Investment opportunities in Chinese consumer equities: MAOGEPING (1318.HK)

The only domestic player in China's top 10 premium beauty groups

Introduction to the new series: Investment opportunities in Chinese consumer equities

Despite economic challenges in China, many domestic companies have thrived by tapping into long-term consumer trends and delivering exceptional products. Brands like Luckin Coffee (PINK: LKNCY), Mixue (2097.HK), BYD (002594.SZ), MAOGEPING(1318.HK), Proya, and Giant Biogene(2367.HK) etc. have not only captured consumer hearts but also demonstrated strong profitability.

Baiguan has previously covered numerous investment opportunities in the consumer sector, including Chinese companies going abroad, the rise of new domestic industries/brands, and MNCs succeeding in the Chinese market. So, why launch a new series focused solely on Chinese companies' domestic performance?

The reasons are clear:

Domestic consumption as the next engine for China's economy: Amid a slowing real estate market and local government debt burden, China's economy urgently needs the consumer sector for growth.

Effective policy support: Government initiatives to boost consumption have shown tangible results at the city level, such as Shanghai's restaurant vouchers.

Huge market potential: China's large population and unified market offer vast potential. A prime example is the record-breaking box office success of "Ne Zha 2" during this Spring Festival.

This series, "Investment Opportunities in Chinese Consumer Equities," will provide in-depth analysis and updates on these companies. It aims to offer valuable insights for consumer brand practitioners and investors seeking opportunities in China's market. Stay tuned for more!

So, why mention the beauty industry at this juncture?

