Chinese companies going global: merchandise and manufacturing exports in the new era (Part I)

E-commerce opens new avenues for China’s supply chain clusters

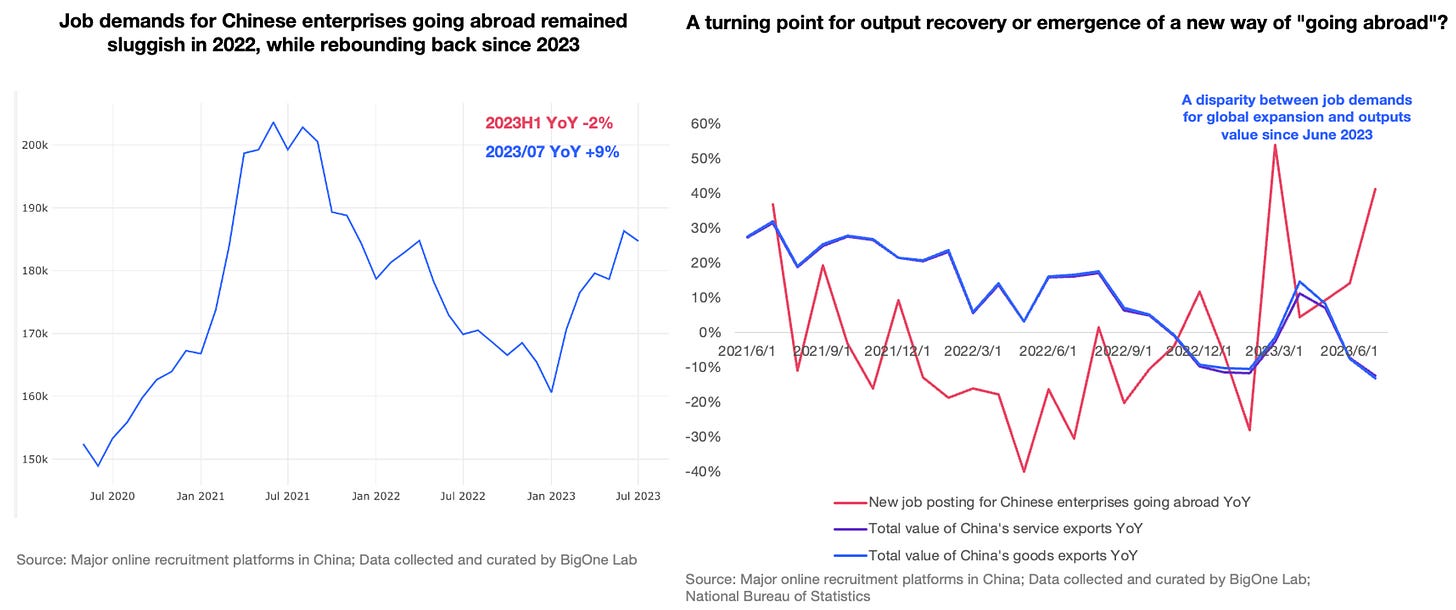

2022 saw a slowdown in global expansion by Chinese enterprises due to pandemic-related challenges, however, 2023 tells a different story. Job postings for Chinese enterprises' overseas venture roles are on the rise, according to BigOne's tracked job data, while the export value of goods and services remains sluggish. This raises the question: Is this the early sign of China's export recovery or the emergence of a new way of going abroad?

Join us on this journey as we uncover the key players and the latest trends in Chinese companies going global. In this article, we'll explore the innovative strategies employed by these enterprises:

Witness E-commerce giants in fierce competition to export China's high-quality supply chain.

Discover how manufacturing companies are forging fresh paths to expand their global production capabilities in response to the China-US tensions and industrial shifts.

