Comprehensive comparison of China and US debt levels

Whoever handles the debt situation better will gain a competitive advantage over the other side

In 2023, the burgeoning topic of national debt has taken center stage in economic discussions within and between the United States and China. The United States has witnessed its national debt swell to an unprecedented nearly $33 trillion due to continuous deficit spending since 2001, with a staggering 89% increase during the pandemic period alone. With the debt-to-GDP ratio brushing the 100% mark—far from the more sustainable 70%—questions about the long-term viability of such debt levels are inevitable.

At the same time, China is facing increased scrutiny over its own debt conundrum. The country is dealing with a growing crisis as local governments struggle with significant debt. This issue is further complicated by the instability in the real estate sector, as evidenced by the recent debt repayment challenges of China's largest developer, Country Garden. The potential for a broader economic impact is a cause for concern and has brought attention to the sustainability of local government finances.

In light of these developments, we present a carefully selected article that offers a thorough comparative analysis of the US and China's debt landscapes. This piece, summarized from a lecture titled "Macro Debt Comparison between China and the United States" at the Zhejiang University Alumni Association, navigates through the debt structures and burdens of the two economic powerhouses. It delves into various sectors, including household, non-financial corporate, and government debt, examining the nuances and potential implications on economic growth within the broader global context.

Why do we showcase this article? Because, as the author claims, whoever handles their own unique debt issues better, will gain a competitive advantage in their relationship.

Below is our translation of the original article:

China vs US: Comprehensive comparison of China and US debt

Note: This article is based on the author's lecture on "Macro Debt Comparison between China and the United States" at the Zhejiang University Alumni Association on October 27, 2023.

Since the collapse of the Bretton Woods system in 1973, human society has entered the era of credit currency.

Compared to the "economy" built on hard currency in the gold standard era, the economy of the credit currency era, from currency creation to economic growth, almost every step of the economic system's operation is built on credit expansion.

Let's take a simple example.

If you want to buy a house but don't have enough money, the bank will provide you with a loan. As a result, a new debt is created in society. For the bank, the corresponding right to the debt is a new credit asset. The bank takes this asset and finds the central bank to borrow against it, and then the central bank will provide the commercial bank with new currency...

Loans-debts-credit-currency. In this activity, the economy expands, currency is issued, debt increases, economic activity increases, and money increases, which is what we call "economic development."

Issuing currency based on debt collateral will generate more credit, which will lead to more currency, and then more wealth will be generated in society, and the economy will expand accordingly. Debt, credit, and currency are magically intertwined and form a perfect, self-recurring debt Möbius loop.

What is a Möbius loop?

Take a strip of paper, twist it 180 degrees, and then stick both ends together to form a Möbius loop.

Ordinary paper definitely has a front and a back, but a Möbius paper loop has only one side. A small creature can crawl over the entire surface without crossing any edges. It was discovered by German mathematician Möbius-Liszt, so it is called a Möbius loop. From a mathematical point of view, the main characteristic of a Möbius loop is that it blurs the boundaries between two and three dimensions.

Currency represents a claim to wealth;

Debt represents a claim to currency;

Credit represents the ability to repay debt.

Originally, there were clear boundaries between these three, but in today's credit currency era, macroscopically, these three can smoothly convert without crossing any boundaries. That's why I named it the "debt Möbius loop."

However, this Möbius loop initiated by debt has a bug:

Limited by the return rate of the real economy, when the debt ratio increases to a certain level, the operation of this system becomes sluggish.

In 2022, the total global GDP was approximately $101 trillion, with only two countries surpassing $10 trillion, the United States and China, with sizes of $25.5 trillion and $18 trillion, respectively, accounting for 43% of the global total.

According to the International Institute of Finance (IIF) monitoring report on global debt, China and the United States not only account for nearly half of the world's economy but also hold over 50% of the world's debt in the real economy.

In contemporary macroeconomic analysis, macro debt is generally divided into four sectors:

Household sector

Non-financial corporate sector

Government sector

Financial sector

The combined debt of the first two sectors is referred to as "private non-financial sector debt," while the combined debt of the first three sectors is known as "non-financial sector debt," which is what we usually refer to as "total debt of the real economy." The debt of the financial sector mirrors the debt of the real economy sector.

Furthermore, government sector debt can be further distinguished as "central government (federal government) debt" and "local government debt." In addition, there are hidden debts of local governments or central governments (included in non-financial corporate sector debt or financial sector debt). I have already written an article comparing the government debt of China and the United States: China vs US: Who Has Higher Government Debt?

