Goliath vs. David: How homegrown PROYA disrupts L'Oreal's dominance in Chinese beauty industry

A deep dive into how local skincare brands better cater to the diversified demands of Chinese consumers and leverage live streaming e-commerce channels to achieve sustainable growth

In the fiercely competitive landscape of the Chinese beauty industry, where international giants have long held dominance, a wave of homegrown Davids has emerged, challenging the established order. These local brands have been steadily gaining market share, successfully taking on the once-unassailable overseas brands from Europe, the US, Japan, and Korea.

Among them, PROYA (珀莱雅)(SHA:603605) has emerged as a standout player, overcoming initial criticism regarding its Chinese name similarity to the international giant L'Oréal (欧莱雅) (OTCMKTS: LRLCY). During this year's 618 shopping festival* pre-sale phase, PROYA showcased its mettle by surpassing L'Oréal in both GMV levels and growth rate, firmly establishing itself as a formidable competitor within the Chinese beauty industry.

*Similar to Black Friday or Cyber Monday, the 618 shopping festival is an annual retail event in China's e-commerce that takes place on June 18th, with its presale phase starting as early as the end of May.

By strategically targeting niche markets and catering to the evolving demands of Chinese consumers, PROYA has successfully avoided direct competition with international brands while establishing a strong foothold in the industry. Furthermore, its early adoption of live-streaming e-commerce has propelled its growth and solidified its position as an industry leader. In this article, we delve into the strategies that have propelled PROYA's success, showcasing its ability to navigate a fragmented market and leverage new sales channels.

The evolution of skincare for Chinese consumers: a journey of sophistication and discernment

Chinese consumers are becoming increasingly savvy and discerning in their choices. Gone are the days of relying solely on brand reputation or marketing hype. Today, Chinese consumers are getting smarter and pickier, demanding skincare products that not only deliver effective results but also cater to their specific needs and preferences. According to Accenture, 58% of Chinses consumers valued efficacy and ingredients, while only 29% of them claimed that they considered brand names when purchasing cosmetic products.

Chinese consumers have become increasingly knowledgeable about skincare ingredients and their effectiveness, leading to more specific and diverse demands when addressing particular skin concerns. On Xiaohongshu, a prominent social media platform for product recommendations and sharing in the beauty and lifestyle fields, various skincare "jargons" have gained popularity within the community.

One such example is "早C晚A" or "Using products with Vitamin C in the morning and Vitamin A at night," which has become a common practice in skincare routines and a well-known term on Xiaohongshu.

The popularity of "早C晚A" can be attributed to its practical reasoning. The use of Vitamin C in the morning provides antioxidant protection throughout the day while incorporating Vitamin A (Retinol) at night allows for its rejuvenating effects without the risk of increased sun sensitivity. By following this timing, individuals can maximize the benefits of both ingredients in their skincare regimen.

The appeal of skincare jargon lies in its concise and memorable nature, contributing to its widespread adoption within the skincare community. Chinese consumers not only comprehend the intricate reasoning behind these jargons but are also willing to incorporate them into their routines; more importantly, pay for it.

Local vs overseas: competitive differentiation

1) Differentiation in Efficacy

Advanced efficacy (anti-aging, spot lightening, and whitening) has high R&D barriers and strong user stickiness, representing the core product competitiveness of the brand.

