Chinese investors frantically invest in overseas assets: An outburst of collective sentiments

How to understand the frenzy of Chinese investors for overseas assets: recent eruption and historical context

*This post is our premium content. Thank you for being a valued paid subscriber.

About the author: Today’s post is kindly written by Aaron Zhou, a seasoned investor and portfolio manager with more than 10 years of experience in investing China and global markets at top-tier buy-side institutions. Aaron is also the industry analyst lead at Baiguan, serving top institutional clients worldwide with his expertise in investment and data product insights. Feel free to subscribe to Aaron's personal Chinese blog on WeChat ( gh_706f1229461e /唐僧的降噪耳机) to gain insights into investing and the Chinese market, or refer to this article if you also read in Chinese.

In the past few years, many foreign fund companies have planned to have a significant impact on the Chinese market. However, they are now gradually suspending operations or withdrawing. These companies offer a wide range of overseas investment products, and if they can seize this opportunity, they should have established a business empire. Unfortunately, they always think about doing business within Chinese onshore market, but they haven't realized that Chinese people want to go overseas.

Exuberant enthusiasm: We want more overseas assets!

Chinese individual investors are actually paying a 20% premium to buy a Japanese market index fund?

It sounds incredible, but it has really happened.

Since 2023, the performance of global stock markets has been very outstanding, especially in the United States, Japan, India, and even the Taiwan stock market has shown impressive performance. On the contrary, the significant decline in China's onshore market, also known as the "A-share" stocks, has increasingly directed investors' attention to overseas investments.

Since last month, this attention has seen an extreme emotional eruption. Several index funds traded on the A-share market have been frantically bought by a large number of investors, leading to an astonishing premium in the secondary market — the Nikkei ETF (513520), for instance, even reached a whopping premium of 20% on January 16th.

Various fund companies have issued warnings. However, individual investors' frenzy cannot be stopped. A 20% premium means that the Nikkei 225 index needs to rise by 20% for these Chinese investors to break even. We can see in the graph below that the blue line represents the Nikkei 225 ETF (513520) listed in China, while the green line represents the Nikkei index itself. These two should ideally be aligned. However, starting from the end of 2023, the growth rate of China's ETF has significantly outpaced the Nikkei index.

Context: Why do Chinese investors buy offshore funds in the onshore market?

Why not invest directly in overseas markets? Due to foreign exchange controls in China, individuals are not allowed to invest in overseas stocks and assets.

Only institutional investors are eligible to apply for a QDII (Qualified Domestic Institutional Investor) license, which allows them to invest domestic funds in overseas markets upon approval.

After the launch of the Hong Kong Stock Connect, domestic individual investors have the opportunity to purchase Hong Kong stocks through the mutual access mechanism. This may be the only "offshore" stock market that individual investors can directly access.

However, the substantial decline in Hong Kong stocks for three consecutive years has resulted in significant losses for domestic investors. Even the mention of Hong Kong stocks makes people shake their heads repeatedly.

If someone wants to invest in markets outside of Hong Kong without encountering foreign exchange controls, they can only purchase QDII funds listed on the A-share market. These funds include both ETF index funds and actively managed equity funds.

Why are ETF index funds more popular?

In the past 5 years, China's A-shares market has had a profound impact on Chinese investors through its "investor education": index funds are considered superior to actively managed stock funds.

In terms of investment performance, actively managed funds did not consistently outperform their benchmark index. In fact, most of them underperformed their corresponding industry benchmark index.

Index funds have very low fees. For example, when it comes to subscription fees, many index funds have zero fees, while actively managed funds can go up to 1.5%.

Investor Distrust: Each year, China produces numerous "emerging" star fund managers who aggressively raise funds’ AUM under the pretense of marketing. Almost without exception, their investment performance declined in the subsequent 1-2 years.

This process has also occurred in the US market, and to this day, the scale of index funds in the US exceeds that of actively managed funds. In China, this process is accelerating. Investors are becoming increasingly disillusioned with the high fees and low returns (especially losses in recent years) of actively managed equity funds.

Among products that aim for exposure to overseas assets, fund companies are also more inclined to issue ETFs. As of mid-January, 29 out of the top 30 funds in AUM investing in overseas markets and issued onshore in China were ETFs.

ETF Index funds surge in premium: Are index funds also risky now?

