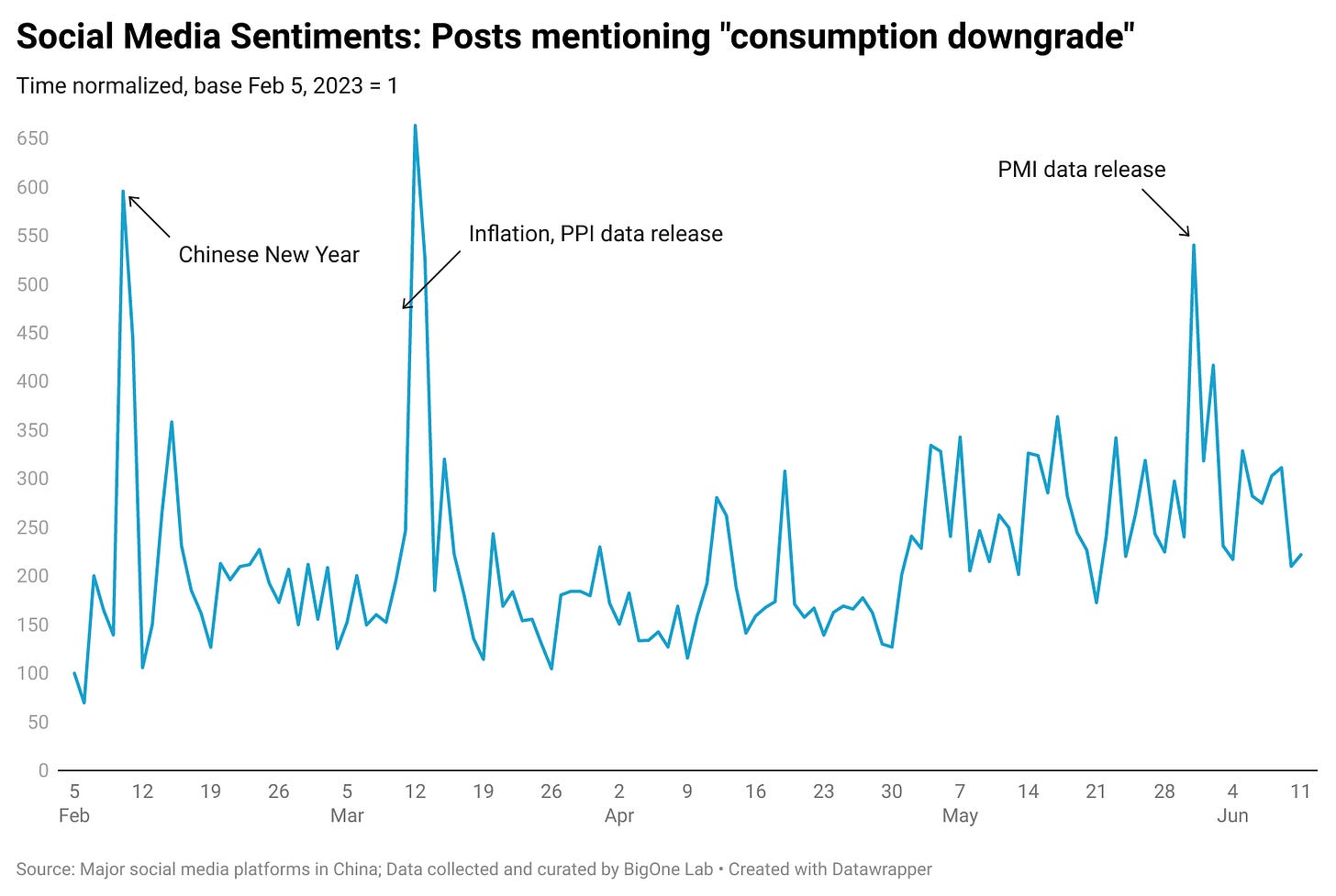

In recent months, concerns have emerged that China is undergoing a "consumption downgrade," a trending phrase that reverberates across social media platforms. According to BigOne Lab’s social media sentiment data, discussion regarding “consumption downgrade” peaked three times, around the Chinese New Year and upon the release of economic data. The disappointing PPI and PMI data have posed questions about whether China is really heading towards a “consumption downgrade”.

In the first half of 2023, some evidence suggests that consumers are reducing discretionary spending, especially on digital products and consumer electronics. Despite the rebound of tourism, they are spending less on average when traveling. Furthermore, the gloomy employment outlook has compelled many consumers to increase saving instead of spending, leading to saving and deposit levels reaching a 5-year high in March.

So is China really heading towards a “consumption downgrade” on all fronts?

Undeniably, social media sentiments can set the stage for powerful narratives. The buzzword "consumption downgrade" has increasingly echoed throughout 2023. However, a deeper look into the data reveals a pattern that is not as straightforward as a mere downward trend.

A “selective” consumption rebound led by sports, health, and wellness

Contrary to widespread belief, Chinese consumers are not universally cutting back on spending across all categories.

Despite prevailing narratives about China's "consumption downgrade", Chinese consumers have shown a steadfast commitment to health and wellness. In April, online sales (Tmall, JD, and Douyin) of sportswear increased by 49.38% and health supplements by 51.83%, continuing the strong recovery momentum in 23Q1. Driven by the rebound of tourism, sales of outdoor gear such as sunscreen, cycling clothing, and outdoor clothing have seen a year-on-year increase of 100%-300% in online sales from January to April 2023.

