For many of you who are investing in China, the name Horizon Insights (弘则研究), a well-respected independent research provider, shouldn’t be a new one. Founded in 2015 but with a core team that was formed almost 2 decades ago, Horizon Insights has proven one thing: despite a “young” sell-side research industry that has been dominated by high-turnover trading, hearsays, and all sorts of short-term behaviors, and despite a major market downturn in the last few years, independent research can still survive and prosper in China.

This is why when the Baiguan team met the Horizon Insights team, we instantly bonded. Both of us take pride in our respective craftsmanship. Both of us share a common goal in identifying facts, filtering out noise, and deriving actionable insights that are actually relevant for those of you who have a genuine stake in this market.

This is also why we are so thrilled today to announce a major partnership with Horizon Insights, in the form of a special collaboration series through the Baiguan newsletter. Horizon Insights’ strength in macroeconomic, FICC, and equity research will complement Baiguan’s data-driven focus, providing global investors with one of the most comprehensive reads on China today.

In this inaugural issue, we will present an essay by Mr. Ma Dongfan, the Founder and Chief Strategy Analyst of Horizon Insights, to ask one crucial question that has been bugging many China analysts recently:

How Has Macroeconomic Research Misjudged China?

Dongfan MA, Founder & Chief Strategy Analyst, Horizon Insights

Over the past year, pessimism surrounding the Chinese economy has become widespread. One question we’ve been asked repeatedly is: “Is China’s economy truly in trouble?” This reflects not only widespread market sentiment but also many investors' internal judgments. When we break down the macro data—total social financing, credit, PPI, housing prices, investment, rebar, coal, trade relations, land finance—virtually all indicators seem to confirm the mainstream view.

However, from industrial and micro-level research, we are seeing stark divergences. That is why we’d like to approach this discussion through three key questions:

If macro data looks this weak, why are markets still rising?

Why have PPI declines decoupled from corporate profitability?

Why are China’s interest rates and exchange rates starting to decouple?

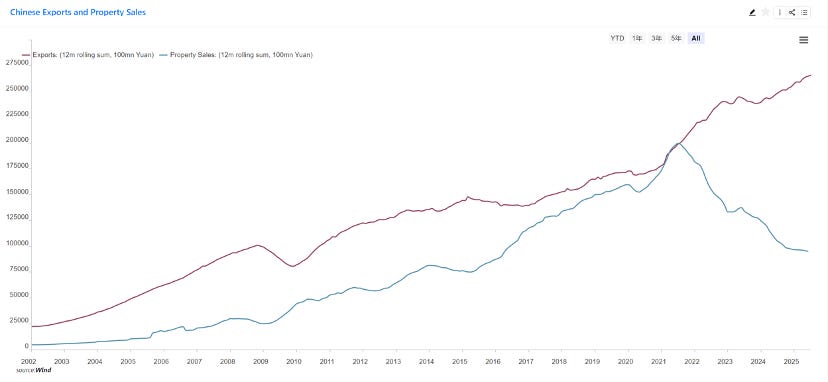

If there were a single chart to represent the current shift in China’s economy, we would choose the one shown below.

If macro data looks weak, why are markets rising?

In the past year, whether we examine real estate, consumption, fiscal stimulus, geopolitics, or global trade, there has been little sign of fundamental improvement in China’s economy. Especially given the ongoing property downcycle, the debt burden on local governments, and weak consumer demand, traditional macro indicators hardly offer a reason for optimism.

But the market tells a different story. In 2024, both Hong Kong and China’s stock markets ranked among the top three performing markets globally.

Meanwhile, China remains in a quasi-deflationary environment. Housing prices are still falling, and households have not resumed leveraging. Yet, at the same time, corporate earnings are clearly improving. Starting in Q1 2025, return on equity (ROE) among listed firms saw its first significant uptick in three years.

From 2000 to now, China’s economic structure has undergone at least three major transitions:

2000–2010: Export and processing-led growth was the dominant force.

