China's economy struggles, but Lululemon is having a shopping Fiesta!

A data-driven review of Lululemon’s expansion strategy

*You are currently accessing a limited-time preview of content typically exclusive to our premium subscribers. We appreciate your engagement.

China's economy is struggling, with consumers preferring to save and leaning towards frugality and cost-effective alternatives. However, an unexpected brand is bucking the trend. Lululemon, known globally for its high-end athletic wear and corresponding price tags, is seeing a surge in sales in China.

In Q1 2023, Lululemon disclosed its China revenue breakdown for the first time in its 10Q filing and reported a 79% year-on-year increase in revenue from China in the first quarter. By Q1 2023, China had become one of the top three geographic regions with the highest revenue, contributing 12.5% of Lululemon's total revenue, following Canada (12.7%) and the US (65.7%).

Lulu's leadership also demonstrated confidence in expanding the Chinese market and building brand awareness during the earnings call.

"I had a chance to visit Shanghai in mid-April for the first time in three years, and it was great to see how much our brand has grown in the city…We expanded channels. We have .cn. We have Tmall. We added JD…We have a leader in CN that is based in Mainland China, in Shanghai. We have a specific SSE office where we have talent and resources that are specifically focused on driving these initiatives and building the business in Greater China and Mainland China." Calvin McDonald (CEO)

“Our new store openings in 2023 will include 30 to 35 stores in our international markets with the majority of these being planned for China.” Meghan Frank (CFO)

We believe that Lululemon is likely to maintain its momentum into the second quarter of 2023. On Tmall and JD (where Lululemon operates its official online stores in China), Lulu's total sales jumped 26% year-on-year in Q1 2023 and 110% year-on-year in Q2 in the sports and health product category. The significant increase in Q2 could be partly due to the Covid lockdown in Shanghai during April-May 2022 creating a low base. However, the increase still surpasses the overall Sports and Health category growth and Lulu's major competitors such as Nike, Descente, and Fila.

Additionally, we see a well-balanced increase across all product categories. Online sales of Lulu's flagship yoga and dance products increased by 70% year-on-year, and sales of other sportswear increased by 172%, now contributing to almost half of Lulu's sales.

Despite the decelerating economic conditions, affluent consumers did not seem to slow down their consumption, especially in the sports and outdoor categories. This is a trend we have previously observed in both fashion consumption and luxury shopping.

While Lulu's current growth in China is impressive, there's skepticism within investor circles about its long-term potential. A primary concern is the brand's steep pricing. For context, Lulu's signature Yoga Align pants come with a price tag of around ~1,000 CNY — nearly 10% of the monthly salary for a beginner role in finance or IT in China's major cities. As consumers increasingly seek out more affordable alternatives amid economic hardship, the sustainability of Lulu's sales surge is under scrutiny. Further, there's apprehension regarding Lulu's heavy reliance on its iconic yoga pants; such product concentration might pose challenges in sustaining future growth momentum.

During Lulu’s 2023 Q2 earnings call, Lulu’s leadership addressed their core strategies to mitigate these concerns, which include:

Increasing brand awareness by “launching market-specific activation campaigns, investing in traditional brand marketing, and leveraging digital channels such as WeChat and WeCom in China”.

Product innovation: “bring innovation via new fabric technologies, create styles and silhouettes that solve for unmet needs…continuing to build out our golf and tennis collections with versatile styles that can be worn both on and off the course and court.”

“Maintain balanced growth across all markets, categories, and genders”

In today's article, we'll delve into our online sales data from Tmall & JD—Lululemon's official online storefronts in China—as well as consumer sentiment insights from platforms like WeChat, Douyin, and Xiaohongshu, where Lululemon enjoys significant brand visibility. Our aim? To address pivotal questions and evaluate the effectiveness of Lulu's expansion strategies in the Chinese market. Dive into our latest insights to gauge Lulu's potential for success in expanding its footprint in China, as we discuss:

Consumer Profile: Delve into the demographics of Lulu enthusiasts – who are they, where are they located, and what product features resonate most with them.

Product Strategy: Discover the top-selling products, Lulu's potential for future growth, and the brand's foray into male-centric items and a broader range of wearing occasions.

Who’s buying Lulu’s infamously expensive yoga pants?

One man's trash is another man's treasure.

Many Chinese consumers dub Lululemon's 1,000 CNY yoga pants as "IQ Tax" or "智商税," a term implying that one is paying unnecessarily high premiums when cost-effective alternatives exist. A significant portion of consumers are gravitating towards more affordable options like Descente and the local brand Maia Active. Others are exploring high-quality replicas on 1688.com, a domestic B2B platform known for its vast assortment of economically priced products.

