Can IFBH(6603.HK) sustain its impressive growth momentum?

Assessing IFBH’s sustainability (and potential risks) through four key questions

Our June overview of IF coconut water sparked significant interest among our subscribers, especially after IFBH’s listing on the Hong Kong Stock Exchange (6603.HK) on June 30. For context, here’s a recap of IFBH’s disruptive model:

The "Geographical Arbitrage" Engine: Leveraging Thailand’s 18% lower raw material costs for Nam Hom coconuts, IFBH produces additive-free coconut water (95.6% of revenue) and sells 92.4% to China—a market devoid of native coconut resources. Its ultra-light asset strategy outsources 100% production to sister company General Beverage (GB) and 97.6% sales to distributors, avoiding capital-intensive factories or logistics. Combined with China’s coconut boom (82.9% CAGR since 2019) and savvy marketing (e.g., celebrity endorsements, co-branding), this propelled IFBH to dominate 34% of China’s coconut water market with ¥1.16B revenue (¥25.21M per employee)

Today, leveraging BigOne Lab’s exclusive retail supermarket data, we dissect IFBH’s sustainability through four key questions:

Why is IF’s product line so singular?

Can IF's light-asset model withstand rising risks?

New entrants entering the market: Can IFBH defend its throne?

Will IFBH's channel simplicity create a growth ceiling?

*BigOne Note: BigOne Lab's China retail supermarket data: The offline supermarket sample includes an average of 70,000 to 80,000 active stores monthly, covering all 31 provinces in the country. These datasets track the operational status of various sectors and brands, including alcoholic beverages, daily necessities, and condiments. The following trends are derived from the BigOne offline supermarket sample and do not represent a prediction of overall company performance.

Why is IF’s product line so singular?

