China‘s bumpy path towards economic growth - Charts of the week

Catch up with China’s recent economic trend in 15 charts

April economic data highlight: the economy is still facing headwinds

Industrial production grew 5.6% year-on-year, accelerating from the 3.9% pace seen in March, but below expectations for a 10.9% increase.

Retail sales jumped 18.4%, up sharply from a 10.6% increase in March for their fastest increase since March 2021.

Fixed asset investment rose 4.7%, against expectations of 5.5%.

Exports rose 8.5% in U.S. dollar terms, marking a second-straight month of growth, while imports fell 7.9% compared with a year ago.

China's economic data for April showed signs of improvement, but growth remained below expectations. Uncertainty, concerns over employment, and geopolitical tensions continue to be key factors on China's path to economic recovery.

Overall, economic activity has rebounded well since 2022 but has not yet matched pre-Covid levels from 2019 and earlier. Let's delve into the details to better understand the nuances.

Datapoints covered in this issue:

Industrial activity: sales of excavator

Automobiles

Real estate

Employment outlook: job postings breakdown by industry; social sentiments regarding salary outlook

Duty-free shop sales & luxury sales (China mainland)

Online consumption and live-shopping platform sales

Offline consumption and breakdown by city tier

Industrial activity picked up moderately

The unexpected decline of the PMI to 49.2 in April raises concerns about the potential contraction of the economy.

Based on BigOne Lab's nationwide panel, there was a moderate increase in year-on-year excavator sales in April. This may indicate a slight improvement in industrial activity in the upcoming months, but the pace of expansion remains cautious.

Consumers continued buying automobiles, while the real estate market cools down

In April, Chinese passenger car sales increased by 55.5% year-on-year, reaching 1.63 million units. According to the weekly report published by the China Passenger Car Association, sales have maintained their momentum leading into May.

