We’re officially kicking off registration for the 2025 China Tour (Oct 27 Monday to Oct 30 Thursday in Shanghai & Hangzhou). This is your opportunity to join a curated, high-quality experience with Baiguan and fellow global professionals as we explore China’s business and economic landscape together.

Why is this tour different?

The dominant narrative in global media is that China is facing deflation and deep structural challenges—and long gone are the days when every sector posted double-digit growth. In this new phase of the Chinese economy, identifying structural investment opportunities requires a sharper lens and a deeper presence on the ground.

While the macro picture feels uncertain, specific sectors are thriving—driven by generational shifts in behavior, demand for domestic cultural identity, and a new wave of tech innovation. But these are not always the trends you’ll find in boardrooms or equity research reports.

We believe that the best way to deepen your strategic understanding of China is to come and see it for yourself. Meet the founders and operators of tomorrow’s Pop Mart and Deepseek. Hear directly from the companies shaping China’s next growth cycle.

This tour takes you beyond glossy surfaces. You’ll meet both listed and pre-IPO companies, dine with local founders and investors, and visit the spaces—both digital and physical—where real consumer behavior takes shape.

If your investment thesis depends on understanding where China is going, not where it was, this trip is for you.

✈️ Tour Itinerary

Please note that while the list of company visits is final, exact daily schedules and the representatives you’ll meet will be shared a few weeks before the tour, as coordinating multiple companies and participants takes time. A detailed handout will be provided prior to departure.

Day 0: Shanghai - Welcome Dinner

We will host a welcome dinner on the evening of the 26th, giving everyone a chance to get to know each other. The location will be near the recommended hotel in Shanghai. You are free to attend if your travel plan allows.

Day 1: Shanghai – Understanding the Daily Life of China’s Young Consumers

Theme: How a typical urban professional in their 20s–30s works, eats, and shops in 2025 China

Atour Hotels (NASDAQ: ATAT): Atour is one of the most loved hotel chains among Chinese in their 20s to 40s. Beyond being a reliable choice for both business and leisure travel, Atour has successfully expanded into retail, with its household product line now contributing ~39% of group sales. It’s one of the first hotel brands in China to transform into a "lifestyle brand." A visit to Atour offers insights into how young Chinese consumers think about travel, home, and lifestyle.

Lunch @ Super Bowl: Super Bowl is a popular healthy fast-casual chain among China’s young office workers. Its grain bowls, lean proteins, and app-based ordering reflect a rising awareness of health and convenience, localized for Chinese tastes. Lunch here highlights how “clean eating” concepts are evolving into scalable restaurant models. We’ve invited an early investor in Super Bowl—who has also backed several successful consumer startups—for a conversation on the evolving dynamics of China’s consumption landscape.

M&G Stationery (SHA: 603899), founded in 1997, is etched into the childhood memories of nearly every Chinese student. Once known simply as a trusted stationery maker, it is now reinventing itself into a creative, globally-oriented brand. From IP collaborations to ESG initiatives—such as launching China’s first carbon-neutral stationery—M&G exemplifies how China’s “time-honored” companies are innovating and building brand power to stay competitive.

Private Welcome Dinner with Family Offices & Founders An English-friendly gathering with founders, second-generation leaders of family businesses, and local investors. This is a unique opportunity to network and exchange perspectives on brand-building, challenges, and investment trends in China.

Transport: Private coach transfer to Hangzhou (~2.5 hrs)

Lunch and dinner will be provided today.

Day 2 Hangzhou: Digital Culture and Entertainment in Transition

Theme: How content, entertainment, and commerce intersect in a rapidly evolving consumer landscape

Foshan Yowant Technology (002291.SZ): Livestreaming is one of China’s most influential retail formats, blending product discovery, trust-based marketing, and instant conversion. Yowant remains the industry leader, with top celebrity hosts, collaborations with 25,000+ brands, and the highest number of livestreams surpassing RMB 100 million in single-session sales. We will step inside a livestreaming room to see how it works in practice, and explore how new technologies—AI-powered content and digital marketing—are reshaping creator-led commerce.

Netease Games (NASDAQ: NTES): China’s gaming industry has rapidly advanced in visual storytelling, design language, monetization models, and global expansion. NetEase is one of the leading players—not only producing its own titles, but also publishing and investing in a diverse portfolio of games with strong domestic and international potential. Our session will explore questions such as: how AAA games are developing compared with mobile-first titles, what monetization opportunities exist, and how Chinese studios are positioning themselves in overseas markets. We will also get a preview of emerging games that could become the next breakout hits.

Lunch will be provided today. Once you arrive, we’ll give you some dinner suggestions featuring local flavors.

