Disclaimer: This post is not sponsored by Chagee. I do not own Chagee shares, but I do drink 2–3 cups of Chagee per month.

Back in July, I wrote about how Chagee was selling caffeine “the Chinese way,” and its ambition to become the “high-end” tea brand in China—much like Starbucks is to coffee. I noted that while Starbucks was struggling with poor localization and declining “price-for-value,” Chagee had captured the “ancestral blood awakening” of Gen Z consumers who were rediscovering tea as a healthier, cooler alternative to coffee.

The irony today is thick enough to chew on. As we enter 2026, both the “master” (Starbucks) and the “apprentice” (Chagee) are running into the same wall in China. What was once a race to define premium branding in coffee and tea has devolved into a cut-throat fight for survival.

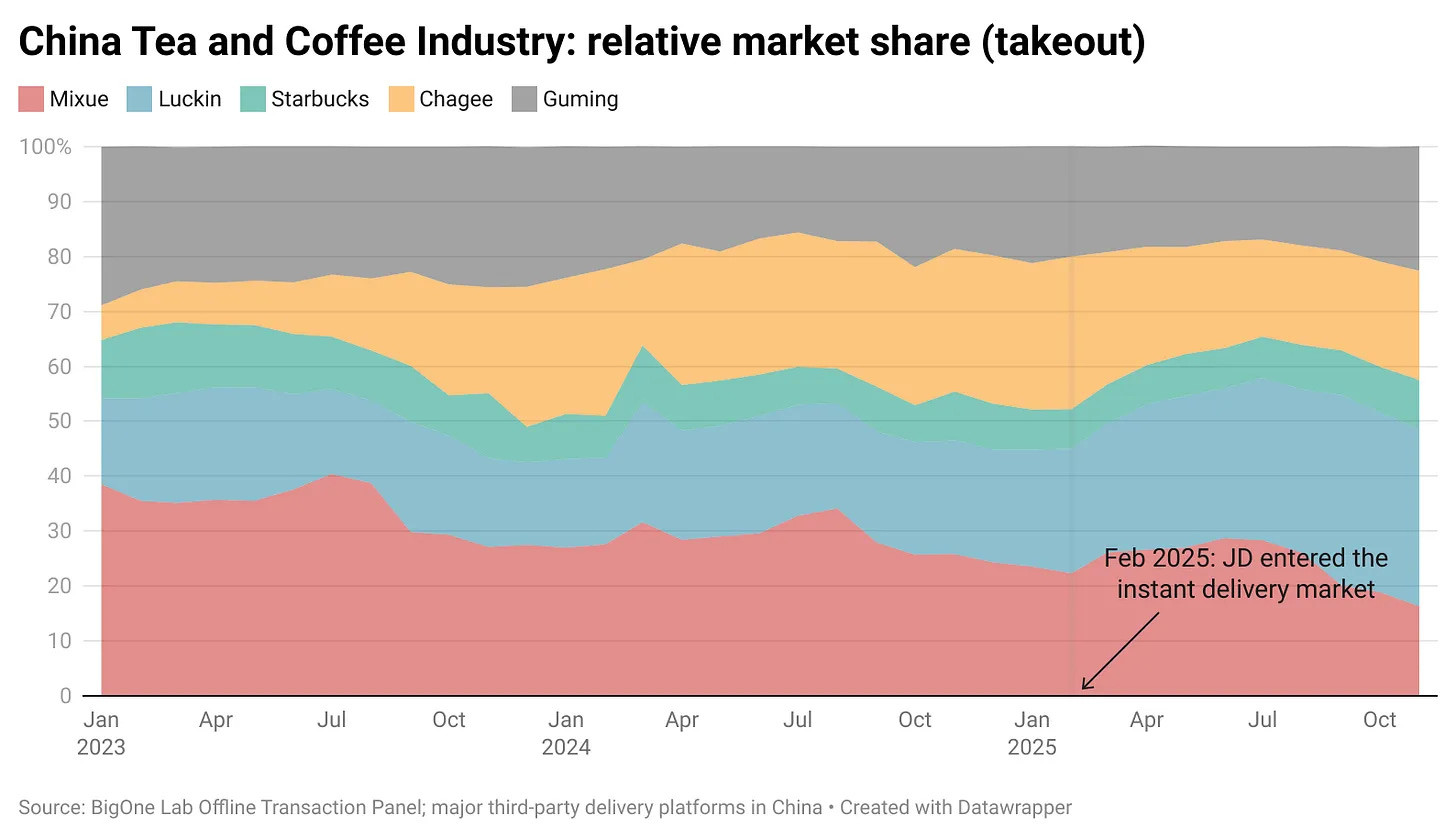

In 2025, China’s food delivery platforms entered into a fierce price war. With massive subsidies flooding the system, coffee and tea brands emerged as the biggest beneficiaries: consumers rushed to order beverages for delivery at steep discounts—to the point where “zero-yuan milk tea” briefly became a reality.