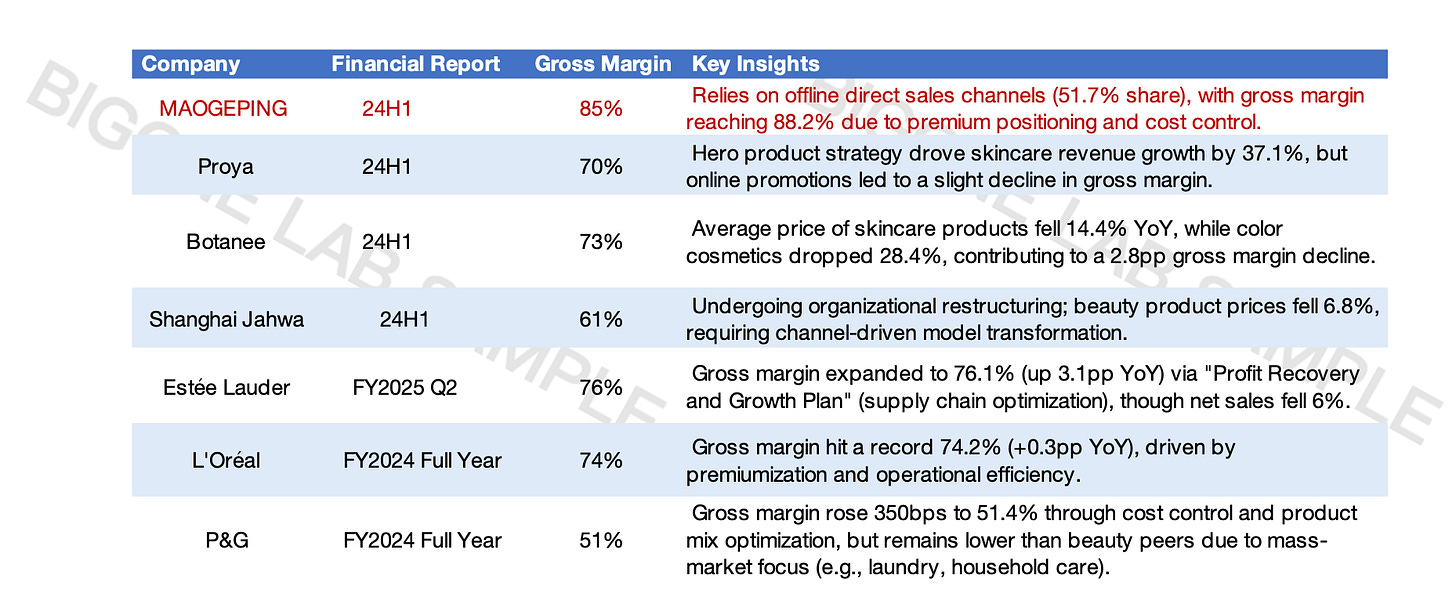

We are aware that the beauty industry faced significant challenges in 2024. According to the annual reports of major global cosmetics groups in 2024, most companies experienced a slowdown or even a decline in revenue, primarily due to the sluggish Chinese market and the deceleration in Chinese consumer spending. For instance, North Asia, where China is located, became the only market to decline among L'Oréal Group's top five markets, with sales down 3.4% year-over-year. This marks the first decline in the Chinese market for L'Oréal Group in nearly a decade. In Estée Lauder Companies' Q2 fiscal 2025 (from Sept 30 to Dec 31, 2024), the group's net sales fell by 6%, and net profits turned from profit to loss. The Asia-Pacific region, where China is situated, saw the most pronounced decline, with net sales down 11% YoY.

However, despite the overall downturn in the industry, there was no uniform decline across the sector. There were outperformers—since the beginning of 2024, in the securities market, the beauty and personal care sector has seen Giant Biogene(2367.HK) and newly-listed Maogeping(1318.HK) outpace other stocks. Benefiting from the broader trend of domestic substitution, both companies have carved out highly differentiated paths. Today, we will analyze the investment logic and growth drivers of these two companies from a fundamental perspective.

Main structure of this article: three industry trends and two companies

Stability of high-end demand: The demand for high-end products remains strong despite the overall market slowdown.

Ongoing domestic substitution: Domestic brands continue to gain market share from international brands.

Simplifying but selective demands: Historically, the beauty industry was characterized by increasing complexity—more steps, more product categories. However, the trend has reversed, and now consumers are seeking simplicity. This doesn't mean they are willing to settle for basic products; instead, they have become highly selective and discerning.

Advantages of two local companies:

The only local brand with High-End Positioning: Maogeping

Ingredient-Centric Approach: Giant Biogene

This article is Part I, focusing primarily on the industry's trend shifts and the achievements and future prospects of Maogeping. In Part II, we will delve into the story of Giant Biogene.

Let's first examine the key trends in China's beauty market.