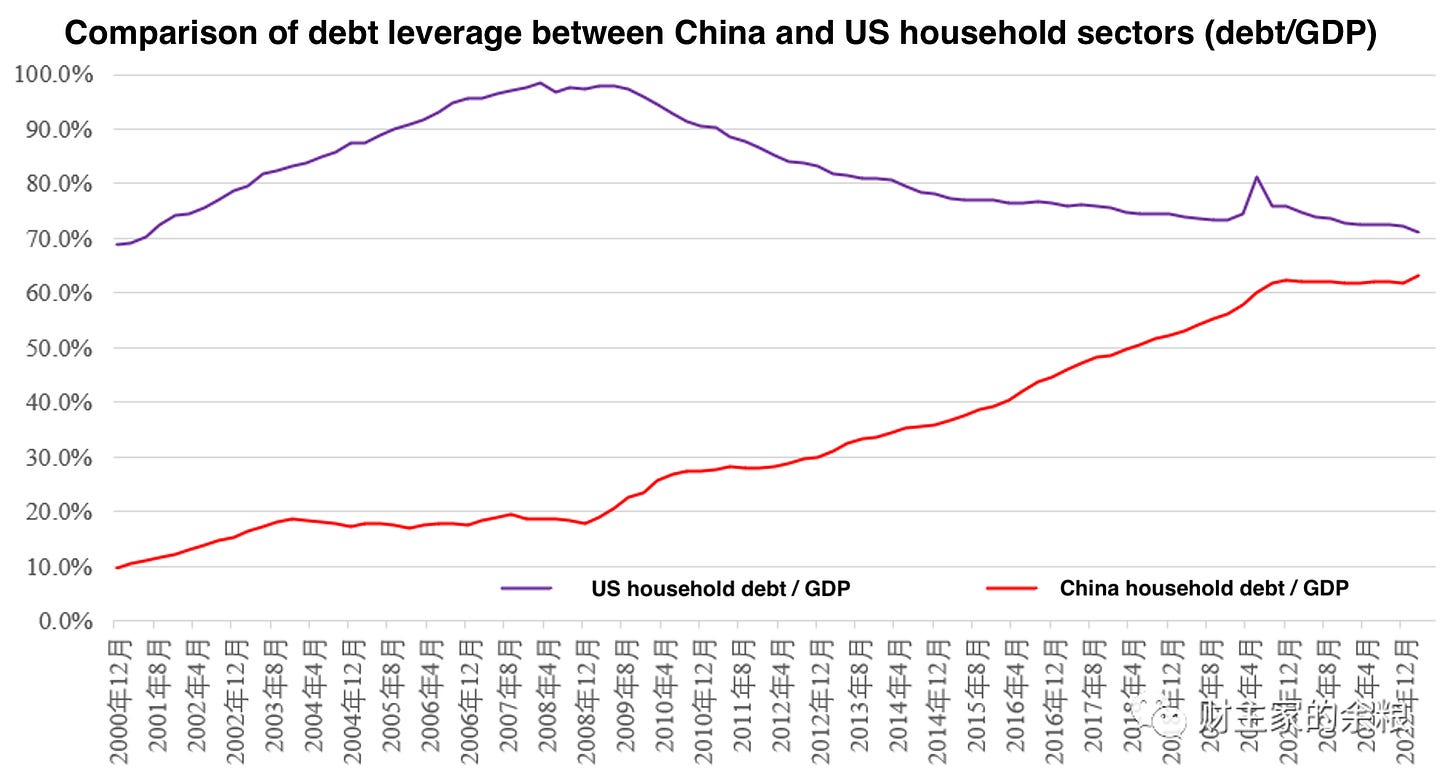

Next, let's take a look at the debt comparison of the household sector. According to data from the Bank for International Settlements (BIS), the US Federal Reserve, and the China National Balance Sheet Research Center (CNBS), the household sector debt leverage of China and the United States in the first quarter of 2023, based on their respective GDP, was 63% and 71%.

According to currency valuation, as of the first quarter of 2023, the total debt of China's household sector is 77.46 trillion yuan, equivalent to 11.07 trillion US dollars. In contrast, the total debt of the US household sector is 19.07 trillion US dollars.

In terms of the debt-to-GDP ratio, the US household sector experienced its highest debt burden during the 2007-2008 subprime crisis. Since then, its debt pressure has significantly decreased. On the other hand, China's household sector had a relatively light debt burden before 2007, but it has rapidly increased since then until the third quarter of 2020 and has since remained relatively stable. Despite the US household debt-to-GDP ratio decreasing since 2009, it has consistently remained higher than that of China. Additionally, with current interest rates in the US surpassing 5%, one might wonder if US residents are suffocating under debt.

The reality is different.

As for the comparison of debt burdens between the household sectors of China and the US, a simple contradiction is:

If their household sectors were heavily indebted, why are US mortgage rates so high while housing prices continue to rise?

