A "decoupled" bull: Chinese equities opportunities in focus – Charts of the Week

Which consumer stocks deserve your attention beyond big tech?

"Charts of the Week" is Baiguan's series that features key data points to help you quickly grasp the general state of affairs in China in just a few minutes. We handpick the highlights of the data charts from a variety of sources, analyzing and delivering insights trusted by 100+ top institutional and corporate clients worldwide at BigOne Lab. Don't forget to subscribe before you continue reading!

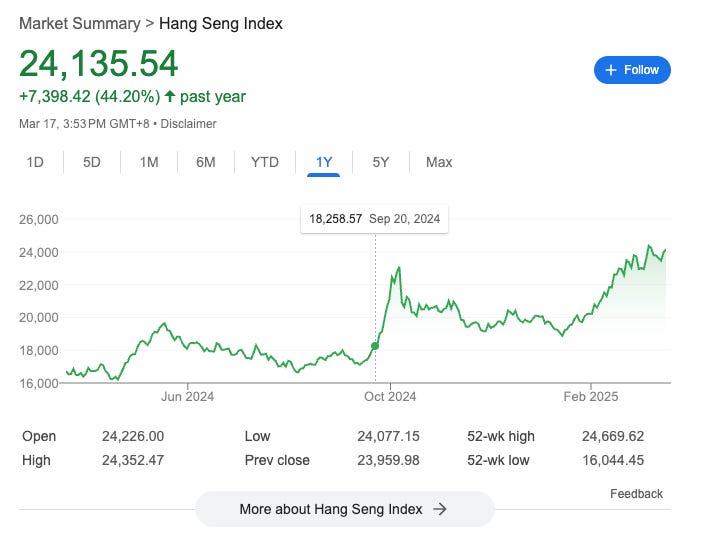

Since Deepseek's launch in late January, Chinese equities have witnessed a rally, driven by the renewed confidence in China's tech companies to keep innovating. This round of rally has been more sustained so far compared to the one that occurred last year after the policy stimulus packages were introduced in September. One encouraging sign is that the market did not "sell the news" after the just-ended "two sessions" meeting - although the stimulus measures emerging from the "two sessions" were in line with expectations and not extraordinary, the market did not rush to take profits as it did last year.

Chinese equities have sustained the rally thus far, in spite of the recent US equities sell-off. (Some Chinese netizens are jokingly referring to this, saying that Trump is "making Chinese equities great again".) As of the close on March 14, the Hang Seng Index traded at approximately 13.8x PE, which is considered fair value and approaching the highest level in three years. A natural query is how long this bull market will persist, given that much of the valuation has been restored.

As I indicated in the last "charts of the week" post, we are currently in what can be characterized as a "vacuum" period, as not a lot of macro data are released in January and February due to the slowdown of activities during the Spring Festival. One aspect to monitor going forward is whether China's real estate and consumption data continue to recover, because fundamentally, a broader recovery and sustained rally will hinge on the continued alleviation of deflation pressure. At present, much of the consumption is driven by voucher programs for home appliances, digital electronics, and new energy cars. However, these items are relatively expensive and non-recurring large-ticket purchases. Thus, it is still essential to objectively assess whether a broader recovery of household consumption is underway.