Trend 1: Resilient demand for high-end products

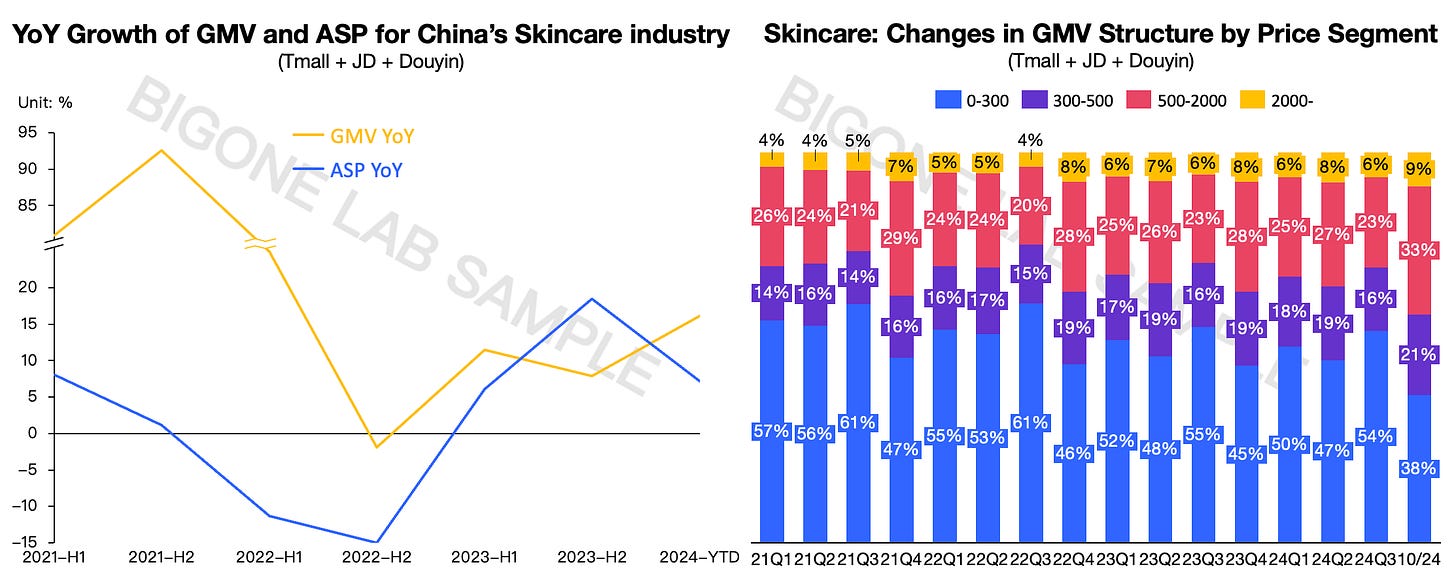

The growth rate of China's skincare market is slowing down, with mass-market demand contracting, while demand for high-end and ultra-high-end products has proven more resilient. Although online sales of Chinese skincare products have significantly decelerated since the second half of 2022, the Average Selling Price (ASP) has turned positive since 2023, primarily due to structural changes. Specifically, the proportion of sales in the 500-2000 RMB and above 2000 RMB segments has steadily increased, reaching a combined contribution rate of 42% by October 2024—nearly half of the total. This indicates that demand for high-end products remains solid.

Trend 2: Ongoing domestic substitution

In mid-2023, we alerted the market that the competitive dynamics between international and domestic brands had fundamentally changed—a trend that persisted into 2024. This is reflected in the following observations:

Seasonality in market share: Historically, the market share of top international brands exhibited clear seasonality, peaking in Q2 and Q4 (during major shopping festivals like 618 and Double 11) when consumers stockpiled purchases. This pattern demonstrated strong consumer trust in these brands. In contrast, domestic brands had virtually no seasonality before 2022. However, starting from Q4 2022, domestic brands began to show similar seasonality, which became more pronounced in Q4 2023 and Q4 2024.

Market share shift: The market share of top international brands has come under pressure, showing a downward trend, while domestic brands have filled the gap. For example, in Q4 2023 compared to Q4 2022, the market share of international brands dropped from 24% to 20%, while domestic brands increased from 11% to 13%. In Q4 2024, the market share of international brands further declined to 18%, while domestic brands rose to 15%. The gap between the two now stands at just 3%.

Import data for cosmetics and the performance of international beauty groups also support this trend.

Customs Data: In 2024, China's cosmetics import volume fell 9.4% YoY to 324,800 tons, and import value declined 7.9% YoY to RMB 116.08 billion, the lowest in five years.

Shiseido: Reported a net loss of JPY 10.8 billion in 2024 (vs. a profit of JPY 21.7 billion in 2023), driven by China's consumption slowdown and intensified price competition.

L'Oréal Group: Sales grew 5.1% YoY to EUR 43.48 billion in 2024, but North Asia (including China) declined 3.4% YoY, marking the first drop in China in a decade.

Estée Lauder: Net sales fell 6% YoY to USD 4.004 billion in Q2 FY2025, with a net loss of USD 580 million. The Asia-Pacific region (including China) saw an 11% YoY decline in net sales.

Trend 3: Simplified beauty needs without compromise

Historically, the beauty industry has been characterized by "extreme complexity," where more steps, refined product categories, and detailed efficacy claims were the norm. For example, under the broad category of anti-aging, there are now subcategories such as firming, wrinkle reduction, antioxidant, anti-photoaging, anti-glycation, and barrier repair—each with its own dedicated product. This trend was epitomized by the meticulous skincare routines in Japan, where products even targeted specific issues like darkening and thickening of skin due to prolonged sitting.

However, in China, this trend has reversed, with consumers now favoring a "simplified" approach to beauty needs. For instance, in China's sunscreen market, we observe a shift towards simplification. Sunscreen-infused base makeup products (such as foundations and BB creams with SPF) are growing rapidly in both sales and market share. In contrast, standalone sunscreen products, which once dominated the market (as indicated by the large blue area in the chart), are now experiencing stagnant growth. This trend reflects that while consumers are simplifying their skincare routines, they are not compromising on efficacy. Instead, they expect products to deliver multiple benefits in fewer steps.

The reason behind this is related to what we previously mentioned about consumers increasingly valuing "quality-to-price ratio" and becoming more selective in their choices. I wrote this two years ago:

Chinese consumers have become increasingly knowledgeable about skincare ingredients and their effectiveness, leading to more specific and diverse demands when addressing particular skin concerns. On Xiaohongshu, a prominent social media platform for product recommendations and sharing in the beauty and lifestyle fields, various skincare "jargons" have gained popularity within the community.

One such example is "早C晚A" or "Using products with Vitamin C in the morning and Vitamin A at night," which has become a common practice in skincare routines and a well-known term on Xiaohongshu.

The popularity of "早C晚A" can be attributed to its practical reasoning. The use of Vitamin C in the morning provides antioxidant protection throughout the day while incorporating Vitamin A (Retinol) at night allows for its rejuvenating effects without the risk of increased sun sensitivity. By following this timing, individuals can maximize the benefits of both ingredients in their skincare regimen.

The appeal of skincare jargon lies in its concise and memorable nature, contributing to its widespread adoption within the skincare community. Chinese consumers not only comprehend the intricate reasoning behind these jargons but are also willing to incorporate them into their routines; more importantly, pay for it.

Among these three trends, only companies that adapt to the trends or have products with highly distinctive and differentiated features can win over consumers.

Winner 1: Maogeping: the only local player in the premiumization trend

Since its IPO in December 2024, Mao Ge Ping's stock price has surged by 174% as of March 3, 2025.

Mao Geping is a renowned Chinese makeup artist and entrepreneur, born in 1964 in Wenzhou, Zhejiang. He rose to fame in 1995 for his makeup design in the TV drama "Empress Wu Zetian," which also became the source of his initial popularity.

"China has no film or TV drama that allows an actor to portray a character from age 15 to over 80. If such an opportunity is given to you and you seize it well, you will surely become famous." In 1995, Mao Ge Ping was still hesitant about whether to take on the makeup role for the "Empress Wu Zetian" production when actress Liu Xiaoqing, who played the lead role, enlightened him with these words. Later, the legend of Mao Ge Ping became a household name as the drama gained popularity.

From a lively and innocent young girl to an aged and frail old woman, Mao Ge Ping's masterful makeup skills allowed Liu Xiaoqing to portray Empress Wu Zetian from the age of 16 to 80 on screen. His almost supernatural makeup artistry earned him the reputation of a "magical makeup artist" in the industry.

Unlike other beauty brands that focus solely on their products, Mao Geping’s business journey began with an educational institution. Since 2000, Mao Geping has established several “Mao Ge Ping Image Design Art Schools,” which have cultivated and supplied talent to the makeup and styling industry for over two decades. This has not only solidified his reputation in the industry but also laid the foundation for his future entry into the cosmetics market. During the teaching process, he noticed that existing cosmetics on the market were not suitable for student training, which led him to the idea of creating his own line of cosmetics. In the same year he founded the makeup training school, he also launched a cosmetics company.

Mao Ge Ping Co., Ltd. primarily engages in the research, development, production, and sales of makeup and skincare products, as well as makeup training services (represented 55%, 41%, and 4%, respectively). Focusing mainly on makeup with skincare as a secondary offering, the company owns two brands: “MAOGEPING” and “Zhi Ai Zhong Sheng/至爱终生.” The former contributes 99% of the company’s revenue (as of 2023).

According to the e-commerce data tracked by BigOne Lab, MAOGEPING achieved year-over-year growth rates of +29% in Q3 2023 and +65% in Q4 2023 for its online direct sales revenue, significantly outpacing the industry average growth rate.

The MAOGEPING brand targets mid-to-high-end consumers with an average transaction value ranging from 200 to 800 RMB, and it primarily operates through direct sales channels (providing services like tailored makeup design and styling).

As a result, Mao Ge Ping enjoys a significantly higher gross margin compared to its industry peers.

In the following article, I will unpack the key fundamental focus areas for MAOGEPING by addressing the following questions. This content is exclusive to our paid subscribers.

Color cosmetics business:

Amidst the overall trend of consumption downgrading and significant price pressure in the color cosmetics market, how is MAOGEPING’s base makeup category demonstrating strong anti-cyclical characteristics?

Despite fierce competition in the base makeup segment, how is MAOGEPING achieving robust growth in market share?

Skincare business:

How is MAOGEPING leveraging the trend of high-end demand to carve out a unique position among domestic brands and compete directly with international luxury brands?

How much growth potential does MAOGEPING’s skincare business hold?