The revolutionary nature of China’s state-owned enterprises KPI reform

And how that’s driving China Mobile’s shares to historical highs

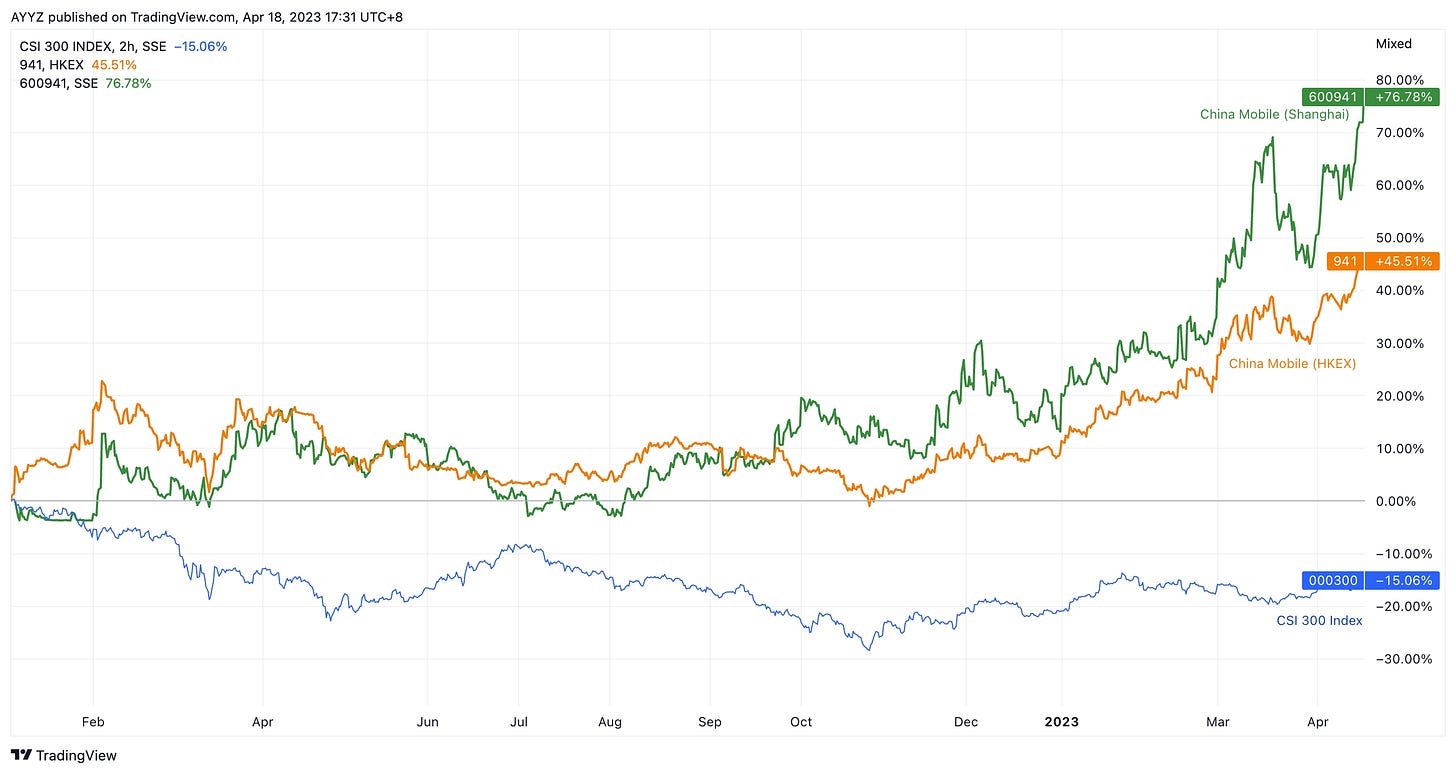

In a landmark event, on April 17, China Mobile surpassed Kweichow Moutai as the largest company by market capitalization on China’s onshore A-share market. Long-considered as backwaters in the capital markets, the state-owned enterprises (”SOEs”) including China Mobile have outperformed the wider market with a huge margin over the last several months. Why is this happening? What does it mean for China’s policies and economic development? Is this trend sustainable?

Three key phrases will help us understand this phenomenon: 1) public finance pressures 2) “中国特色估值体系 valuation system with Chinese characteristics” 3) “一利五率 1 profit, 5 ratios”

Key Phrase #1: Public finance pressures

The combination of a slowing economy, the end of real estate boom, declining birth rates, advanced level of urbanization and 3 years of zero covid measures means one thing: China’s public finances, which are heavily reliant on land sales, are short of money.

According to researchers at Finance Research Center of Fudan University Development Institute:

One important issue currently facing China is the gradual decline of traditional land finance. On the one hand, the long-term downturn of real estate is due to the aging of the population dividend, slowing urbanization, and high housing prices…On the other hand, real estate investment and land finance revenue also face a long-term downward trend. If we look at the proportion of residential construction investment to GDP under stable conditions, Japan and the United States fluctuate at around 3%, while China's proportion is over 6%. As land tightly links with real estate and finance, the decline in the proportion of real estate investment in the economy will also gradually reduce the proportion of land revenue in fiscal revenue. The peak of land finance revenue was 8.7 trillion yuan in 2021, accounting for more than 30% of government revenues (public finance + government fund revenue). The peak in terms of proportion appeared in 2020, but it dropped to less than 6.7 trillion yuan in 2022, accounting for less than 24%.

Within such context, it is no wonder that China will tap more into SOEs for incremental source of public finance. By some estimates, SOE’s contribution in the form of taxes and dividends paid already accounts for ~18% of government revenues. In the future, it will become a policy necessity to let this pillar play an even bigger role to make ends meet.

But government understands that they cannot grow revenues from SOEs without making SOEs more profitable, and more valuable in the eyes of capital market.

Key Phrase #2: 建设中国特色估值体系 Building valuation system with Chinese characteristics

Due to long-standing market concerns about SOEs’ governance structure, growth profile and profitability, SOEs usually trade at cheaper valuations than non-SOEs. Many SOEs, despite being profitable on paper, often trade at price-to-book ratio of less than 1, meaning Mr. Market values SOEs even less than the actual net assets that these SOEs hold. It is within this context that Mr. Yi Huiman, Chairman of China Securities Regulatory Commission, first proposed the term “建设中国特色估值体系 building valuation system with Chinese characteristics” (”中特估 VSCC”):