4 Dos and Dont's to succeed in China's skincare sector

Data-proven winning strategies learned from the decline of Botanee, China’s Avène

Consumers are naturally drawn to fresh concepts and new product lines when it comes to their skincare routines, and therefore companies rely on novel products to steer their growth trajectory forward. However, it’s important to keep in mind that enduring success in the skincare market hinges on a profound understanding of consumer cognition and experiences.

In this post, we will take a deep dive into the winning strategies in China's skincare sector, drawing insights from the journey of Botanee (300957.SZ) – a skincare company that initially outshone overseas competitors like Avene but experienced a rapid decline within a year.

The rise and fall of Botanee

Once, Botanee Biotech (300957.SZ) illuminated the market horizon with a dazzling surge in stock price in mid-2021. Investors flocked to the stock due to its unique position in a burgeoning yet under-penetrated domain: advanced, highly effective skincare with dermatological-grade benefits.

Since 2018, China's dermatological-grade skincare market has experienced a rapid surge, surpassing its US counterpart in 2021 and capturing significant attention. Once dominated by overseas brands such as Avène and La Roche Posay, this landscape saw a transformative shift. A local brand, Winona (contributing over 95% of Botanee's online sales), emerged as the driving force behind this change, catapulting its market share from 10% in 2016 to 21% in 2019, effectively breaking the stranglehold of foreign brands, as per Euromonitor's data.

*Dermatological-grade skincare products are formulations designed to meet dermatologists' high standards, backed by science and rigorous testing for effectiveness and safety. They target various skin concerns and are trusted for their quality and reliability.

Investors were drawn to Winona’s strong brand awareness, high satisfaction and trustworthiness (known for being protective, gentle, and non-irritating) among consumers with sensitive or sensitized skin, along with a strong top-line growth momentum, unique distribution channel within hospitals (recommended by dermatologists) and robust profitability (with over 80% gross profit margin).

Yet, over time, a change occurred. According to BigOne Lab, Botanee's online sales began to slow down in mid-2022, coinciding with the start of its share price decline. Within just a year of its peak, its share price experienced a sharp plummet. This downturn starkly contrasted with the overall consumer discretionary sector and thriving competitors like Proya (603605.SH) (for more on Proya, refer to our earlier note).

In this article, we distill four crucial lessons from Botanee's downturn, offering insights to emerging skincare brands on selecting the right skincare category and efficacies, and effectively showcasing products and concepts to the increasingly “pickier” Chinese customers.

Lesson 1: Mitigate reliance on face mask category

Winona (the core brand of Botanee): Over-reliance on face masks threatens future growth momentum

Face masks tend to have initial popularity due to their affordability and novelty attracts consumer attention. However, the category has inherent limitations. The allure they present tends to be fleeting, lacking sustained customer loyalty, as face masks typically have fewer and lighter efficacies.

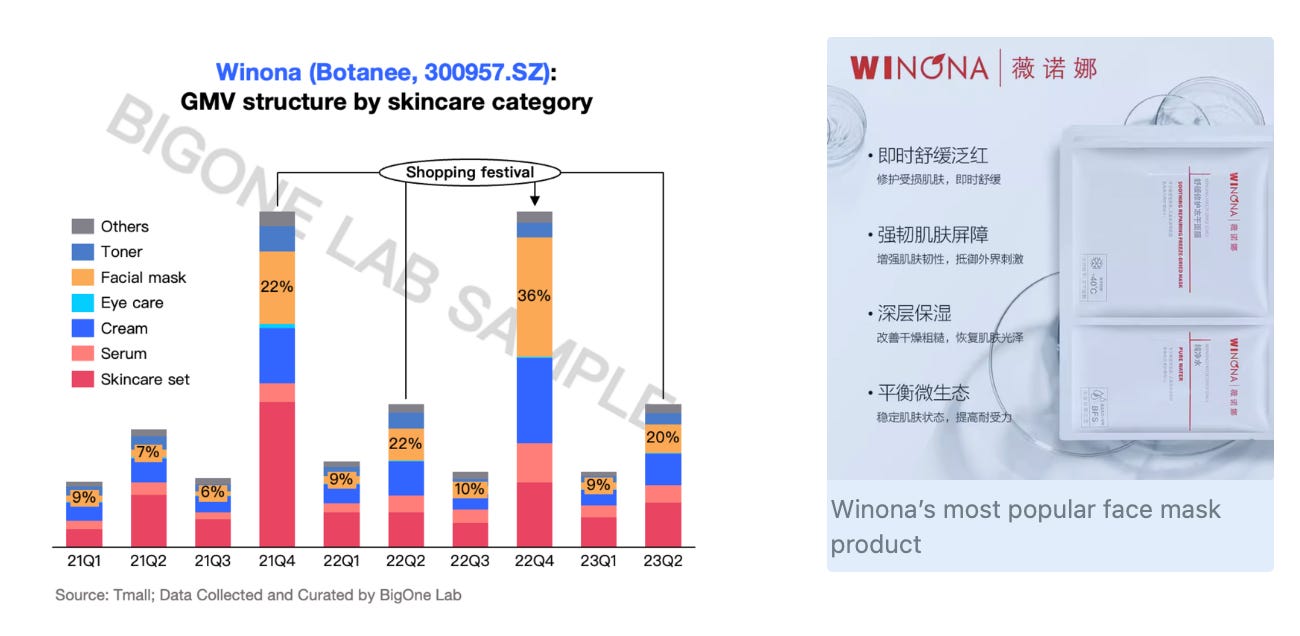

Winona, the core brand of Botanee (300957.SZ), demonstrated a pronounced reliance on face masks, especially during the shopping festivals in Jun and Nov. Sales performance during these months essentially charted the course of the brand's annual sales landscape. Specifically, online sales for the skincare category in Jun and Nov collectively accounted for a remarkable 32% of the entire year's GMV in 2022, according to BigOne Lab tracked e-commerce data.

