Winners and Losers of China’s Delivery Platform Price War - Charts of the Week

Luckin, Starbucks, Mixue, Chagee, Guming—Who Takes the Lead?

“Charts of the Week” is Baiguan’s series that features key data points to help you quickly grasp the general state of affairs in China in just a few minutes. We handpick the highlights of the data charts from a variety of sources, analyzing and delivering insights trusted by 100+ top institutional and corporate clients worldwide at BigOne Lab.

Price Wars Cool Down as In-Store Shopping Returns

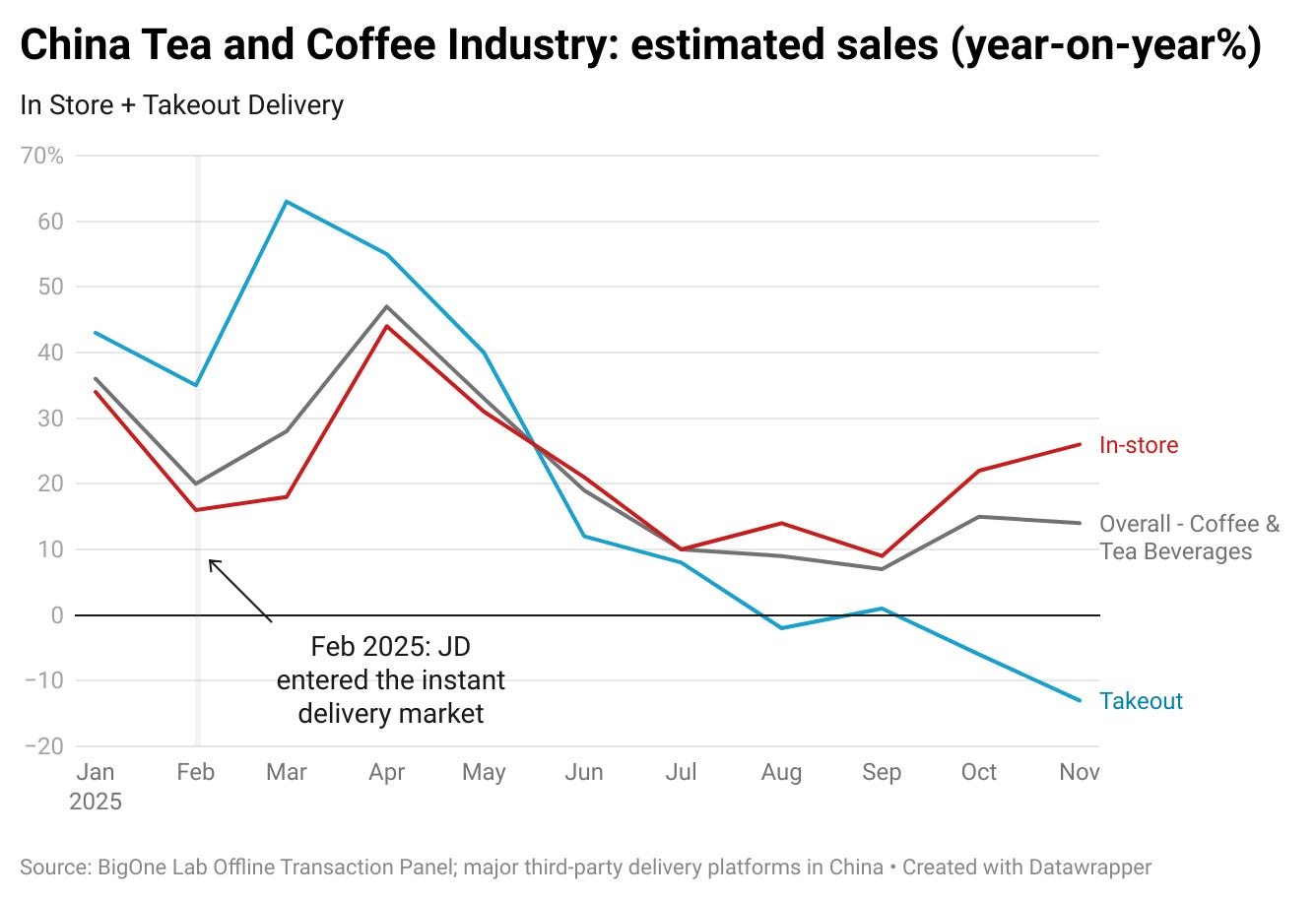

The price war among Chinese instant delivery platforms began in early 2025 when JD entered the race, intensifying through the summer as Meituan and Eleme joined the fray. While this initially created a massive spike in takeout demand, the momentum has since collapsed as prices returned toward normalization in the second half of the year.

Earlier this year, competition became so intense that consumers could occasionally get bubble tea for virtually zero yuan through platform subsidies. While this was clearly a lose-lose situation for delivery platforms, food and beverage chains benefited from the subsidy war as consumers rushed onto takeout platforms.

