China's May Day holiday winner: County-level destinations - Charts of the Week

Essential charts & data on China's export, real estate and Labor Day Holiday in under 3 minutes

"Charts of the Week" is Baiguan's series that features key data points to help you quickly grasp the general state of affairs in China in just a few minutes. We handpick the highlights of the data charts from a variety of sources, analyzing and delivering insights trusted by 100+ top institutional and corporate clients worldwide at BigOne Lab. Don't forget to subscribe before you continue reading!

Strong May Day holiday tourism data

During China's 2024 Labor Day holiday, which spanned from May 1st to May 5th, the country witnessed a significant surge in tourism. Domestic tourism experienced a 7.6% year-on-year increase, with a total of 295 million domestic trips, marking a new high and a 28.2% increase compared to the pre-pandemic level in 2019. Domestic tourists spent 166.9 billion yuan ($23.13 billion USD), representing a 12.7% increase year-on-year and a 13.5% increase compared to 2019.

County-level destinations became the winner

Calculating based on the official data, spending per trip during the 2024 Labor Day Holiday increased by 5% year-on-year compared to 2023 but decreased by 12% compared to 2019. While some may see this as a sign of increasing frugality, where travelers prefer less expensive destinations, personally I think there are two sides to that narrative:

Lower-tier and county-level cities, often referred to as the "sinking market" by the Chinese business community, are indeed the winners during the Labor Day Holiday. According to Ctrip.com, China's largest OTA platform, tourism orders and ticket bookings increased by 140% and 151% in lower-tier cities, respectively. This suggests that consumers are seeking better value for money and becoming more cautious about their spending—a trend we've seen in other areas of domestic consumption as well.

On the other hand, developments in infrastructure and enhancements in cultural and tourism offerings have fueled consumer interest in these areas. Many are opting for a "reverse travel" experience, going from metropolitan areas to less crowded, culturally rich, and scenic county-level destinations.

For instance, social media engagement for posts mentioning "Wuyuan," a popular county-level destination during the holiday, surged by 425% in 2024 Q1 compared to last year. Known for having some of the best-preserved ancient architecture in China, Wuyuan boasts a landscape filled with unique caves, secluded rock formations, and numerous historic sites. And Wuyuan looks like this:

Whereas Nanjing (a metropolitan city destination, my hometown, and also a top destination during the past holiday) looked like this. Netizens were joking that "Are you guys invading Nanjing? I'm not joking, there are at least 100 million people in Nanjing!"

So in my opinion, the preference for county-level travel experiences is not solely driven by a frugal mentality. In fact, I believe that county-level travel destinations will continue to experience upgrades in infrastructure, cultural attractions, and tourism products in the coming years. The major cities in China have started to "look all the same", and county-level towns will offer different cultural and scenic experiences.

Since December 2023, China has added 127 new 4A-level scenic spots (the highest rank), with 65% of them located in county towns and county-level cities. Businesses and entrepreneurs are already flocking to county-level and lower-tier cities like Dali to build luxury hotels and restaurants. (I posted a story on Dali and its tourism potential which you can read here.)

Inbound and overseas tourism both experienced a rebound

In terms of outbound travel, according to data from Flight Manager (a flight booking APP in China), the volume of regional/international passenger flights during the first four days of the Labor Day holiday has recovered to approximately 111.6%/73.9% of the same period in 2019.

Meanwhile, inbound travel has also seen a significant rebound. According to Ctrip.com, orders for inbound travel increased by 105%. Among them, the 12 countries with unilateral visa exemptions from China and the mutually visa-exempt countries such as Singapore and Thailand, saw an approximately 2.5-fold increase in inbound tourists.

On social media, more people are discussing "inbound tourism" and claiming that it is a "blue ocean" market for Chinese travel agencies. Posts mentioning "inbound tourism" and people who are seeking business partners in the inbound tourism business surged in 2024.