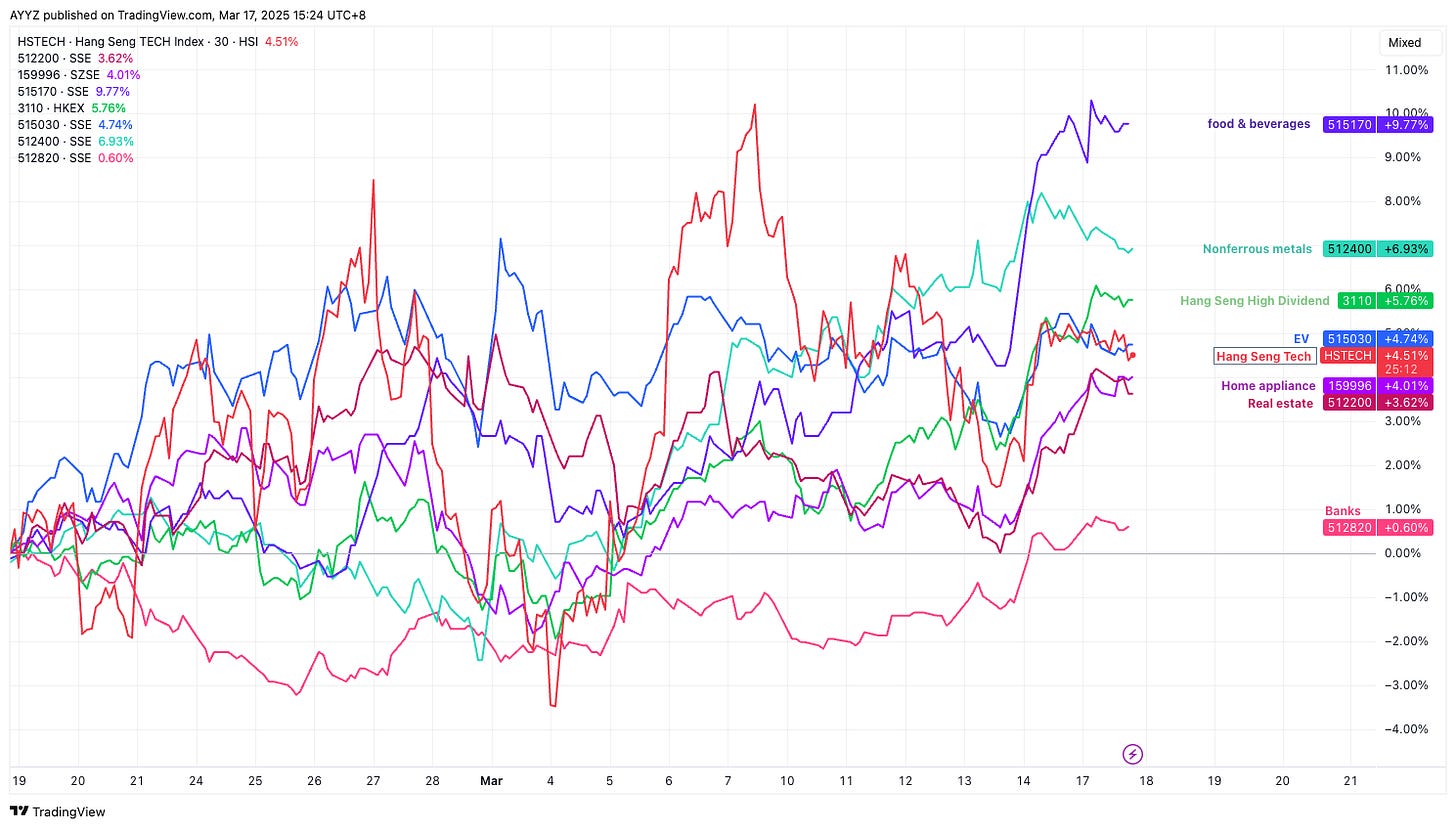

Another positive indicator to observe is whether the rally extends to sectors other than technology, which has drawn a considerable amount of "hot money" that can be speculative. On that front, the market is beginning to exhibit some initial signs of this, albeit quietly and not making as much headline news as tech stocks.

In the past month (since February 18), food and beverages (515170.SS, an ETF primarily tracking beverages and alcohol) has gained over 9%, surpassing the best-performing tech sector (represented by the Hang Seng Tech index, which rose 4.5% in the same period). More cyclical sectors like nonferrous metals (512400.SS) and high-dividend stocks (3110.HK) are also outperforming Hang Seng Tech, indicating that the market has started to witness some recovery in broader sentiments, not just in tech.

