Dancing in chains: HUAWEI's comeback to the stage backed up by the Chinese semiconductor industry (Part I)

Huawei has once again attracted worldwide attention, not because of new sanctions from the US, but because the sanctions seem to have not had the expected effect. With new flagship phones, new 7nm chips, and satellite calls, Huawei has returned to the center stage. Backstage, China's semiconductor industry supply chain is busy.

Huawei's successful unveiling of its new smartphone Mate60 series catapulted it to the headlines of major media outlets worldwide, making it a phenomenon. Unlike the treatment given to other manufacturers' phones, both domestic and international media initially placed their focus on the new proprietary chipset featured in this series. They regarded this as a symbol of Huawei's breakthrough in overcoming US technology restrictions and a significant milestone in the development of China's semiconductor industry. Clearly, this transcends the realm of traditional business analysis for consumer electronics products.

To assist our readers in gaining a deeper understanding of the full scope of this event and its potential significance and impact, I will analyze the story of Huawei's new smartphone through a series of three articles, blending technological, business, and political perspectives, while also examining the landscape of the China-US tech rivalry behind it.

Intro

About a month ago, I read an interesting research report named Technology competition between nations: Views from industry leaders. The author solicited about 285 global executives, academics and researchers in the global technology industry for their views on the future of global technology competition. Among these respondents, 35% each worked for Chinese and US companies, and the rest worked for companies in Europe, India, East Asia, and South East Asia.

Several of the survey results impressed me:

Respondents do not believe China will ascend to the #1 position in the development of core technologies. Fewer than 10% of respondents believe China will surpass the technical capabilities of the United States over the next ten years, whereas more than 40% believe China’s technology self-reliance effort will have slow progress or even fail.

Respondents are very optimistic that China will produce a top 3 global player in electronic vehicles, but slightly optimistic that Chinese companies will take global leadership in the cloud computing as well as the analog, power, and radio frequency semiconductor markets. However, for the foundational technologies that underpin the datacenter, PC, smartphone and AI industries there is considerably less optimism, with less than 10% believing China can produce a top 3 global player in GPU, CPU or operating system industries.

Respondents do not expect Chinese companies to be able to outcompete global companies for high-end and leading-edge chips even within China’s domestic market. For example, nearly 75% of respondents indicate that Chinese companies will only win in the lagging edge and most price-sensitive sectors of the domestic Chinese market; over 90% of respondents indicate that the most advanced semiconductor segments in China, which are most critical for artificial intelligence leadership, are expected to be dominated by non-Chinese companies.

I think these views have been representative in both the US and China for a long time. However, Huawei's recent news and the story behind it may influence those who hold these views.

Part I: Amid the Silence Comes the Crash of Thunder

Part I will revolve around three questions:

What background information is worth knowing about this event?

From a technical perspective, what are the highlights of Huawei's latest smartphones and the new chip?

What is the public and market's perception of Huawei's latest smartphones? Will Apple be affected?

I. Mate 60 series and the new chip Kirin 9000S

2023 is not an easy year for smartphone manufacturers. According to Counterpoint's data, since the global demand for consumer electronics products declined in the second half of last year, the shipment volume of smartphones has been declining year-on-year for several consecutive quarters. Market research institutions predict that the global shipment volume of smartphones will decline by 6% year-on-year this year, two consecutive years of decline, and will hit a new low in nearly 10 years.

However, Omdia's smartphone preliminary shipment report for Q2 2023 shows that while shipments of major smartphones are generally declining year-on-year, Huawei and Transsion Holdings seem to be the exceptions.

Huawei has shown a momentum of recovery after two consecutive quarters of shrinking shipments. It seems like Huawei regaining smartphone market share despite lacking 5G in the newest flagship devices. Omdia notes that “Overall, Huawei is performing well against very tough market conditions and competition. It’s in a much stronger place now versus a year ago, however without the rights to produce smartphones with 5G, there will be a ceiling to this growth.”

Omdia's ceiling concerns are not without reason. As cited by a news report of VOA, in 2020, Huawei briefly surpassed Apple and Samsung to become the world's largest smartphone seller when its market share peaked at 18%, according to market tracker Canalys. After successive rounds of US export controls imposed by the US government since 2019, by 2022, Huawei had a 2% share of the global smartphone market, with most of its sales in China. Also, a research report in 2021 indicates that the second US ban significantly weakened Huawei’s competitiveness in the 5G arena.

On August 29, 2023, without any prior announcement, Huawei surprised the market by directly releasing its latest flagship smartphones, the Mate60 and Mate60 Pro. According to system information displayed on the actual devices, both of these new models are powered by a new made-in-China design SoC (system-on-chip, the core and most important chip of a smartphone) Kirin 9000S. Considering that Huawei has faced difficulties in obtaining production support from chip foundries like TSMC since the implementation of 3rd round of US sanctions in 2021, this new chip quickly garnered attention in mainland China.