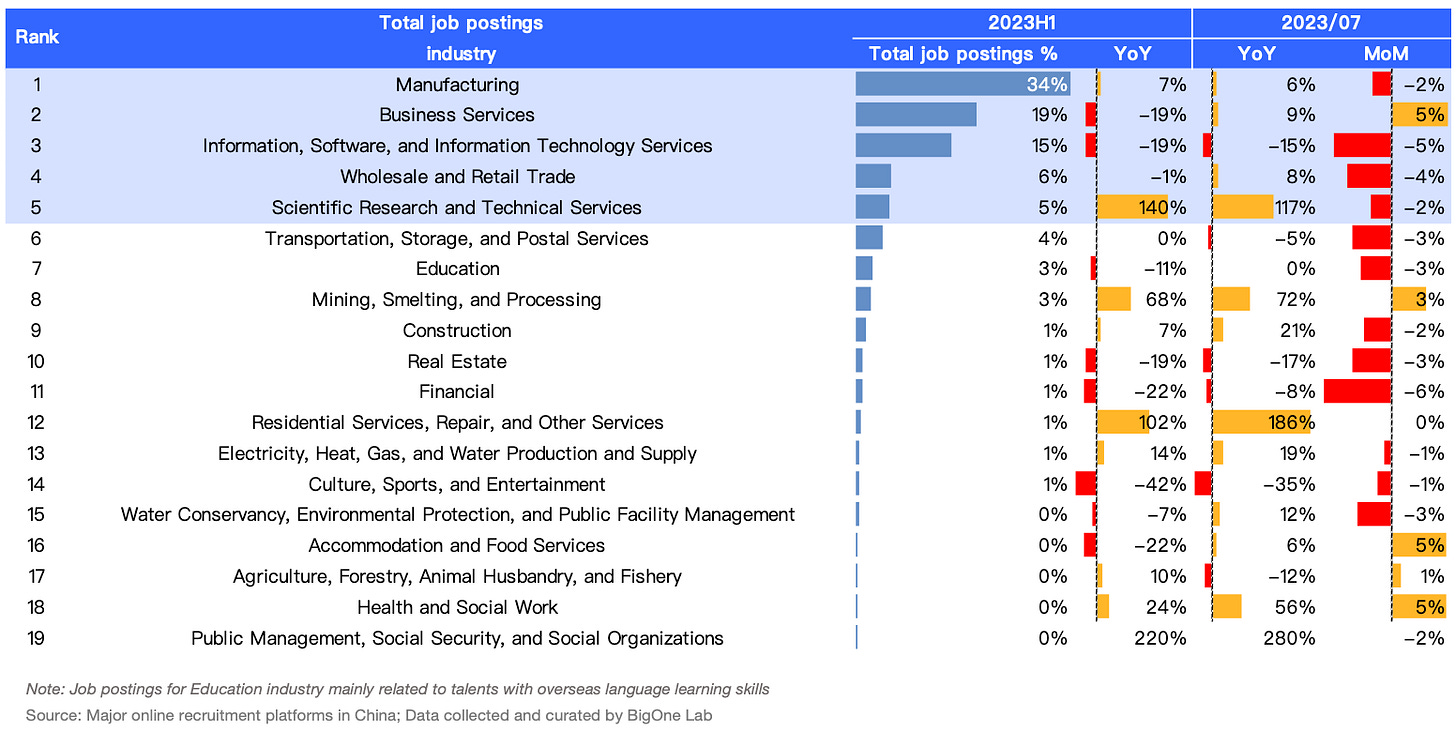

Before we delve into the stories, let's take a quick glance at the overseas expansion of Chinese companies. Notably, the manufacturing sector leads the charge in human resources going abroad, accounting for 34% of total job postings and showing resilience in 2023H1. Following closely are the Business Services and IT sectors, both experiencing a 19% decline in 2023H1.

Among the key players:

Top gainers: Alibaba expanding across business divisions, and PDD

Top decliners: Bytedance, Tencent, NetEase, and Shein

New energy names: CATL, LONGi, and SunGrow

Top Auto industry players: BYD, Geely

We will do in-depth reviews of China's merchandise exports and manufacturing exports in two issues. Make sure to subscribe!

Part I: China merchandise exports ride the wave of E-commerce

Since joining the WTO, the exploration of Chinese entrepreneurs in going global has never ceased. In addition to traditional trade models, the flourishing development of e-commerce business models has also provided more channels for the export of Chinese goods. E-commerce is a good way to bring high value-for-money products to overseas markets based on China’s strong supply chain. According to General Administration of Customs, China's cross-border e-commerce import and export volume reached 2.11 trillion yuan in 2022, a year-on-year increase of 9.8%.

