Where to invest amid the US-China trade war 2.0

China Mobile, name to keep under your radar

It’s hard to talk about investment ideas these days without acknowledging the elephant in the room: U.S.-China tensions and the ongoing tariff threats. Markets are jittery, geopolitics are messy, and headlines feel like landmines. But even in this fog, not all opportunities are lost.

There are still names in the China equity universe that look compelling—especially those that are largely immune to U.S. tariffs and external tech sanctions. These types of companies not only offer upside but may also serve as good diversification against intensifying worries about a potential U.S. recession and the broader unraveling of U.S. exceptionalism.

For instance, as I’ve mentioned in previous newsletters, in this kind of environment I’d stick with:

Domestically driven companies, particularly A-shares, where the "national team" has shown clear policy and capital support;

Sectors/companies with stable cash flow and high dividends (such as banks);

More defensive plays, rather than chasing new highs of tech giants, where risk-reward looks less attractive than the "pre Deepseek" days, in my view.

The CSI 300, tracking the top 300 stocks on Shanghai and Shenzhen exchanges, has been notably more resilient to external shocks than the more volatile Hong Kong market, amid the global sell-off that followed Liberation Day. With China's "national team" continuing to pledge support for market stability, I believe onshore stocks will remain better positioned to weather macro headwinds and benefit from a broader range of policy tools in the year ahead.

In the upcoming newsletters, I’ll continue to highlight investment ideas that check these boxes: strong domestic exposure, good risk-reward, and limited vulnerability to global drama. If that sounds like your style, subscribe to stay ahead.

High-dividend stocks

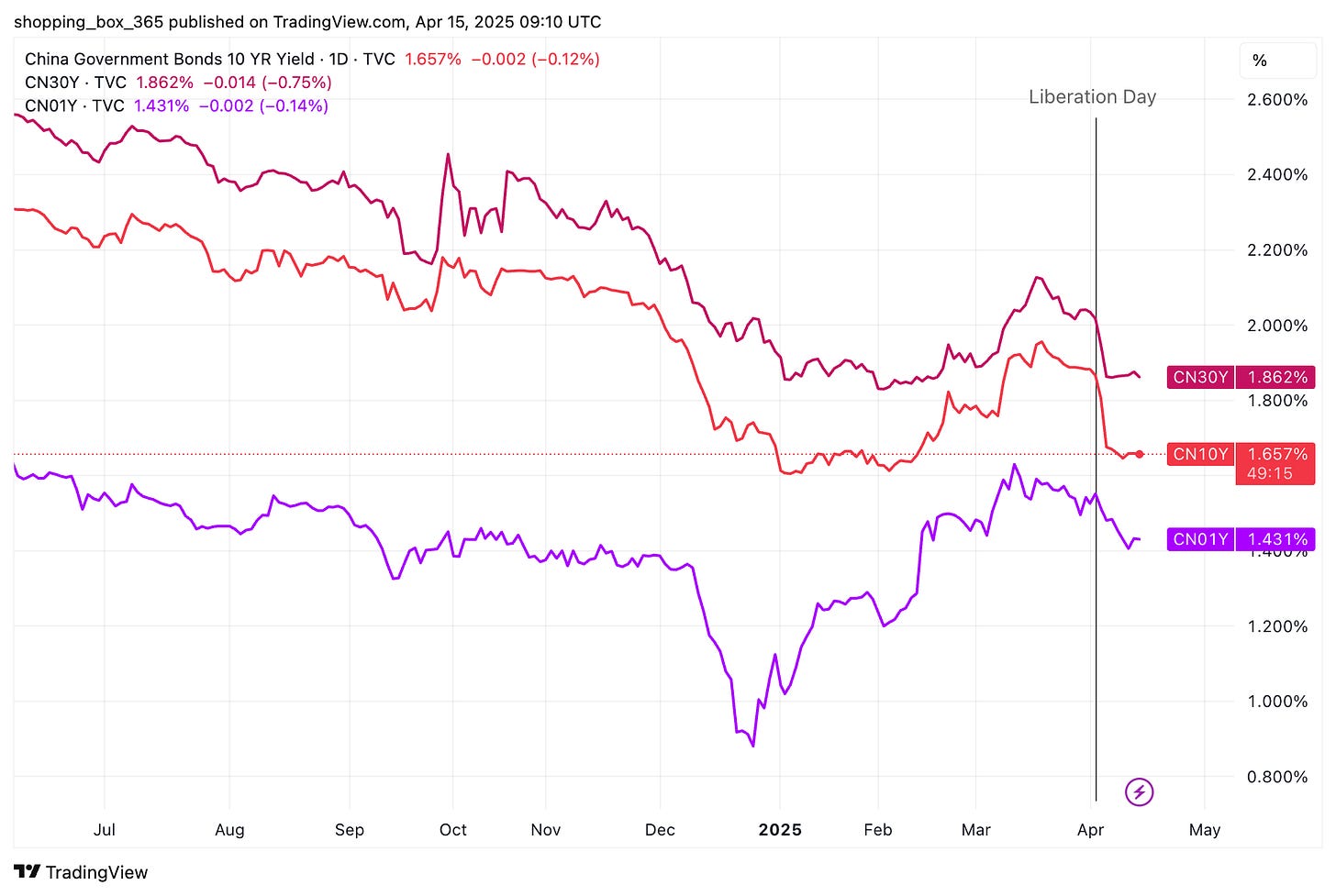

As early as January, we pointed out in the newsletter “Top 6 China Equity Trends in 2025” that high-dividend stocks would be a winning strategy for Chinese equity investment this year. Now, I still believe high-dividend stocks are the way to go—especially as risk-free returns are likely to fall further, with China expected to counteract tariff-related pressures.

China’s 10-year bond yield has already fallen back to around 1.6% following Liberation Day.

In the Discord channel for our paying members, I highlighted telecoms back in February as a sector that stands out for both growth potential and attractive dividend yield. And today, amid heightened global uncertainty, I think its risk-return profile looks even more compelling.

For more timely discussions, consider joining our private Discord channel for paid readers. To enhance your decision-making, we also provide a daily digest of equity research from top sell-side institutions, covering macro trends and specific company analysis. Each day of digests includes a 3-minute audio summary to make it easy to absorb key insights quickly.

In particular, China Mobile—the largest telecom operator in China (and in the world), with around 60% of the country’s wireless market—is a name worth keeping on your radar if it isn’t already. Here’s why:

Today’s idea to keep on your radar: China Mobile (0941.HK / 600941.SH)

Disclaimer: I currently hold a position in China Mobile. This content is for informational purposes only and does not constitute investment advice. Please consult a licensed financial advisor before making any investment decisions.

It now has an AI / data center upside: