What’s Pushing China’s Stocks to Decade Highs?

Déjà Vu or New Beginning? Can It Be Sustained?

Last Friday, the Shanghai Composite surged 1.45% to close at 3,826—a decade high. This marks a sharp reversal from the prolonged pessimism that followed the Ukraine-Russia war and China’s Covid lockdowns in 2022.

On one hand, the rally signals renewed investor optimism. On the other, many (especially the retail investors) fear déjà vu: a sudden correction similar to September last year, when China unveiled its largest-ever stimulus package on Sept. 24, 2024, sparking a violent but short-lived surge. The current rally is beginning to resemble that pattern, raising questions given that China’s macroeconomic fundamentals still face lingering risks and have not rebounded with the same force.

So, what’s different—if anything—this time? And can the rally sustain upside momentum? In today’s Charts of the Week, we’ll dive into the key drivers behind this market move.

Disclaimer: The content provided here is for informational purposes only and should not be considered financial advice. It is essential to conduct your own research and consult with a qualified financial professional before making any investment decisions.

This time, the mood looks distinctly risk-on

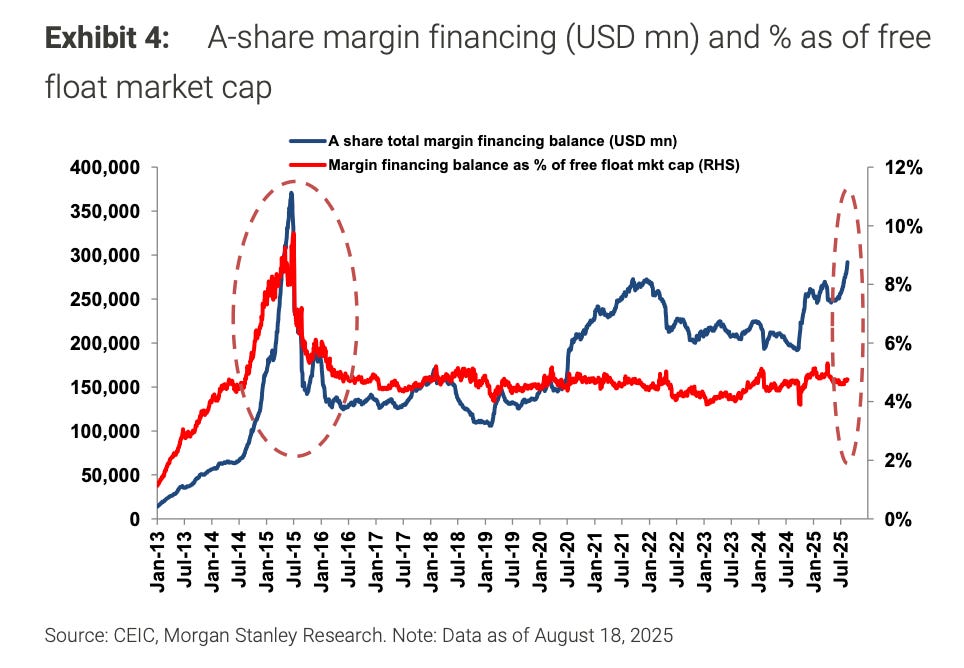

Margin financing for A-shares has climbed to a multi-year high, with total balances approaching levels last seen during the 2015 super bull rally—an indicator of growing investor confidence. That said, leverage hasn’t yet reached overheated territory: margin financing as a share of free-float market cap remains within a relatively healthy range.

Continue reading to explore the key drivers behind the rally and my thoughts on what comes next.

To get a sense of what is offered, you are welcome to check out this older post in the same series: Charts of the Week. You can also get free access by sharing us.