Fukushima outrage: Are Chinese consumers abandoning Japanese brands?- Charts of the Week

July sales and social sentiments of Shiseido, SK-II, and other Japanese brands; deciphering the economic impact of Fukushima's decision, beyond headline noise

*In light of the global significance, ranging from environmental issues to China-Japan relationships, we are offering key insights free of charge to all readers. Brand-specific data will be reserved for our paid subscribers. Please like and share as a nod to our team's rigorous research and data analysis efforts that went into producing this piece.

Fukushima water discharge: Popular opinions trending on Chinese social media

The Japanese government recently began discharging over 1 million tons of treated radioactive water from the Fukushima Daiichi nuclear power plant into the Pacific Ocean. This decision has been met with opposition from China, which has called it "irresponsible" and a threat to the global environment.

China's General Administration of Customs institutes an immediate ban encompassing all aquatic products, including edible imports, to safeguard against risks associated with Japan's nuclear-contaminated waste water discharge into the Pacific Ocean.

Debate over the safety of Fukushima's water release is heated worldwide. Many in China, especially online, condemn Japan's actions, asking, "If the water is so safe, why isn't Japan using it for agricultural or industrial needs?”

Many influencers have also written about the Fukushima situation from a purely scientific perspective, highlighting the IAEA's safety green light, with many warning against letting this event stoke negative feelings towards Japan. Despite the IAEA's approval, doubts remain. Many question if Japan can maintain the approved safety levels for the entire 30-year release, especially considering Tokyo Electric Power Co (TEPCO)'s not so glamorous track record.