Day 3 Hangzhou: Culture, Identity & Chinese Brands’ Global Ambition

Theme: Explore how Chinese brands fuse heritage, pride, and innovation to win at home and go global.

Proya Cosmetics (603605.SH): Proya is a leading example of a domestic beauty and skincare brand successfully shedding the “cheap, low-quality” stereotype. Through strong R&D, effective digital marketing, and culturally resonant products, Proya competes head-to-head with global giants while driving the localization and upgrade of China’s cosmetics industry.

JNBY Group (3306.HK): JNBY is a prime example of how a Chinese designer brand tells the story of China’s fashion. It blends modern taste with subtle Chinese design elements, cultivating loyal followers both at home and abroad. The brand exemplifies the rise of Guochao (“China Chic”) brands that balance innovation with cultural identity.

Saint Bella (2508.HK): If you follow China’s news, you’ve likely seen headlines about declining birth rates. A key question is how consumer brands continue to adapt and stay competitive in this environment. We will visit Saint Bella, the largest postpartum and family care group in China and Asia, to see how it builds a strong portfolio of both services and retail products, domestically and overseas. More importantly, this visit offers a chance to explore how Chinese mother & baby brands are responding to changing demographics and what this signals for the industry’s future.

Private Welcome Dinner with Family Offices & Founders An English-friendly gathering with founders, second-generation leaders of family businesses, and local investors. This is a unique opportunity to network and exchange perspectives on brand-building, challenges, and investment trends in China.

Lunch and dinner will be provided today.

Day 4 Hangzhou: Tech Frontiers: AI & AR glasses

Theme: Exploring China’s AI innovation and consumer tech products

Alibaba AI (NYSE:BABA): Visit Alibaba’s AI Labs to learn about their cutting-edge AI developments, including China’s leading large language model, Qwen, which uniquely integrates AI capabilities directly with e-commerce operations. Gain insights into how Alibaba’s foundational research supports commerce, logistics, and cloud services, and understand where China is innovating or diverging in the AI landscape.

Lunch@Home Original Chicken 老乡鸡 (HK Pre-IPO): Home Original Chicken is one of China’s most recognizable fast-casual chains, famous for its homestyle chicken dishes and grassroots brand image. It thrives on a uniquely Chinese formula: down-to-earth marketing, approachable prices, and comfort food rooted in local traditions. Now preparing for its IPO, Home Original Chicken raises an intriguing question—could it become China’s own version of KFC or McDonald’s? Experiencing it firsthand in China offers an authenticity and scale that no overseas case study could replicate.

Rokid: Rokid is a leading Chinese startup in AR glasses and spatial computing, positioning itself as a rising rival to Apple’s Vision Pro. Experience hands-on demos of their latest technology and discuss applications across industrial, consumer, and entertainment sectors. This visit highlights the opportunities and challenges for AI and AR hardware and software innovators in China’s vast market.

Lunch will be provided today.

Who exactly will we meet?

What sets the Baiguan China Tour apart is the quality of our access. Our itinerary is curated to ensure you go beyond the standard corporate pitch.

Throughout the tour, you will engage directly with: founders & C-level executives, key division heads who are directly responsible for business units and product strategy, and second-generation family office leaders.

We bypass the PR teams to connect you with the individuals driving the business, ensuring you receive unfiltered insights into their strategies, challenges, and vision.

Cultural & Experiential Stop

In addition to company visits, we will also include curated cultural and experiential stops in Hangzhou—designed to give participants a first-hand feel of China’s unique commercial environment. This will highlight unique aspects of China’s consumer market—phenomena and experiences that can only be found in China. The exact activity will be confirmed closer to departure.

💳 Registration & Fees

👉 To begin your registration, please fill out this google form.

(The RSVP form will close once all seats are filled.) Our team will send you a secure payment link via Stripe within 1 day, which accepts all major credit cards, Apple Pay, Google Pay, or Link.

Standard Price: $4,280 USD

Early Bird Price (ends Sept.15): $3,980 USD (save $300)

We do realize that sometimes our email can get into your spam box. Please help us check if that's the case if you don't hear from us within 1 day.

This tour is strictly limited to 20 seats to ensure an interactive and high-value experience. Spots are confirmed only after successful payment and are allocated on a first-come, first-served basis.

*If you are traveling with others, each participant must register and complete payment separately to ensure accurate details for everyone.

✅ Confirmation Process and What to Expect Next

Once your payment is successfully completed, here’s what you can expect:

Upon successful payment, you will receive an immediate payment receipt from Stripe. This confirms your seat and registration.

Within 24–48 hours: You will receive a personal welcome email asking for the following information:

Personal information: Legal name, phone number, dietary restrictions/allergies, arrival & departure flights, a short personal introduction (optional, for cohort networking), and emergency contact.