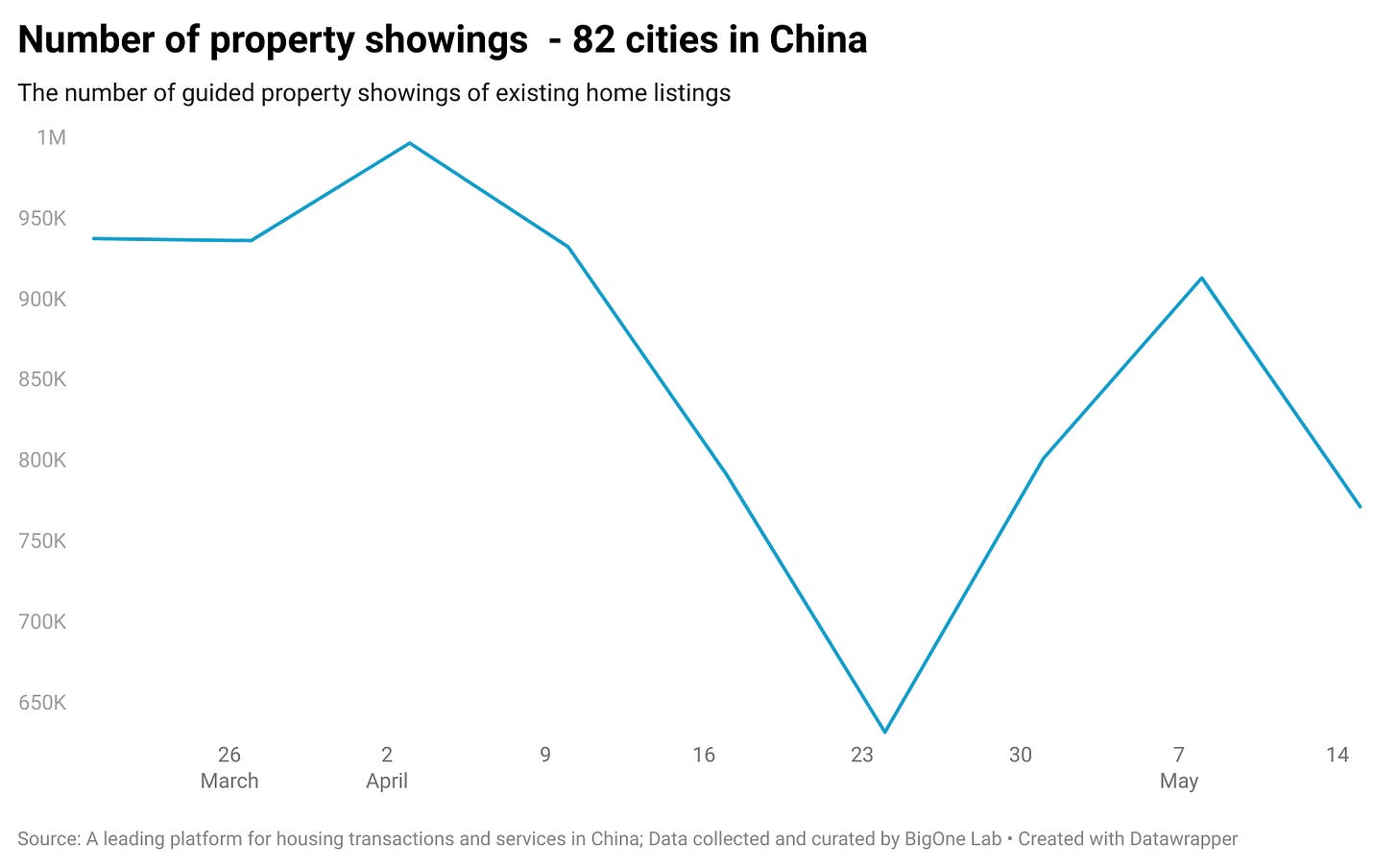

The real estate market remained tepid in April and mid-May. The total number of property showings for existing home listings tracked by BigOne in 82 cities in China has decreased from its peak in March and continued to be cool going into mid-May.

Historically, the number of property showings has been highly correlated with transactions, making it a good leading indicator for monitoring the real estate market.