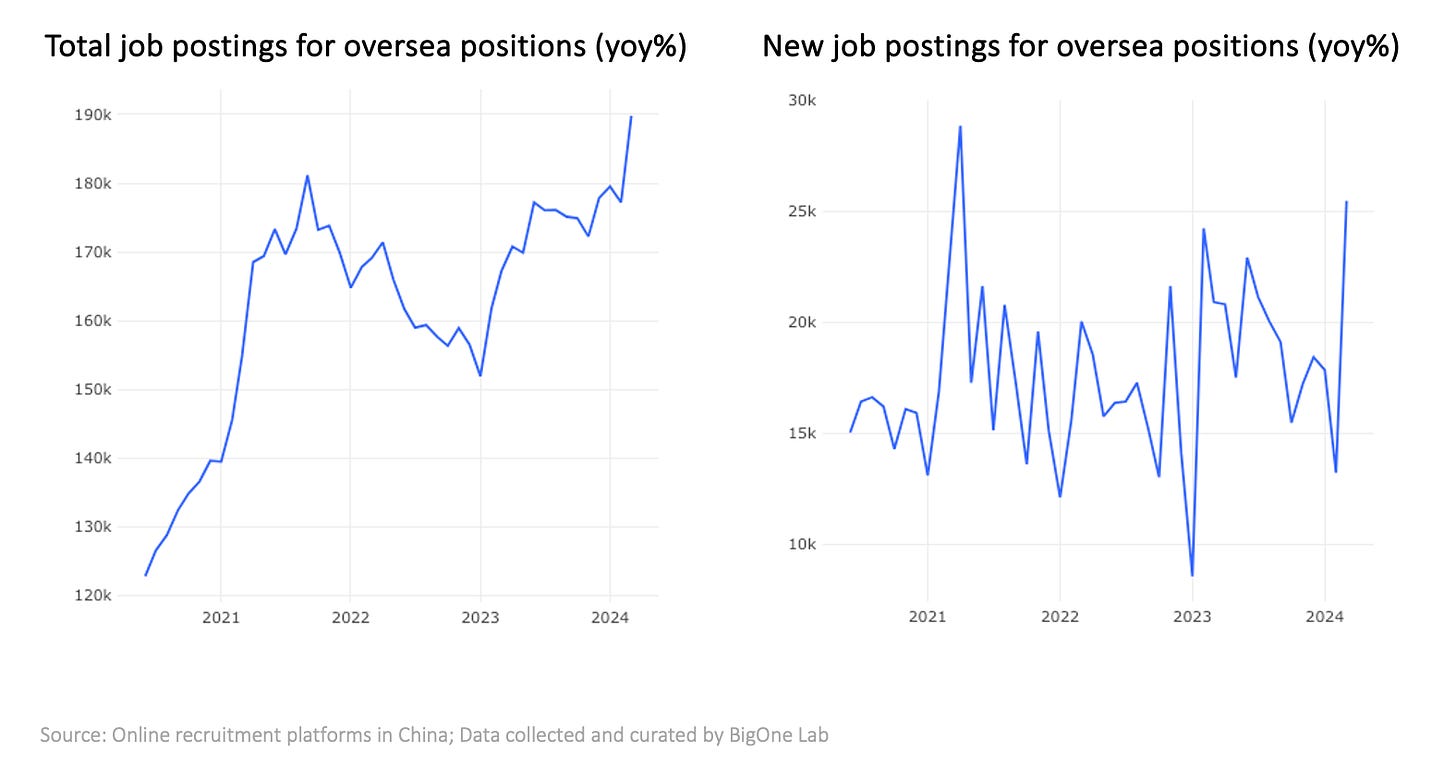

Chinese companies are recruiting for overseas positions at unprecedented levels

China's export data for early 2024 showed mixed results. Exports rose 7.1% to USD 528.01 billion in January and February, surpassing forecasts of a 1.9% increase, driven by a rebound in global trade, especially in electronics. However, March saw a 7.5% decline to USD 279.68 billion, worse than the expected 3% drop, due to an uneven recovery and a high comparison base from last year's 10% growth.

As the domestic consumer market becomes increasingly competitive, more Chinese companies are venturing overseas. The number of job postings for overseas positions, and domestic positions that target the overseas market, are reaching record highs across major recruitment platforms in China.

