Laopu Gold(6181.HK): Handcrafted Chinese gold thrives despite sluggish luxury sales

Laopu Gold (6181.HK)'s stock price is up by 184% since its IPO in late June 2024 (vs HSI 18% and CSI 300 20%)

Is the gold rush over for China's youth?

Last year, we witnessed a revival of traditional pursuits among young Chinese, including temple visits, spiritual retreats, and a boom in gold buying, as a hedge against economic uncertainty and for luck. But the glitter seems to be fading.

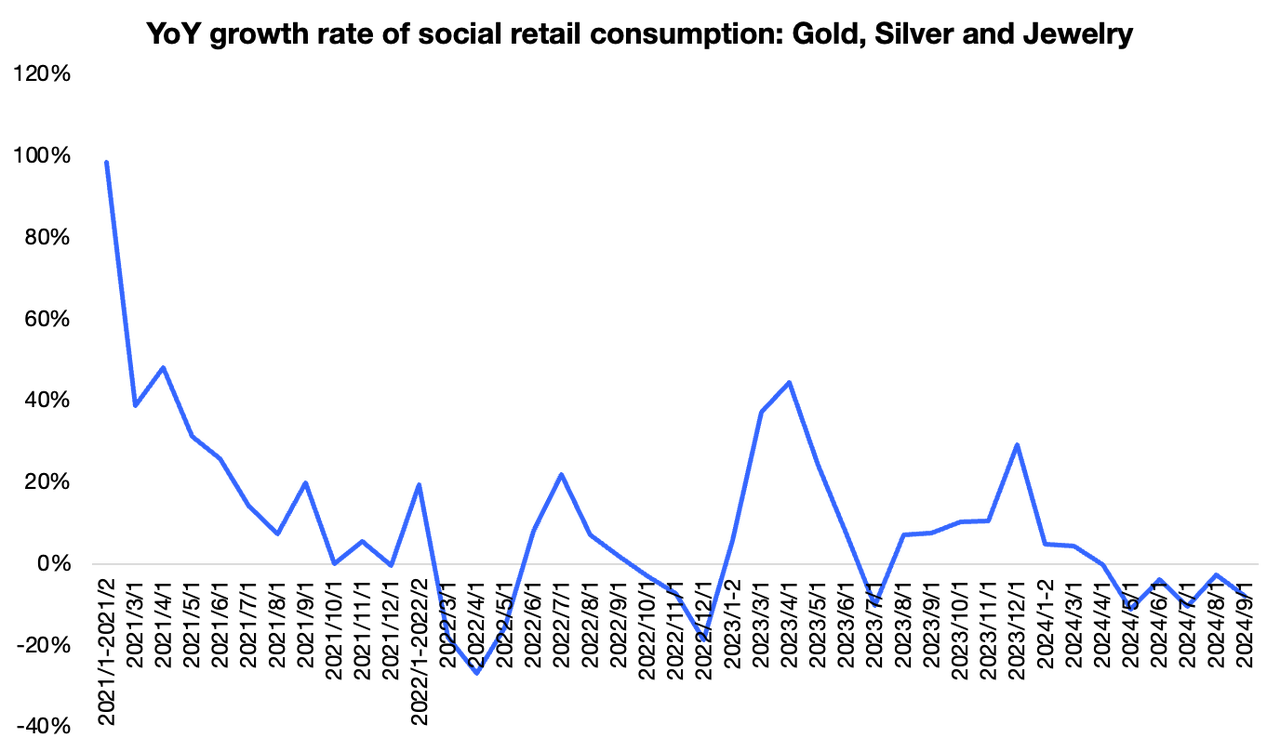

Data from the National Bureau of Statistics on retail social consumption indicates that the consumption of gold, silver, and jewelry has been in a year-over-year downward trend since 24Q2. The primary reason for this decline is the high gold prices, which have dampened retail consumption of gold products.

The surge in gold prices has pushed the cost of gold consumption to new heights. On the 23rd, data from the Shanghai Gold Jewellery Trade Association showed that for pure gold, major brands like Lao Feng Xiang, Lao Miao, and China Gold all priced at 813 yuan per gram, and Chow Tai Fook at 815 yuan per gram.

