On April 6th, Novo Nordisk registered a Phase III clinical trial on the Chinese Clinical Trial Registry and Information Disclosure Platform to evaluate the efficacy and safety of once-daily administration of 50mg semaglutide tablets in overweight or obese adults in China. This is Novo Nordisk's first Phase III study for semaglutide tablets for weight management in China.

Semaglutide, sold under brand names of Ozempic or Wegovy, is a medication used for treating diabetes. It keeps gaining global attention as celebrities, Elon Musk and TikTok influencers have described its magical ability to help lose weight in short time frames. In that regard, semaglutide works by reducing appetite and increasing feelings of fullness, leading to reduced calorie intake and weight loss, at the same time with seemingly now or low side effects.

Less known is how it is doing in China. Unlike in the US, Ozempic is officially only a prescription drug for diabetes in China. But still, it has already became a phenomenal, word-of-mouth products, sold as weight-loss products in underground markets. We will partially translate an article from 深蓝观, a WeChat Blog on pharmaceutical industry in China. We will also utilize data provided by BigOne Lab to demonstrate you the popularity of this product and what the new clinical trial potentially means.

China’s weight loss market

Weight-loss is a market situated between healthcare and cosmetics. It was supposed to be a huge market, not least because of a widespread 容貌焦虑 anxiety towards physical appearance in Chinese societies. Back in March we showcased a number of hidden consumer trends in China, many of them are related to beauty-related anxiety. However, a lot of the demand is untapped because there aren't many good products that can address this demand. According to the article:

While liraglutide and semaglutide are prevailing abroad, the Chinese weight loss market has been surrounded by slimming teas and meal replacements, with only orlistat being approved as a weight loss drug.

Seizing the opportunity in the domestic weight loss market, 碧生源 Besunyen (926.HK) has spared no effort in advertising on TV and elevator screens, and enlisted celebrities to endorse their products. With its two product lines, Changrun Tea and Slimming Tea, it has achieved sales of over 4 billion yuan.

Orlistat's sales have also maintained a growth trend, increasing from 56.34 million yuan in 2017 to 381 million yuan in 2021, with sales growth rates of 13.2%, 104.5%, and 95.8% in 2017, 2018, and 2019, respectively. [BAiGUAN: This is in spite of severe side effects of Orlistat]

When people who want to lose weight struggle with meal replacements and dieting, and cannot find a good way to slim down, the sudden appearance of semaglutide undoubtedly opens a safe and convenient door for this group of people.

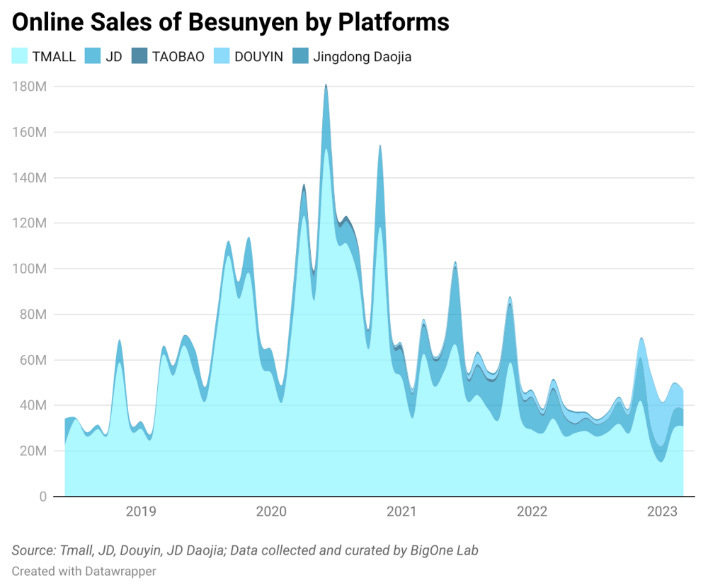

According to BigOne Lab’s data, Besunyen reached a sales peak back in 2020 but have never recovered ever since then. This shows that for weight-loss products in the short run, large scale spending on marketing can bring about strong sales. Without actual effect, the product will just be a short-lived fad.

However, for the wider market, interest for weight-loss related products has kept growing, with a sharp increase starting from latter half of 2022. Clearly the demand is large, with few high-quality products to satisfy.