Following initial evaluations by domestic tech media, these new smartphones have demonstrated network communication speeds that have reached 5G levels, even though the signal indicator on the phone does not display the "5G" mark (In contrast, when switching to a 4g network, the "4g" mark is displayed normally). This suggests that Huawei has likely overcome the "chokepoint" technology issue with 5G radio frequency chips. There are traces of this development: in July of this year, a Chinese company announced the breakthrough of domestic substitution and commercial-scale mass production of critical components of 5G radio frequency chips—BAW filters, which are the items subject to US export control.

Overseas, a few days later, on September 5th, Bloomberg's news report broke the silence of international media: They sent Mate 60pro to Techinsights, a leading semiconductor technology analysis firm, for teardown and analysis. The analysis results indicated that "Huawei is able to come close to, though not quite match, the fastest mobile devices using a chip that’s designed and produced in China". As noted by Bloomberg in a follow-up report, this suggests that Huawei has somehow managed to break through the years-long US sanctions.

II. Preliminary disclosure of important technical information on Mate60 pro

Apart from the basic configuration information on the official website (which does not indicate the information on 5G or Kirin 9000S), Huawei has not provided any official statement on further technical details of Mate60 series. The following is a compilation of key technical information related to the Mate 60 series (primarily Mate 60 Pro) based on publicly available sources:

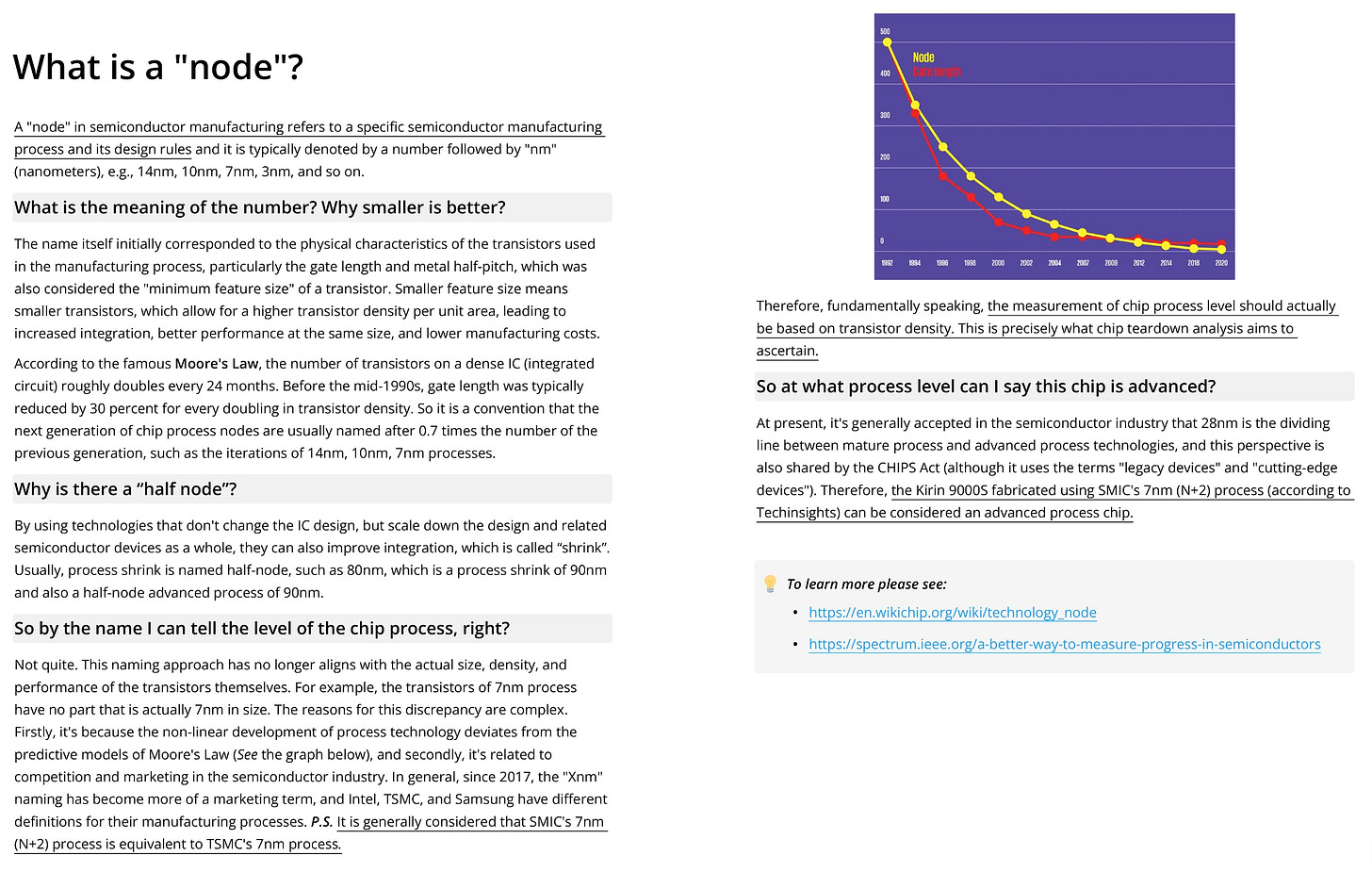

In its chip teardown report on September 4th, TechInsights revealed some technical findings. They believe that the Kirin 9000S is manufactured using SMIC's 7nm (N+2) process and deduced that it might be manufactured by SMIC. This inference may be based on their discovery in July 2022 when they first identified SMIC's commercial use of the 7nm chip manufacturing process through the teardown of the MinerVa Bitcoin Miner.

In fact, earlier than Techinsights' analysis, a Chinese professional hardware review blog Geekerwan conducted its test and provided analysis results on Mate60 pro and Kirin 9000S from hardware and performance perspective, and quoted by Engadget:

Benchmarks conducted by Geekerwan suggest that the Kirin 9000S's performance is close to Qualcomm's Snapdragon 888, meaning it's around two generations behind. Its energy efficiency ratio can not catch up with Apple's A16, Qualcomm's Snapdragon 8gen2, and Mediatek's Dimensity 9200 using TSMC's process, but it's better than Google's Tensor and Samsung's Exynos2200 using Samsung's process.

Geekerwan added that the CPU here features one big core and three middle cores based on Huawei's own "TaiShan" architecture, in addition to four little cores based on Arm's efficient Cortex-A510.

As a bonus, the Kirin 9000S is the first mobile processor to support multi-threading — running eight cores with 12 threads, though apparently apps will require further optimization to make use of this feature.

As for the GPU, Huawei added its own Maleoon 910, which is allegedly on par with the one in the Snapdragon 888.

It is worth mentioning that on September 5, 2023, a CCTV(China Central Television) news program interviewed Dan Hucheson, Vice Chairperson of Techinsights, about their findings on Huawei chip teardown. He stated that the Mate 60 Pro exhibits an unexpectedly impressive level of quality, undoubtedly on a world-class level. Evaluating whether Huawei has successfully navigated the US sanctions is challenging, but their achievement in developing the Kirin 9000S chip is noteworthy. While it may not match the absolute cutting-edge chips, it's only 2 to 2.5 nodes not behind the current state-of-the-art technology.

P.S. I noticed that Dan was later interviewed on the TV show Daybreak Asia on September 8 as well, and the core content was pretty much the same, except that it was more emphasized that the chip is not particularly leading, and also that most of the components are made in China, and the ratio looks to be around 2/3, whereas before it was only about 1/4 or 1/3, which is a significant improvement.

Specifically, what is the level of the process of Kirin 9000S? The semiconductor industry generally considered that SMIC's 7nm (N+2) process is equivalent to TSMC's 7nm process. Given that processes beyond the 28nm process are now generally considered to be "advanced processes" (which is a concept opposite to "mature process". Advanced process chips are mainly used in mobile terminal devices, high-performance computing, automotive electronics and communications, IoT and other cutting-edge fields), Kirin 9000S is an advanced process chip.

[Author's Note: For more info about the "node" and chip process, please see below.]

In addition, during that news program on CCTV, the host also conducted a live interview with a Chinese technology expert, Professor Lv Tingjie from Beijing University of Posts and Telecommunications, who also serves as the Vice Chairman of the China Information Economics Society and an independent director of China Satellite Communication Group, can be considered a credible and professional voice within the semiconductor industry. He provided a more detailed perspective and analysis. Here are the key points of his views:

Western countries' teardowns primarily aim to confirm the level of domestic substitution of core components of the Kirin 9000S, whether it utilizes technologies within the scope of U.S. export controls, and the level of technological advancement. Based on analysis from various sources, it should be noted that the domestic substitution rate is very high, and the US sanctions against Huawei have not had the expected impact.

The gap between Kirin 9000S and the most advanced process chips is about 2 to 2.5 nodes, which theoretically translates to a gap of 3 to 5 years. However, China often achieves faster catch-up speeds.

While achieving the domestic substitution of a 7nm 5G SoC is a significant breakthrough from 0 to 1, it's important to realize that the subsequent research and development of 5nm and 4nm, with increased non-linear difficulties for further integration, remain challenging, and further efforts are required.