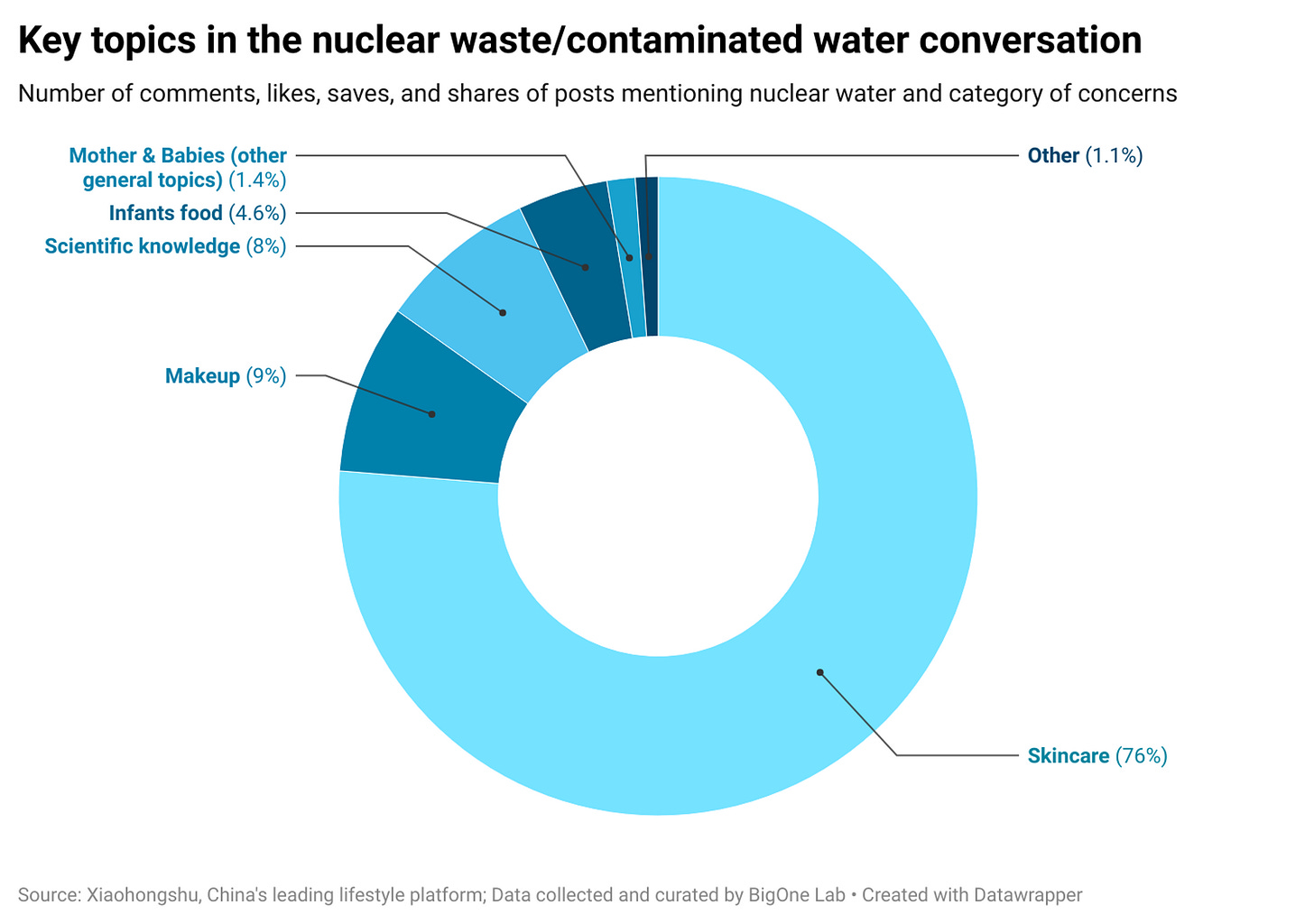

However, the predominant discourse on Chinese social media pivoted to concerns about food safety and cosmetics products safety following the announcement by the Japanese Prime Minister. Social media has seen a significant increase in posts and interactions (comments, likes, saves, shares, etc.) on these topics.

A few remarks before we dive into the charts

The debate is raging on Chinese social media about how to label the water from the Fukushima incident. A significant voice calls for it to be termed "nuclear-contaminated water" (核污水) to stress potential hazards. Other terms like "nuclear wastewater" (核废水), "nuclear treated wastewater" (核处理水), or just "Fukushima water" are viewed by many as downplaying the issue.

I'll use these terms interchangeably throughout this article.

Regardless of the name or true nature of the water, Chinese consumers hold a potent tool: their purchasing power. The prevailing thought is straightforward - even if the water is safe from a purely scientific standpoint, why gamble with health when equivalent alternatives exist? Nuclear water, treated or not, does not sound like a gourmet option, after all.

Beyond the headlines and ideological debates, the Fukushima incident might cast a long shadow on Japanese brands in the Chinese market.

In this article, we'll probe Chinese consumers' evolving attitudes towards Japanese brands. Drawing from data up to July 2023, we'll gauge the pulse of online sentiments and sales.

Are Chinese shoppers turning their backs on iconic Japanese brands like Shiseido and SK-II? We'll dive into the data from Tmall, JD, and Douyin, as well as interactions on China's top eight social platforms to get the full picture.