This heightened dependence on face masks, consequently, exposed the brand to the volatility stemming from ever-changing consumer preferences.

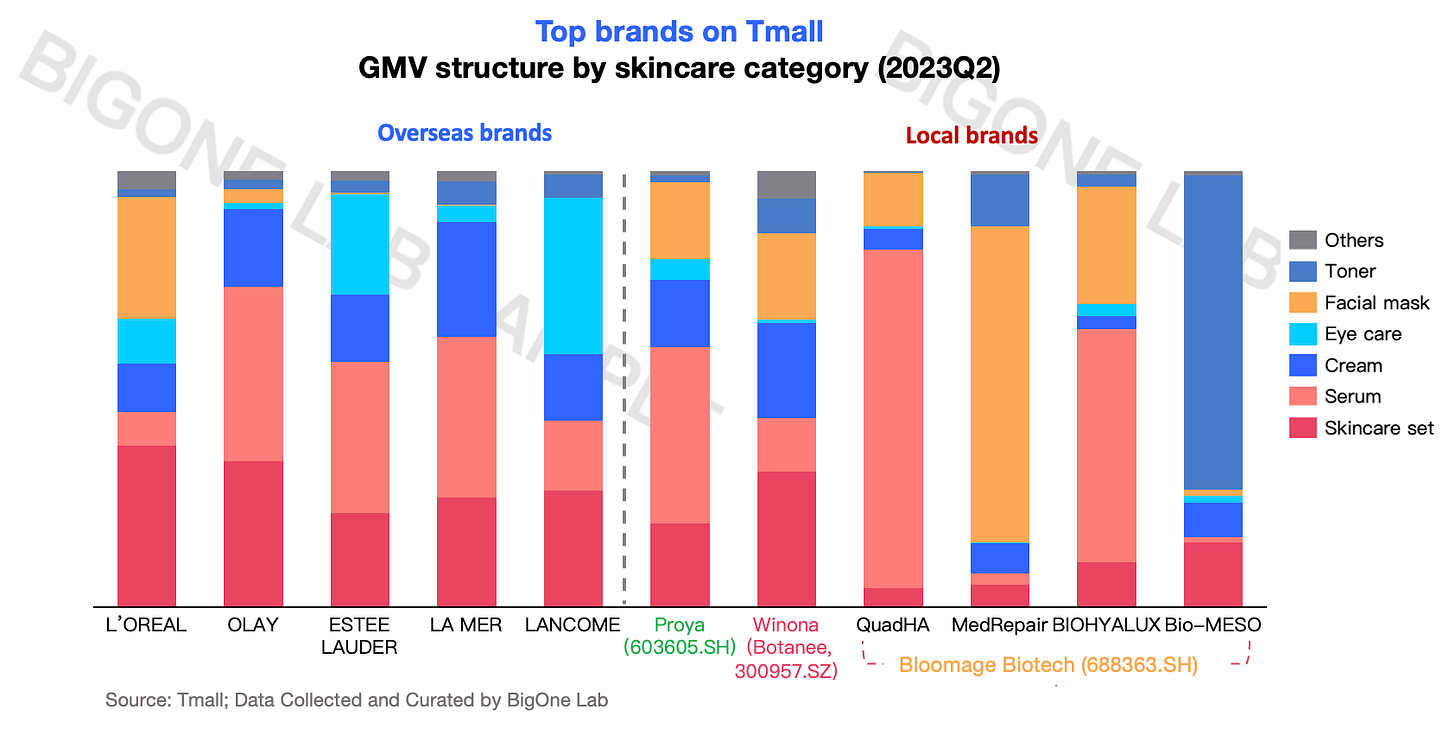

Better performers: A more balanced and stabler spectrum of categories

More established overseas brands like Lancome or Estee Lauder maintain a well-balanced and stabler GMV structure across various categories, signifying a more robust and enduring market presence.

Chinese consumers are extremely discerning and well-informed when it comes to skincare products. While one might assume that launching specific product lines targeting "anti-aging" would be sufficient, this isn't nearly enough to stand out. Even products formulated for "hydration," "soothing," and "repair" may seem specialized, but it's essential to recognize that these consumers meticulously analyze the ingredients of a product. When opting for an "anti-aging" solution, they delve deep, comparing myriad functional ingredients targeting the same issue, and are astutely aware of how each formula might cater to their skin type. (Yes, they do read the product package and understand what each ingredient does.)

When it comes to marketing, the key, however, is in crafting a straightforward yet unforgettable brand message that encapsulates the product's complexity and the nuances of its ingredients. In the subsequent article, we will unravel critical strategies to thrive in China's cosmetic domain:

What forms of product innovation genuinely resonate with Chinese consumers, prompting them to pay a premium?

How can you sculpt a second growth trajectory around best-selling products?

Which marketing approaches, in terms of messaging, branding, packaging, and promotions, might backfire, and what are the advisable alternatives?

Backed by extensive sales data and consumer sentiments gleaned from Chinese social media, you will discover precisely what kinds of product lines, packaging, and marketing language are proven to succeed (and those that you should avoid using). Continue reading for our detailed case studies exploring Botanee and Proya to find out more.

LAST DAY to secure our limited-time discount for a 1-year subscription! Click the button below to take the offer.