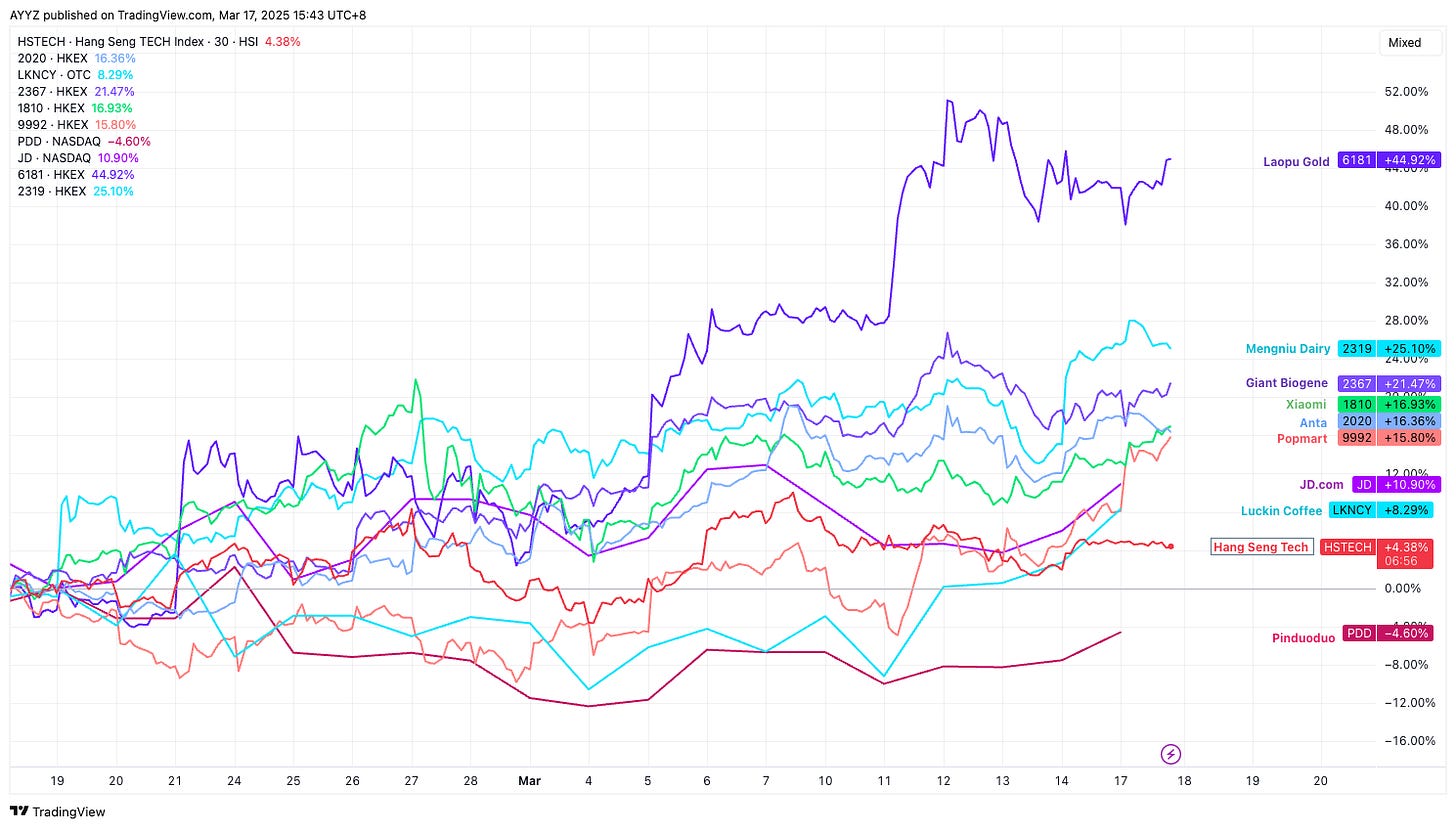

The consumer discretionary stocks have also witnessed a significant rally over the past month. For instance, some of our favorite stocks mentioned in the previous newsletter, including Laopu Gold (6181.HK), Xiaomi (1810.HK), Giant Biogene (2367.HK), Anta (2020.HK), Popmart (9992.HK), and JD (NASDAQ: JD), had all delivered quite fruitful gains as of writing (Mar 17).

Whether China's rally can last depends on real estate (the wealth effect) and employment (the income expectation). These are two fundamental factors that are more important than all enthusiasm and sentimental noise. Without a genuine recovery, the market could eventually lose the enthusiasm it has now.

So in the first part, we'll update you on these two pillars so you can understand the real economic condition in China. In the second half, we'll cover the consumption sectors and the names we like to keep an eye on.