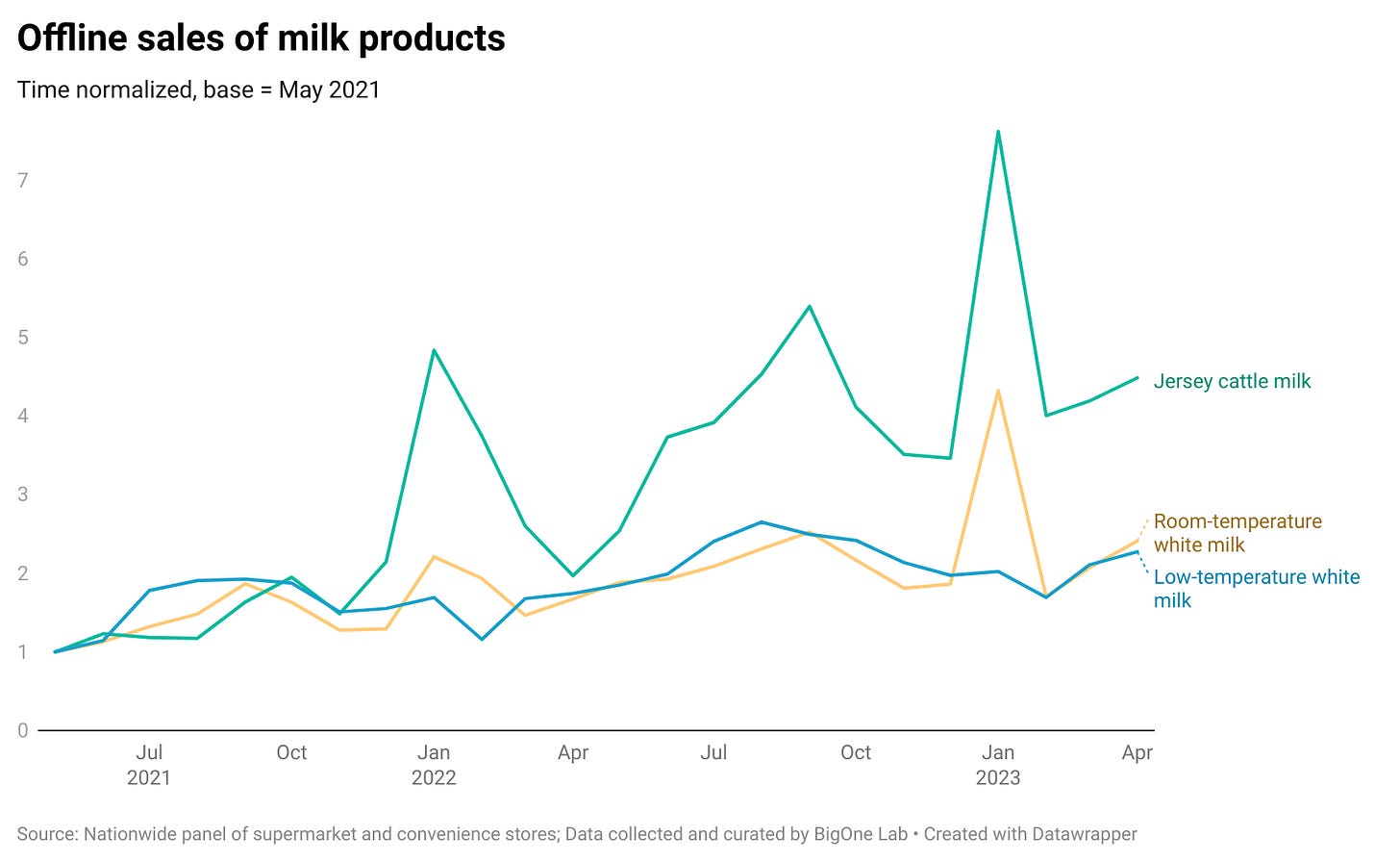

The increasing popularity of Jersey cattle milk in China is an interesting example of Chinese consumers' emphasis on health. The Jersey breed, a small dairy cattle breed from Jersey, UK, is known for its creamy texture and higher concentrations of milkfat and proteins. Although Jersey cattle milk is imported and sold at higher price points in China due to its superior nutrition, its sales growth has consistently surpassed the industry average since 2021, even during the pandemic. This demonstrates Chinese consumers' willingness to invest in quality, healthful products.

Moreover, consumers' dedication to health and wellness goes beyond just physical health. We have noticed a significant trend toward "pan-health items" in 2023. Products that can bring joy and enrich life quality, such as snacks & beverages, picture frames, aromatherapy candles, and floral arrangements are quickly rebounding. In April, online sales for these categories grew year-on-year by 88%, 86%, and 71%, respectively. Luxury brand aromatic candles experienced significant growth in Q1 2023, suggesting that small items like candles could become the "lipstick effect" for Chinese consumers.

Conversely, consumers are reducing their expenditure on items such as 3C products (computers, communications, and consumer electronics), fashion accessories, and home appliances. Home appliances and smart devices that prioritize beauty and comfort, such as hair dryers, laser beauty instruments, and neck and shoulder massagers, are leading the first wave of the rebound in online sales. In April, these products saw a 100%-200% year-over-year increase, underscoring the selective purchasing preferences of consumers.

"Consumption downgrade" is not a new narrative. What does it really mean?

In fact, discussions about the concept of “consumption downgrade” began appearing on Chinese social media as early as 2018. While COVID and economic setbacks have certainly catalyzed decreased spending, Chinese consumers have been exhibiting a growing preference for value-for-money, rational, and practical purchases for years prior to the pandemic.