Gold and matrimony in China

In China, the purchase of gold jewelry is more than just a consumer act; it is a significant reflection of family and social culture. Traditionally, gold jewelry bought during the marriage period—typically bracelets, rings, and necklaces (namely "Three Golds")—is seen as a blessing for the newlyweds and a symbolic gift from parents to their children.

However, with marriage registrations dropping to a recent low—according to the Ministry of Civil Affairs, 3.43 million in the first half of 2024, down by 498k from the previous year—gold jewelry demand is waning. The China Gold Association reports a 46.02% increase in gold bar and coin consumption, contrasting with a 26.68% decrease in gold jewelry consumption in the first half of 2024.

"Planning to get married by the end of this year, I've been watching the gold prices since the beginning of the year, hoping to buy the 'three golds' at the right time, but the prices just keep climbing," a young man from Shandong lamented. He and his fiancée were never big fans of gold jewelry, and the current prices have completely extinguished their desire to purchase the traditional 'three golds.' Walking down the street, one can notice many gold shops are nearly deserted, unusually quiet. (Source: Daozongyouli)

Franchise store closures: chill spreads across the industry

The gold retail sector is facing a chill as some stores close and others move to cut costs. Major brands like Chow Tai Fook saw a net closure of 145 jewelry retail points in China in Q3, focusing on lower-tier cities. This year, Luk Fook and Chow Sang Sang also reduced their stores by 76 and 22, respectively.

Franchised gold shops, often in smaller cities, are struggling more than flagship stores, which are directly managed by brands and located in larger cities. High gold prices have reduced demand for gold jewelry, affecting franchises that rely on this high-profit item. Meanwhile, demand for gold bars and coins is rising, but these franchises lack sufficient inventory.

Rising gold prices are linked to a crisis in US dollar credibility, boosting investment demand for gold

Central bank purchases, tied to the US deficit, and investment demand, particularly for gold ETFs influenced by real interest rates, are key drivers. According to CICC research, since 2022, higher real interest rates have dampened investment demand, but central bank buying has sustained gold prices, becoming a major price setter. Developing countries' central banks are likely to remain significant in future gold pricing.

This trend has reached retail investors, with a notable shift since early 2024 where the sales growth of gold and silver investment products has outpaced gold jewelry on China's major e-commerce platforms, according to data tracked by BigOne Lab, the parent company of Baiguan.news.

An exception in gold consumption demand - Laopu Gold (6181.HK): how a high-premium brand thrives in a challenging consumer environment

Overseas luxury brands are experiencing a slowdown in China

Luxury consumption is generally cyclical, fluctuating with economic cycles. According to BigOne Lab's exclusive offline payment data, mainstream luxury brands in the Chinese mainland market have shown a significant slowdown in 2024, with Gucci's decline reaching 30-40%. Even the more defensive Hermes, benefiting from its strict supply control, experienced a revenue drop in Q3. An analysis by a foreign investment bank's research department indicates that hard luxury (watch and jewelry) declines even more than soft luxury (fashion and leather goods).

This post is sponsored by BigOne Lab, our parent company. BigOne Lab proudly announces the introduction of China Mobile Payment dataset, covering high-frequency offline sale performance of brands such as LULU, Hermes, LV, Starbucks, POP MART, Miniso sportswear, luxury, coffee and tea chains and speciality retail sectors that were previously undercovered by data. If you are interested in subscribing, please contact more@bigonelab.com

However, amidst the weak high-end consumption, there is an outlier: Laopu Gold, humorously referred to as the "Hermès of gold." People queue up at the store gates, even early in the morning.

Laopu Gold (6181.HK)'s stock price is up by 184% since its IPO in late June 2024 (vs HSI 18% and CSI 300 20%)

In the following sections, I'll go through factors you should consider when analyzing why Laopu Gold outperformed in the challenging luxury consumption environment and whether Laopu Gold will stay good investment going forward.