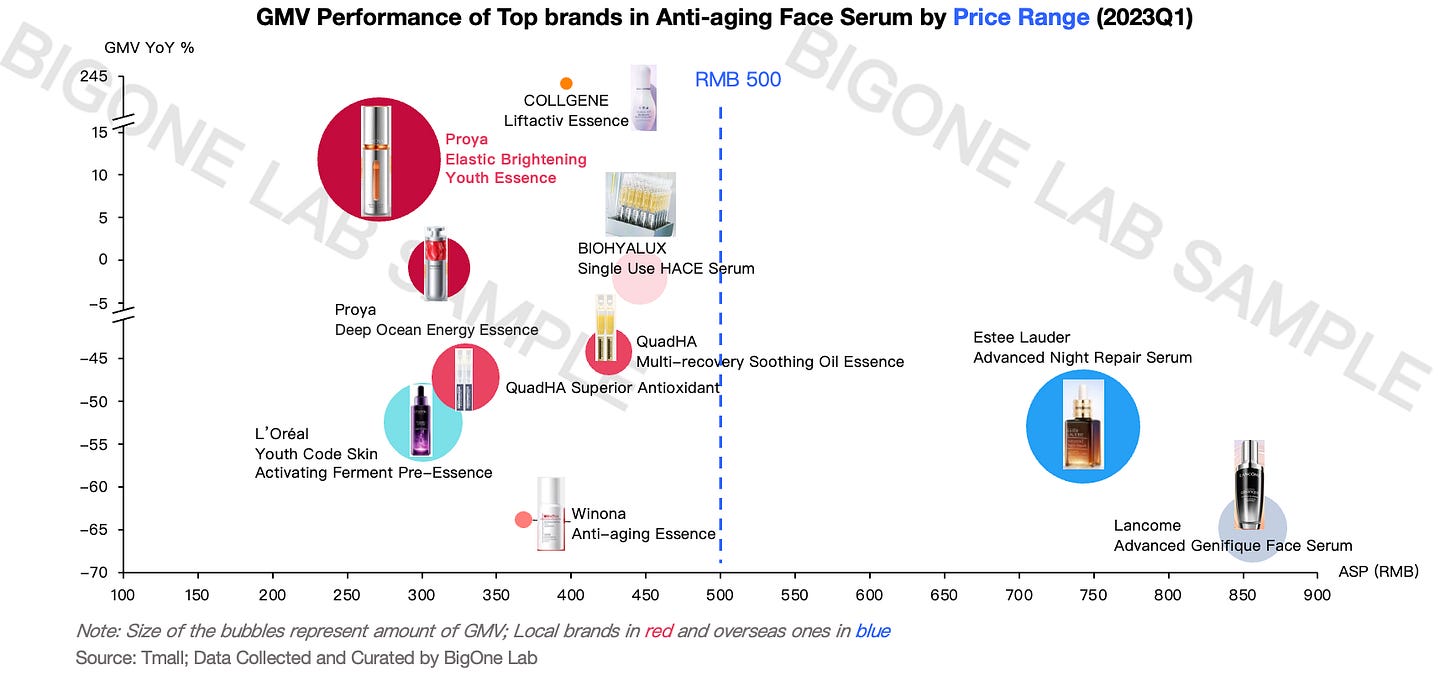

Looking at the left chart, overseas big brands contribute higher GMV through their offerings of advanced efficacies like anti-aging and brightening. On the other hand, local brands excel in delivering basic efficacies such as hydration and anti-sensitivity, which form a larger portion of their sales. However, PROYA emerges as a shining star, even in the anti-aging category typically dominated by overseas brands, as depicted in the right chart.

Local players are focusing on the mid-range price segment (below RMB 500), avoiding direct competition with overseas giants. PROYA stands out with robust growth momentum and a high sales level which is on par with renowned overseas brands, such as Estee Lauder Advanced Night Repair Serum.

Local players like PROYA provide consumers with accessible and cost-effective options to obtain anti-aging benefits, reaching a larger audience. Furthermore, they offered more detailed skin solutions for specific skin issues, which better cater to the increasingly diversified demands of Chinese consumers.

2) Differentiation in Sales Channel

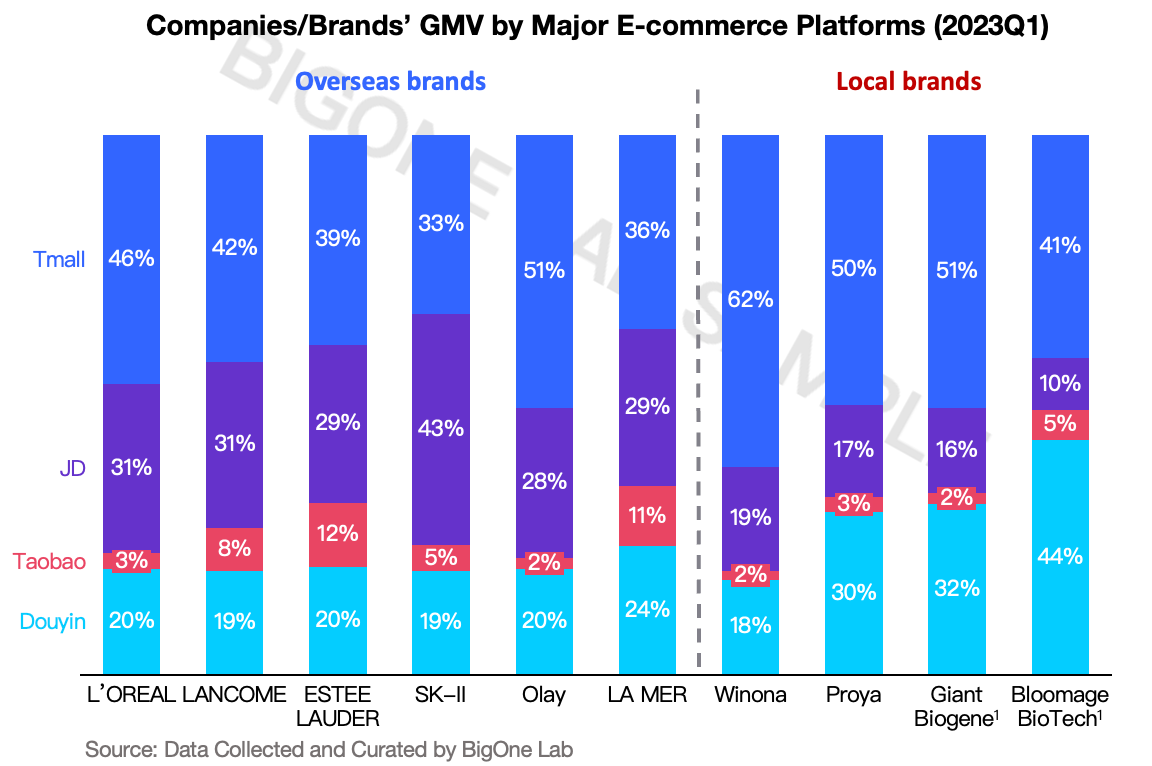

Live-streaming platforms, like Douyin, have emerged as the primary catalyst for the growth of the skincare industry. In particular, skincare consumption on Douyin experienced a significant rebound in the first quarter of 2023, while other major e-commerce platforms, such as Tmall and JD, lagged in recovery. Douyin's unique format of interactive and engaging live broadcasts has proven to be a powerful tool for brands to connect with their target audience and drive sales growth.