Popularity of Ozempic

Now enters Ozempic. Despite the fact that Ozempic is only a prescription drug for diabetes in China right now, it does not stop Ozempic from becoming a phenomenon:

Young girls crowded into the endocrine and metabolism department of the hospital, regardless of whether they were thin or fat, just to get a dose of semaglutide. This has caused concern for doctors in the endocrine and metabolism department of a certain 三甲 tertiary [highest level of hospital in China] hospital in Shanghai, who are struggling with the high cost of drugs and the scrutiny of medical insurance. Every day, at least three or four patients influenced by social media come seeking treatment, claiming to have diabetes and specifically requesting semaglutide.

In the doctor's hospital, they only prescribed just over 100 doses of semaglutide in June, but now the number has risen to 1500-2000 doses, which is the average sales volume of semaglutide in most tertiary hospitals in Shanghai.

This has surprised medical sales representatives who are constantly visiting doctors' offices and struggling with product marketing. This drug sells itself, and as long as there is stock, it sells out immediately without the need for doctor education or market promotion. They even lamented that "semaglutide may be the best product in recent years."

Because it is too difficult to find medicines, many doctors are even coming to medical representatives for semaglutide. One medical representative revealed that they had already helped fifty or sixty doctors with prescriptions. These doctors are from various departments, some injecting themselves and some doing so at the request of family and friends.

"Now whether they are overweight or not, they all come to me for semaglutide," said a chief of endocrinology who was in a difficult position. "More than two-thirds of the sales of semaglutide in China are for weight loss, not diabetes." He emphasized that using such drugs to treat obesity is playing with fire, but he also admitted that it does have a weight loss effect.

As a result, major hospitals in Shanghai have been out of stock since August. Even medical sales representatives were surprised. They firmly believe that semaglutide is a good product for treating diabetes, but never expected it to be out of stock so quickly.

Some hospitals have already restricted the supply of semaglutide. "Some hospitals now have high thresholds for prescribing, and only chief physicians and specialists can prescribe it. Some only allow it in VIP clinics," revealed a doctor from a major tertiary endocrinology department in Shanghai.

An insider said that when Novo Nordisk released its sales forecasts for the Chinese market, it was based on the capacity for treating diabetes and did not take into account the needs of medical aesthetics. No one predicted that the drug would sell out so quickly. Now, Novo Nordisk can only guarantee the supply to some large hospitals and cannot fully supply the entire market.

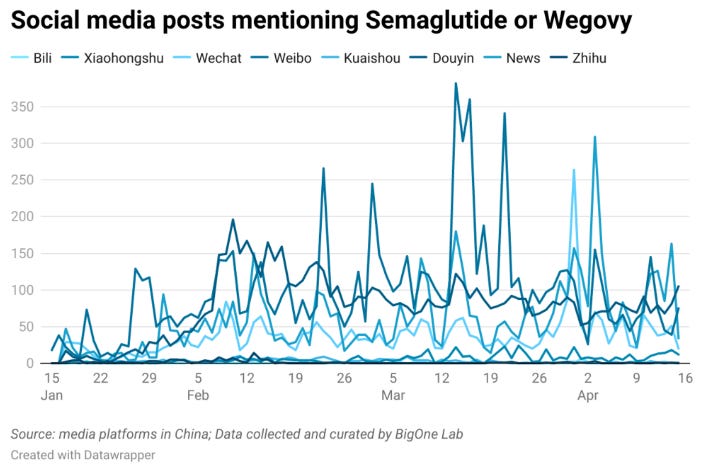

We also check BigOne Lab’s social media data, including Xiaohongshu, the go-to place now for consumer product-related information. Although medical-related information is tightly regulated on the platform, we are still able to see quite a number of posts talking about this drug and the numbers are quickly rising. We can only imagine what it will look like once Phase III trial for obesity was completed. For now, we speculate most of the online discussions take place within private chat groups.

Ozempic as a consumer product

The most interesting part about this article is about how in China Novo Nordisk’s semaglutide prevailed over Eli Lilly’s dulaglutide (commonly known as Trulicity), which to many medical professionals are basically the same. At least part of the answer lies in clever design for consumers’ taste (even though both are supposed to be prescription drugs.)