Huawei recognized the "chokepoint" issue in EDA (Electronic Design Automation, which herein refers to industrial software for IC design) early on and made independent developments. However, there are still some industrial segments, such as coating, lithography technology, and especially lithography machines, where there are gaps. [Author's Note: In March of this year, Huawei's Rotating Chairman, Xu Zhijun, stated in an internal meeting that Huawei had successfully achieved domestic substitution in the chip sector for EDA for 14nm process and above. ]

Internationally, a production volume exceeding 5 million units is generally considered mass production, meaning it can generate economic benefits. Huawei has increased the production volume of Mate60 Pro to over 10 million units, undoubtedly reaching mass production scale. Huawei's achievement in the commercialization and mass production of the 7nm 5G SoC indicates significant progress in controlling chip process costs and yield rates.

Huawei possesses a complete industry ecosystem, including both hardware and software capabilities. It has the HarmonyOS operating system and will introduce the PanGu 3.0 large language model (i.e. system-level generative AI services), which combines software and hardware capabilities to provide a comprehensive ecosystem solution. This is one of the key reasons why the Mate 60 Pro has become a phenomenon in the smartphone market.

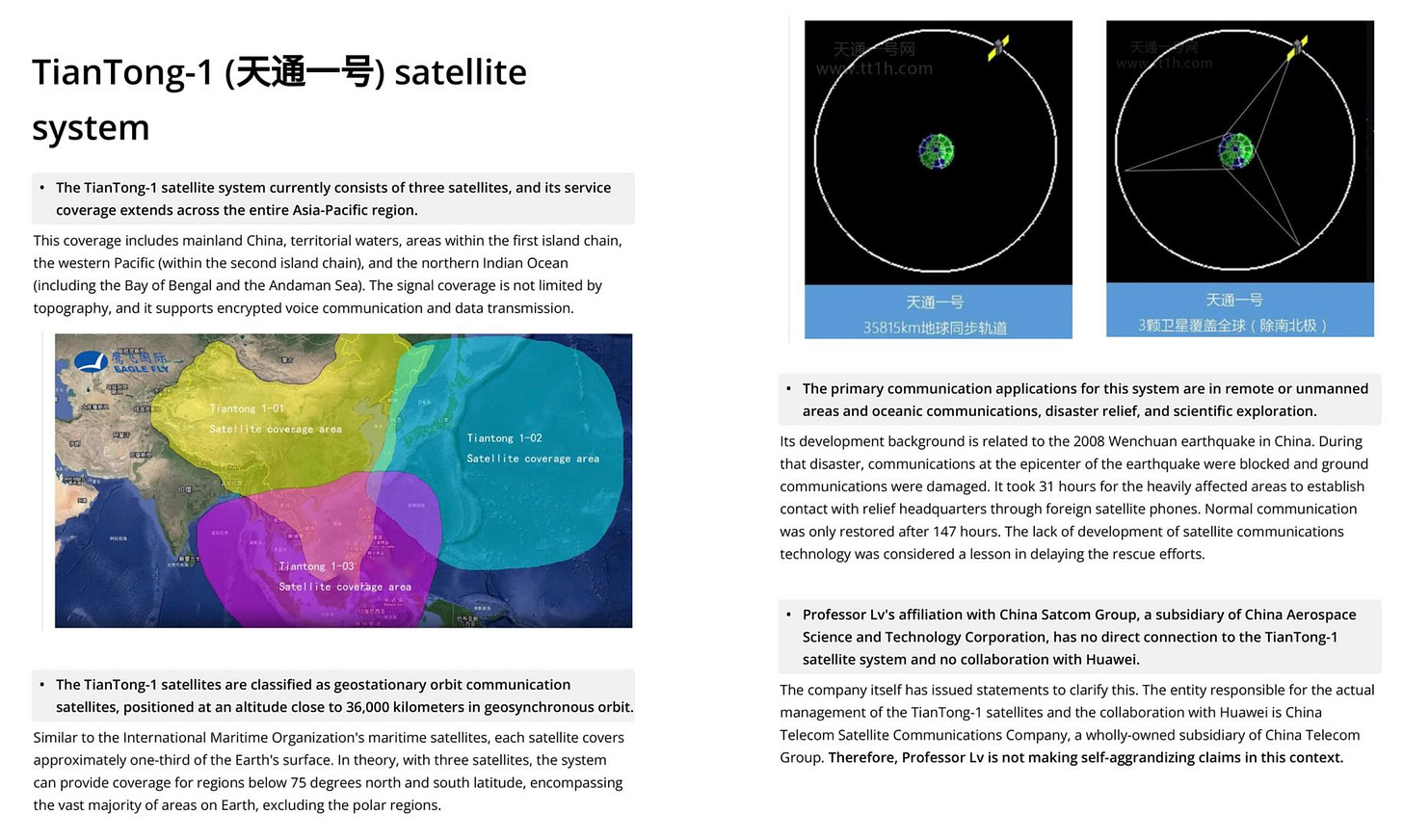

The satellite communication technology integrated into the Mate60 Pro is a significant advancement that has impressed professionals. It is achieved through communication with the TianTong-1 satellite, launched by China in 2016. This high-orbit digital broadcasting communication satellite orbits at an altitude of 36,000 kilometers. In comparison, Elon Musk's Starlink satellites orbit at over 1,000 kilometers and require additional ground receiving equipment and phased-array antennas. In terms of difficulty and cost, Huawei's technology is more advanced. Professor Lv believes that Huawei has made important breakthroughs in antenna and power consumption technology in this regard.

[Author's Note: For more info about the TianTong-1 Satellite System, please see below.]

The teardowns have confirmed that the main control SoC (System-on-Chip) of the Mate60 Pro and the majority of its chips are domestically produced in China. Only the LPDDR5 memory and NAND Flash storage come from SK Hynix. According to the Chinese media 财经十一人, the Mate 60 Pro currently boasts the highest domestic substitution rate among smartphones. It sources components from at least 46 suppliers, with over 10,000 different parts originating in China, resulting in a domestic substitution rate of over 90%. This percentage is higher than Techinsights' initial estimates.

Following the release of the Mate60 and Mate60 Pro, Huawei further released upgraded models, the Mate60 Pro+ and the folding screen phone MateX5, both of which still feature the Kirin 9000S according to configuration information displayed on the settings page of the devices.

Regarding the satellite communication functionality:

Media and users have noted that the Mate60 Pro's product category marked on the packaging is "satellite communication terminal".

China Telecom is currently the exclusive operator for this feature, and users need to subscribe to China Telecom's services to use it.