I'm collaborating with my colleague Nina Chen, who covers macro research at Baiguan, for today's post. This is the first batch of comparable data after the Spring Festival. You'll get the best research from our team. So let's dive in.

Real estate: transactions heat up, but price recovery remains unstable

Covered by Nina Chen@Baiguan

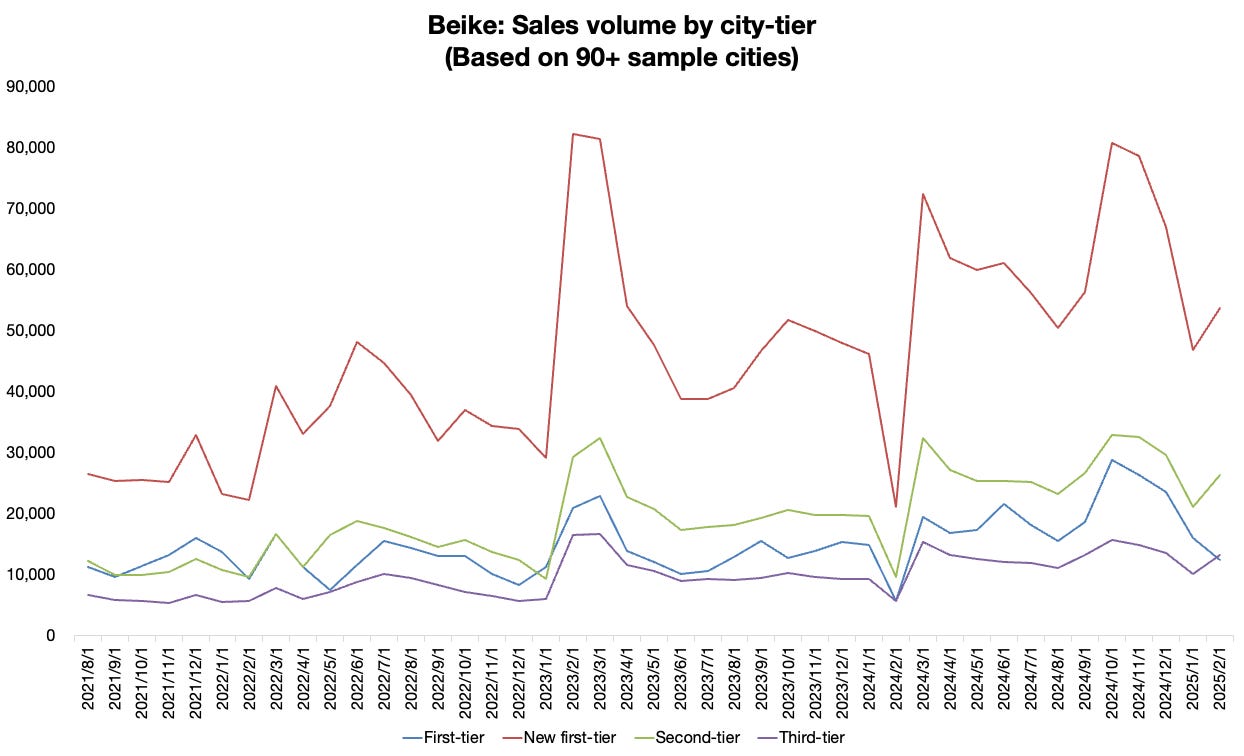

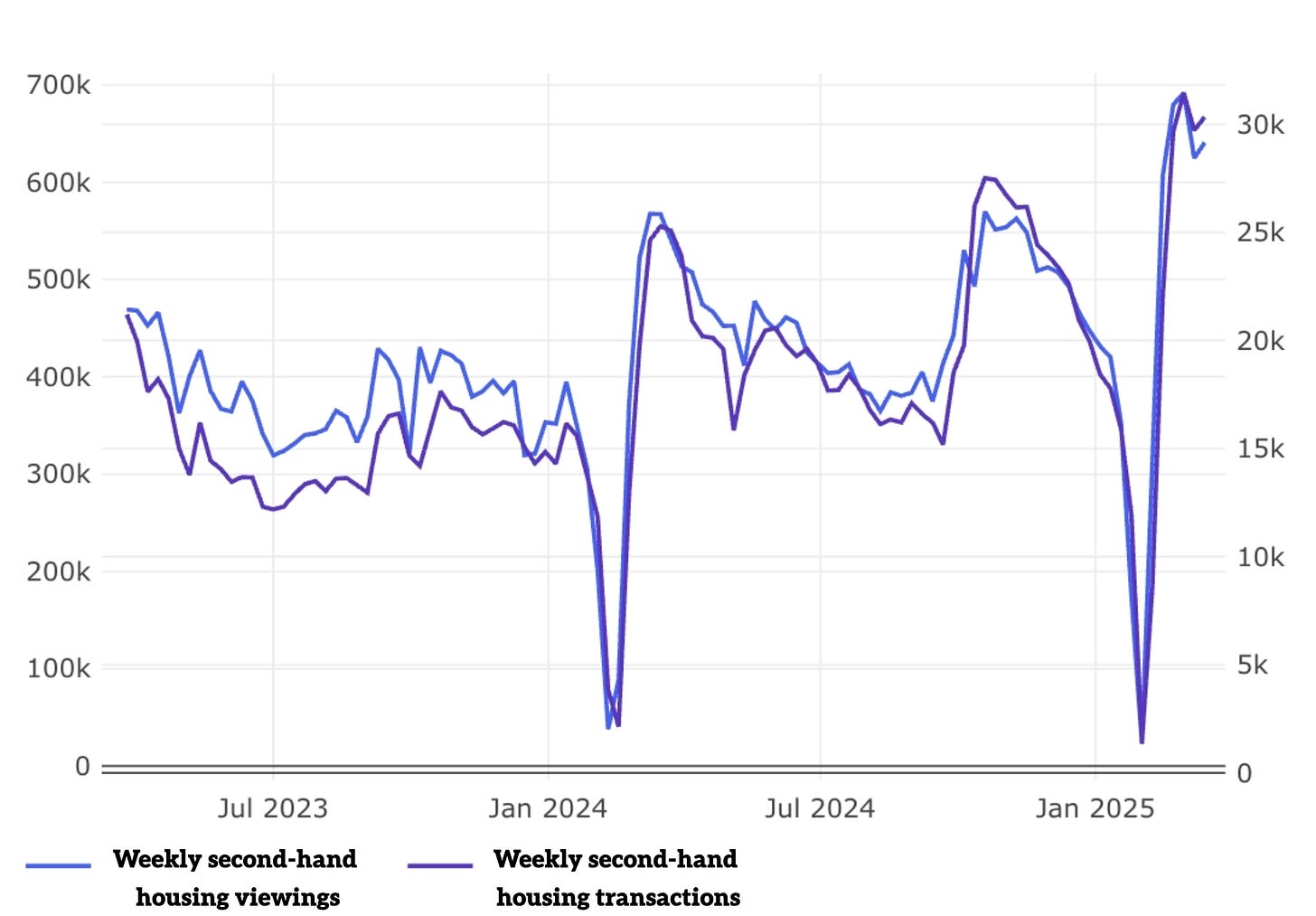

First-tier cities see strong growth in second-hand home sales From January to February 2025, BigOne's tracking of second-hand home transactions across over 90 cities monitored by Beike (China's largest real estate transaction platform) showed a year-over-year increase of 51% in transaction volumes. Specifically, first-tier, new first-tier, and second-tier cities saw year-over-year growth rates of 38%, 49%, and 61%, respectively. In the first three weeks of March (up to March 15), second-hand home sales increased by 29% year-over-year, with first-tier, new first-tier, and second-tier cities recording growth rates of 40%, 27%, and 32%, respectively. While first-tier cities continue to maintain strong sales momentum, growth in lower-tier cities is gradually slowing.

