The "sinking market" Chinese turn optimistic: key updates on JD, BABA, Douyin, consumer confidence, and job market trends – Chart of the Week

Latest sentiments on Chinese domestic demand in 10 charts

"Charts of the Week" is Baiguan's series that features key data points to help you quickly grasp the general state of affairs in China in just a few minutes. We handpick the highlights of the data charts from a variety of sources, analyzing and delivering insights trusted by 100+ top institutional and corporate clients worldwide at BigOne Lab. Don't forget to subscribe before you continue reading!

In the last "Charts of the Week" post, we explored how China's strong exports might have limited potential to drive economic growth. We discussed several trends that could dampen consumer confidence, including declining real estate prices, a sluggish salary outlook—especially for the youth—and a general shift toward more cautious spending. These challenges raise the question: Can Chinese consumers still become the key driver of economic growth moving forward?

In today's newsletter, we'll update you on the outlook for China's consumers and the latest performance of major e-commerce platforms like JD, Alibaba, Douyin, and Kuaishou in this environment.

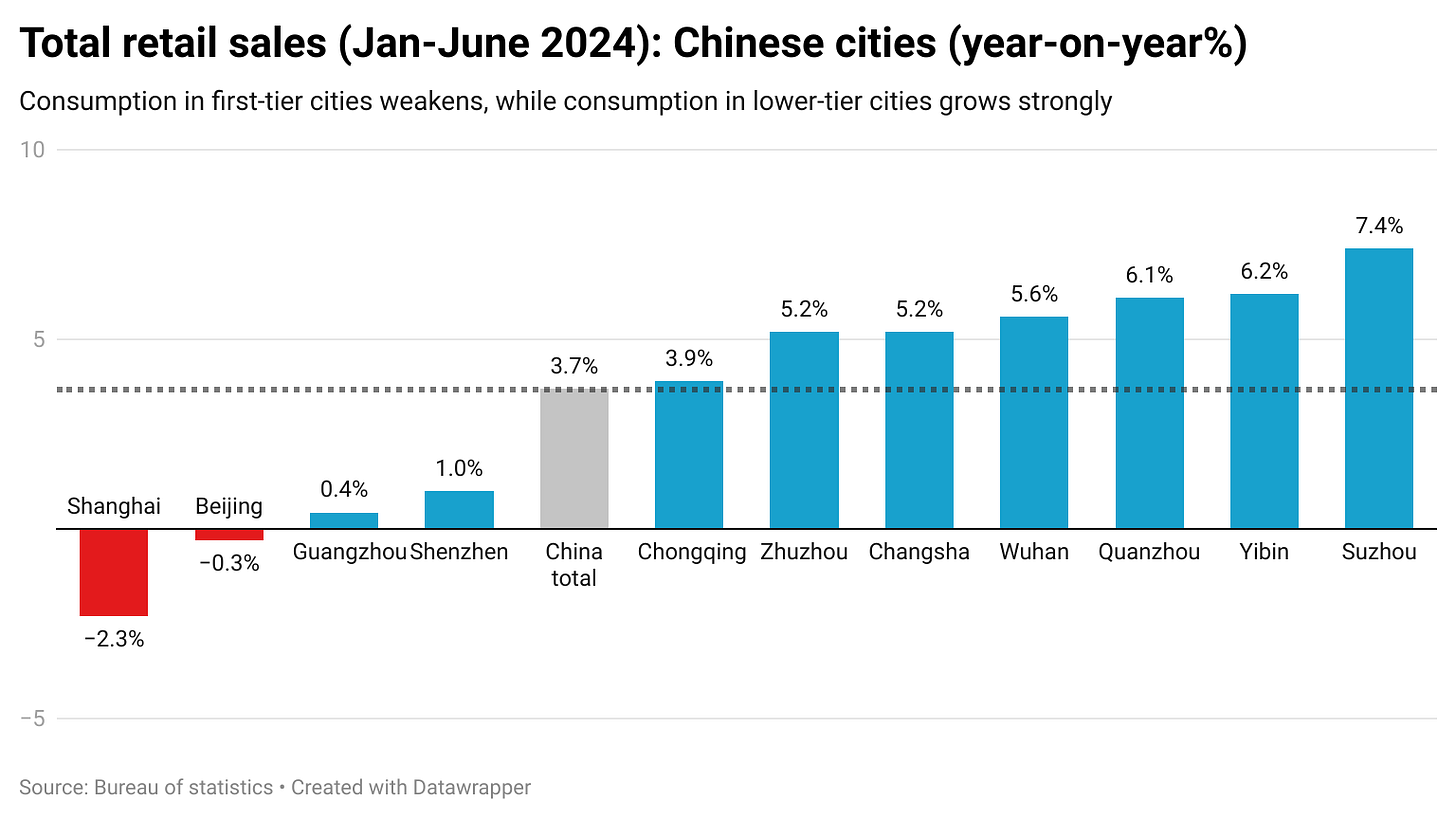

First-tier cities have become the least cost-effective places

Beijing and Shanghai experienced a decline in retail sales in the first half of 2024, with drops of 0.3% and 2.3%, respectively. The other first-tier metropolises, Guangzhou and Shenzhen, saw minimal growth at 0.4% and 1%, respectively.

In sharp contrast, other cities represented by regional centers such as Chongqing and Changsha, as well as suburban towns like Quanzhou and Yibin, saw strong growth in total retail sales.

Luxury purchases saw a sharp decline in mainland China, except for Hermès, which remains relatively strong among all luxury brands, according to our observations from the nationwide consumer panel. Some high-net-worth consumers have shifted their spending to Japan, where the weaker yen works in their favor. Meanwhile, middle-class consumers who previously held high-paying jobs in multinational companies, finance, or the IT industry have become the most vulnerable and cautious, significantly reducing their luxury spending.

First-tier cities have simply become the least cost-effective places to live and spend.

The most vs least confident Chinese consumers

A recent McKinsey study revealed notable differences in consumer sentiment among various groups in China.

The Most Optimistic: "Urban Young and Elder"