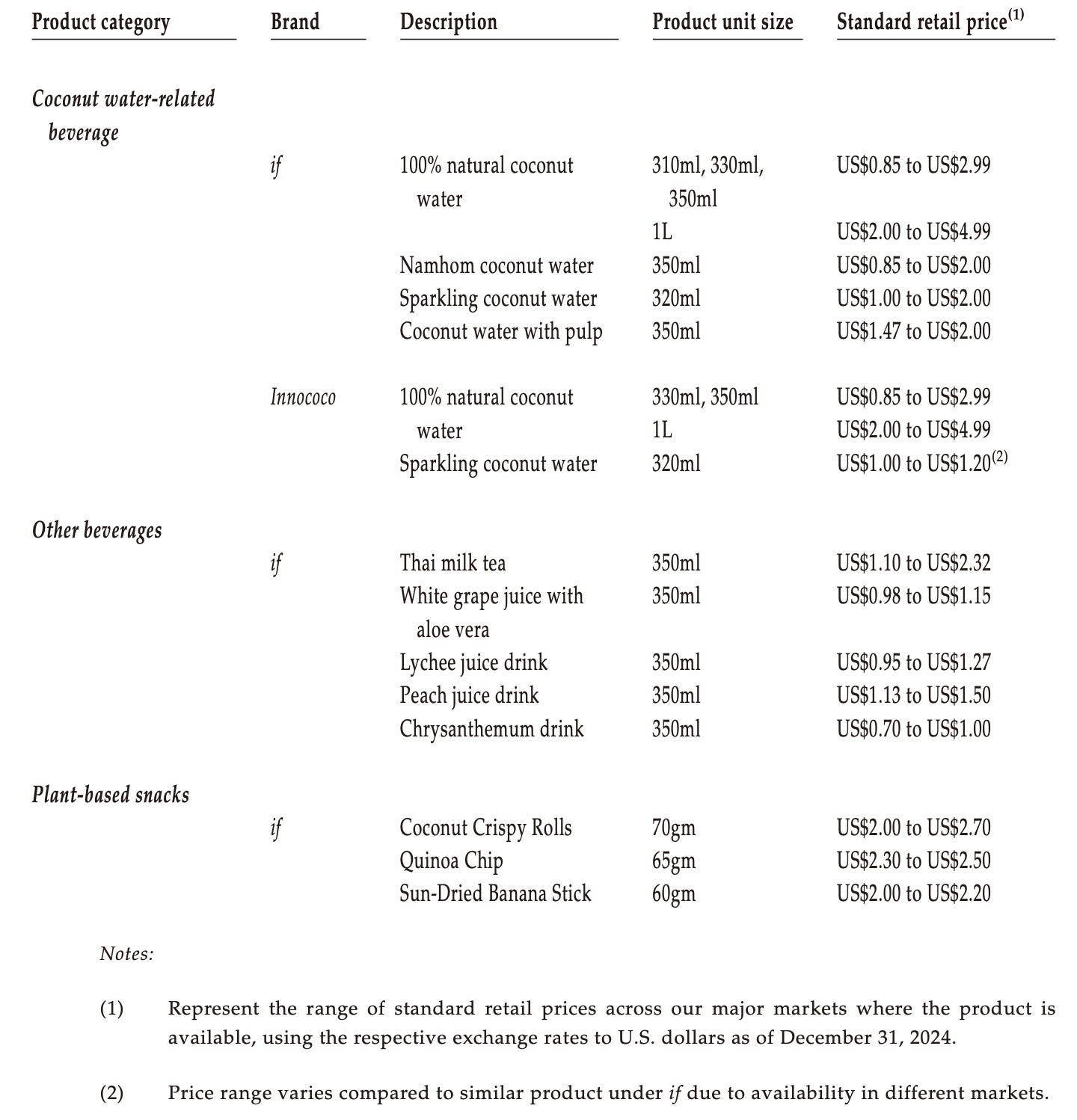

As noted in our previous article, 95.6% of IFBH’s revenue stems from a single product line — pure coconut water differentiated solely by packaging formats (e.g., 330ml cans, 1L cartons). Non-coconut beverages and snacks remain negligible contributors. This contrasts sharply with diversified giants like Coca-Cola or China’s Eastroc Beverage (605499.SH), whose expansive portfolios leverage established distribution networks to penetrate broader demographics.

The unique dynamics of China’s coconut water industry stem from a stark imbalance between supply and demand in the domestic coconut sector. According to a report titled In-Depth Analysis of China’s Coconut Water Industry Development and Future Investment Research (2024–2031) released by Guanyan Report Network, Hainan Province—the country’s primary coconut-producing region—yields approximately 220 million coconuts annually, while domestic demand exceeds 2.6 billion coconuts per year. This disparity forces China to rely heavily on coconut imports from Southeast Asia. Furthermore, companies possessing resource advantages, such as access to stable supply chains or logistical infrastructure, are positioned to dominate the market.

Another brand highly reliant on the same product is "Coconut Tree/Ye Shu椰树", a household name in China that has been a constant companion to Chinese youth from a young age.

Coconut Tree/Ye Shu椰树 is a leading brand in China's coconut milk industry, with a stable market share of around 40%. According to BigOne Lab's supermarket data, Coconut Tree's market share is 3 - 4 times that of the second-place competitor. The brand has almost complete control over several major high-quality coconut-producing areas in Hainan, giving it extremely strong bargaining power and an absolutely dominant position in the industry. This advantage is reflected in various aspects, such as raw material costs, economies of scale, pricing power, and technological barriers. By collaborating with local coconut farmers, Coconut Tree not only helps increase farmers' income but also ensures the stability and cost advantage of its raw material supply.

Similarly, IF, as a Thai company, engages in arbitrage between the Tropics of Cancer and Capricorn by selling low-cost coconuts produced in Thailand to the demand-strong Chinese market. However, I personally think there are some hidden risks in this business model. The first risk is how to maintain growth. The revenue of Coconut Tree Group has almost stagnated, with a compound annual growth rate of only 1% from 2014 to 2024. When the penetration rate of coconut water reaches a certain level, how will IF maintain sales growth and support its stock price with performance? This is a question that needs to be considered in the medium and long term.

Can IF's light-asset model withstand rising risks?

IFBH operates without its own manufacturing facilities or logistics network, with 96.9% of procurement concentrated among its top five suppliers—the largest accounting for 33% of total sourcing. Beyond production outsourcing, the company also relies entirely on major distributors for sales, as its top five partners handle 97.7% of revenue—one distributor alone contributed 47% last year.

This asset-light approach is sustained by a lean team of only 46 employees globally: three executives based in Singapore, complemented by 20 sales personnel, five R&D staff, six operations specialists, and 12 administrative and HR personnel. The model enables extraordinary productivity, generating ¥25 million revenue per employee annually—five times the beverage industry average.

Vulnerabilities may emerge in this setup. Extreme dependency on a few suppliers and on one country (Thailand) may expose IFBH to cost volatility since coconut yields fluctuate with seasonal patterns and import regulations—shortages or price spikes could become threats.

This contrasts sharply with Luckin Coffee’s counterstrategy. As reported by China Daily, Luckin secured exclusive multi-year contracts for 200,000 tons of annual coconut capacity from Indonesia’s Banggai Islands, effectively establishing a "coconut futures" buffer through bulk procurement of one million tons over five years. By vertically controlling supply, Luckin erected a cost moat against market turbulence that IFBH’s outsourced model fundamentally lacks. The distinction underscores that IFBH’s remarkable efficiency may prove fragile against commodity supply chain risks Luckin systematically neutralized.

In the following section, we will examine two critical issues: 1) the competitive dynamics of the coconut water industry, particularly whether rivals are encroaching on IF’s competitive sustainability; and 2) how IF’s channel strategy in China aligns with its blistering revenue growth.

Our analysis leverages BigOne Lab’s exclusive retail supermarket datasets, with the following content reserved exclusively for premium subscribers.

*BigOne Note: The following content is based on BigOne Lab's China retail supermarket data. The offline supermarket sample includes an average of 70,000 to 80,000 active stores monthly, covering all 31 provinces in the country. These datasets track the operational status of various sectors and brands, including alcoholic beverages, daily necessities, and condiments. The following trends are derived from the BigOne offline supermarket sample and do not represent a prediction of overall company performance.