Index funds have an important indicator: Net Asset Value (NAV). This is the total value of all the stock assets held, converted at the current exchange rate, representing how much they can be sold for. Simply put, for all index funds, their fair value is just their NAV.

The so-called premium refers to the situation where traders pay a price higher than the Net Asset Value in order to purchase it.

As of the market close on January 16th, the premiums of several representative overseas funds have reached the following levels:

Nikkei ETF: The premium at the close was 8.7%.

India Fund LOF: The premium remained at 7.8% at the close.

Southeast Asia Technology ETF: The premium was zero at the close, but it reached 8% during the morning trading hour.

The nature of premium is "scarcity": as more people desire it, the trading price will deviate further from the intrinsic value.

Index funds can be bought and sold on the secondary market, and their prices are heavily influenced by investors' emotions, particularly when individual investors rush in.

For instance, let's consider the Nikkei ETF:

From my observation, there have been lively discussions about the investment potential of the Japanese stock market on major investment forums. The topic has gained significant popularity among Chinese investors in January, especially with the Nikkei index reaching a 30-year high.

After the market opened on January 16th, there was a sudden influx of buying capital, and the premium (the part where the price is greater than the Net Asset Value) reached as high as 20% at one point. This means that if we bought this ETF in the morning, the Nikkei index would need to rise by 20% in the future for us to break even (for the price to equal the Net Asset Value).

By the afternoon close, the premium was still over 8% (please refer to the chart below, highlighted in red, NAV vs. Discount Rate).

What was originally a transparently priced ETF has turned into a fierce battleground for individual investors. Behind this contest lies a frantic pursuit of high-quality overseas assets.

Chinese investors are eager for overseas assets, but their desires are far from satisfied

1. The starting point for overseas investment is not good

QDII funds in China were introduced in 2007. During that time, the four largest domestically operated publicly raised securities funds launched their initial QDII funds, with a strong desire to generate profits in overseas markets. These QDII funds were massive, including the Global Selection Fund launched by Huaxia Fund, which reached a scale of 30 billion RMB. This was an unimaginable achievement in 2007. Back then, even a regular domestic fund with a scale of 5 billion RMB would have been considered among the top funds. [Baiguan: In the Chinese context, publicly raised securities fund refers to "公募基金", which is similar to a mutual fund in the West. We’ve done an explainer previously. ]

It can be seen how strong the interest to venture overseas was among Chinese investors then.

However, this interest was quickly extinguished. The timing of establishing the first batch of QDII was very bad, as it coincided with the 2008 financial crisis. The net value of these QDII funds was quickly halved, with some experiencing a decline of over 60%. Investors had a very poor experience, which has led to a lack of trust in QDII for a long time.

Because of this "distrust," QDII developed slowly in the following years. Based on my experience working in publicly raised securities funds, QDII fund managers were once marginalized figures within the company, not well-regarded, and received low bonuses. The issuance of new QDII funds between 2008 and 2020 was also very challenging.

With the cooling of the domestic stock market after 2021, overseas investment has heated up again! QDII funds have returned to the public eye. In 2023, funds invested in the domestic market were almost unsellable, with most in a net redemption state. Only the AUM of QDII funds grew close to 20% compared to the beginning of the year, and their outstanding shares increased by 35% from the beginning of the year.

It can be said that investing in overseas markets was the only "theme" that the entire public fund industry could sell last year.

2. Highly concentrated investment scope

Currently, QDII falls far short of meeting investors' overseas allocation needs.

From the distribution of the total investment market value, approximately 60% is allocated to Hong Kong stocks, while investments in US stocks (primarily in the Nasdaq and S&P 500 indices) make up nearly 30% of the total market value. Other funds are allocated to countries such as Vietnam, Japan, and Germany, where the available investment options are relatively limited.

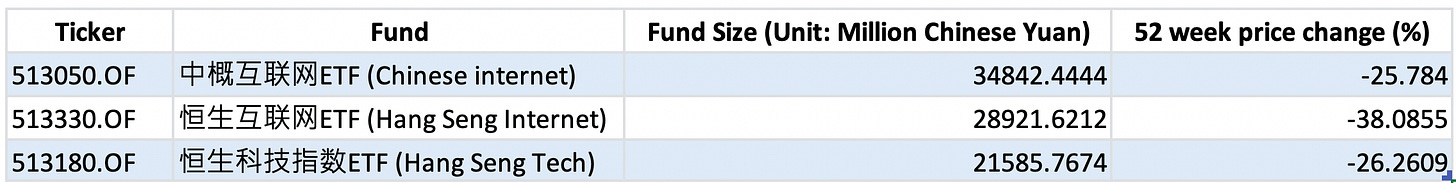

Due to over 60% of QDII investments being in Hong Kong stocks, the returns have been very poor. The economic correlation between Hong Kong and mainland China is extremely high, and it has not achieved the intended diversification effect. I classify these QDII funds as "pseudo" overseas investments.