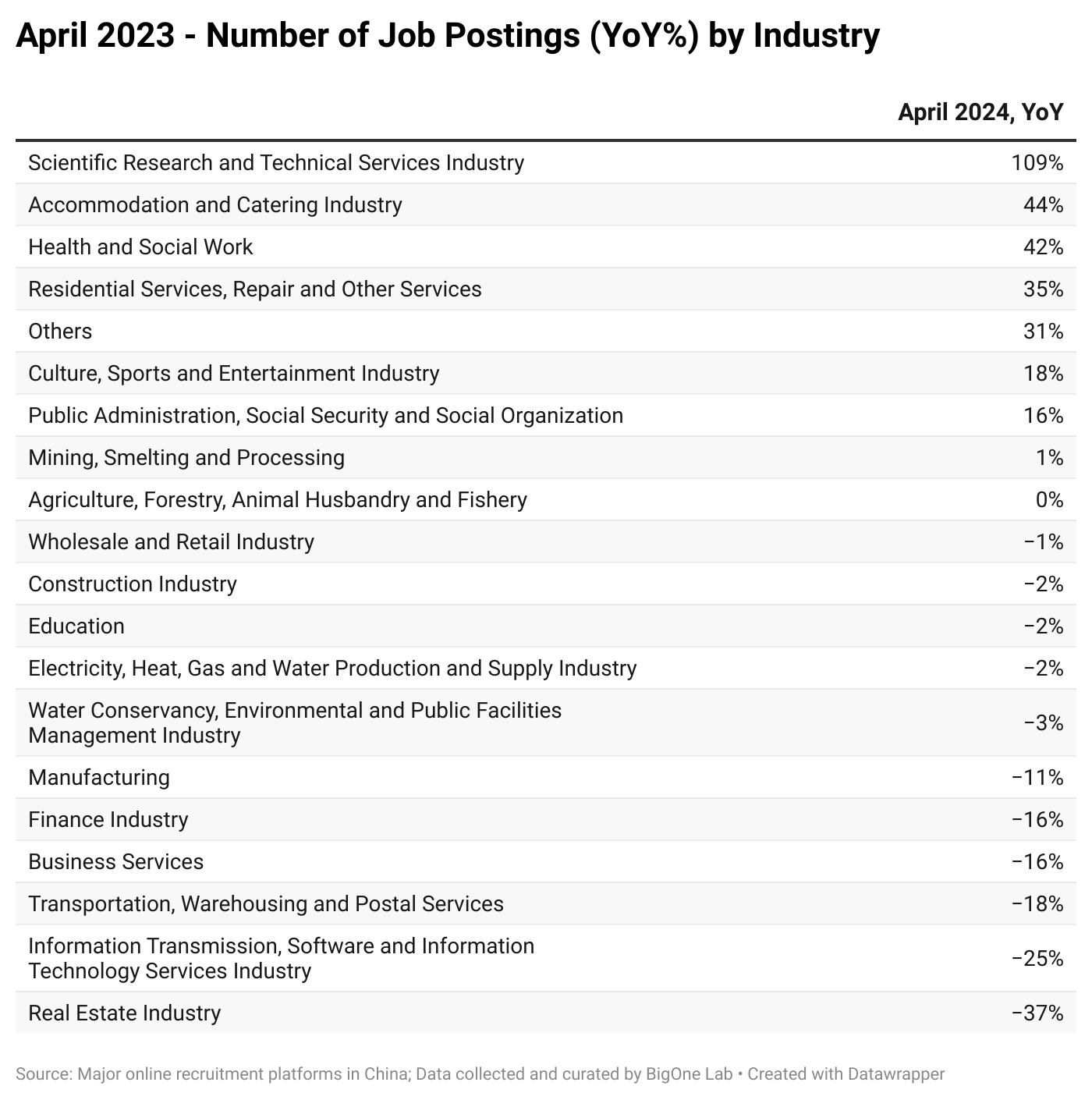

Employment outlook: the scientific research and accommodation industries led the rebound, while IT and real estate lagged behind

In April, overall unemployment remained steady, down 0.1% from the previous month. BigOne Lab's job postings data show similar trends, with job postings on major recruiting platforms remaining roughly unchanged compared to March.

Boss Zhipin, the largest online recruitment platform in China, has shown a stronger rebound in job postings compared to industry peers. The number of active companies recruiting on Boss Zhipin increased by 57% YoY in April. Furthermore, the average daily usage time of the Boss APP increased by 15% YoY during the same period. These statistics indicate an increase in demand from both companies and job seekers.

In April, the Scientific Research and Technical Services Industry experienced a rebound in employment, primarily due to an increase in positions for junior engineers and researchers specializing in AI, VR/AR, autonomous driving, and quality control. Although the overall labor market remains tepid, we have observed that industries such as semiconductors are actually competing for talent.

Boosted by the revival of tourism and offline consumption, the Accommodation and Catering Industry also saw a 44% increase in job postings year-on-year in April.

Youth unemployment remains a significant concern. In April, the unemployment rate for the labor force aged 16 to 24 reached a record high of 20.4%, up from 19.6% in March.

Related read on youth unemployment

China’s record-high 20.4% youth unemployment: where did everyone go, and will it get better?

China's urban unemployment rate for April was 5.2%, down 0.1% from the previous month, according to data released on May 16 by the National Bureau of Statistics. However, the unemployment rate for the labor force aged 16 to 24 rose to a record high of 20.4% in April from 19.6% in March.

Employment outlook: concerns remain over salary reductions

According to BigOne Lab's analysis of social media sentiment, while concerns about job loss have stabilized, expectations of potential salary cuts have increased significantly in May.

