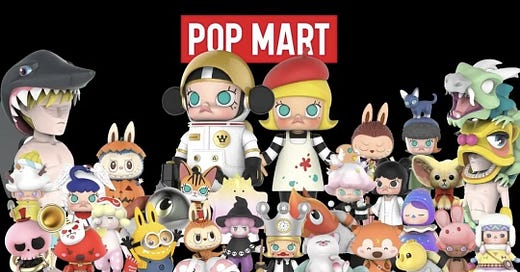

Will Pop Mart (9992.HK) become China's Disney?

How a Chinese toy company turned plastic figurines into a billion-dollar empire and set its sights on international expansion

*This post is not sponsored by Pop Mart

Pop Mart (9992.HK) emerged as a surprise winner amid China's not-so-enthusiastic consumer market after the pandemic. While domestic consumers remained cautious, resulting in a decline in the average selling price of most online purchases categories, Pop Mart was able to record increases in both sales and average selling price. Moreover, its expansion into international markets, particularly in Southeast Asia, met with significant success in 2023.

Pop Mart, founded in 2010, has uniquely positioned itself in the Chinese market by branding its products as "潮玩" (trendy toys). The company has created a phenomenon where its toys are not just playthings but collectibles with "investment" value. Pop Mart sells its toys through "盲盒" (mystery boxes or blind boxes), a type of product where consumers cannot identify which toy figurine they will receive before opening the box. This concept originated in Japan and became popular among young Chinese consumers. Many consumers trade Pop Mart's limited-edition toys (which require buying numerous blind boxes to increase the chance of getting one) on the second-hand market, treating them as valuable assets rather than mere toys.

The business model wasn't without doubt when the company first began its journey. Some questioned whether Pop Mart's business model could sustain consumer interest (including myself, as I couldn't sympathize with buying a bunch of plastic toys just to get the limited edition ones in the blind box). After all, unlike companies like Disney or Japanese anime creators, Pop Mart doesn't own its content other than plastic figurine toys that can easily be copied.

When Pop Mart's stock price peaked in February 2021, shortly after its IPO, the price went downhill from there, seemingly validating these doubts. However, few expected the stock to rebound amid the sluggish domestic consumption market in 2024. Surprisingly, the company's resilience is noteworthy not in the hot consumer market of 2021, but rather when consumers became more cautious post-pandemic.

The company has gained over 86% year-to-date in 2024, while the Hang Seng hasn't turned green.