My constructive view on Pop Mart: Why I think it doesn’t look expensive now

What social media and sales data say about post-Labubu demand

Several months ago, the bears came for Pop Mart (9992.HK).

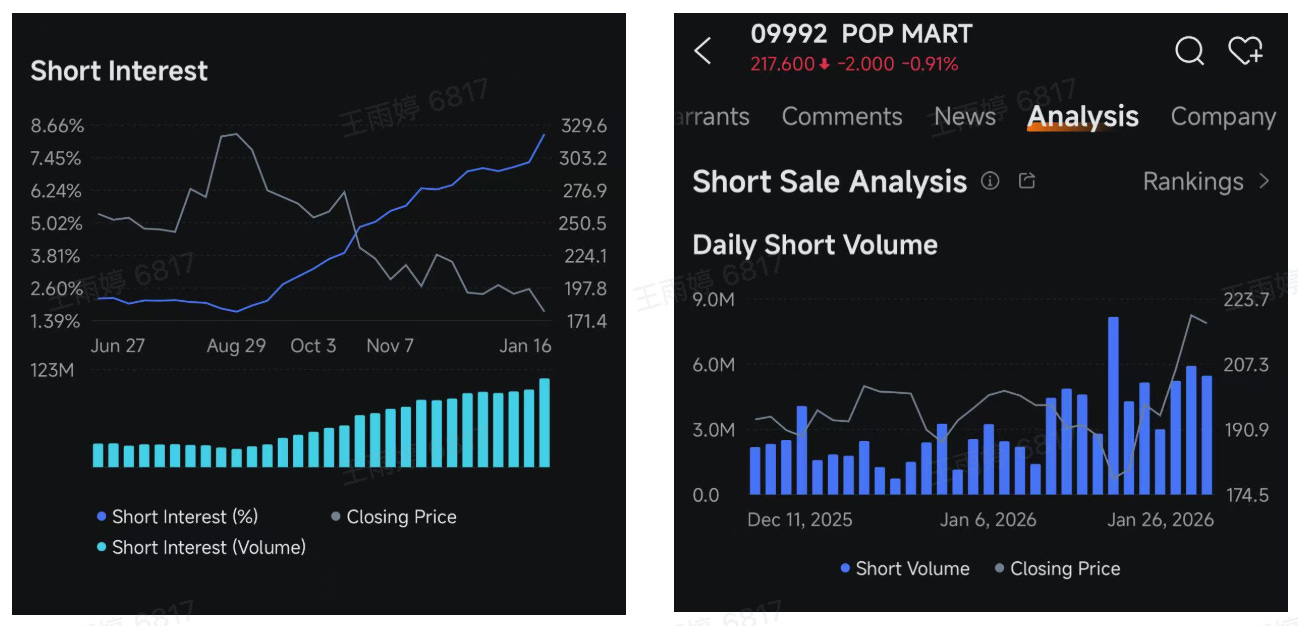

Following a series of bearish reports, short interest in the stock has remained stubbornly high. Pop Mart’s price has since corrected more than 35% from its peak.

The core narrative driving this sell-off is straightforward and, admittedly, compelling. Many argue that Pop Mart’s explosive 2025 run was a temporary ‘supercycle’ driven by a single IP anomaly—Labubu—and a viral moment in the West that is now effectively over.

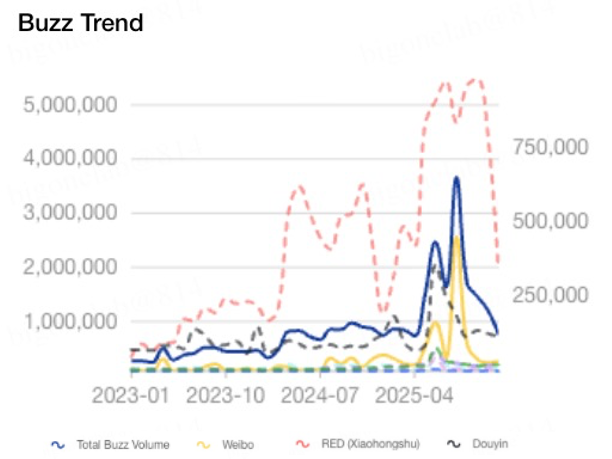

For instance, short sellers argue that Labubu is a ‘one-hit wonder’ that has already faded from its peak with no successor in sight. They cite plummeting search interest, cooling social media buzz, and falling resale prices on second-hand platforms as proof of demand destruction.

While our own social media data confirms this trend—and I do acknowledge that the Labubu craze has decelerated—I remain constructive on the current setup for the company following this sharp correction.

In a nutshell, I believe the operational reality at Pop Mart points to normalization, not a total collapse. There is a massive difference between a company going to zero and a company returning to ‘normal’ (and still rapid) growth.

Behind the paywall, I will explain why Pop Mart doesn’t look particularly expensive at these levels, backed by BigOne Lab‘s recent sales and social media data, as well as some on-the-ground observations of new monetization mechanisms the company has recently rolled out.

Disclaimer: This newsletter is for informational purposes only and does not constitute investment advice. Please do your own research or consult your financial advisor.