For example, the top three QDII funds in terms of AUM all invest in Hong Kong stocks. Their losses in the past year have all exceeded 20%. The majority of the constituent companies these funds hold are from mainland China.

In the TOP 10 QDII funds, only 3 ETFs are invested in the United States and they are all linked to NASDAQ index, all of which achieved a positive return over 40% in the past year. The remaining funds are all invested in the Hong Kong market and have incurred losses.

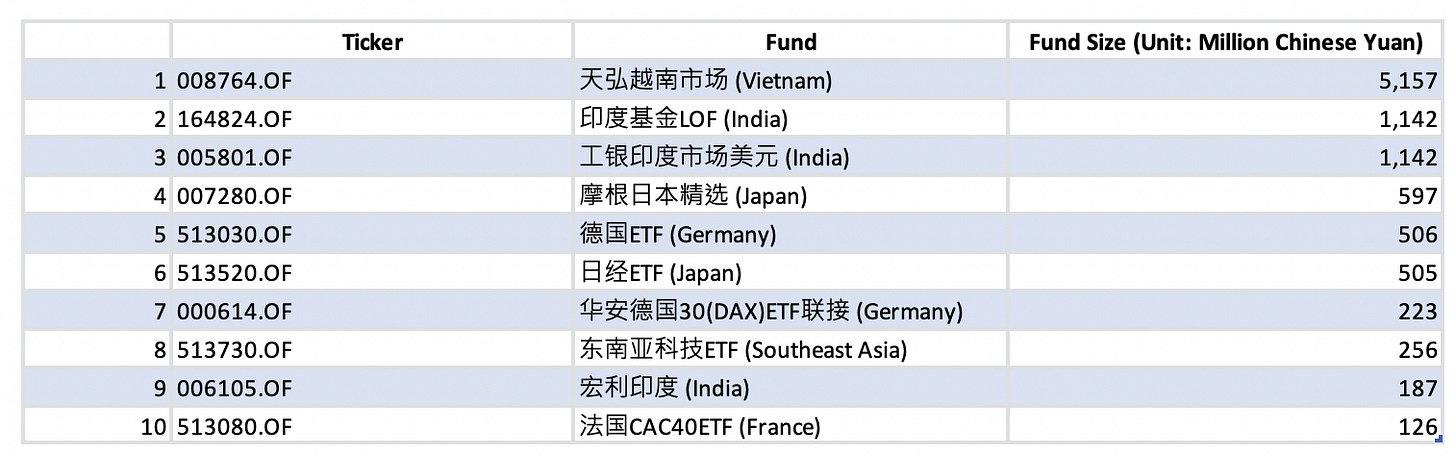

Very few funds truly invest outside of Hong Kong and the United States. I have searched for data up until January 2024, and the following 10 funds are representative:

The Indian and Japanese markets are the most attractive to domestic investors. Due to well-known reasons, India is catching up with China in the manufacturing industry, and its population advantage is becoming more apparent. Japan, on its path to returning to inflation and growth, has seen a significant rise in its stock market, with the added allure of Warren Buffett's investment. Vietnam, due to its ongoing economic reforms, has also garnered attention from Chinese investors.

However, the size of these funds is relatively small, and the number is also limited. Once the demand from investors in the secondary market increases, it can easily lead to a premium. To be honest, there are too few options available!

3. Supply-demand Imbalance, Chinese investors are eager to go global

Over the past three years, Chinese companies have been increasingly expanding globally. For instance, Shein, Pinduoduo, and Miniso, with their supply chain and efficiency advantages, have successfully entered overseas markets. Also, the penetration of new energy vehicles into international markets has been particularly strong.

However, what is often overlooked is that Chinese stock investors also need to go global and are super eager to do so.

My takeaway from this event: what’s the future for China’s overseas investment?

Where there is a huge demand, there should be a significant business opportunity.

Continue reading my perspective on opportunities for China's overseas investment. You can also get free access by sharing with us.