China Q3 in Review: Is the Ground Still Shaky? — Charts of the Week

13 Charts on the Real Estate Market, Jobs, and Consumer Sentiment

“Charts of the Week” is Baiguan’s series that features key data points to help you quickly grasp the general state of affairs in China in just a few minutes. We handpick the highlights of the data charts from a variety of sources, analyzing and delivering insights trusted by 100+ top institutional and corporate clients worldwide at BigOne Lab. Don’t forget to subscribe before you continue reading!

As Q3 2025 closes, more are starting to question the disconnect that has emerged in China between the stock market rally and a macroeconomy that hasn’t materially changed—with CPI/PPI still in a deflationary range and the real estate market still showing weakness.

Today’s “Charts of the Week” issue dissects China’s job market, real estate, and consumer sentiment to get a holistic understanding of how household confidence is really holding up.

The real estate market remains sluggish

The recent National Day holiday saw a continued drop in property viewings and transaction volumes for existing homes, partly due to a high comparison base from last year. For the week ending October 11, transaction volume in over 90 cities plummeted 36% year-over-year, while property viewings in 80+ cities declined 11%. Listing prices also continue to fall, and an increase in new listings is placing further pressure on the supply-demand balance.

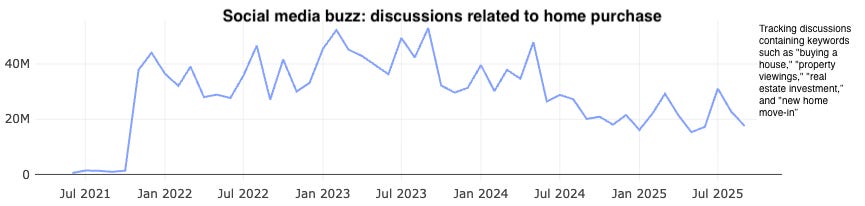

Looking forward, the intention to purchase a home also remains low. On social media, no significant pickup in discussions related to home purchasing has been seen in Q3.

On the flip side, income expectations marginally improved

The average salary for jobs posted on China’s online recruitment platforms began to rise in Q2 and continued to increase through Q3.

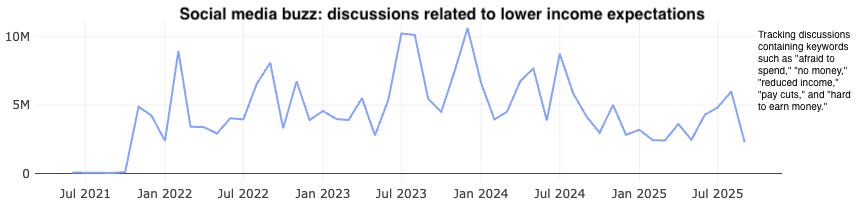

Accordingly, fewer people are discussing topics related to “lower salaries/income,” “pay cuts,” or being “afraid to spend” on social media.

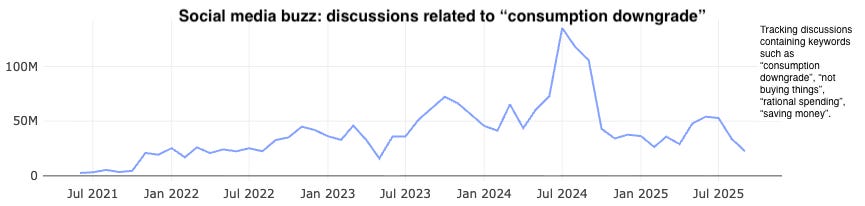

Discussions about “consumption downgrade,” “not spending/buying things,” or “saving money” have also declined, indicating improving consumer sentiment.

But the recovery is uneven — the job market is still tough for certain groups

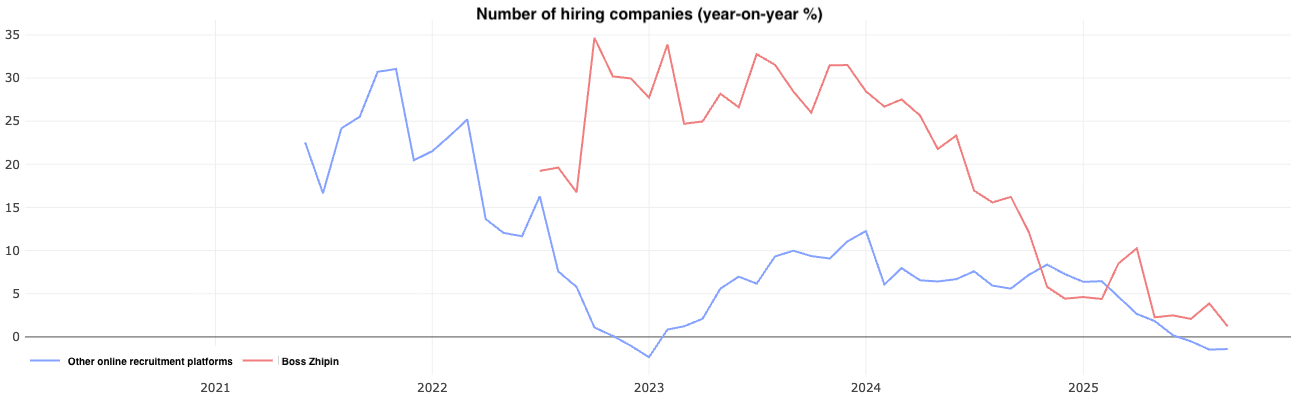

While salary increases started to pick up for companies that have survived, the number of companies hiring continued to grow at a slower pace on Boss Zhipin and turned negative on other recruitment platforms in Q3.

The quality of jobs also seems to be declining, with more people moving into part-time roles. The part-time workforce experienced peak growth in 2023, building on a low base in 2022 due to COVID lockdowns, and this momentum continued into the following years.

Charts behind the paywall answer the following questions:

How fast is China’s “gig economy” growing, and are part-time wages keeping up?

Are Chinese companies still aggressively hiring for their global expansion?

How tough is the job market for new graduates, and which cities offer the most opportunities?

To get a sense of what is offered, you are welcome to check out this older post in the same series: Charts of the Week. You can also get free access by sharing us. For more timely discussions, consider joining our private Discord channel for paid readers.