China's renewed deflation concerns: 12 key charts beyond CPI & PPI —Charts of the Week

Understand China’s latest domestic consumption, real estate, and social sentiments in 13 charts

*This post is our premium content. Thank you for being a valued paid subscriber.

November economic data highlights

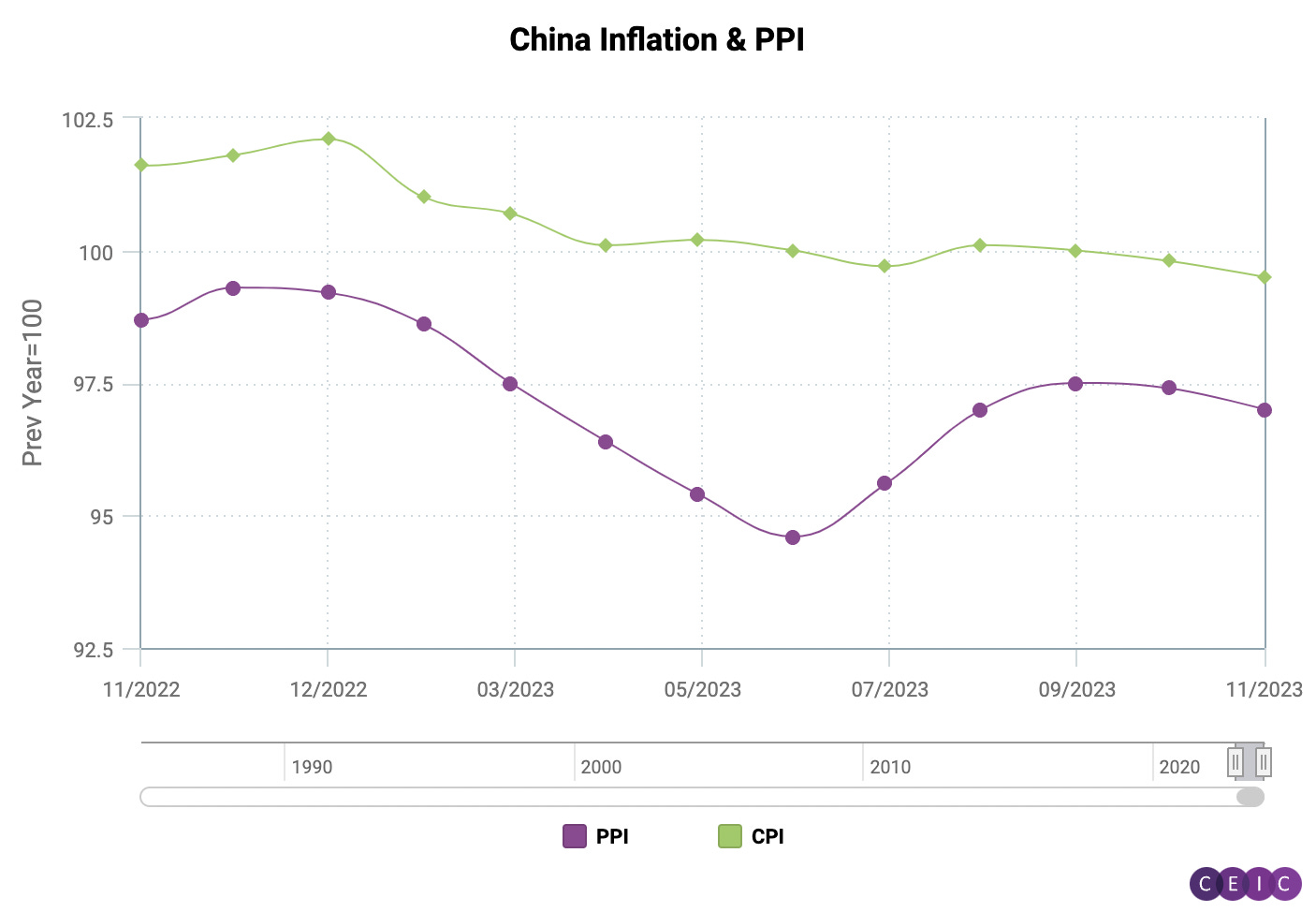

In November 2023, deflationary pressures deepened, with the consumer price index (CPI) falling 0.5% from the previous year, extending the 0.2% decline from the previous month. The producer price index (PPI) also fell 3.0% year-on-year, continuing a 14-month trend of decline and performing worse than forecasted.

The retail sector continues to improve, with retail sales growing 10.1% year-on-year and vehicle sales increasing by 27.4%. Exports also experienced a growth of 0.5% year-on-year, marking the first positive growth in 6 months.

China Export

China's exports turned positive with a 0.5% year-on-year growth, marking the first positive growth in 6 months. The number of job postings for overseas positions offered by Chinese companies continued to increase in November, although at a slower pace compared to previous months.

In November, China's exports to India, the United States, and Mexico improved, with exports to Mexico leading other trading partners and growing 7.39% year-on-year.

Chinese companies are intensifying their efforts to expand their global presence.

Our previous editions have delved into the increasing trend of Chinese businesses going international, with a special focus on how emerging economies, notably Vietnam and Mexico, are becoming central hubs for receiving intermediate goods exported from China, followed by re-exports.

In 2023, Mexico has emerged as the United States' largest trading partner. With Chinese companies expanding their operations overseas and a shifting global geopolitical landscape, a significant question arises: Could Mexico potentially replace China as the "world's factory"? Read our recent post to gain deeper insights into the expansion of Chinese enterprises into Mexico.

Continue reading to unlock our latest update on:

China's employment outlook: We also cover the latest job demand situation for junior positions, featuring job posting data across major online recruitment platforms in China.

Domestic consumption and consumer sentiments: Track China's gross merchandise values (GMV) across major e-commerce platforms including JD.com, Douyin, Kuaishou, and Tmall, highlighting current buying trends and the pace of recovery in discretionary spending.

Real estate: Get briefed on transaction volumes for existing homes in 82 Chinese cities

To get a sense of what is offered, you are welcome to check out this older post in the same series: Charts of the Week. You can also get free access by sharing us.