However, Lululemon's loyal fans, say things like "There is absolutely no substitute for the fabric and workmanship." They call themselves "Lemon People" and have a strong sense of belonging to the community. This is not exclusive to the high-income community, as many consumers are also saying they would like to save and cut spending elsewhere to buy Lululemon.

So, they are two distinct groups of consumers, and it is clear that Lululemon is targeting a specific customer profile by charging a premium for delivering high-quality products that cater to its target customer base. Lulu's CEO even reemphasized the company's premium pricing strategy.

“…we enter markets with our similar premium positioning of the brand with the intent to sell at full price with markdowns being used only as a means to exit through seasonal shifts in product and not leverage promotional discounting in order to fuel and create demand.”

Data from Xiaohongshu, China’s premier lifestyle social media platform, reveals that typical Lululemon enthusiasts also favor other premium brands, such as Nike, Chanel, Arc'teryx, and Dior. Notably, Nike emerges as the most frequently co-mentioned brand alongside Lululemon.

Keywords commonly associated with Lululemon posts include fashion, outfitting, and OOTD (outfit-of-the-day). Following closely are terms like fitness and sports. This suggests that Lululemon's appeal isn't merely functional; aficionados appreciate its “athleisure” style and design.

Post-Covid in 2023, Lululemon's social media footprint has expanded dramatically, marked by an upsurge in mentions on platforms like Xiaohongshu and Douyin. As of July 2023, among Lululemon's Chinese admirers on Xiaohongshu, the largest group is from Shanghai, where Lulu has made significant investments, at 28%. This is followed by Beijing at 12%, Guangdong at 9.4%, Zhejiang at 7.9%, Sichuan at 2.9%, and Chinese residents in the U.S. at 3.06%. This shows that Lululemon's plan to increase online presence and brand awareness is coming along nicely.