Real Estate: Positive sentiment following the April Politburo meeting

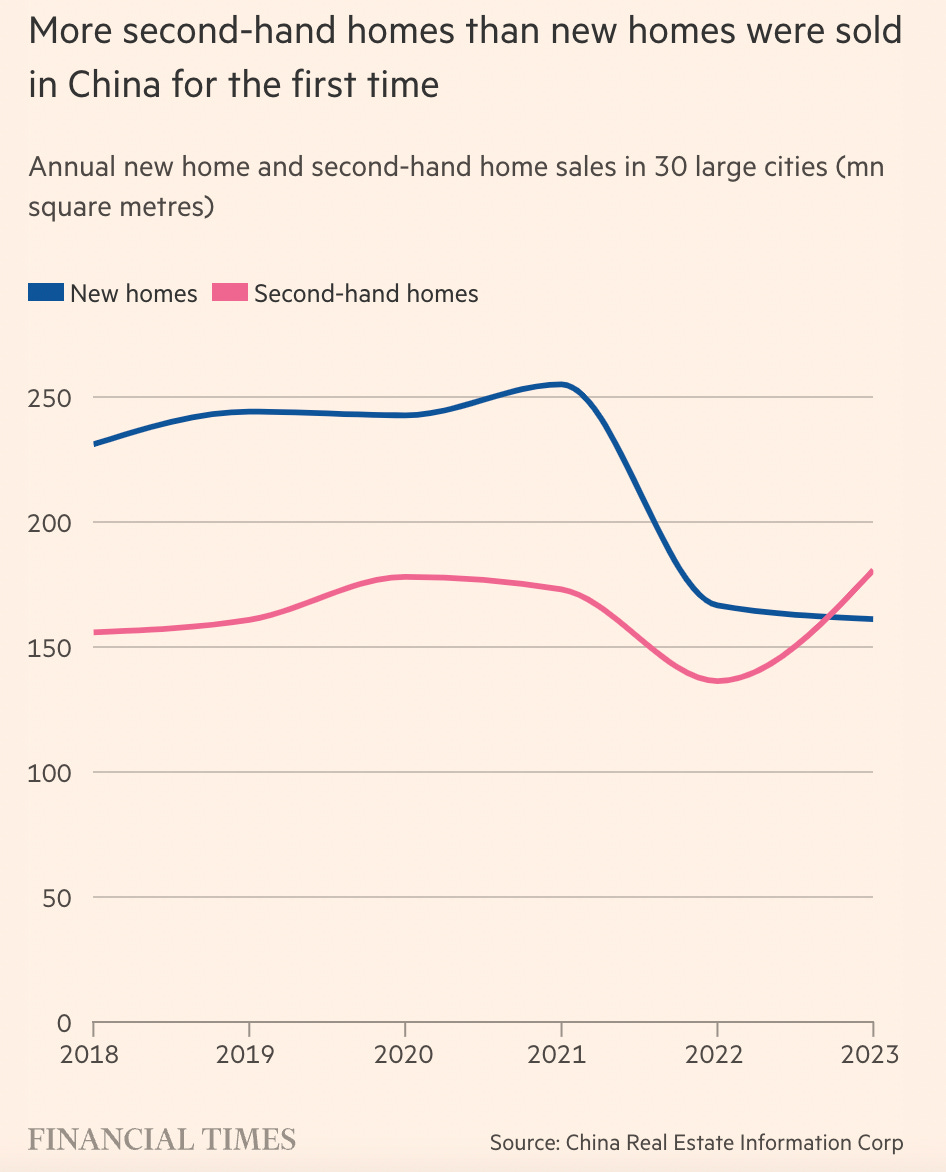

The real estate market in China is experiencing a significant shift towards second-hand homes, indicating a potential change in the sector's dynamics. According to data from the China Real Estate Information Corporation, sales of second-hand homes are now surpassing those of new homes, marking the first time China is transitioning to a market dominated by second-hand homes since the inception of its real estate market.