Many video bloggers and users have shared their real-world testing experiences in various scenarios, reporting positive results. Interestingly, some users even attempted to use it on airplanes, and it worked successfully (the flight speed of a civilian plane is generally in the range of 800-1000km/h. The test result can reflect the stability of the signal connection in a high-speed moving state). However, this practice was temporarily halted by aviation authorities due to potential unassessed risks.

Professionals in the telecommunications industry generally consider the Mate60 Pro as possibly the first consumer-grade smartphone-sized device to achieve maritime satellite-level satellite voice communication.

Currently, only the Mate60 Pro, Mate60 Pro+, and MateX5 support satellite communication functionality.

Regarding chip production capacity:

财经十一人 cites a semiconductor investor with ties to Tsinghua University who stated that initially, the yield rate (meaning the percentage of successfully manufactured usable chips in the production process, indicating production efficiency and product quality) of the Kirin 9000S chip was insufficient to meet commercial demands. However, it saw a significant improvement in 2022, reaching over 50% at that time, and as for now the yield rate has reached an acceptable level.

Both Mate60 and Mate60 pro are powered by Kirin 9000S. Their official starting prices are CNY 5,499 (about USD 759) and CNY 6,499 (about USD 892), respectively, which are higher than the Mate 50 series (with 4G SoC) but similar to the Mate 40 series (with the previous 5g SoC Kirin 9000). At least from the pricing, it's difficult to discern the adverse impact of production capacity issues (if any).

TechInsights predicts that Huawei's journey to recovery in the smartphone market will continue this year, with shipments expected to reach 35 million units (a 36% year-on-year increase). It estimates that the Mate60 series will ship between 5 million and 6 million units throughout its lifecycle (approximately two years).

To Counterpoint, Techinsights' predictions seem a bit conservative. Its research notes that shipments of the Mate 60 Series in the first four months after launch could reach 4 million units in China.

Kuo Ming-chi, a renowned analyst at TF International Securities, mentioned that Huawei is expected to sell 5.5 to 6 million units of the Mate 60 Pro within the year and anticipates selling at least 12 million units of the Mate60 Pro in the 12 months following its launch.

Chinese domestic media, from the supply chain perspective, appears even more optimistic. According to news from CLS on September 14th, citing industry insiders, the shipment volume of Huawei's Mate60 Pro and Mate60 Pro+ has been raised to 20 million units. Previous supply chain sources had indicated that Huawei had increased orders for the Mate60 Pro to a range of 15 million to 17 million units. On September 12th, Securities Daily cited sources close to Huawei, revealing that the performance of the Mate 60 series exceeded expectations, prompting Huawei to raise its shipment target for the second half of the year by 20%. This to some extent supports CLS's statement.

In summary, these reports reflect at least a considerable degree of confidence from Huawei and the market in the production capacity of the Kirin 9000S.

III Public reactions and market implications of Huawei's new phones with Kirin chip

Market was ignited

Due to the timing of Huawei's new smartphone release coinciding with the conclusion of the visit by US Commerce Secretary Raimondo, and with Chinese netizens pointing out that the "2035" serial number engraved on the Kirin chip casing may not indicate the actual production date but rather the 35th week of 2020, which is August 17, 2020 – the day when the U.S. Bureau of Industry and Security (BIS) implemented new export control rules, forcing Huawei to sever ties with any parts, components, or equipment using US technology or software. Based on these, it is widely believed in the industry that this release serves as a silent counterback to the U.S. Department of Commerce, which played a significant role in previous sanctions against Huawei and China's semiconductor industry.

Digital fans and Huawei supporters associate the Mate40 series from three years ago, which was equipped with Huawei's self-developed Kirin chip launched under the third round of sanctions. Yu Chengdong (Richard Yu), CEO of the Consumer BG of Huawei, mentioned the mantra "遥遥领先 (far ahead)" 14 times at the Mate40 launch event. After the release of Mate60 series, "遥遥领先" was recalled and quickly became a well-known meme on the Chinese internet.

Huawei and the Mate60 have almost become the focal point of public discourse, rekindling Chinese consumers' interest and enthusiasm for smartphones. They are expressing their support for Huawei through action. Starting from September 11th until now, timed flash sales on various online channels have sold out instantly. Even for the Mate60 Pro+ and Mate X5, which haven't announced specific prices, pre-order slots were quickly filled. Pre-orders through offline channels also require waiting, with reports suggesting that deliveries may not occur until at least October.

What about actual deliveries? According to Tech Financial News, as of September 1st, the total combined online and offline sales of the Huawei Mate 60 Pro amounted to approximately 800,000 units. There's also unverified data from a digital blogger on Weibo with 228,000 followers, indicating that as of September 12th, the Mate60 Pro had surpassed 1.1 million activations across all channels.

Wang Peng, Deputy Researcher at the Beijing Academy of Social Sciences, told Securities Daily, "Currently, there are three layers of definition for the Huawei Mate60 series in the market. First, its actual capabilities, level, and quality as a high-end smartphone. Second, its basic implementation of 5G communication. Third, its use of domestic chips and the HarmonyOS operating system." He noted that the symbolic significance of the Huawei Mate60 series lies in China achieving a creative breakthrough in the high-end smartphone field. In the long term, the Huawei Mate60 series is a landmark event that will undoubtedly impact the smartphone market landscape.

Apple's iPhone 15 series faces challenges head-on

The market is particularly concerned about the impact Huawei's return to the high-end smartphone market may have on Apple.

According to data released by market research firm IDC China in October 2020, in the Chinese smartphone market segment priced above $600 in the first half of 2020, Huawei held a 44.1% market share, while Apple held a 44% market share. Other brands had much smaller market shares, with Xiaomi accounting for approximately 4%, and OPPO, Samsung, and others each having less than 3% market share.

As of the first half of 2023, Apple has established an absolute advantage in the high-end smartphone market in China. According to IDC's data for the Chinese smartphone market in the first half of 2023, Apple holds a 67% market share among smartphone manufacturers in the segment priced above $600.

It can be seen that in the years when Huawei was sanctioned, despite the lack of 5G and most advanced chips, Huawei was not completely squeezed out of the high-end smartphone market, but Apple took the significant lead.

On the second day of the Mate60/60 Pro release, Apple officially confirmed the date for its fall event and the unveiling of the iPhone 15 series, which was scheduled for the early morning of September 13th, Beijing time. In the week leading up to the Apple event, Huawei continued to unveil the Mate60 Pro+ and MateX5, opening pre-orders for these devices. One day before the Apple event, Huawei held a headline-grabbing event for its smart car solution, the ATIO Wenjie New M7.

Some media reports have addressed that COO of Huawei Terminal BG, He Gang, revealed a detail during the spring launch event in March. He mentioned that in the Chinese market for smartphones priced above 5,000 yuan, whenever Huawei releases new devices, Apple's market share tends to decline. He Gang believes that in the high-end smartphone market, Huawei is Apple's strongest competitor. It's clear that Huawei came prepared.

After the iPhone 15 series was released, the market did not immediately respond with a positive attitude. Apple share price declined over a percent on the launch event date. Over the previous five days, the Apple stock price has fallen more than 6%. By contrast, Apple shares have rallied 41% year to date, according to exchange data. This has been interpreted by many media, like Reuters, as an impact partly from Huawei.

Compared to previous market predictions, the iPhone 15 series has some highlights:

Prices have not been raised.

High-end models feature new titanium shells for a more comfortable and lighter grip.

The entire series has transitioned to a Type-C interface, allowing the use of Android phone Type-C data cables.

