China iterated multiple times that it is keeping its door open, and welcomes foreign business and capital. China also took action to show its interest in foreign business, from the last-minute business development of government-chartered flights to multiple EU countries right after the end of the Zero-COVID policy, to the glorious reception of US key business leaders like Elon Musk, Jamie Dimon, and Bill Gates, to Premier Li Qiang’s trip to Germany. But amidst geopolitical tensions, episodes of regulatory actions that resemble what happened in 2021, and a bumpy recovery of the Chinese economy, there are many questions about whether foreign capital and business will continue investing in China.

Following China's 20th National Congress in October 2022, the net flow of foreign capital in China showed mixed signs. There was a noteworthy outflow of foreign capital during this period, which was reflected in the over 10% dip in the Hang Seng Index in the week following the National Congress. Furthermore, the sluggish economy has led to rate cuts, increasing pressure for the yuan to further depreciate. On the other hand, however, the Chinese government rolled out a slew of measures aimed at attracting foreign capital, such as reductions to the negative list for foreign investment, hinting at the government's commitment to sustaining a stable and open investment milieu despite the challenges. We, on the ground, also see Foreign Direct Investment (FDI) as administrative KPIs of many local government leaders, and they would subsequently set up incentive programs where companies that bring in FDI would be awarded subsidies from the government.

What has been the reality of foreign capital in China amid leftover shivers from the last three years of uncertainty in the authorities, heightened concerns over geopolitics, and weaker-than-expected economic recoveries?

Long-term capital vs “Hot Money”

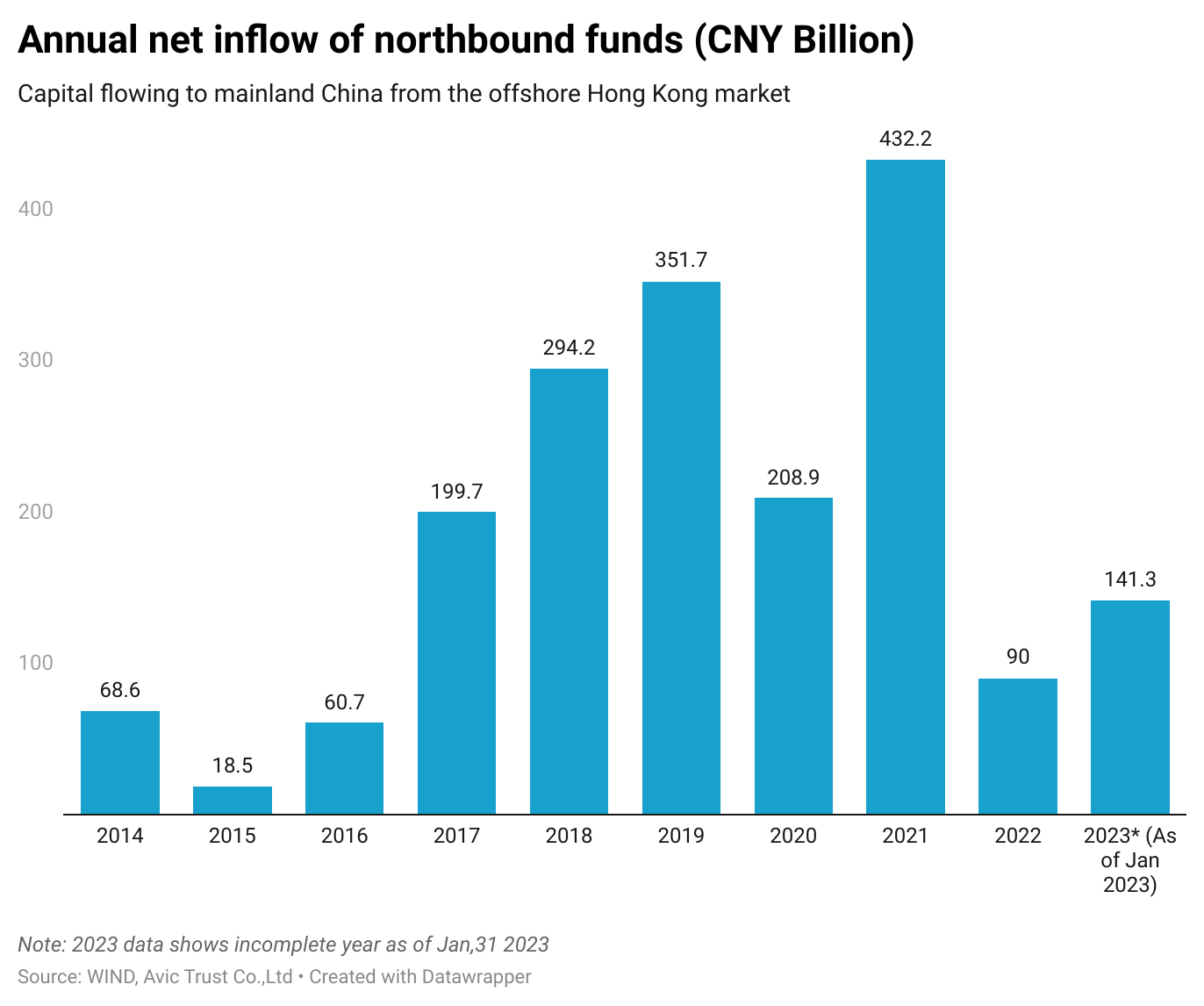

Foreign capital has been an important source of incremental capital in recent years. This is evidenced by the increasing yearly net inflow of the northbound fund, which represents investment capital flowing to mainland China from the offshore Hong Kong market.

The foreign capital in China is predominantly made up of two categories, as explained by Industrial Securities: Long-term capital consists of investors like overseas pension funds and sovereign wealth funds, who have a long-term investment horizon and focus on long-term investments. "Hot money" is composed of high-frequency or short-term traders, such as overseas quantitative hedge funds, which are relatively more speculative.

As of February 2023, long-term capital accounted for 80.1% of the total holdings, with "hot money" comprising the remaining 19.9%.

Hot money accelerates outflow as Yuan depreciates, but long-term capital remains a steady inflow.

Against a backdrop of China's slowing economic recovery, rising geopolitical tensions, and persistent rate hikes by the US Fed, the Chinese yuan has depreciated significantly against the US dollar in the first half of 2023.

In an attempt to stimulate the slowing economy, the People's Bank of China (PBOC) made a series of moves to cut multiple major benchmark rates in June. These included the 7-day repo, medium-term lending facility (MLF), and subsequently, on June 20, the loan-prime rate (LBP), which sets the benchmark for consumer and mortgage loans. The series of rate cuts has sent the Yuan to new lows (at the time of writing, 1¥=7.1756$).

The Chinese government's decision to cut rates while the rest of the world is raising them is a sign that the country is facing different economic challenges than countries haunted by inflation. However, despite fluctuations in the yuan, long-term northbound funds have been steadily flowing into the onshore market. This is illustrated by the chart put together by Industrial Securities.

In May, long-term capital accelerated its allocation to China, while short-term "hot money" funds - which are more sensitive to exchange rates and the yield gap between the US and China - experienced a net outflow.

According to estimates by Industrial Securities, from May 4th to May 19th, long-term capital inflows increased by ¥18.784 billion, while hot-money funds outflowed ¥9.884 billion.

Looking ahead: Will foreign capital inflow pick up in the second half of 2023

In our opinion, the future dynamics of the foreign capital inflow largely depend on three factors: geopolitical risks and policy supports, the yield gap between US and China, and the recovery of China’s economy.