The discussion about Fukushima nuclear accident

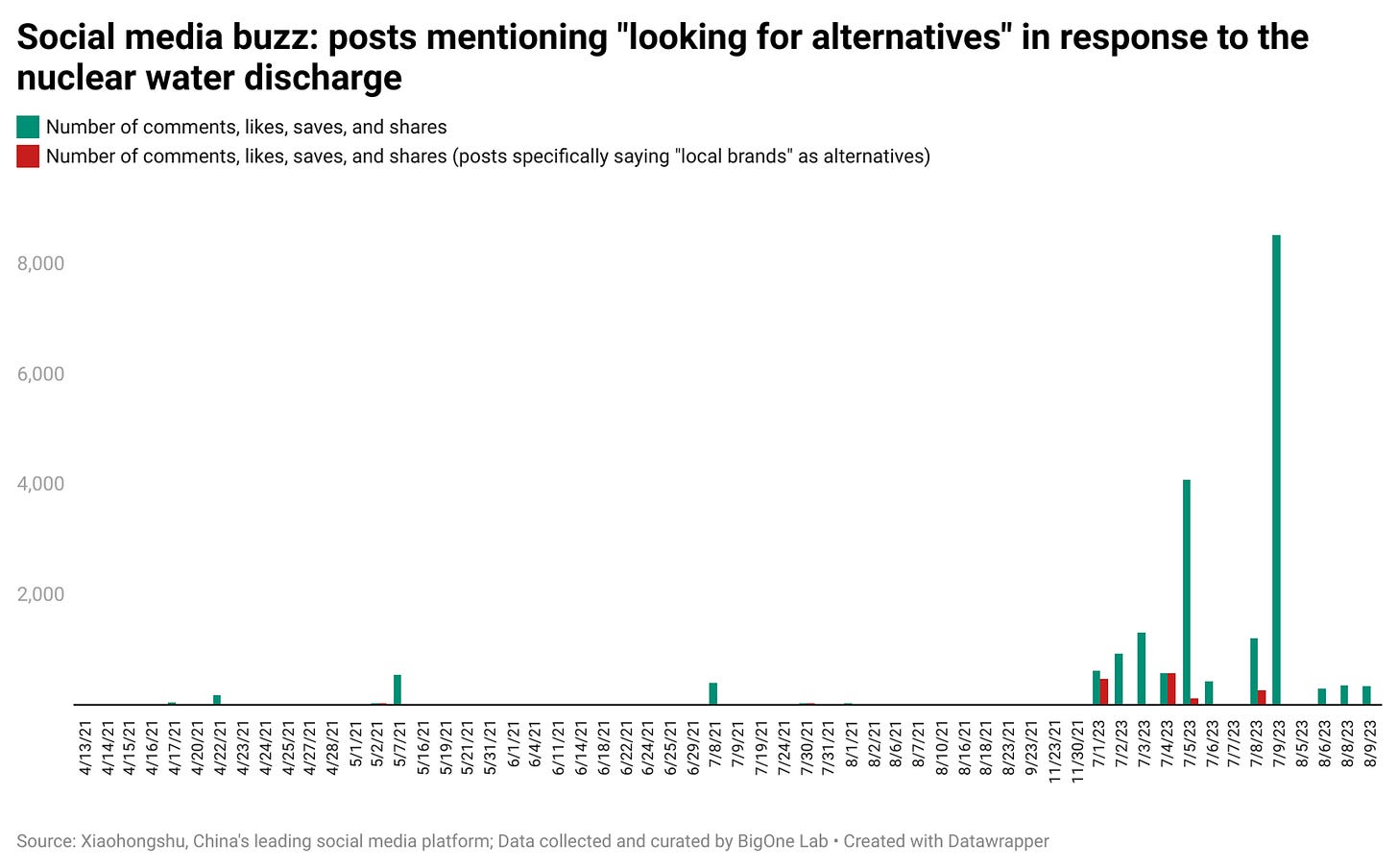

Posts mentioning "nuclear-contaminated water" or "nuclear wastewater" appeared on Xiaohongshu, China's biggest lifestyle social media platform as early as April 2021, when the Japanese Cabinet approved the discharge.

The social media buzz peaked around September 2021 when TEPCO stated that 34% of the water met the discharge standards and proceeded with the plan. However, the spike in social buzz quickly faded.

But this time, consumers seem to be getting real with finding the alternatives

Posts mentioning "looking for alternatives" and "nuclear water" at the same time peaked in July 2023, when Japan finalized the plan and announced the starting date of the nuclear water release.

Top categories of concern: Skincare and Makeup

Most discussions and interactions on Xiaohongshu regarding the Fukushima water release are about skincare and makeup products.

A considerable number of discussions also went into mother & babies' products, as many parents stress over the alternatives for diapers, milk powders, supplements, and other related products.

The reliance of Japanese brands has been decaying long before the Fukushima nuclear water release