2010–2020: Real estate and household leverage became the drivers, with Total Social Financing (TSF) as the key indicator.

Post-2020: Traditional models started to fail, and new growth drivers began to emerge.

Yet, most macroeconomic analyses remain stuck in phase two—still using TSF and real estate sales as core references. What we observe now is that these indicators have lost predictive value. Their correlation with PMI and corporate earnings is quickly fading.

Hasn’t export growth already stagnated? Why is it driving the economy again?

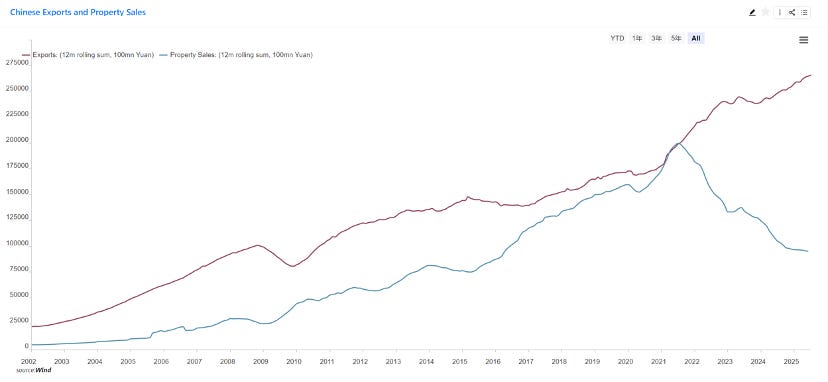

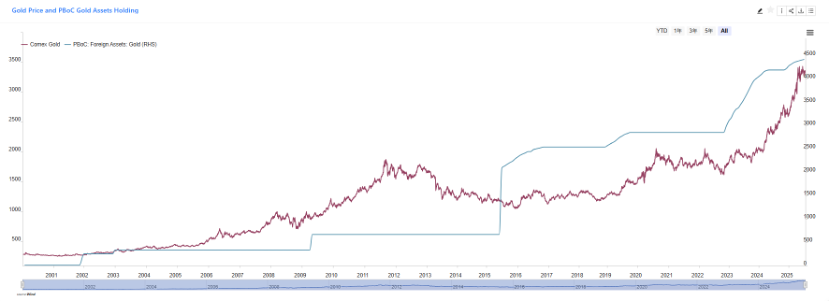

If we were to choose a chart that captures the most fundamental shift in China’s economy, this would be it. Processing trade began tapering off after 2010. But from 2016 onward, general trade has grown steadily and rapidly.

This distinction matters: processing trade mostly reflects contract manufacturing for others, while general trade signals the rise of China’s own manufacturing capabilities, brands, and integrated industrial chains. In 2024, China’s total export volume was already three times the size of real estate investment. Back in 2019, the two were roughly equal.

In other words, China’s new economic engine is no longer real estate, nor low-end contract exports—but rather the international expansion of Chinese brands.

Is this structural transition a short-term event or a long-term trend?

Since 2022, Horizon Insights has focused its research entirely on China’s structural transition and the global expansion of Chinese enterprises. This wave of “Chinese companies going global” is not a fluke.

We’ve studied many outbound brands—MINISO, Pop Mart, Xiaomi, innovative pharmaceuticals, EV makers, short-form video platforms, games—and what we see is not a fleeting opportunity but a fundamental shift. It reflects the rise of talent, capabilities, and global competitiveness.

The era of debt-fueled growth is over. Today, growth comes from improvements in corporate strength, from truly competitive products, and from globalized operations.

What other changes does China’s economic restructuring bring?

1. Interest rate–exchange rate decoupling

One particularly unique feature of China’s economy in 2024 is the decoupling between interest rates and exchange rates. Historically, widening U.S.-China interest rate spreads have been seen as a major driver of RMB depreciation. However, despite the Fed’s continued tightening and China’s rate cuts, the RMB has remained relatively strong.

