Where do investment opportunities lie in China's after-school tutoring sector in the new era?

Identifying the key growth drivers of EDU and TAL post-policy normalization

Today's article is based on our recent speech at Morgan Stanley's China BEST Conference, which was held last week in Beijing. Here, we will provide you with top-quality information, accessed by global institutional investors, and will focus on China's after-school tutoring sector and its major players, EDU and TAL.

We will address three key questions in the article:

How did EDU and TAL perform in the Autumn quarter, which will be disclosed by the companies in late January?

What could be the key growth engines within the after-school tutoring sector after policy normalizations?

How are new businesses, empowered by AI technology, emerging?

Introducing BigOne's data coverage on EDU and TAL and their Autumn quarter performance

We cover the major educational services of EDU, including overseas test prep, domestic test prep, high school, new educational initiatives (mostly from non-academic tutoring), and study tours. Based on our track record, we have highly accurate estimates of the company's gross billings by business segment and can post our estimates 1-2 months prior to the earnings release.

The main competitive advantages of our EDU's data product are, firstly, its broad coverage. We have the industry's leading technology to collect a wide range of courses, achieving near full coverage. Secondly, we excel in providing granular breakdowns to identify the growth drivers within the educational services.

EDU will post its Autumn quarter report on January 21, 2025. Here, we provide you with our estimates for the quarter. We expect EDU's YoY growth of educational business in the Autumn Quarter to be 26%, meeting the high end of guidance (23%-26%).

For TAL, we offer two data dimensions, including: 1)The Peiyou business line, within the company's Learning Services segment; 2) Online sales performance within Content Solutions. Similar to EDU, we have very precise estimates of the segment growth momentum.

We estimate TAL's F25Q3 Autumn quarter (to be disclosed on January 23, 2025) to grow at a similar pace as the last quarter, thanks to:

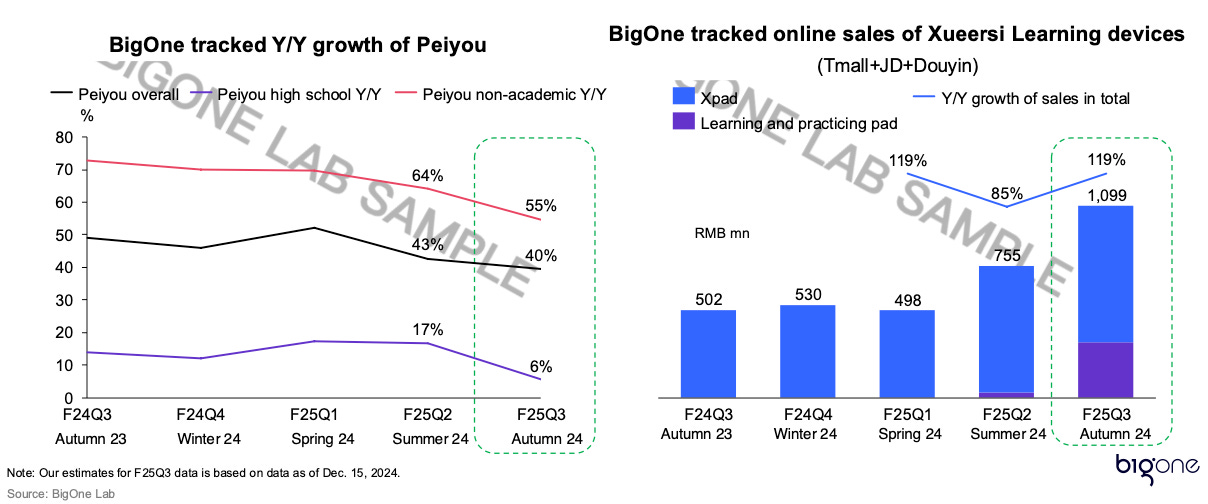

Slow season of high-school: As shown in the left chart, Peiyou overall delivered a growth rate of 40%, roughly on par with the summer quarter (43%). High-school experienced a sharp slowdown to 6% from 17%, but it contributed less to overall performance due to the slow Autumn season.

Acceleration in learning device sales: As shown in the right chart, Xueersi learning devices delivered an aggressive sales performance in the Autumn quarter, mainly due to the launch of the learning and practicing pad (aka "学练机") in August 2024.

Key growth drivers in K-12 tutoring: a comparative analysis of EDU and TAL

Following the "double reduction policy" in July 2021, the entire after-school tutoring sector underwent a drastic reshuffling and restructuring. Many smaller players either shrank their businesses or shut down entirely, leading to a much higher concentration among top players, which are primarily EDU and TAL, the two giant educational companies.

We have identified three key growth drivers within the K-12 tutoring business, based on our exclusive and granular data on EDU and TAL: 1) Offline expansion, 2) Grades/subject extention, and 3) Price rise.

A silent agreement among EDU and TAL to refocus their strategy on offline business

There appears to be a silent agreement between EDU and TAL to refocus their strategies on offline business. The offline tutoring business is growing quickly, mainly due to:

The restrictions on population mobility, which were in place to control the pandemic, have been lifted since late 2023.

A nationwide normalizing policy environment for after-school tutoring businesses.

In September 2024, the Ministry of Education (MOE)'s statements at a press conference implied more stability in the regulatory environment for education stocks. Following the three years of the Double Reduction policy, the MOE concluded that the expansion of subject tutoring, which they had previously seen as disorderly, has largely been contained, and the burden from students' homework and after-school tutoring has essentially been reduced.

Broader demands in brick-and-mortar settings and enhanced efficacy of learning experiences, which in turn leads to improved renewal rates.

Therefore, both TAL and EDU have delivered rapid sales growth in their offline businesses (YoY 60-90% for TAL and 40%+ for EDU), while their online businesses are stabilizing or even contracting.

In the following content, we will explore the offline expansion strategies of EDU and TAL, comparing their approaches to geographical and business segment growth. Our analysis will also cover the effects of grade/subject expansion and pricing strategies on business expansion, alongside the influence of tech-driven business model innovations.

Key questions addressed:

What are the similarities and differences in the offline expansion strategies of EDU and TAL? How efficient are their learning centers? We will analyze the tracked number of learning centers (LCs) and assess the utilization of new and mature LCs for both companies.

Which age group of students holds the highest untapped potential? Could TAL's new course launches pose a threat to EDU in the near future?

Are there any consumption upgrades or downgrades occurring in the after-school tutoring sector? We explore this through an examination of hourly pricing data across different segments.

How is AI development enhancing the after-school tutoring business? We provide insights into two key areas: direct sales of learning devices (supported by our tracked online sales data) and custody classes equipped with learning devices (backed by gross billing data and their contribution to the overall business).

This in-depth analysis offers exclusive insights to our paid subscribers, providing a comprehensive view of the market dynamics in the tutoring industry.