JD vs. Meituan: Are consumers switching over?

We analyzed millions of social media posts to understand how consumers feel

JD.com, China's e-commerce giant, recently shook up the instant delivery market by announcing its entry into the local delivery service market—directly challenging Meituan’s dominance.

While corporate showdowns in China’s internet sector aren’t uncommon, JD CEO and billionaire Richard Liu made this battle particularly attention-grabbing. Liu personally delivered several orders, hosted delivery drivers for hotpot dinners, and publicly committed to providing comprehensive social insurance benefits to the drivers. This direct appeal addressed growing public concerns about delivery drivers' challenging working conditions, such as low pay, long hours, and inadequate social protections—a topic we extensively explored in our previous newsletter "China's grassroots labor market (Part I): The Turbulent Destiny of Gig Workers in the Platform Economy." Liu positioned JD’s entry as a step toward removing monopoly in the sector, a narrative that certainly resonated with many consumers advocating for improved labor conditions.

Richard Liu’s bold moves clearly indicate JD’s serious intent to disrupt the online-to-offline (O2O) market, which is already fiercely competitive. Prior to JD's entry, this sector was dominated by Meituan, followed by Alibaba's Eleme. Given the inherently low-margin nature of business model, consumer loyalty is fragile, and technological barriers are minimal. With Meituan and Eleme firmly entrenched, JD’s entry represents more of a direct market-share grab rather than an expansion into incremental growth.

Since JD announced the head-on competition, billions in market cap have been wiped out from both companies combined. The low-barrier business model gives reason to believe that JD has a fair chance of eating into Meituan's market share. However, the low-margin nature of the business has made JD's shareholders concerned that JD will need to burn substantial cash on consumer subsidies to win market share.

But beyond stock price movements, how do consumers truly feel about JD's entrance into delivery? Are they genuinely considering a switch?

Based on my on-the-ground observations, reactions have been mixed:

Some consumers are complaining that despite many marketing efforts by JD's team, they feel confused about where to place an order.

Some consumers have noted that JD's restaurant recommendation algorithm feels less personalized compared to Meituan or Eleme.

A group of my friends has been ordering from JD daily for their work lunches, taking advantage of the generous discounts JD is offering.

Meituan delivery drivers are visible nearly everywhere, including small counties and lower-tier cities, whereas Alibaba's Eleme drivers are predominantly seen in big cities. Some people have mentioned beginning to spot JD drivers in lower-tier cities as well; so far, I've rarely seen JD drivers in Beijing, only occasionally.

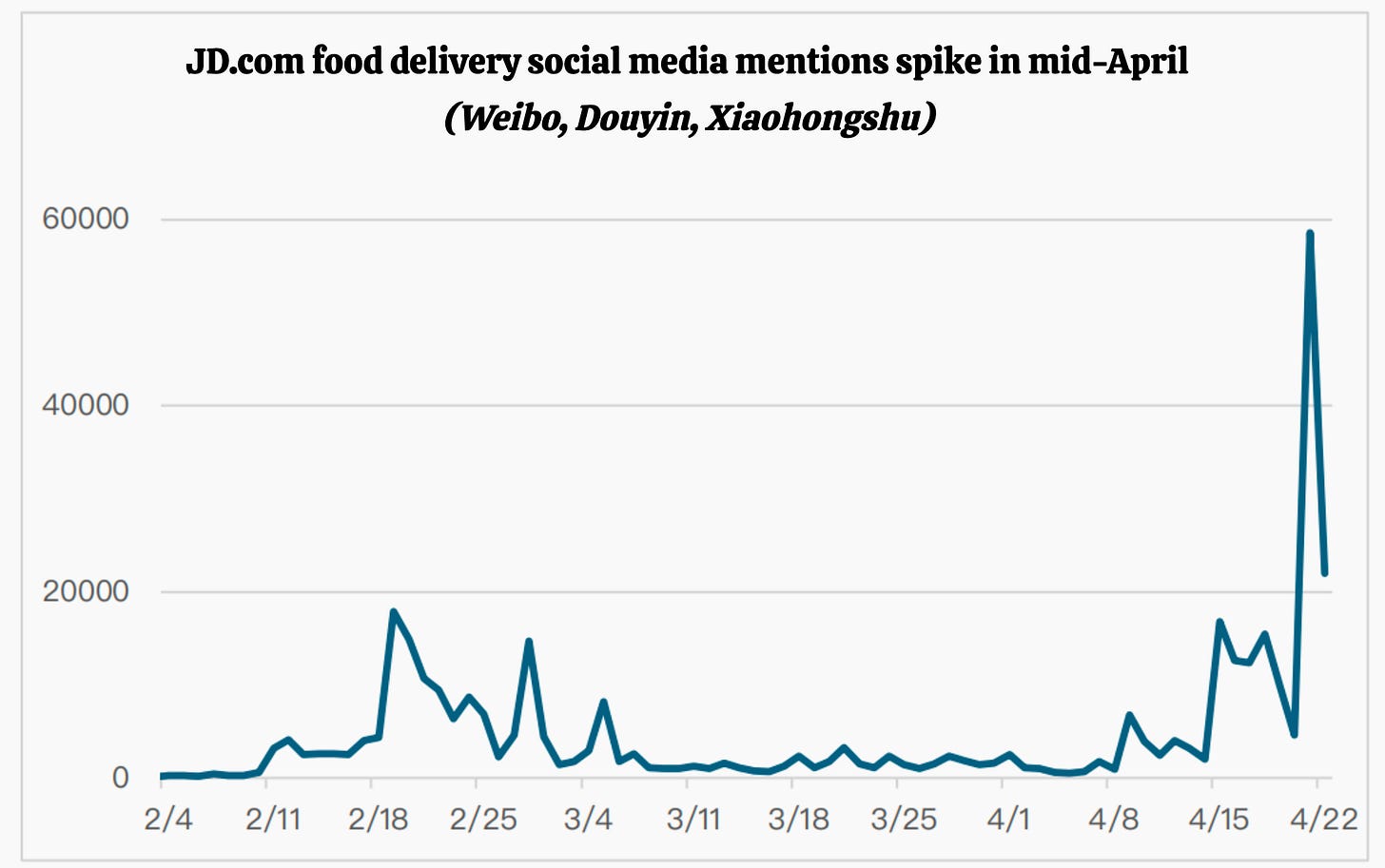

To gain a more objective and comprehensive understanding, we analyzed extensive data from key Chinese social media platforms—Weibo, Douyin, and Xiaohongshu (Red Note)—to gauge consumer sentiment. Behind the paywall, you will find exclusive charts illustrating the topic’s popularity, showing how the situation is escalating among consumers, along with sentiment analysis that breaks down whether this showdown has made consumers feel more positively or negatively toward both JD and Meituan.

The insights below are provided by the research team at BigOne Lab, the parent company of Baiguan. This analysis is part of our specialized research services tailored for institutional clients. If you represent an institutional client interested in deeper insights on JD or Meituan, please reach out to us at more@bigonelab.com, and our team will be happy to assist you.

JD.com’s foray into food delivery: Will its media blitz unseat Meituan?

(April 22 Public Sentiment Data Analysis)

As public debate over food delivery heats up between JD.com and Meituan, we leverage real-time sentiment data to assess user attitudes and the broader impact of JD.com’s entry on Meituan’s market position.

(Note: April 22 data reflects a half-day sample)