This reflects a deeper shift: the drivers of exchange rate movements have diverged from interest rates. This aligns with what we’ve seen structurally—debt expansion has stalled, while product and enterprise globalization are accelerating.

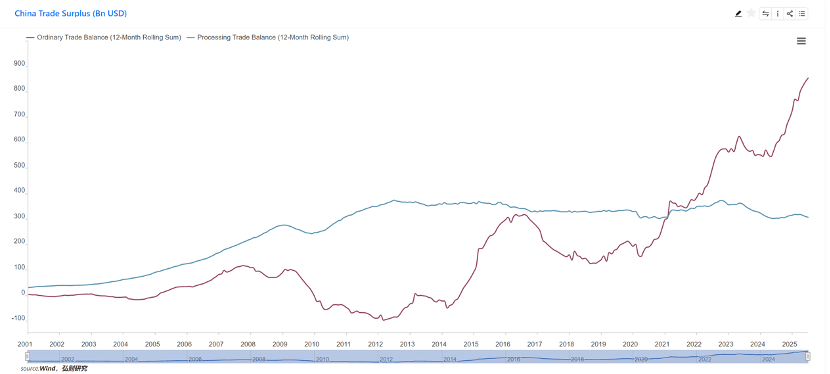

2. The revaluation of gold

The sharp rise in gold prices also carries clear signals from China’s central bank. The decoupling between gold prices and U.S. Treasury yields, and their disconnect from global macro risk factors, point to China’s growing influence in the gold pricing mechanism.

While the geopolitical background deserves separate discussion, one reason for this shift is straightforward: China’s trade surplus has expanded significantly, giving the central bank stronger motivation—and room—to restructure its foreign reserves.

Conclusion: What lens should we use to reassess China?

We are not arguing that traditional tools like fiscal stimulus, real estate policy, or TSF are irrelevant. But we do believe that using ten-year-old indicators and frameworks to judge today’s Chinese economy will lead to inevitable misjudgments.

Instead, we need to understand the nature of this structural transition—keep pace with its shifts—and identify where sustainable growth will come from.

Horizon Insights began systematically researching China’s globalizing companies and industrial upgrading as early as 2022. Based on this direction, we’ve also built investment strategies that have been validated over the past two years. In future editions of our column, we’ll continue to explore these opportunities—including emerging forces we’ve observed beyond Pop Mart.

Still worried about China’s government debt? Concerned that the debt expansion of 2010–2020 is no longer sustainable? TSF growth slowing down? PPI still falling? Property prices not yet bottomed? Premium liquor sales still sluggish?

We have data and research to show that many former economic pillars and core assets are undergoing a transition. These variables are no longer fatal risks to the Chinese economy or its markets.

We invite you to follow Horizon Insights’ column, where we will continue to use data, structural shifts, and enterprise analysis to reconstruct a more accurate and dynamic picture of China’s economy.

For inquiries or collaboration, contact us by replying to this email or at: subscribe@hzinsights.com

Horizon Insights Research Team

July 2025

About Horizon Insights —Established over a decade ago, Horizon Insights is dedicated to delivering in-depth, cycle-aware insights into Chinese assets. Our core team comprises well-regarded investment research professionals who have been working closely together for almost two decades and have earned the trust of over 1,000 institutional and professional investors worldwide. Our research is recognized for its independence and foresight, grounded not in noise but in long-term conviction and depth. We’re grateful to connect with you through this Newsletter, and we look forward to ongoing, thoughtful dialogue.

On exports, Japan's were biased to a few narrow product categories, automotive stands out. I suspect that if you subtract autos from the export values, you don't see this sort of growth. Maybe you have to add 1-2 more product categories (cell phones?).

Note my background is as an economist focused on Japan, but I taught an undergrad course on the Chinese economy for 30 years, starting in 1987 or 1988 through 2018. In my last iteration, real estate was still booming but reeked of "bubble" (I was in Tokyo 1991-2 at the peak of Japan's bubble.) From about 2008 I switched my research focus to the global auto industry, which dominates my own substack.

Thank you Robert.