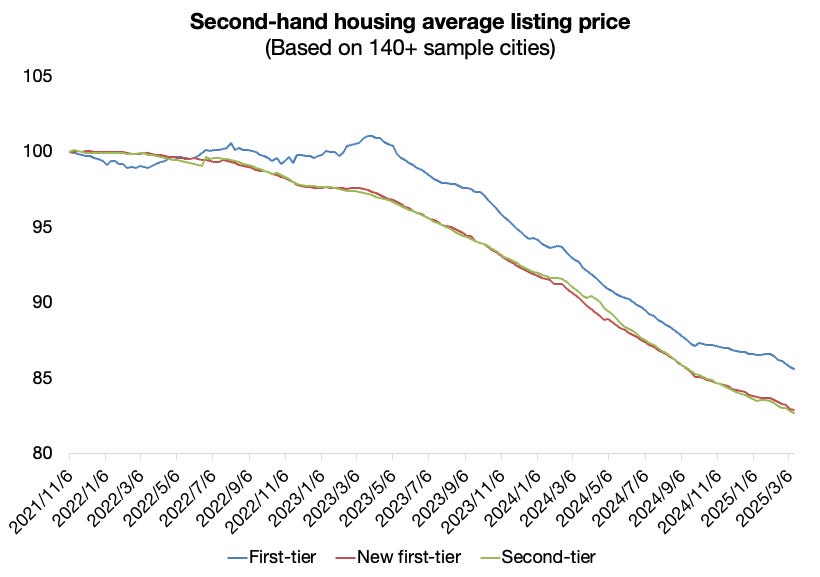

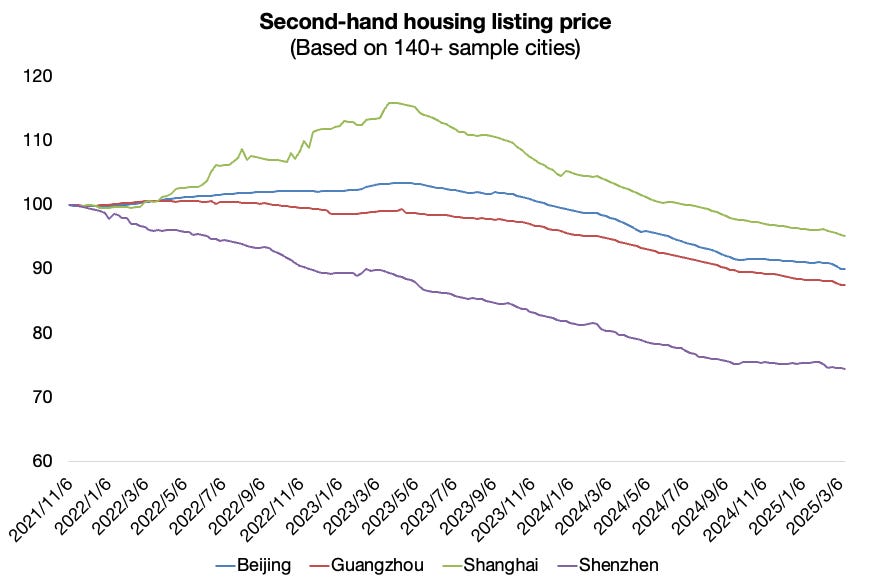

Listing price: stabilizing after last Sept policies, but declining sharply in March

The following charts show the index of second-hand housing listing prices by city tier and top-tier cities. After the policies in September, the decline in listing prices in first-tier cities decelerated. However, following the Spring Festival, these cities began to experience a sharper drop in listing prices.

Upon further analysis of the detailed data, I found that the oversupply of small-sized homes is driving down prices more rapidly. For example, in Shanghai, the average listing price in March saw a steeper decline, primarily due to price reductions in available properties, especially those with small sizes (under 60 sqm and 60–90 sqm). Additionally, the increased supply of small-sized homes (60–90 sqm) has led to a structural shift that lowers the average price. These two factors may be interrelated, with excess supply putting downward pressure on prices.

Last weekend, I visited several properties in the Huamu area of Pudong New District, Shanghai (a region known for its convenient commute to the financial center of Lujiazui, as well as its well-developed infrastructure, including apartment greening, school districts, libraries, and shopping malls. This area was once a popular residence for Shanghai’s financial white-collar workers during peak times). Our grassroots research suggests that the pressure on listing prices may be due to a narrower negotiation space. Real estate agents noted that the transaction prices have remained relatively stable since the 928 policy, but the listing prices have been “squeezed” of excess. The two properties we viewed had transaction prices negotiable at around 200,000 yuan above the lowest unit price for similar units in the same community, representing a negotiation space of about 2–3%. In contrast, this figure could reach 10% last year, based on my personal observations.