If China's household sector had a lighter debt burden, why are our mortgage rates so low while our housing prices have been declining?

The secret lies in the distribution of GDP.

According to data from the International Labour Organization, China has the lowest share of labor income in GDP among the major economies. In the process of GDP creation, the income of Chinese workers is systematically suppressed. Therefore, the income and wealth possessed by China's household sector are actually insufficient to support a debt ratio as high as that of the United States.

To truly understand the real debt burden of the household sectors in China and the United States, it can be compared using the debt-to-disposable-income ratio. For example, in the first quarter of 2023, the total disposable income of US residents was $19.61 trillion, while the total household debt was $19.07 trillion, resulting in a debt-to-disposable-income ratio of 97.2%. In contrast, in the first quarter of 2023, the total disposable income of Chinese residents was 56.84 trillion yuan, while the total debt was 77.46 trillion yuan, resulting in a debt-to-disposable-income ratio of 138.7%.

Based on this calculation, in the past 20 years, the household sector in China has had the heaviest debt burden, surpassing even the peak debt burden of US households in 2007. The reason why housing prices in China have been declining since 2022 is due to this heavy debt burden!

In contrast, the debt burden of US households is currently much lower than it was in the past 20 years. Therefore, it is natural for the American people to continue buying, even though the US currently has the highest mortgage rates in the past 20 years and housing prices remain strong...

After comparing the household sectors, let's move on to comparing the debt of non-financial corporate sectors.

According to BIS data, the debt leverage of China's non-financial corporate sector (compared to GDP) has been outrageously high since the available data. In the first quarter of 2023, China's non-financial corporate sector debt-to-GDP ratio reached 165%, while the US only had 77.2%.

As of the first quarter of 2023, the total debt of China's non-financial companies reached 202.07 trillion yuan, equivalent to 29.39 trillion US dollars, while the total debt of US non-financial companies was only 20 trillion US dollars, which is much lower than that of China.

Although China's GDP has not surpassed that of the US, its corporate debt is much higher than that of the US. Does this mean that China's corporate debt problem is much more serious than that of the US?

This is not necessarily the case.

As I mentioned in the article "China vs US: Who Has Higher Government Debt?," a significant portion of China's so-called "non-financial corporate debt" is actually debt of LGFVs established by local governments—debt of urban investment companies [Baiguan: we will use “urban investment companies” and “LGFVs” interchangeably]. These debts are actually implicit liabilities of local governments, but they are included in the "non-financial corporate debt," which naturally leads to an extremely high level of debt for China's non-financial companies.

According to estimates by the China National Balance Sheet Research Center (CNBS), since 2008, the debt of urban investment companies established by local governments has accounted for over 40% of China's total non-financial corporate debt.

Using the example of 2022, the total debt of non-financial enterprises in China, including local government financing vehicles (LGFVs) debt, reached 88 trillion yuan. Excluding this debt, the total debt of all non-financial enterprises in China is approximately 114 trillion yuan, with a debt-to-GDP ratio of about 94%, which is not significantly different from the 77% of the United States.

After adjusting for the data on local government financing vehicles debt from CNBS, the comparison of non-financial enterprise debt leverage between China and the United States is as follows:

From this chart, it can be seen that if we do not consider the surge in debt of urban investment companies, China's non-financial companies have actually been in the process of deleveraging since 2016, and the debt leverage ratio has been continuously decreasing...

After comparing the debt of households and non-financial enterprises, we can now compare the debt leverage of the private non-financial sector in China and the United States.

It should be noted that in the internationally used term "private non-financial sector," the "private" specifically refers to the sector relative to the government. In China, this term can easily cause misunderstandings (due to the large number of state-owned enterprises in China, which are also the main debtors in the non-financial sector). To avoid confusion, I personally refer to it as "debt leverage of the production sector."

We all know that the financial sector does not truly create wealth, and the government sector is responsible for wealth distribution. Therefore, from a macro perspective, the sectors that truly produce and create wealth for society are the households and non-financial enterprise sectors. If the combined debt of these two sectors reaches a high proportion, and they are only busy dealing with the principal and interest payments of the debt, it is likely that the wealth creation potential of the entire society has been exhausted...

Without considering the debt of urban investment companies, before 2015, the total debt leverage of China's production sector was much lower than that of the United States. Therefore, China's production sector was able to create wealth by taking on more debt, and the debt promoted credit expansion. As a result, China's real economy was able to develop rapidly, far exceeding that of the United States. After 2015, the debt leverage of China's production sector has basically caught up with that of the United States, and the high debt leverage has slowed down the development speed of China's real economy, diminishing its advantage over the United States.