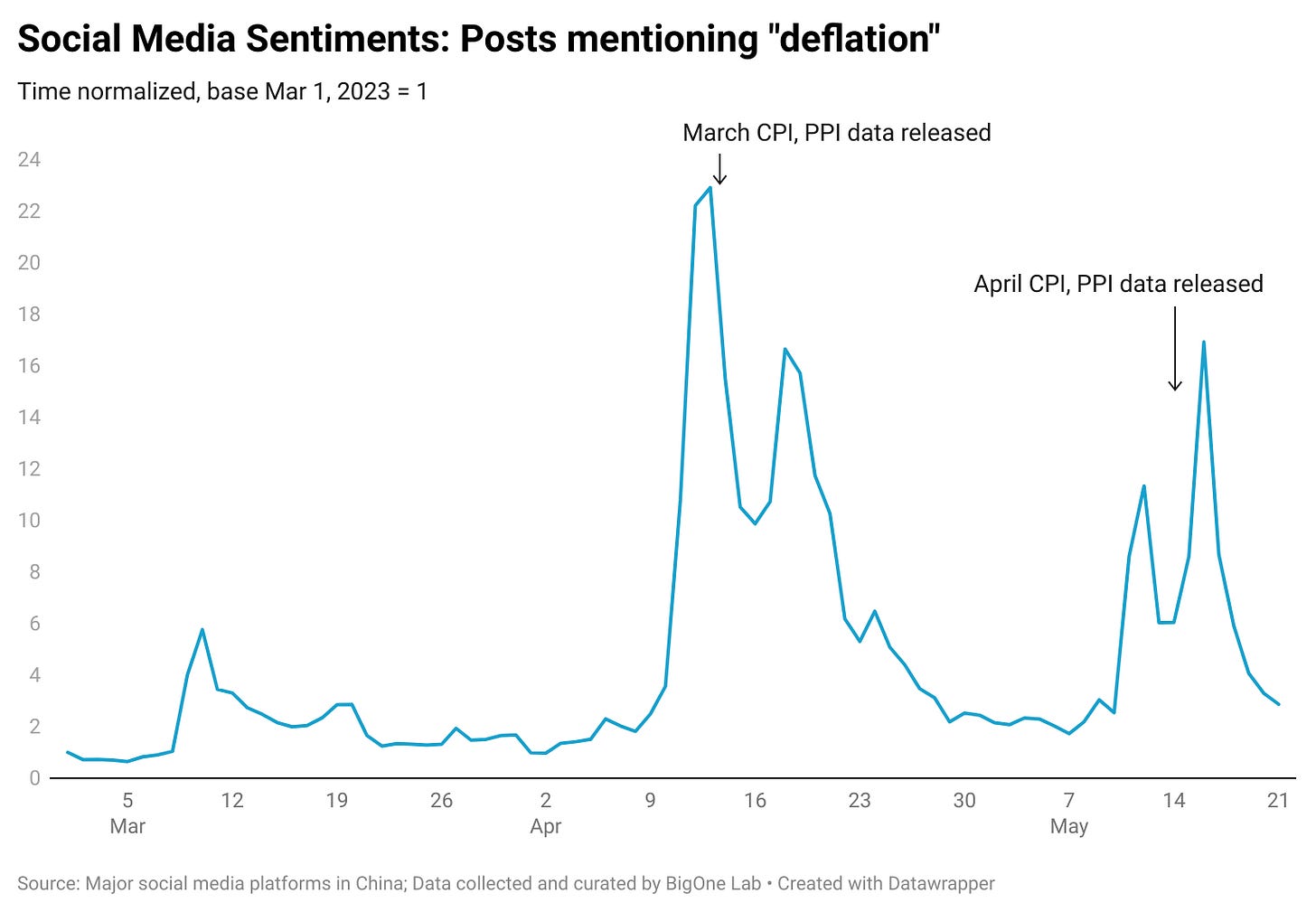

Concerns over deflation still loom, as indicated by social media sentiment

As we have previously noticed, social media sentiment regarding the fears of deflation surged after the release of March data. The number of social media discussions mentioning "deflation" spiked again after the release of April economic data but to a lesser extent. The trend suggests that concerns over deflation and economic slowdown still loom.

Related read on deflation concerns

Charts of Week: Deflation Fears Cast a Dark Shadow; Is China Heading for a Recession?

Week of Apr. 17, 2023 China recently released mixed economic data: On the positive side: the country's GDP Growth Rate YoY was at 4.5%, Industrial Production YoY at 3.9%, Unemployment at 5.3%, Retail Sales YoY at 10.6%, and Exports YoY at 14.8%——all beating expectations.

Divergence: the wealthy engaged in "revenge shopping," while the middle class preferred a more practical way of life

Three years of Covid have not had a material impact on the 0.3% of ultra-wealthy people. Luxury consumption is heading for a very strong recovery into 2023, with both sales and average spending per transaction surging.

According to BigOne Lab's nationwide sales panel, sales at duty-free shops and for the top 30 luxury brands have increased by over 110% and 160%, respectively.