What are they buying: Align™ still dominates

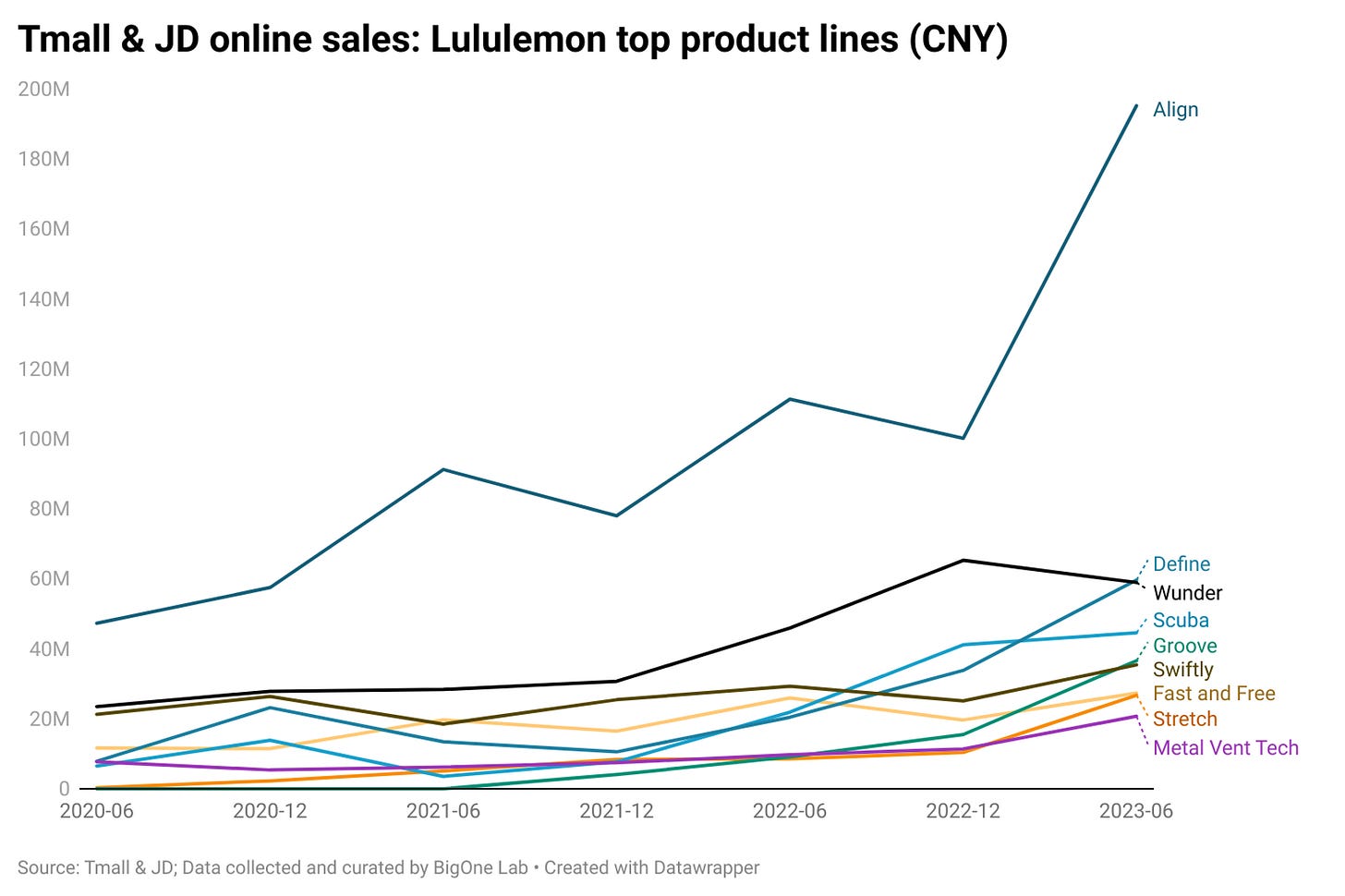

Tmall and JD's online sales show that Lululemon's iconic Align™ line still dominates sales and maintains robust year-on-year and quarter-on-quarter growth in Q2 2023 compared to other flagship product lines such as Define, Wunder, Scuba, and Groove.

Align™ represents more than just a cash cow for the company. Its charm largely stems from Nulu™, Lulu’s signature fabric used in every Align™ product. This material has endeared itself to consumers, particularly because of its "buttery-soft" texture.

On Chinese social media platforms, consumers list their primary reasons for purchasing a Lululemon item. Among these reasons, the most prominent ones are the "soft, lightweight fabric" that gives the sensation of feeling "naked," and the slimming cut that elongates the legs. While there are consumers who doubt the fabric's "technology", suggesting it's merely an "IQ tax" and can be easily replaced with cheaper alternatives, our e-commerce data suggests otherwise.

Sales of products made from Nulu™ fabric (excluding the Align series, which exclusively uses Nulu™) have seen a remarkable upward trend in recent years.

In the first half of 2023 alone, sales of products using Nulu™ fabric shot up by 689% year-on-year on Tmall and JD. (The Align series saw a growth of 114% year-on-year during the same period.)

The takeaway is clear: consumers are willing to pay a premium for this unique, technology-infused fabric. This trend offers Lululemon an opportunity to capitalize on a secondary growth trajectory by integrating styles and fabric.

A well-balanced growth across products for all genders

The overall sales of male products have been growing at a pace on par with female and other products since 2022.

Notably, the men's line "Metal Vent Tech" also made it to the top products with the highest year-on-year growth, showing a robust increase of 191% in Q2 2023 compared to the previous year.

Expanding the Lululemon experience: wear for more occasions

Lululemon's initiatives to diversify its product offerings are resonating with Chinese consumers. As of Q2 2023, online sales for running and training products have eclipsed those of Lululemon’s cornerstone Yoga items.

For context, in the first half of 2023, Nike's online sales for running and training shoes amounted to 1.4 billion CNY across platforms such as Tmall, JD, and Douyin. While Lululemon's sales in this category stand at approximately 2% of Nike's figure across Tmall and JD (Lululemon doesn't sell on Douyin), they're surging at an impressive rate of 273% year-on-year, compared to Nike's growth of 44%.

Lulu's local activation campaigns and activities, which consumers can register for and participate in through WeChat, have helped boost sales. These activities are mainly offered in running, training, yoga, and Pilates, and are available in 28 cities throughout China.

Although hiking and tennis do not yet represent sizable portions of Lulu's revenue in China, they have seen significant sales increases since Lulu launched these products in the country. Notably, we have observed that more consumers are buying functional products such as UV protection clothing and water-resistant/rain jackets.

Emphasizing comfort and a “chillax” vibe

In Q2 2023, the product line witnessing the swiftest growth is the Pull-on styles, followed by Softstream, Groove, Stretch, and Lightweight. These products share a central theme, emphasizing comfort, efficient sweat-wicking, simplicity, versatility, and designs that make wearers appear taller and slimmer.

Notably, the Pull-on and Softstream pants exude a "Chillax" ambiance, aligning with the style trend embraced by Chinese consumers this summer.

Consumer loyalty: are they opting for more easily replaceable accessories?

