Is China's economic data telling the truth? - Charts of the Week

Gao Shanwen, chief economist at SDIC securities, on China's GDP abnormalities, true employment and consumption conditions

AMA Announcement

We will host our third "Ask Me Anything" live webinar session on Thursday, Dec 12 @ 9:30 PM Hong Kong (8:30 AM New York), where you can ask Robert Wu and the Baiguan team any questions you have about China, without limitations.

If you are a paying subscriber of Baiguan, please sign up with this form.

On December 3, a speech by Gao Shanwen, the chief economist at SDIC Securities, sent shockwaves through the Chinese investor community. In his remarks, Gao didn't just touch on the cyclical pressures facing China or the post-pandemic divergence in consumption patterns—he took a hard look at some of the most pressing questions foreign observers often ask: Is China really doing well? Is its GDP inflated? Why doesn’t the official unemployment rate reflect the struggles in the job market?

Gao’s speech raised eyebrows by pointing to inconsistencies in China’s official economic statistics, particularly the post-pandemic GDP figures. His candid analysis struck a chord because it offered a rare, unvarnished view of China's economic reality, beyond the official narrative. Even more striking was his summary of the current state of Chinese society: "Vibrant seniors, disillusioned middle-aged, and despairing youth.(生机勃勃的老年人、生无可恋的中年人、死气沉沉的年轻人)" This blunt assessment has sparked further debate and unease across broader society.

In today’s newsletter, I’ll be translating and sharing the key highlights from Gao’s 1-hour, 17-minute speech. Below, you'll find a summary of his main viewpoints, along with selected charts from his presentation to give you a clear, concise understanding of China’s economic landscape.

Gao’s analytical viewpoints

1. China has made clear progress toward structural economic transition, but cyclical pressures are the more prominent cause of the slowdown in economic growth (not structural transition).

Since 2018, China has begun shifting away from a debt-driven growth model, focusing on technological advancement and industrial upgrading. Performance data from all publicly listed companies in China indicates that sectors benefiting from government policy support have grown, while restricted sectors have shrunk, reflecting some progress in the economic transition.

The charts below show that the total revenue and market capitalization of policy-supported companies (red line; such as electronics, defense, telecommunications, and automotive industries) have increased their share relative to all listed companies. In contrast, policy-opposed companies (blue line; such as real estate, education, and media) have seen their shares shrink.

However, the performance of neutral industries shows a significant decline in revenue and total workforce since 2021, indicating that the current slowdown in economic growth is more driven by cyclical pressures than the cost of transformation.

The charts below reveal a sharp decline in the year-on-year growth of revenue and the number of employees for neutral companies—those whose performance is primarily influenced by economic cycles rather than government policy—since 2021.