High-end models utilize the latest 3nm process SoC A17pro from TSMC, resulting in improved performance.

The iPhone 15 Pro Max exclusively introduces a new periscope telephoto lens, enabling 5x optical zoom and 25x digital zoom.

Overall, both Chinese and overseas tech media have described it as "incremental improvements." There are upgrades, but not much.

It's worth noting that Geekerwan, after conducting in-depth testing of the A17pro (they have consistently given Apple's SoCs high praise), indicates:

From a CPU perspective, it's primarily in line with Apple's official numbers, ~10% increase.

From a GPU perspective, well going by the synthetic benchmark it seems like the A17 Pro is not as impressive compared to the competitor (Qualcomm's snapdragon 8gen2), while there is a jump over the A16, it's power consumption is a lot more excessive to get this performance leap and compared to the competitor its power/efficiency is not as impressive.

Their conclusions are: A17pro's peak performance is the best in the mobile space, but that comes with a power consumption cost. The heat dissipation performance and battery life are also a bit disappointing. The iPhone 15 Pro Max has about 40 minutes less battery life compared to the previous generation. A17pro did not meet expectations in terms of peak power consumption and battery life. Testers did not see a significant improvement in TSMC's 3nm process compared to the previous node and expressed concerns about the possible end of Moore's Law.

The testers have previously shared interesting insights and interactions with Apple R&D engineers in live broadcasts. They mentioned:

Apple doesn't pay particularly close attention to heat dissipation design because a lower percentage of US users engage in intensive 3D gaming on their phones (console gaming is more popular), which typically doesn't lead to significant heating issues on phones. In contrast, Chinese users prefer mobile games and are more sensitive to heating problems.

Apple's phones have relatively weak charging capabilities compared to competitors and may experience signal issues in China, not because of inadequate technology but largely because Apple considers product quality and communication standards differences in the global market. This is a conservative approach aimed at avoiding potential safety and brand risks.

Apple engineers rarely use Android phones and may not be familiar with the innovative improvements that Chinese Android system phones have made to user experiences. For example, when a phone heats up to a certain extent, Apple devices drastically reduce screen brightness, while Chinese Android phone manufacturers typically implement a linear transition, resulting in a different user perception.

These insights highlight that Huawei and other Chinese smartphone manufacturers may have advantages that Apple lacks when it comes to understanding the Chinese market and user preferences.

CINNO Research noted that the iPhone 15 series will face a dual challenge of economic downturn and competition from Huawei's new phones, making it difficult to attract a large number of users for upgrades. Their forecast suggests that iPhone sales in the Chinese smartphone market in 2023 may reach around 45.5 million units, representing a slight 2% decline compared to the previous year. Specifically, the sales performance of Apple's latest iPhone 15 series in 2023 is expected to be around 10 million units, which is a 22% decline compared to the sales of the previous iPhone 14 series during the same period, resulting in a reduction of approximately 2.9 million units.

Despite facing challenges, the iPhone 15 series has shown strong initial performance in the Chinese market. It has been reported that the first batch of iPhone 15 Pro and iPhone 15 Pro Max in the official flagship store of Tmall Apple Store sold out within one minute. Some users have been informed that the iPhone 15 Pro Max will not be delivered until mid to late October, indicating a delay of 4-5 weeks in delivery time for the iPhone 15 Pro Max in China. The delivery of the iPhone 15 Pro will also be delayed by 2-3 weeks.

The future sales performance of the iPhone 15 series in China remains to be seen. Huawei has also confirmed that it will hold its autumn product launch event on September 25th, where, in addition to the known Mate60 series, it is expected to introduce new products across various scenarios, including headphones, tablets, smartwatches, and more new technical solutions, directly competing with Apple's product lineup.

The competitions on the same stage may have only just begun.

Geopolitical Factors

National-level popularity

The excited responses of the Chinese public to Huawei's new smartphones, often interpreted by Western media as an outburst of nationalism, is a narrative that is both rough and lazy. Not every national-level event should be interpreted solely from a nationalist perspective. It's worth considering whether the narrow nationalism depicted by such a narrative is actually brought about by Huawei or by the forces of anti-globalization, unilateralism, and trade protectionism.

If it is thought nationalism is part of the Huawei Mate60 story, then it's essential to highlight the more important part of this story: Huawei's Mate60 series and Kirin 9000S, on the one hand, have alleviated the anxiety of the Chinese public about China's comprehensive development of core technologies being hindered by the US, and on the other hand, have boosted their confidence in the scientific research and innovation capabilities of Chinese enterprises and the semiconductor industry. That is the core of public support.

