China's labor market: silver linings in the fog

Wage prospects, industrial shifts and directions of demographic movements

Today's article is an excerpt from our recent speech at Morgan Stanley's China Technology, Media, and Telecom Conference. Here, we will provide you with top-quality information accessed by global institutional investors and will focus on China's labor market, drawing insights from online recruitment data tracked by BigOne Lab and official unemployment and wage income disclosures.

We will address three key questions, answers to which might surprise both foreign investors and even some local investors:

Why is recruitment under pressure despite an improving unemployment rate per official statistics?

Are Chinese people getting richer or poorer through wages in the past 2-3 years?

What could be the next growth engine for China's economy, considering population flow, industrial shifts, and business prospects?

IMPORTANT Community Announcement

We are planning to launch a paying member-only online community for you to exchange ideas. We have yet to decide on details, but very likely it will be a Discord community. We welcome other suggestions from you.

Starting from July 15, we will increase our subscription price from $100/year to $188/year, $15/month to $20/month. Prices will NOT increase for paying subscribers who sign up by July 15th, so please subscribe before then to lock in the old price.

Paying members of Baiguan enjoy free access to China Translated, the personal newsletter of Robert Wu, which is currently worth $100/year. Please DM us if you wish for this access.

Recruitment under pressure despite improving unemployment rate...Why?

Let's explore a controversial issue. On one hand, the average number of job postings on China's major recruitment platforms (tracked by BigOne Lab) has been declining year-over-year. On the other hand, the unemployment rate has improved over the past two years.

Some might argue that the decline in job postings is a natural consequence of a shrinking working-age population in China. However, the working-age population peak occurred as early as 2015, but we saw a surge in job postings in 2021, coinciding with post-COVID economic optimism. This suggests that recruitment trends are a barometer of business confidence — companies expand hiring when conditions are favorable or anticipated to improve.

So, why exactly is this discrepancy happening?

Reason 1: Lower voluntary turnover rate

There's a noticeable decline in voluntary turnover rates across major cities, provinces, and industries. This suggests that employees are increasingly reluctant to leave their current jobs, especially given the turbulent job market.

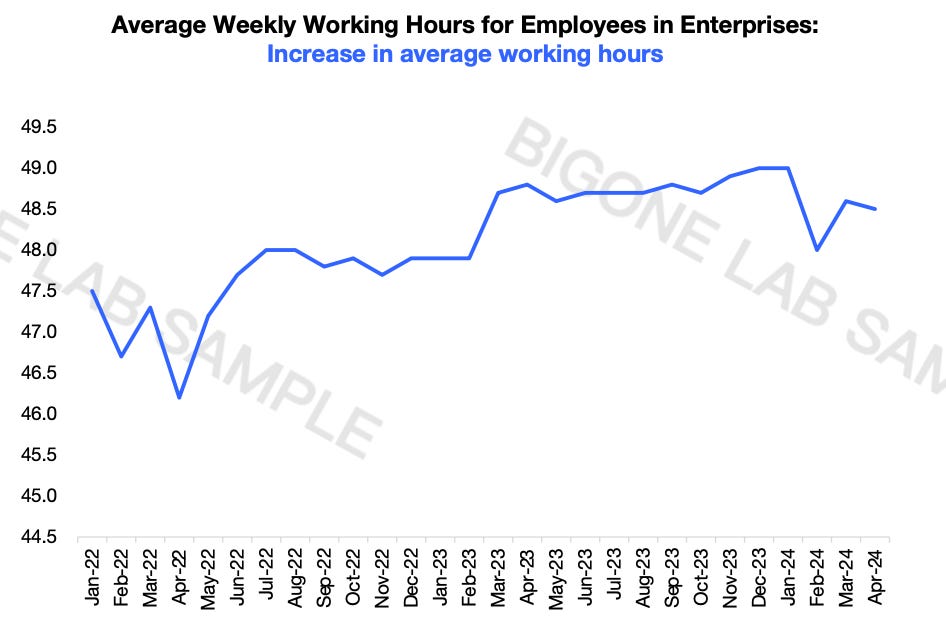

Reason 2: Longer working hours

Chinese workers typically put in longer hours compared to those in other developed countries, largely due to the labor-intensive nature of many industries and thus lower productivity.

Recently, average weekly working hours have stretched from 47.5 hours in 2022 to 49 hours in 2024, according to official NBS data. This, coupled with lower voluntary turnover rates, suggests that companies are squeezing more productivity out of their current employees instead of bringing in new hires.

Reason 3: Blue collar recovery drives employment improvement

The faster recovery of blue-collar jobs is a major factor in the improving employment rate. The National Bureau of Statistics (NBS) provides data on unemployment rates, distinguishing between the local registered workforce and non-local ones. Understanding this difference requires some insight into China’s "Hukou" (户口) system.

China's household registration system, namely "Hukou"

The Hukou system classifies residents as either "agricultural" or "non-agricultural." Urban non-agricultural Hukou holders have better access to social services, whereas migrant workers, often holding agricultural Hukou, face barriers to urban services like education and healthcare due to their rural status.

In 2022, the urbanization rate for permanent residents was 65.22%, while the rate based on Hukou was 47.70%, highlighting a significant disparity. Many migrant workers live in cities but still have rural Hukou, underscoring the need for reform to align population mobility with Hukou status.

Our previous article (China's grassroots labor market Part I and Part II) on China’s migrant workers emphasized that these individuals are the backbone of China’s urbanization and economy, particularly in manufacturing, construction, transportation, and consumer service sectors.

Blue collar workers lead employment recovery

Blue-collar workers have seen greater employment improvement compared to their white-collar counterparts. Migrant workers, represented as the non-local registered workforce in the charts, were more severely affected during the COVID-19 pandemic in 2022. Lockdowns in major cities like Shanghai hit them harder because their jobs, such as construction and ride-hailing, depend on physical presence.

However, after the Chinese government lifted COVID-19 restrictions, the non-local registered workforce experienced a rapid recovery in employment, driving down the overall unemployment rate. In contrast, the local-registered workforce, which primarily consists of white-collar workers, has shown greater stability in unemployment rates from 2023 to 2024. These workers are more likely to be engaged in jobs tied to online recruitment, resulting in weaker trends in online recruitment demands.

Are Chinese people getting richer or poorer? Examine Chinese household income through recruitment salaries

To delve into Chinese household income trends, we'll analyze recruitment salary data from China’s major online recruitment platforms collected by BigOne Lab. Our focus will be to:

How do our data echo NBS's per capita disposable income growth? We will distinguish overall average salary changes by separating the impact of mix change from like-for-like salary changes.

Why do we think mid-tier cities, SMEs, and the manufacturing sector are poised to become the economy's future backbone.

Let's take an initial look at our findings.

The uneven hand of history touches everyone differently. In the chart below, each blue dot represents a unique group within the workforce. Those in the upper right corner, the outliers of 2023, are the notable beneficiaries, enjoying significant increases in job demand and salaries, particularly experienced R&D professionals in the automotive industry. Conversely, the outliers in the lower left corner have been disproportionately affected, enduring declines in both job opportunities and pay, notably recent graduates in the real estate and internet industries.

Our comprehensive analysis and the latest trends in 2024 to date are covered next. You can also get free access by sharing us.