Typical Gen Z: Urban 18-25-year-olds, recent graduates with a relaxed mindset. They are usually single children supported by their parents and grandparents, with no children or mortgage burdens. Despite a competitive job market, they continue to spend.

Typical Urban Baby Boomer: Individuals living in big cities, with steady retirement income. Many are successful business owners or executives who benefited from China's rapid growth period.

The Least Optimistic: "Big City Millennials and Rural Elder"

Typical Big City Millennial: Employed in large firms such as IT, finance, or multinationals. Many have mortgages, but face declining real estate prices, and support aging parents and their own families. They are concerned about job insecurity and prefer more stable employment in the current environment.

Typical Rural Older: This group often lacks economic opportunities and less support compared to their urban counterparts. Their children often work in big cities far from home, providing even less support.

On Xiaohongshu, China’s biggest lifestyle social media platform, discussions about "layoffs" and "salary cuts" have been gaining traction recently. This platform is frequently used by city-dwelling millennials, who are notably vocal in expressing their concerns online.

From the above, we see that Chinese consumer sentiment is currently less enthusiastic, but this isn't a universal trend. In fact, it reveals a deeper divide: Big-city millennials, who once enjoyed the highest salaries, now face both pay cuts and a shift in mindset from their previous fast-paced, money-driven approach. Meanwhile, rural elders struggle with real gaps in wealth and social benefits, deepening their sense of frustration and disconnect.

But households in the "sinking market"—Chinese living in regional centers and suburban towns—are becoming the primary drivers of domestic demand growth.

In our previous post, we observed that many people did not return to first-tier cities in China after COVID, as they sought more cost-effective lifestyles in their hometowns or other suburban areas. Individuals who have returned to their hometowns from big cities are bringing their consumption habits with them, creating significant growth potential for these regions.

How are e-commerce giants JD and BABA doing in this environment?

Continue reading to see the latest sales figures for JD, Alibaba, Douyin, and Kuaishou, as well as trends in the recruitment market, including job postings, salary outlooks, and the latest developments for the youth group.

To get a sense of what is offered, you are welcome to check out this older post in the same series: Charts of the Week. You can also get free access by sharing us.