Local brands have gained a competitive advantage in the new sales channel by being early adopters and leveraging the benefits of live-streaming e-commerce. They have tapped into this emerging trend earlier than their overseas counterparts, allowing them to capitalize on the initial surge of traffic and engagement associated with live-streaming platforms. This early-mover advantage has provided local brands with a head start in building brand awareness, expanding their customer base, and generating sales through this dynamic and interactive sales channel.

How does PROYA succeed?

1) An active player in a fragmented market, excelling with product strategies

PROYA has achieved success through its proactive approach in a fragmented market, employing effective product strategies. Here are some key factors that have contributed to their accomplishments:

Niche market focus: PROYA identified a niche market segment and developed its flagship product, the "Elastic Brightening Youth Essence", which emphasizes anti-oxidation and anti-glycation properties. By carving out a unique position in the market, PROYA has avoided direct competition with overseas giants and established a distinct brand identity.

Continuous product upgrades: PROYA demonstrates a commitment to product improvement by actively upgrading its existing offerings. The introduction of the second generation of the essence product, featuring upgraded ingredients, formulations, and technologies, has garnered significant popularity. This has translated into both increased sales volume and higher selling prices, indicating consumer satisfaction and recognition of the brand's efforts.

Riding the Waves of Buzz and Buzzwords: PROYA has effectively capitalized on emerging skincare concepts and jargons, such as the "早C晚A" skincare set. This product gained significant attention and traction on social media platforms in late 2022. Despite the initial hype fading, PROYA has sustained its growth momentum in sales. The sales boom of skincare sets has pushed up the brand's average selling price, which rose from RMB 124 in 2021Q1 to RMB 202 in 2023Q1.

2) An earlier adopter of live-streaming e-commerce

PROYA entered the Douyin channel as early as 2020Q4. Leveraging the power of Key Opinion Leader (KOL) live streaming, the brand witnessed remarkable sales growth.

However, recognizing the potential for further expansion, PROYA took decisive action to adopt self-broadcasting. By enhancing its own live streaming capabilities since 2021Q1, the brand successfully alleviated the reliance on KOLs for revenue allocation, and retained greater control over its sales process for more sustained growth.

In comparison, overseas brands adopted self-broadcasting relatively later than their local industry peers, and they rely more on KOL live streaming, which is a "pay for growth" strategy and comes with risks. For example, Estee Lauder's sales dropped drastically since 2022Q3 when KOL activities were halted.

My take

Local skincare brands were dismissed as cheap imitations or ineffective alternatives to their overseas counterparts in the past years. However, the emergence of brands like PROYA has shattered these preconceptions, demonstrating that local players have the capability to meet the unmet demands of consumers that have long been overlooked by international giants. Personally, when I think about why I purchase PROYA products, it's not just about the comfortable and soothing sensations on my skin (which is not too bad), but also about a sense of alignment with their shared values, as well as the collective consumer experience with my fellow friends, netizens and KOLs.

The PROYAs are highly attuned to the prevailing societal shifts in China, such as the awakening of women's consciousness, the adoption of self-care lifestyles, and the rise of well-educated consumers. On 2022 Women's Day, PROYA produced a short film called "Awakening Lioness", performed by the all-female lion dance troupe from Guangzhou (Traditionally it's performed by male dancers). With the slogan of "Gender is not the boundary, prejudice is", they encourage women to push boundaries further and write their own stories.

Homegrown brands recognize and integrate the prevailing social trends into their product design and marketing expressions, thus fostering brand recognition and cultivating a deep sense of trust among local consumers.

Related Reads

Charts of Week - China E-comm giants facing new competitions; Industry leaders to watch in April

Local company Proya (SHA: 603605) delivered resilient results in Q1 2023, despite an overall slow recovery.

Both multinational cosmetics corporations, L'Oreal (OTCMKTS: LRLCY) and Estee Lauder (NYSE: EL), experienced negative growth in online sales in March. In contrast, local cosmetics maker Proya delivered a 30% year-on-year growth in March, continuing its strong sales momentum since the second half of 2022.

Proya, listed on the Shanghai Exchange, has achieved a return of over 760% since the company went public in 2017.

China's 2023 Luxury Consumption in 5 Keywords

Cosmetics are still under pressure, while leather goods, jewelry and skin-care are rebounding.

According to BigOne Lab’s data on online sales via Tmall and JD, the LVMH group's sales of facial skin care products and body care products increased by 6% and 39% year-on-year, respectively. However, sales of makeup declined by 19% year-on-year. Makeup and perfume sales (via online channels) remained broadly weak for luxurious brands in 2023 Q1.