Chagee and Starbucks, however, took a more principled—and ultimately painful—stance. Both brands largely refused to join the subsidy bloodbath in order to protect their premium positioning. The outcome was mixed. By November 2025, Chagee’s relative takeout market share had fallen sharply. Meanwhile, peers such as Luckin used subsidies to aggressively expand, and Starbucks—despite also staying out of the price war—managed to retain comparatively greater resilience in market share.

Chagee’s PR Crisis: Crossing the Red Lines

If the recent numbers weren’t bad enough, a series of PR crises has begun to erode Chagee’s premium branding.

In December, Chinese social media erupted over Chagee’s high caffeine content after a prominent KOL claimed that some of its teas, due to their caffeine concentration, were “edging toward drugs 蹭准毒品”. Even before this incident, it was not uncommon to see consumers sharing experiences online about difficulty sleeping or heart palpitations after drinking Chagee’s tea. Most of these discussions were anecdotal and hard to verify—personally, I’ve never experienced such effects, though I know people who have—but the KOL’s remarks pushed the controversy to an entirely different level.

In China’s historical and cultural context, “drugs” is an absolute red line—and the comparison clearly struck a nerve with consumers. Chagee’s caffeine levels—roughly 117 mg in a 600 ml cup—remain well within accepted adult safety limits, regardless of consumers’ subjective experiences. Yet, whether due to quality-control issues or something else, the brand has gotten this reputation, and the mere association with “drugs” was enough to damage the image of a brand that markets itself as “clean” and “low-burden.”