"Ban order" on Apple

Since WSJ's report from September 6th, many overseas media claim that China ordered officials at central government agencies not to use iPhones and other foreign-branded devices for work. Restrictions on the use of iPhones by central government employees are being expanded to local governments and state-owned companies, Nikkei Asia reported. It appears that the media is concerned that the Chinese government may replicate what the US government did to Huawei in the case of Apple.

While Chinese Foreign Ministry spokespersons have stated that China has not issued laws and regulations to ban the purchase of Apple or foreign brands' phones, I am not attempting to prove that Chinese CCP members, government officials, and state-owned enterprise employees absolutely do not face situations where they are discouraged from using foreign smartphone brands. Given the far-reaching implications of the PRISM Gate incident, these concerns and restrictions have their rationale and may not have started only recently. However, it may not be able to compare with the situation faced by Huawei in terms of scope and enforcement.

The key question is whether the worst-case scenario, where Apple becomes a new casualty in the US-China rivalry and is substantially excluded from the Chinese market, will actually occur?

From the perspective of politics, my view is the probability of this happening is quite low:

Apple and China still maintain a close two-way dependency. Apple generated approximately $74 billion in revenue from China last year, accounting for around 20% of its total revenue. Apple also remains highly dependent on the supply chain in mainland China. According to research data, in 2022, suppliers in mainland China made up 21% of all Apple suppliers. Among Apple's Asian suppliers' factories, mainland China's factories constituted 43%. These supply chains also create millions of jobs. For more information, you may refer to the in-depth reporting by the Financial Times.

Apple CEO Tim Cook has visited China several times and met with high-level officials this year, including Premier Li Qiang, to discuss the company's future in the country. In a recent CBS interview, Cook did not support Raimondo's view that China has become "uninvestable". Apple maintains a positive relationship with the Chinese government and so far no material evidence shows that Apple has proactively engaged in any negative behavior from China's position that goes against China's core political interests (such as the Taiwan issue or supply chain security).

Despite recent pressure on Apple for certain security vulnerability incidents and controversies from European countries over radiation limits on the iPhone 12, there have been no policy-making or law enforcement activities related to these issues at the government level in China. If there were to be a national-level review or large-scale restrictions on Apple, there would at least be administrative procedures involved, similar to the Micron event.

However, it is undoubted that Apple is facing increasing political pressure for balance in the midst of geopolitical turbulence, both from China and the US.

To be continued

The unexpected release of the Mate60/60 Pro seems more like a strategic test for the responses of all parties. As of today, there are still mysteries shrouded in the mist. What can be confirmed is that Huawei will officially launch the next-generation Bluetooth technology - NearLink (星闪). However, it seems that there is more:

According to media reports on September 19th, users of the Mate 60 Pro reported receiving a system update with version number 4.0.0.116 on September 18th. Although the update description mentioned "Optimize system stability in certain scenarios," device information detection revealed that the multi-threaded mode of Kirin 9000S has been officially unlocked, and the CPU core count is recognized as 12 cores. This means that due to the significant improvement in multi-core performance, the CPU's theoretical performance will be further enhanced. Although further professional testing is to be conducted, the tech community is generally optimistic that it surpasses the Snapdragon 888 and reaches the level of the Snapdragon 8gen1.

On June 28, 2023, Meng Wanzhou delivered a keynote speech titled "Embracing the 5G Revolution" at the 2023 MWC, where she mentioned that "5.5G is the inevitable path of 5G network evolution." 5.5G is considered a mobile communication technology that serves as a transition towards 6G and is also referred to as "5G-Advanced (5G-A)". According to official Huawei disclosures, on September 11, "under the organization of the IMT-2020 (5G) Promotion Group, Huawei became the first to complete all functional test cases for 5G-A. This test covered key technologies for ultra-wideband and broadband real-time interaction in both uplink and downlink directions, fully demonstrating Huawei's leadership in 5G-A technology." In addition, recent data from professional network speed testing organizations suggests that the actual measured network speeds of the Mate60 series appear to exceed 5G standards (according to a professional report from CAICT, the average download speed of China's 5g network in 2023 Q1 is 348.31Mbps and the average upload speed is 80.40Mbps). Here's the question: is it relevant to the missing signal mark of Mate60 series?

Huawei's logo now looks like an onion, and it appears that there are still more stories to be unveiled layer by layer.

There's a Chinese idiom that says, "One minute on the stage, ten years of work offstage (台上一分钟,台下十年功)". While the world's spotlight is on Huawei at the center of the stage, backstage of the stage, the Chinese semiconductor industry behind Huawei, is still busy with R&D and production, possibly with no time to pay attention to the show to be performed.

In the upcoming Part II, I would like to tell some stories about the backstage. I will introduce our readers to:

How the Chinese semiconductor industry has developed in recent years and how it happened.

The role Huawei plays in such a development process.

Kindly stay tuned.

Any idea when Part II is coming? No rush by the way =)