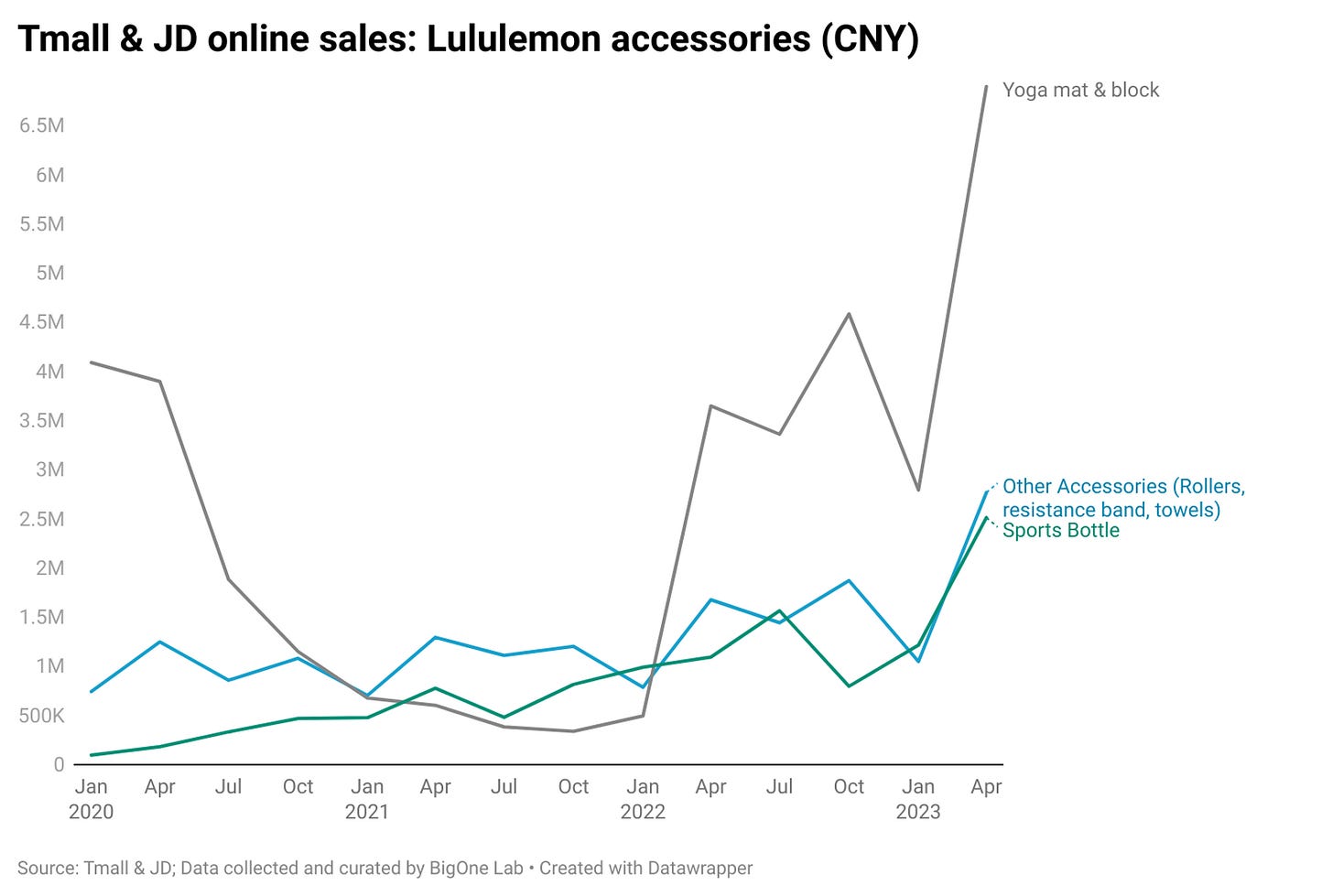

For products often perceived as readily replaceable with more affordable alternatives—like yoga mats, blocks, rollers, resistance bands, towels, and sports bottles—Lululemon still registers consistent growth. This underscores the loyalty of its consumer base.

Though the Align series tops the sales charts, Lululemon's accessories have seen a remarkable year-on-year sales uptick for Q2 2023 on Tmall and JD. Specifically, yoga mats and blocks experienced a 90% rise in sales, sports bottles surged by 130%, and other accessories—including rollers, resistance bands, and towels—grew by 65%

So, does Lululemon worth the 50x P/E?

