Mayday? Deciphering China’s dismaying May PMI through job posting data

The Caixin PMI has returned to the expansion region, while the official PMI indicates further contraction. Where is China's economy headed?

Investors have reasons to worry about China's economic data for May

In May, China's industrial production grew by only 5.6% year-on-year, far below the expected 10.9%. Fixed asset investment also grew less than expected, at 4.8% year-on-year versus the expected 5.5%. Retail sales saw a significant increase of 18.4%, but still fell short of the expected 21%.

The most worrisome data comes from the PMI— the Manufacturing PMI published by the National Bureau of Statistics declined further from 49.2 in April to 48.8 in May, continuing the trend of contraction. The Service PMI remained in the expansion region, but also decreased from 56.4 in April to 54.5 in May. Coupled with a cooling job market and rising youth unemployment, the climate has investors clutching their pearls.

But is it all doom and gloom? Let's examine the current scenarios and future prospects by taking a deep dive and using BigOne Lab's job posting data as an additional source of evidence.

Contradicting economic indicators: The National Bureau of Statistics (NBS) vs. Caixin PMI

In May, a notable discrepancy occurred. While China's official NBS manufacturing PMI fell further into contraction, Caixin's manufacturing PMI returned to the expansion region, increasing from 49.5 in April to 50.9 in May. (Caixin PMI is a joint project between S&P Global and Caixin Media Group. It is a widely followed indicator of economic activity in China, and is often viewed as a more accurate measure compared to the official PMI.)

The discrepancy between the two PMI indicators has naturally sparked confusion among the investment community, especially considering that China's current economic condition is on a tightrope.

The commentary published by Shenwan Hongyuan (SHE:000166), a leading securities brokerage company in China, sheds light on the important reason behind this discrepancy. Here are the main points we have translated and summarized:

The official PMI places more weight on heavy industries, which are greatly affected by domestic investment in infrastructure. In contrast, the Caixin PMI has a higher proportion of light industries, which more directly reflects consumer demand and exports.

In May, the economy showed a pattern of declining infrastructure, stable consumption, and resilient exports. This led to a divergence between the official and Caixin PMI indicators.

Manufacturing has shown resilience, but the recovery remains slow

BigOne Lab's job posting data aligns with Shenwan Hongyuan's analysis. The manufacturing industry has shown resiliency as the average job postings per company remained steady throughout 2022. Although the manufacturing industry also witnessed a decline in average job postings, the magnitude of the decline is far less than other industries that are heavily impacted by the pandemic, such as catering & hotels and transportation & logistics.