In China, there are several well-known industrial clusters. These industrial clusters have formed a scale advantage in the industrial chain and have produced products that are competitively priced worldwide.

These industrial cluster companies export overseas through e-commerce. Looking back at the development history of e-commerce going global, it has mainly gone through several models:

Leveraging international e-commerce platforms, from the early days of eBay to Amazon. In 2012, Amazon officially expanded into the Chinese market with the launch of its global store, and by 2020, Chinese merchants had contributed billions of dollars in GMV on Amazon.

Leveraging Chinese e-commerce platforms to go global, such as Alibaba's AliExpress and TikTok Shop.

Independent websites selling non-standard products, such as clothing, footwear, cosmetics, home decor, and wigs. The earliest categories to go global through independent websites were wedding dresses and wigs.

Platform-based independent websites, such as Shein and Temu, which utilize a broader merchant supply chain to establish more comprehensive offerings.

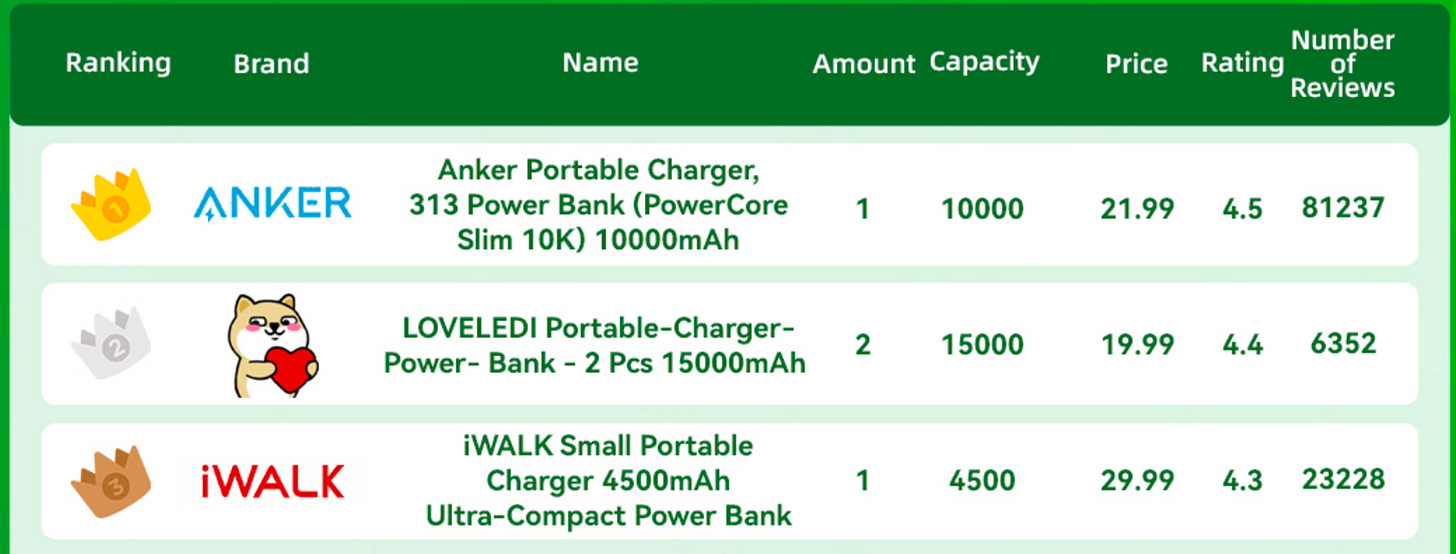

Anker Innovations (300866.SH): pioneer of exporting through global e-com platforms

Anker Innovation entered the American Amazon marketplace in 2011. Anker Innovations sells products ranging from smartphone chargers to portable power banks on Amazon. In 2022, Amazon contributed 7.97 billion yuan or 56.0% of the revenues of the company.

Anker Innovation's overseas job openings have returned to their pre-peak levels in 2023.

Ever wondered whether recruitment efforts by other companies on Amazon and AliExpress have bounced back from the COVID dip? Do self-operated e-commerce stores see resilience amid the slow recovery of China's exports in the first quarter of 2023? What's behind Pinduoduo's TEMU broadening its horizons so aggressively? Our data, fresh from China's top recruitment platforms, offers some answers. Read on to discover.