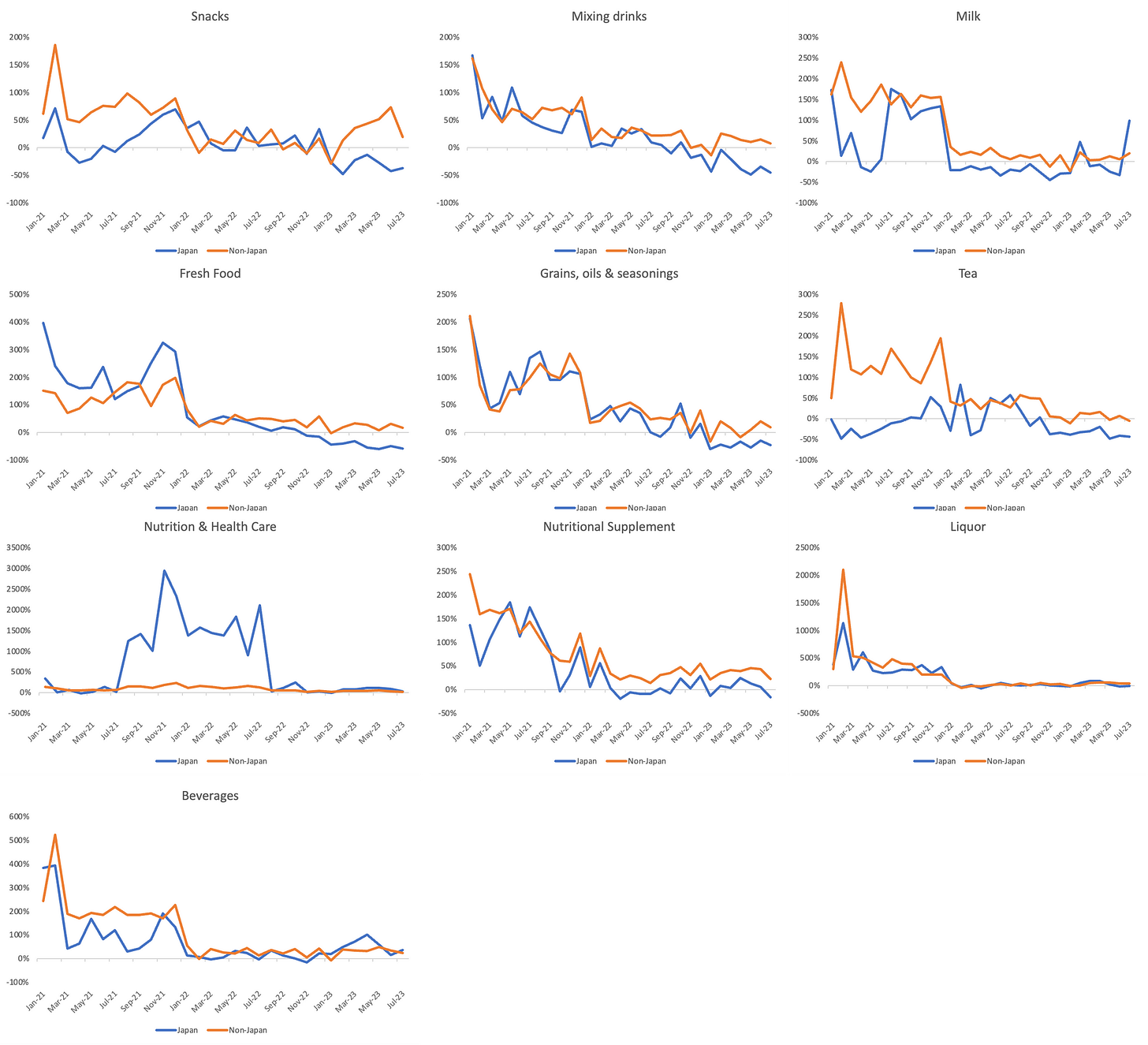

Across three categories that are heavily impacted - personal care & makeup, mother & baby, and food & beverages - online sales on major e-commerce platforms Tmall, JD, and Douyin have shown that year-on-year sales of Japanese products have been growing at a slower or on par pace compared to other products since 2021.

Note: Japanese product sales includes products that specifically mention the keyword "Japan" or "Import from Japan," which may omit some Japanese brands that do not specifically label their products with "Japan" in their product name. However, this analysis nevertheless shows important sentiments towards overall Japanese product sales and their image among Chinese consumers.

Personal Care & Makeup

Across major personal care and makeup product categories, Japanese products have been growing at a similar or slower pace compared to other non-Japanese alternatives, except for men's care. In particular, makeup and facial skincare have seen a widening gap between the growth of Japan vs non-Japan products since the beginning of 2023.

Mother & Baby

Despite the major concerns on Xiaohongshu regarding mother and baby products, milk powder, toys, and dietary supplements saw a year-on-year jump in sales of Japanese products in July. We will need to continue monitoring the sales numbers to see whether consumers are just hoarding before they find suitable alternatives (that’s a trending discussion too) to the products before Fukushima's official release in August.

Food & beverages

Similarly, sales of Japanese milk products have seen a jump in July, while the gap between the growth of Japanese snacks, mixed drinks, and fresh food compared to non-Japanese ones has been widening since 2023.

It seems that the trend of "domestically produced" is present regardless of what happens with Fukushima

We will need several more months of sales data to monitor whether the trend sustains, as our current sales data only goes until July, which is before the official release of the Fukushima nuclear water.

However, social media sentiments suggest that the buzz around "domestically produced" or "domestic substitution" has been trending up since 2021 (left). Interestingly, every time the "boycotting Japanese products" sentiment spikes (right), it seems to coincide with major moves from the Japanese government related to the Fukushima event.

While the Fukushima disaster alone may not be the sole contributor to Chinese consumers' purchasing decisions, it could certainly catalyze a move towards domestically produced products.

In the upcoming sections, you'll uncover:

July's online sales figures across Tmall, JD, and Douyin for prominent Japanese brands in skincare, makeup, and mother & baby categories. Brands like FINO, POLA, SK-II, Shiseido, Pigeon, and Lion will be compared to gauge the extent of impact.

Social media presence of top skincare brands, including Shiseido, SK-II against rivals such as Estee Lauder, La Mer, Clarins, Lancome, Kiehl's, and Cle de Peau Beaute.

Year-on-year online sales growth in July and for the first half of 2023 for Shiseido and SK-II across their primary product lines.

Insights into consumer sentiments regarding potential substitutes for Shiseido and SK-II.

We hope that these data points will enrich your understanding of the economic repercussions that have arisen from the Fukushima nuclear water release. They will also provide insight into the competitive dynamics within the skincare industry, which has been significantly impacted.

We sincerely appreciate your likes and shares as a sign of your interest. If we receive more than 30 likes, we will prepare a follow-up piece presenting the latest data towards the end of 2023!