2. The drop in consumer confidence post-pandemic is primarily driven by the younger population

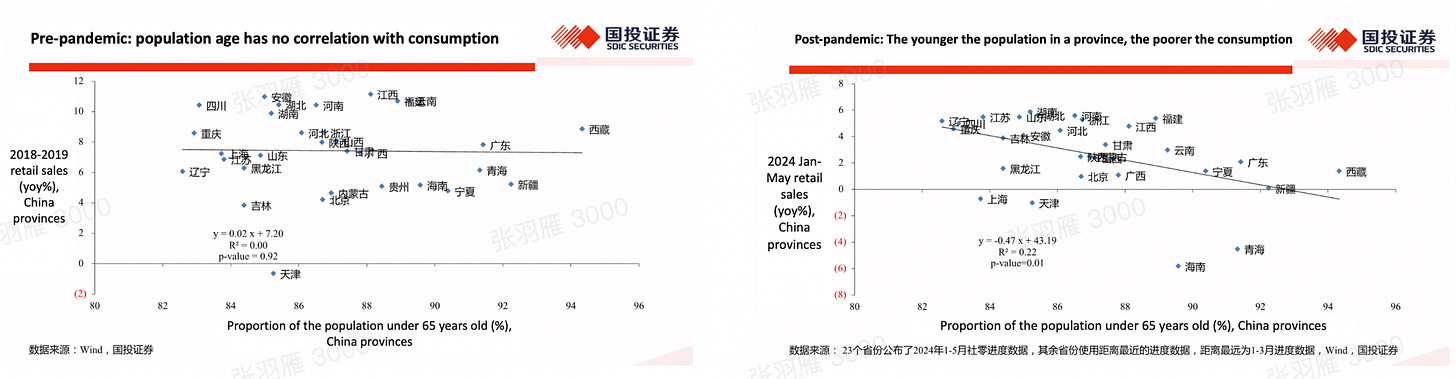

The chart on the left shows that there is no clear correlation between population age (x-axis, right is younger) and consumption (y-axis, high is stronger) across all provinces in China. However, the chart on the right reveals that provinces with younger populations experienced a sharper decline in total retail sales post-pandemic. Albeit unintuitive, this suggests that younger populations contribute to weaker growth in total consumption sales and a more significant drop in consumer confidence.

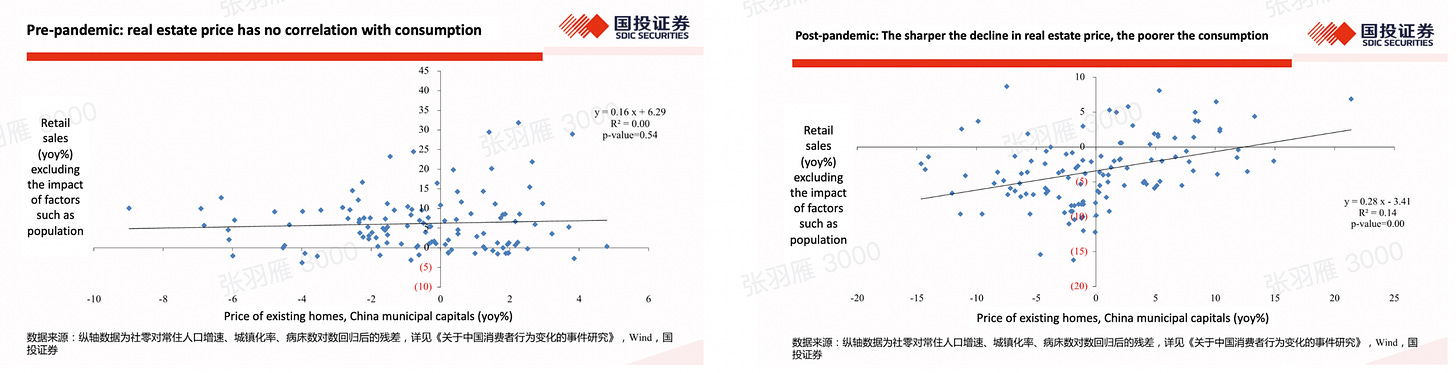

Similarly, when analyzing the average price of existing homes in municipal capitals, there is no clear correlation between real estate prices and consumption pre-pandemic (left). However, post-pandemic, the sharper the decline in home prices, the worse the growth in consumption (right).

This is where Gao’s striking remark, "Vibrant seniors, disillusioned middle-aged, and despairing youth," comes from. The weaker consumption among the younger population post-pandemic can be attributed to deteriorating income expectations and a struggling job market. In contrast, the older generation has more stable expectations for future income, with retirement pensions growing at a pace faster than inflation. As a result, their confidence and quality of life have not been significantly affected.

3. Why does the official urban unemployment rate differ from the real experience in a struggling job market?

China's official urban unemployment rate has stood around 5% since the second quarter of 2023. However, this steady rate seems to conflict with the empirical experience of many people facing a tough job market—it feels too low. Moreover, while average wage growth has slowed since the pandemic, it has not dropped as sharply as consumer confidence, and wages are still growing faster than inflation. Given the stable unemployment rate and wage growth, why then did consumer confidence and real estate purchasing behavior see such a dramatic decline post-pandemic?

To address these concerns, Gao provided the following analytical insights:

Continue reading to get Gao’s analytical viewpoints on abnormalities regarding the unemployment and GDP statistics. To get a sense of what is offered, you are welcome to check out this older post in the same series: Charts of the Week. You can also get free access by sharing us.