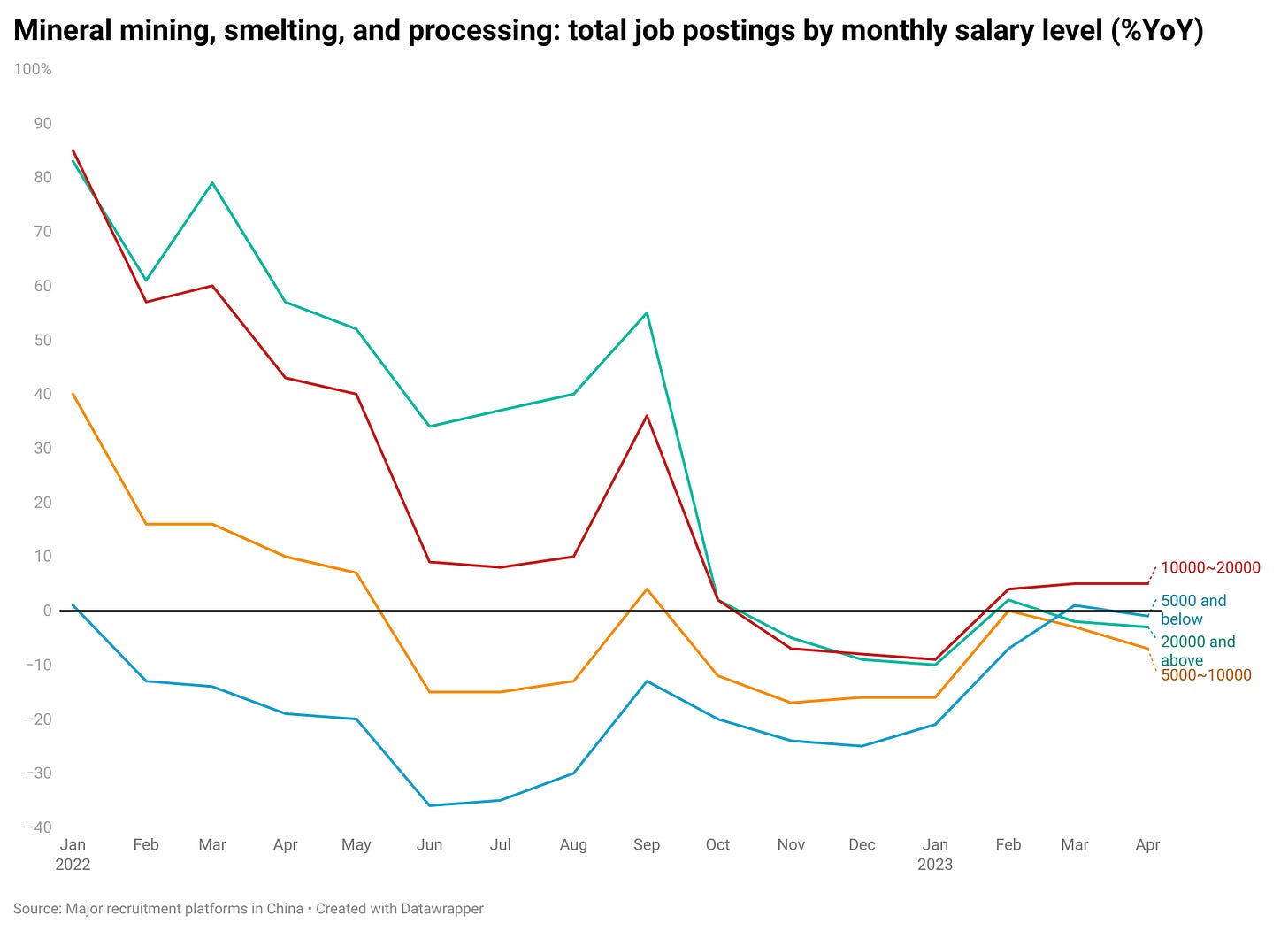

However, heavy industries such as mineral mining, smelting, and processing have remained depressed in average job postings in 2023Q1. Moreover, the year-on-year change in average job postings for the manufacturing industry notched lower in April, suggesting that the recovery may still face some challenges ahead.

In April, several sub-industries of manufacturing, including railway, shipbuilding, aerospace, and other transportation equipment, saw an increase, boosted by tourism and rebounding nationwide activities. Light manufacturing, including rubber and plastic products, as well as raw material processing, also shows significant signs of recovery. Notably, average job postings in textile manufacturing ticked up in 23Q1, suggesting a recovery of domestic consumption and export demand. However, the data shows that household products and consumer electronics remain tepid, indicating a slow recovery of discretionary demand.

Breaking down manufacturing PMI: what factors are driving the decline?

While the official manufacturing PMI decreased in both April and May, the circumstances were different. Shenwan Hongyuan provided a helpful summary:

The structure of the official PMI's decline in May was completely different from that of April. In April, the PMI for consumer goods (-2.1 to 49.8) and for high-energy-consuming industries (-3.2 to 47.9) both weakened significantly…However, in May, although the PMI for consumer goods remained low, it rebounded slightly from April (+1 to 50.8), while the PMI for high-energy-consuming industries continued to decline significantly (-2.1 to 45.8).

The purchasing managers' index (PMI) for the steel industry declined significantly (-9.8 to 35.2). As a result, the overall PMI is estimated to have decreased by 0.6 points. … This suggests that infrastructure investment has continued to decline since its overheated level of 20% in 22Q4. If the steel industry is excluded, the overall PMI rebounded by 0.2 points.

In short, as consumption stabilizes, energy-heavy industries are becoming the main factor driving the decline of the PMI.

Job posting data from BigOne Lab also shows that hiring for workers with a monthly salary below 10,000 CNY decreased in April, which suggests weak demand for workers and entry-level employees in the mining, smelting, and processing industries.