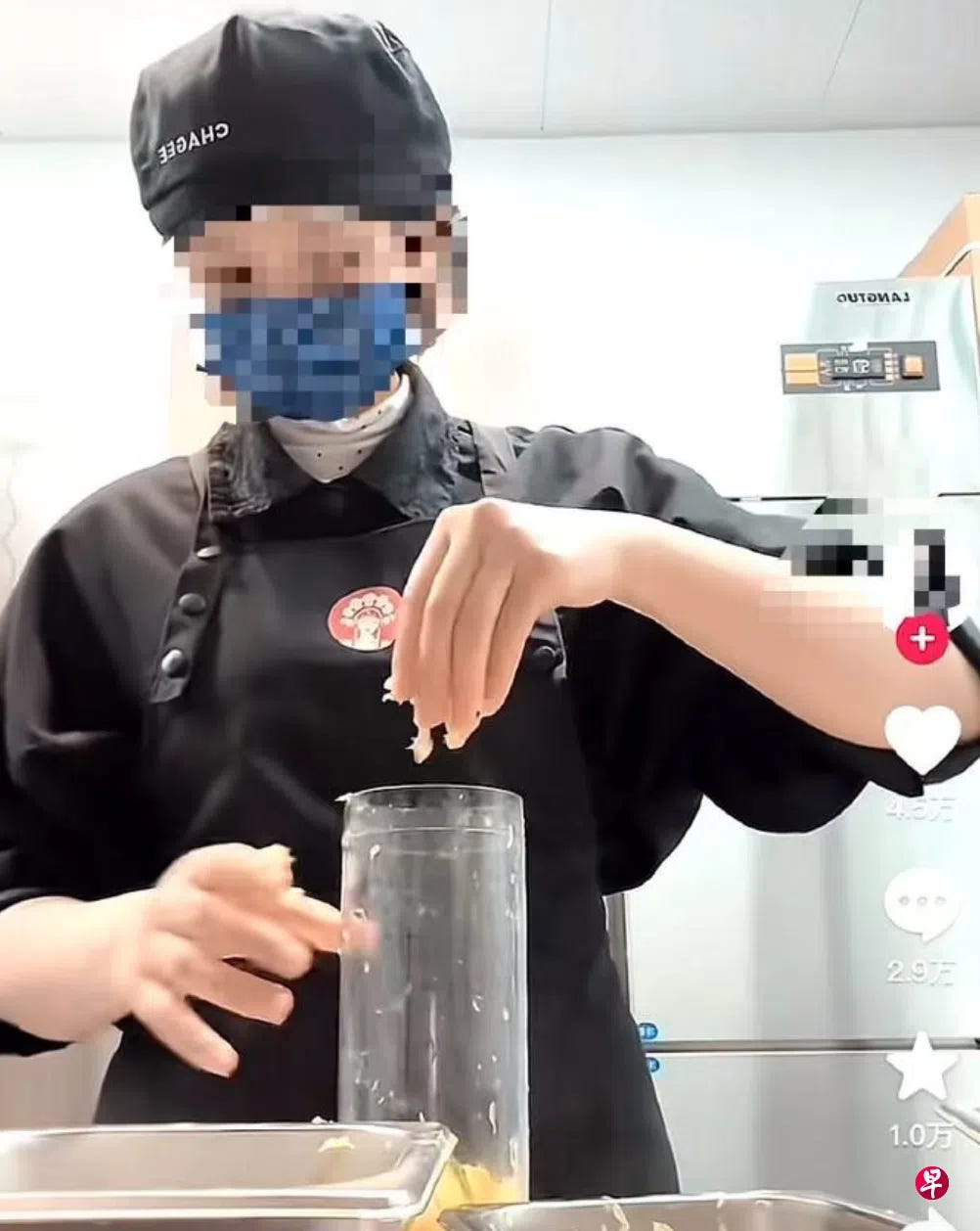

To make matters worse, a viral livestream days later showed a Chagee employee preparing drinks with her bare hands. For a brand that charges a premium, this single moment delivered a visceral blow to consumer trust.

The IPO Aftermath: A Turnaround or a Trap?

Since Chagee’s high-profile NASDAQ debut in April 2025, Chagee’s stock has been in a freefall, losing 60% of its value.

Now it’s time to ask the hard question: What went wrong? Is the “Starbucks of Tea” narrative dead, or is there a turnaround story?

The High-End vs. Mass-Market Trap

Chagee, often positioned as the “Chinese student” of Starbucks, has closely mirrored the coffee giant’s strategy by targeting white-collar professionals in premium shopping malls. While mass-market competitors are shrinking their store footprints to cut costs, Chagee has doubled down on the idea of the “Third Space”—the zone between home and work where people are meant to linger.

To reinforce this positioning, Chagee has moved beyond its standard 60–80 square-meter stores and begun opening oversized “Super Tea Warehouses.” One example is its roughly 1,000-square-meter flagship in Hong Kong, designed to cement its premium image. These locations function less as beverage outlets and more as brand-experience teahouses, leaning heavily on cultural storytelling: wood-toned interiors, seal-script wall designs, and high-end decorative installations inspired by Tang-dynasty tri-color Sancai glazes. The underlying bet is to reframe tea as a “lifestyle” product rather than a simple drink, capturing high-frequency moments such as office tea breaks.

Yet this commitment to high-end positioning has unfortunately left both Chagee and Starbucks trailing their peers in a deflationary market. While I’ve previously argued that Chinese consumers are indeed spending more on “experiences” and “lifestyle,” drinking tea is rarely perceived as one of them. For most Chinese consumers, tea remains a functional staple—not an experiential indulgence. Chagee’s 15–22 RMB price range makes it “expensive” in a deflationary environment.

Seen this way, the struggle is less about “foreign” versus “domestic” brands, and far more about a structural mismatch between high-end positioning and a market that is trading down.

Why Chagee Wins Abroad While Stalling at Home?

While Chagee’s domestic performance is facing a squeeze, its overseas performance tells a completely different story. In 3Q25, Chagee’s overseas GMV surged by 75.3% year-over-year, reaching RMB 300 million. Its network outside Greater China expanded to 262 stores, with Malaysia alone accounting for 196 locations.

This raises an interesting question: Why is a brand that is struggling to hold onto market share in China finding such traction abroad?

You can also get free access by sharing us. If you find our content helpful, please consider getting a paid subscription to access the exclusive benefits for Baiguan paying subscribers.