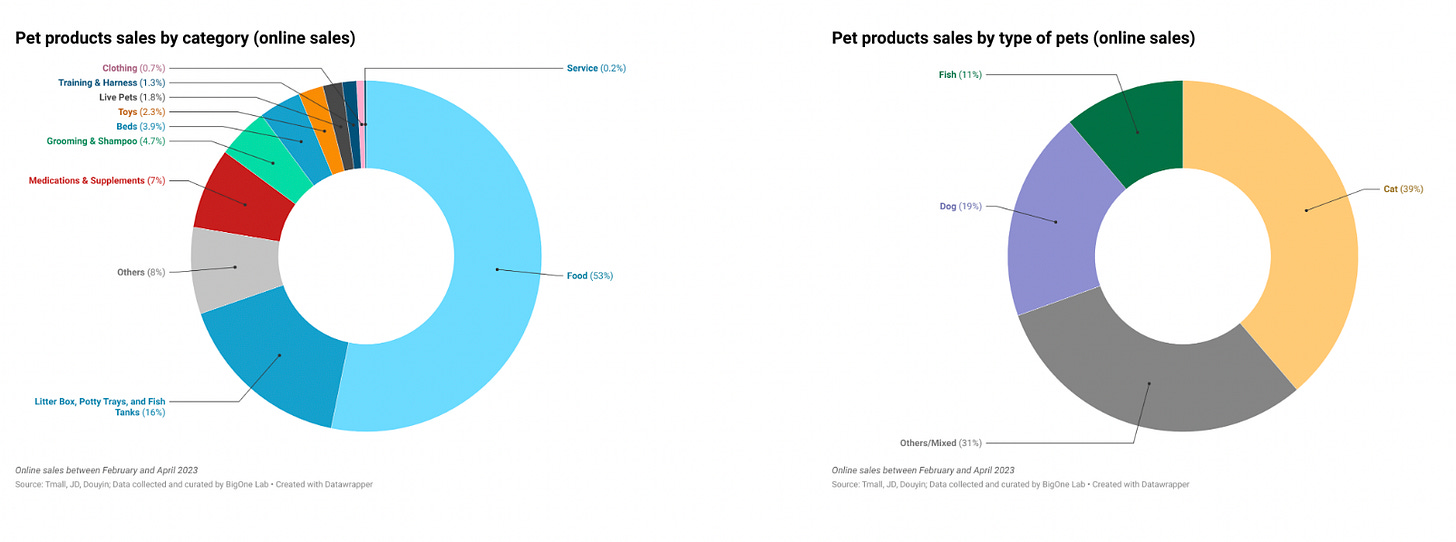

Food currently represents the largest category of China's pet-related consumption, followed by litter boxes, feeding supplies, medicine, and nutritional supplements. Together, these items comprise the largest segments of the pet market.

Urbanization and fast-paced lifestyles are leading many Chinese to prefer pets that require less space and maintenance. As a result, cats have taken the crown in the Chinese pet market, followed closely by dogs. Fish and other pets also claim a respectable share, showing the diversity in pet choices.

Emerging niche markets

As the market size grows, the diversity of product offerings also increases. One important trend is that pet owners are prioritizing the health of their furry friends. Similar to how parents view health supplements as a must for their kids, pet owners are increasingly viewing pet health supplements as a staple. Some pet parents even take this to the extreme, leading to a booming niche market. For instance, essential oils for pet paw care have emerged as one example of this trend.

Some pet owners are projecting their own desires for health and beauty onto their pets. "Anti-aging," which is a common demand from Chinese consumers, has now become a niche market for pets as well. This has led to new products such as "anti-aging" and "low-fat, low-cholesterol" dog food.

Another emerging trend is the use of automatic feeders, which aligns perfectly with the busy lifestyles of young, metropolitan Chinese consumers. According to BigOne Lab’s data, online sales of automatic feeders grew by 927.28% year-on-year on major e-commerce platforms in China.

The backbone of the industry - Supply chain

After scanning through millions of customer reviews on Tmall and JD, we found that taste, value for money, and freshness are the most important considerations when purchasing pet products. These factors emphasize the continued dominance of pet food in the market and highlight the importance of a strong supply chain to ensure product freshness, safety, and on-time delivery.

In an interview with a senior executive at GLP Supply Chain Services (GLP SCS), a global leader in one-stop supply chain services for the pet industry, we learned that brands highly value pet owners' attention to food safety:

Achieving supply chain traceability is an important way to ensure food safety, especially for overseas pet brands that have come to China from afar.

Pet owners consider QR codes essential for tracing product logistics, from origin to destination. To verify the authenticity of products, they require not only a QR code to trace the origin, but also a code to verify the distributor. Fake items are often sold online, especially for more expensive imported brands. Implementing supply chain traceability measures, such as QR codes, can help pet brands identify product damage that may occur during transportation, such as damaged packaging, mold, and insect infestations resulting from improper storage or handling.

Freshness is also a top concern for pet owners. They expect to receive their preferred products on a consistent schedule and want to ensure that the items they receive are not approaching their expiration date.

Some customers also complain about cases where prices are raised immediately after they make a purchase. Such a phenomenon can put the brand in a negative light. For overseas brands, these challenges will be even greater. Therefore, it is essential to partner with companies such as GLP SCS, which are familiar with the local market and have a global perspective. By doing so, brands can not only improve the stability of their supply chain network and ensure safe transportation of products from the factory to the consumer's home, but also effectively manage distribution channels and gain valuable insight into market conditions. One solution may be to use specialized services such as GLP Supply Chain Service's digital trade base to ensure the timeliness and stability of the import supply chain.

A strong supply chain is the linchpin of any successful venture into the pet market. It not only ensures product freshness and safety, but also impacts the final price paid by consumers and the overall consumer experience. A well-orchestrated supply chain can balance cost and quality, meeting consumer demands while optimizing profitability.

A larger and more diverse market lies ahead

Embracing the shift from cradles to kennels can unlock a treasure trove of opportunities for brands. This is a testament to the evolving Chinese consumer market, where nurturing and care extend from two-legged toddlers to four-legged companions, opening up a whole new world of commercial possibilities.

As this affectionate trend blossoms, opportunities are extending beyond the biggest slice of the pie - pet food. Personally, I foresee a future boom in pet toys, nutritional supplements, pet beauty products, and clothing. This reflects the desires of young pet parents who are keen to ensure their pets' holistic happiness, much like parents do for their children.

The bustling urban lifestyle is also set to catalyze innovative product developments. Products like automatic feeders have already emerged as the first wave, but I believe we're just scratching the surface. The future holds immense potential for more innovative products and localized services within neighborhoods and communities.

Related Reads

Foreign vs. Homegrown? Which Brands Are Winning Over Chinese Consumers in 2023?

With more middle-class families and young adults becoming the new generation of consumers, their evolving preferences and tastes will continue to shape consumption in China. This article identifies specific markets with significant demand growth over the past three years and examines how foreign brands have fared

How China’s young consumers buy their way into longevity and health

The concept of "养生" (yǎng shēng), which roughly translates to "nourishing life" or "health preservation," has a long history in China. It refers to a holistic approach to maintaining health and longevity through various practices such as diet, exercise, acupuncture, meditation, and herbal medicine.

Baiguan is powered by BigOne Lab, China's leading data-driven provider of market research and analytics that was founded in 2016 by information services industry veterans from Bloomberg, BlackRock, YipitData, and Nielsen. BigOne Lab's products and services are trusted by 100+ top institutional investors and corporates around the world. BigOne Lab is also invested in by a number of institutional investors, including S&P Global.