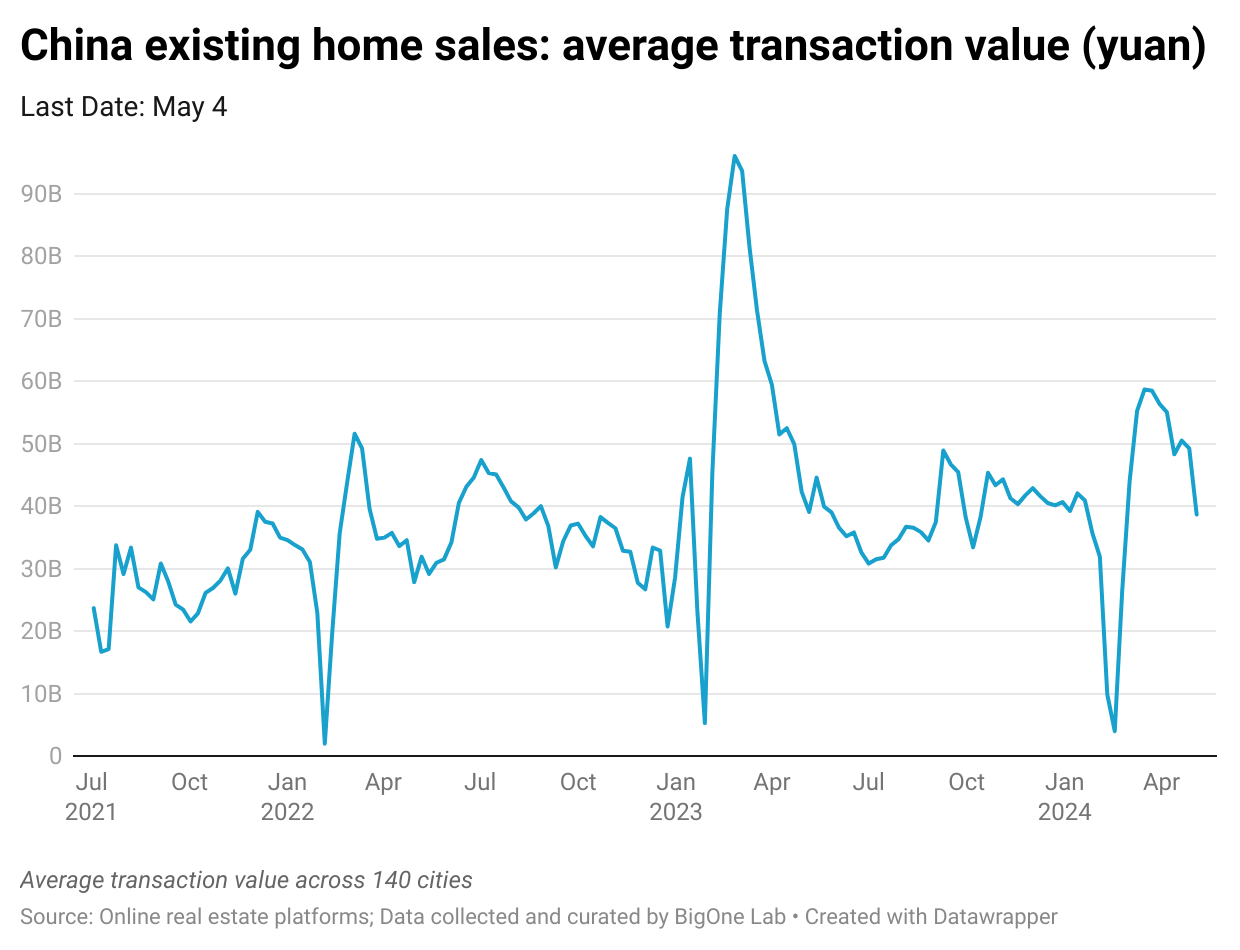

As reflected in the recent Politburo meeting, China has vowed to explore new measures to tackle the issue of unsold homes. Officials announced plans to research ways to deal with unsold properties, as well as to "make flexible use" of tools to support the economy and reduce overall borrowing costs. Analysts and investors saw the Politburo's statement as a sign of a more supportive policy stance.

However, despite the Politburo meeting's unexpectedly positive stance on real estate issues, the actual implementation may face challenges that will take time to resolve, and the effectiveness of inventory reduction will need to be observed over time. (Historically, it could take 6-12 months from the research phase to the implementation of policies.)