As a consumer, I've purchased items like Lululemon pants and sports bras. I wouldn't necessarily label myself as a die-hard "Lemon Person" or part of Lululemon's devoted community. However, I can't deny my admiration for the brand's design, innovative fabric technology, and its flattering cuts. Interestingly, the allure for me isn't necessarily tied to the workout environment. Just as my daily coffee is essential but not bound to any specific cup or brand, I believe one can have an effective workout in any attire. Yet, Lululemon shines post-exercise: slipping on their pants after a workout, heading to the grocery store, and feeling effortlessly stylish.

Transitioning to an investor's lens, it appears that Lulu's upcoming hurdles might pivot more around its branding and aesthetics than fabric prowess. A comfortable and functional design is a fundamental expectation in sportswear — it doesn't confer a distinct edge.

Consumers from varying demographic backgrounds and generations have distinct aesthetic preferences. When Lululemon comes to my mind, I'm instantly reminded of its brand messages centered around "wellness, mindfulness, sustainability, personal betterment, and the philosophy of leading a life that is laid-back, understated, yet always in motion." These values are deeply entrenched and celebrated in North America, where I've lived for a significant portion of my life. However, whether these principles resonate similarly in the Chinese core market is debatable. Drawing a parallel, if we observe other trending sports brands among young Chinese consumers, such as Fila, they broadcast a more "extroverted" fashion narrative emphasizing "streetwear" and pulsating urban energy. Such aesthetics have the potential to appeal beyond mere price points or income brackets.

Industry behemoths like Nike have seamlessly woven their narratives into global cultural fabrics, harnessing universally appealing motifs like basketball. This strategy garners appeal across regions, transcending income brackets, professions, and societal strata. Contrarily, in China, Lululemon still skews towards a niche audience—primarily the affluent, white-collar demographic attuned to global aesthetic sensibilities. (maybe it's not a coincidence that Lululemon is investing in domains such as tennis and golf.)

*For reference, as of writing, Lulu's P/E is 50x and Nike's is 30x. Lulu's gross margin stands at 57.5% as of Q2 2023, while Nike's is 43.6% for the quarter ending May 2023.

In conclusion, Lululemon's expansion into the Chinese market has been met with promising results, with strong sales growth and a dedicated consumer base. However, the brand's premium pricing strategy and concentration on a few iconic products may pose challenges for sustained growth in the long term. Lululemon's leadership has outlined strategies to mitigate these concerns, including increasing brand awareness and product innovation. As the brand continues to navigate the Chinese market, it will be interesting to see how it adapts to the unique cultural and aesthetic preferences of Chinese consumers.

In my opinion, Lululemon's entry into the Chinese market has been impressive (And 2023 Q2 doesn't seem to be slowing down), especially considering the challenges of the extended Covid lockdown and economic downturn. The brand's strategy of premium pricing, coupled with its innovative fabric technology, has clearly found a fan base among the Chinese who value quality. They've been broadening their product line and introducing more diverse wearing options, which seems to be paying off in China. However, an intriguing question emerges: It’s a good starting point, but will Lululemon's aesthetic choices continue to resonate and find universal appeal among broader consumer groups throughout China in the future? (Personally, I think it's promising. Sports and fitness are a never-ending theme that transcends different groups. Let's see how Lululemon plays out!)

*Disclaimer: This article is not sponsored by Lululemon or any other companies mentioned in the article.

China's economy struggles?? Please check before writing!

China's economy is red hot.

China's GDP is $30 trillion PPP

5% growth = $1.5 trillion.

$1.5 trillion = more than the GDP of 192 countries.

$1.5 trillion = more than US + EU growth combined.

$1.5 trillion = 30% of global growth*.

YTD, Consumer sales have risen 7.3% YoY, fixed-asset investment 3.4%. The service sector gained 5.7%, and industrial output rose 3.7%. Urban unemployment was 5.3%, lower than last year's 5.4% Popeyes plans 1,700 new stores in China. Hilton to open 730 new hotels in China. Why? China's GDP growth rate is triple the US' & China's middle class is 400 million people. China is the largest #market on earth. “In Q2 2023, revenue growth of Alibaba, Tencent, Baidu, JD, Kuaishou, Bilibili, iQiyi were 13.91%, 11.32%, 14.87%, 7.6%, 27.88%, 8.05%, 17.21% respectively, corresponding net profit growth were 62.58%, 40.53%, 44%, 50.39%, 146.63%, 23% & 282.65%, much higher than revenue.”

The price of hedging China risk on world markets is unchanged. Investors with real money aren’t worried about China’s property market. Credit default swaps, a form of bond insurance that makes creditors whole after a default, are quoted in basis points .001%, above the cost of interbank funding. The cost of default protection on China traded Aug. 18 at 80 basis points, on the lower side of its historic range.

*(America's 1% growth = 9% of global growth).