Employment: no bad news is good news

Covered by Nina Chen@Baiguan

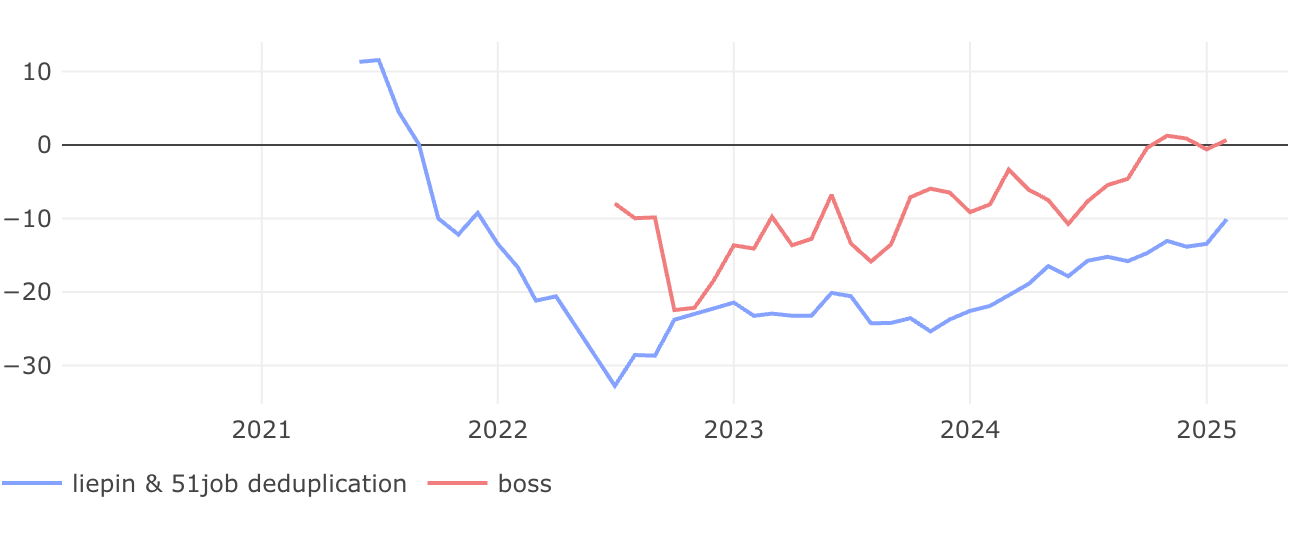

According to data from BigOne Lab, recruitment activity on BOSS Zhipin, China’s largest online job platform, has shown signs of recovery since late 2024. The average number of job postings per company on BOSS has remained flat compared to last year.

Salaries on recruitment platforms somewhat reflect people’s expectations about their income. Based on our tracked salary data, we developed a methodology in June 2024 to separate mix change and like-for-like salary change from the overall average salary growth.

Average salaries have been mostly flat since the end of 2024. As for like-for-like salaries, after a slowdown in the first half of 2024, they started to recover, growing at around 3%. This indicates that mix change is still undergoing a declining trend, implying that demand for higher-paying positions continues to face pressure.

Consumption

Consumption takes center stage as a recurring top priority for China this year. A 300-billion-yuan ($41.47-billion) package was announced for the consumer trade-in program. While this figure met market expectations, it's not "huge" compared to the overall packages. As the stimulus remains moderate, it would be unwise to be overly optimistic or anticipate a sharp recovery in consumption at this point. (That is to say, choosing the correct companies to invest in is very important. It may not be a broad rally like the tech sector. )

In the upcoming section, I will continue to update the consumption trends in key categories, both offline and online, to analyze the recovery of the general consumption sentiment. I will also cover the sectors and company names that I like to keep under the radar.

Keep reading updates on consumption, like updates of offline catering (Luckin, dairy sector/Mengniu, e-commerce JD/Alibaba, skincare sector Giant biogene/Maogeping, and sportswear Anta/Lululemon, etc.) To get a sense of what is offered, you are welcome to check out this older post in the same series: Charts of the Week. You can also get free access by sharing us.