Private group access: We’ll invite you to a WeChat group for timely communication and a more personal connection before and during the tour.

Recommended hotel: Local transportation will be arranged throughout the trip. Please note that while shuttles will be provided, pickup will only be available from the recommended hotel each morning before the day’s activities begin. If you choose to stay elsewhere, please plan to meet the shuttle at the recommended hotel each morning.

Shanghai: Atour Hotel Shanghai Hongqiao Shuicheng Road (view on booking.com).

Instead of a 5-star hotel, we recommend Atour Hotel—a lifestyle brand and hotel chain that has become one of the most popular among young Chinese consumers. It is known for its smart and modern room design. This particular location is close to Hongqiao Railway Station, making it convenient if you are arriving by train.

If you are arriving at Shanghai Pudong International Airport on Oct 26, please let us know your flight details, and we will assist with pickup and transfer to the recommended hotel.

Hangzhou: Sheraton Grand Hangzhou Wetland Park Resort (View on booking.com).

This hotel is recommended because it sits close to companies that we will visit (Alibaba AI, Rokid, Yowant etc.). It is also located next to the Xixi National Wetland Park and inspired by traditional Chinese architecture, offering landscape views of the signature gardens of Hangzhou.

Follow-up communications:

Mid-to-late September: A dedicated newsletter will feature company hosts, guest highlights, and itinerary details. You’ll find out who you’ll meet at each company, along with early insights into the discussion topics and key business highlights.

Mid October: You’ll receive the detailed hour-by-hour schedule and join a pre-tour Zoom briefing to meet fellow participants and the Baiguan team, and to have any questions answered.

📌 Important Policies

Refunds & Cancellations:

Cancel ≥30 days before the tour start date → Full Refund

Cancel <30 days before the start date (any reason, including visa issues) → No Refund

Requests must be sent in writing to baiguan@bigonelab.com

Urgent Action Required for Visa Application: We strongly urge all non-Chinese passport holders to begin their visa application process immediately upon registration. Participants are responsible for securing valid passports and visas. Failure to obtain a visa is not an exception to the refund policy. To be eligible for a full refund, you must cancel before September 26, 2025. Please plan your visa application accordingly.

Travel Insurance: Strongly recommended to protect against unexpected events (medical emergencies, cancellations, lost luggage, etc.).

What’s Not Included: International airfare, accommodation, meals (except those noted in itinerary), visa fees, and personal expenses.

🎁 Perks

All participants will receive a free 1-year Baiguan subscription. Already a paid subscriber? We’ll extend your subscription by 12 months.

Seats are limited — and early bird pricing is only available until September 15, 2025.

We look forward to welcoming you to China in 2025!

Warm regards,

The Baiguan Team

Other FAQ

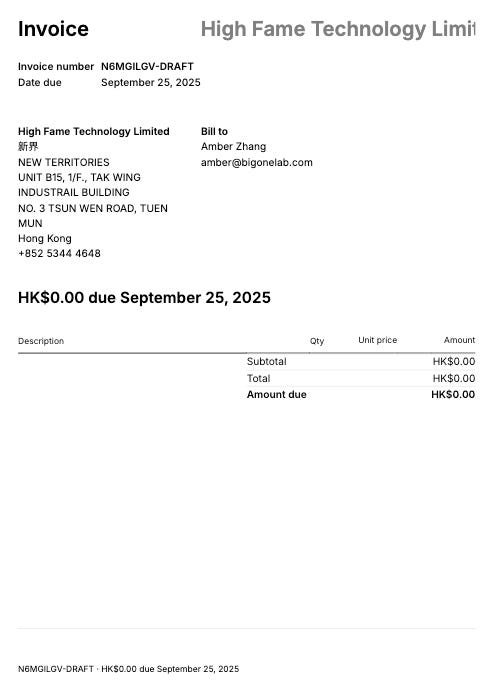

🧾 Invoice Requests

If your organization requires an invoice, simply email baiguan@bigonelab.com after completing your payment. We’ll issue a Stripe invoice (example attached).

Alternative payment methods

If your organization needs a different payment arrangement (such as bank/wire transfer), please contact us at baiguan@bigonelab.com with the subject line: “China Tour Payment Request.” Please note that it may take up to 24 business hours for us to process and respond to your inquiry.

Will there be English translation?

Yes, all company visits and official sessions will have English translation available.

Are meals provided?

Lunch: Workday-style lunches will be provided for all participants.

Dinner: Certain evenings include networking or founder dinners.

Breakfast and other meals: Participants will need to arrange on their own.

What if I don’t stay at the recommended hotel?

Shuttle service will only operate from the recommended hotel. If you choose to stay elsewhere, please plan to meet the shuttle at the recommended hotel each morning before the day’s activities.