Now, without excluding the debt of urban investment companies, the debt leverage of China's production sector is much higher than that of the United States, and the heavy debt burden has essentially depleted the development potential of the economy. However, if we exclude the debt of urban investment companies, and compare it to the size of GDP, the debt-leverage ratio of China's production sector has actually been roughly on par with or slightly lower than that of the United States in recent years, indicating that its development potential is not lower than that of the United States.

Since we have considered the debt of urban investment companies, let's also make a comprehensive comparison of the central government (federal government) and local government debt between China and the United States.

It is obvious from the comparison of government debt that the main concentration of US government debt is in the federal government, while the debt of the Chinese government is mainly concentrated in the hidden debt of local governments.

Taking into account the debt situation of the household sector, non-financial enterprises, and the government sector, the core issue of the current macro debt in the United States is that the federal government debt is too high, while there are no major issues with the debt of enterprises, households, and local government sectors. On the other hand, the troubles in China's macro debt include two aspects:

The debt burden of the household sector is too heavy compared to disposable income.

The hidden debt of local governments is too high compared to fiscal affordability.

The country that can handle its macro debt problem first will be able to achieve economic recovery and get rid of recession, and will also gain an advantage in the short-term future economic competition.

Since October 2023, with the tacit approval of the central government, local governments have issued "特殊再融资债券 special refinancing bonds." In just 20 days, the issuance scale has reached nearly 1 trillion yuan.

The so-called "special refinancing bonds" are actually a process of using new debt to repay old debt and interest on the hidden debt of local governments, and in this process, the hidden debt of local governments is made explicit (new debt becomes regular local government bonds). This is also the "开前门、堵后门 open front door, block back door" debt conversion plan advocated by the central government.

Moreover, because the scale of hidden debt of local governments is too large, if local government finances are used to handle hidden debt, there will be no resources left for other matters. Therefore, the central government has also timely issued "special government bonds" totaling 1 trillion yuan under the guise of "accelerating recovery and reconstruction," with the repayment and interest payment borne by the central government. With this 1 trillion yuan, the central government is compensating for the loss of local government's handling of hidden debt.

Not only will 1 trillion yuan of special government bonds be issued, but the annual fiscal deficit rate of China will also be increased from 3% to 3.8%. This means that as long as local governments actively resolve hidden debt, this 1 trillion yuan is just the beginning. In the coming years, with central government support, local governments will continue to convert their debt.

Finally, if we combine the debts of households, non-financial enterprises, and the government, it becomes the total debt leverage of the real economy.

The following chart compares the total debt leverage of the real economy in China and the United States since the beginning of the 21st century:

From the graph, we can see:

Before 2017, the total debt leverage of China's real economy was much lower than that of the United States. From 2017 to early 2020, the two were basically getting closer, and the total debt leverage of China's real economy began to stabilize.

The outbreak of the pandemic in 2020 led to a significant increase in the total debt leverage of both the United States and China's real economy, with the United States increasing at a faster rate, resulting in its total leverage surpassing China's once again.

Since late 2021, with the easing of pandemic restrictions in the United States, the total debt leverage of the US real economy has been rapidly declining, while China's debt leverage has continued to rise and reached its highest level ever in 2023, far exceeding that of the United States.

These are the comprehensive comparisons of debt between China and the United States.

"According to data from the International Labour Organization, China has the lowest share of labor income in GDP among the major economies. In the process of GDP creation, the income of Chinese workers is systematically suppressed. Therefore, the income and wealth possessed by China's household sector are actually insufficient to support a debt ratio as high as that of the United States"?

Seriously?

The ILO is a Western propaganda front for bs Western style 'unions' that always fail.

In reality, 58% of Chinese GDP goes to wages, compared to the measly 43% of GDP Americans get.

Thanks to 72% membership in a super-union whose head is a member of Xi's 7-man Steering Committee, workers get the Big Man's ear pretty easily.

"If you want to buy a house but don't have enough money, the bank will provide you with a loan. As a result, a new debt is created in society. For the bank, the corresponding right to the debt is a new credit asset. The bank takes this asset and finds the central bank to borrow against it, and then the central bank will provide the commercial bank with new currency"...

If you want to buy a house but housing is too expensive to buy and the elites have successfully isolated you from society, the bank(er) will entrap you with a loan to inflate the value of their real estate holdings. As a result, a new extraction and enslavement is created in society. For the banker the corresponding right to the debt is a new credit asset(a deed of enslavement). The bank takes this asset and finds the central bank to borrow against it, and then the central bank as a tool for the elites will provide the banker with new currency...(by issuing bonds that the bankers will buy so that the government will pay them interest on the money the government issues to help the bankers businesses continue extracting more wealth).

The later, badly writen by me, is a bit more realistic, not the happy fairy tail economist lie about. Well most economist, not ones like Michael Hudson or Radhika Desai.