Coffee and tea brands were the biggest beneficiaries of these price wars. In today’s newsletter, we examine the performance of five major coffee and tea chains—Luckin (OTCMKTS: LKNCY), Starbucks (NASDAQ: SBUX), Mixue (2097 HK), Chagee (NASDAQ: CHA), and Guming (1364 HK). Together, these companies account for a large share of China’s overall coffee and tea market. Using data up to November this year, we analyze their performance and assess who emerged as winners—and losers—in the subsidy war.

My colleague and I have also examined the impact of the subsidy war on delivery platforms in earlier newsletters. Interested readers can find our analysis here:

For today’s newsletter, we use BigOne Lab’s offline transaction panel data, along with tracked takeout data from major platforms (Meituan and Eleme), to analyze performance across both in-store and delivery channels. Historically, this dataset has allowed us to track sales growth trends with a high degree of accuracy.

The price erosion

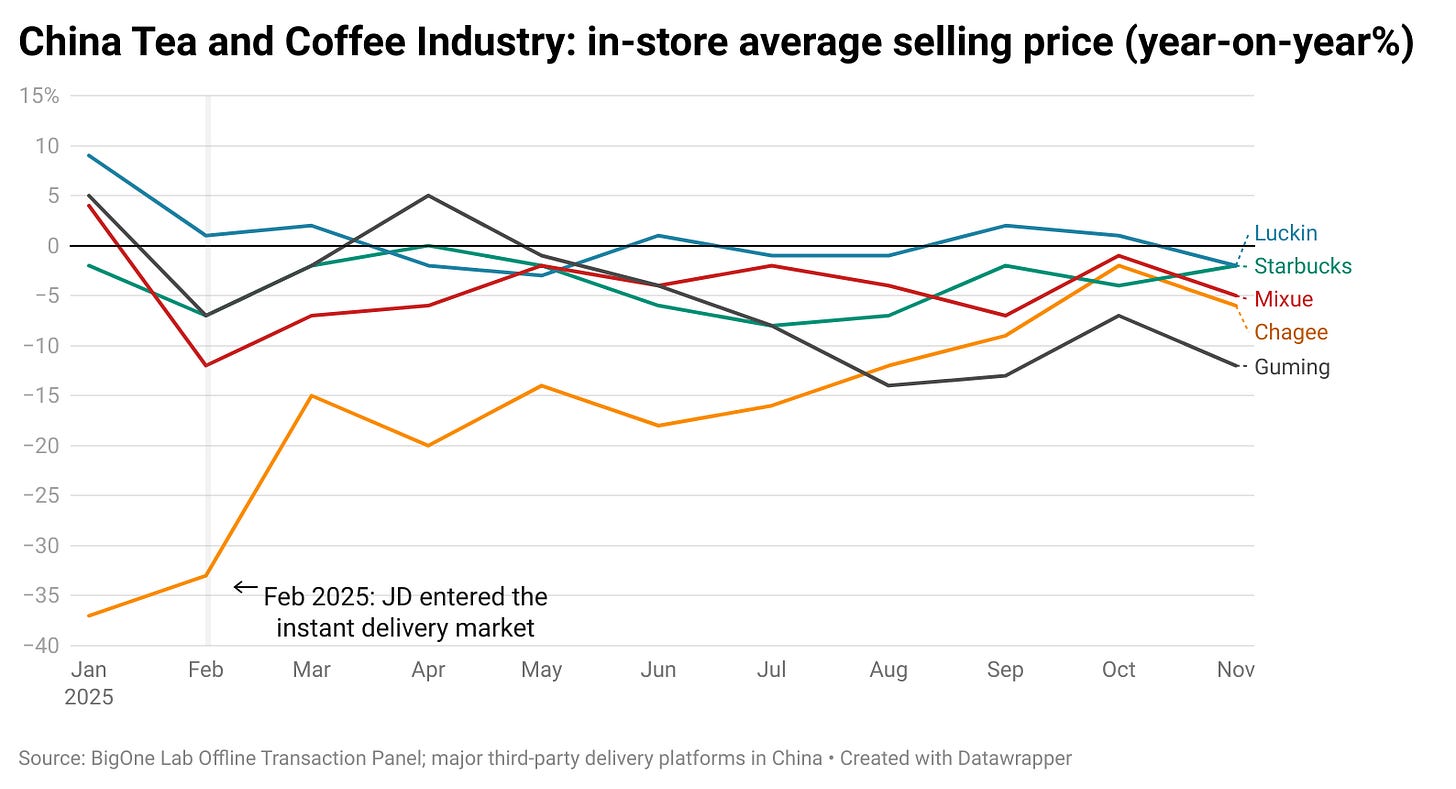

Amid cut-throat market competition, most brands have already seen their in-store average selling prices (ASPs) contract over the course of the year.

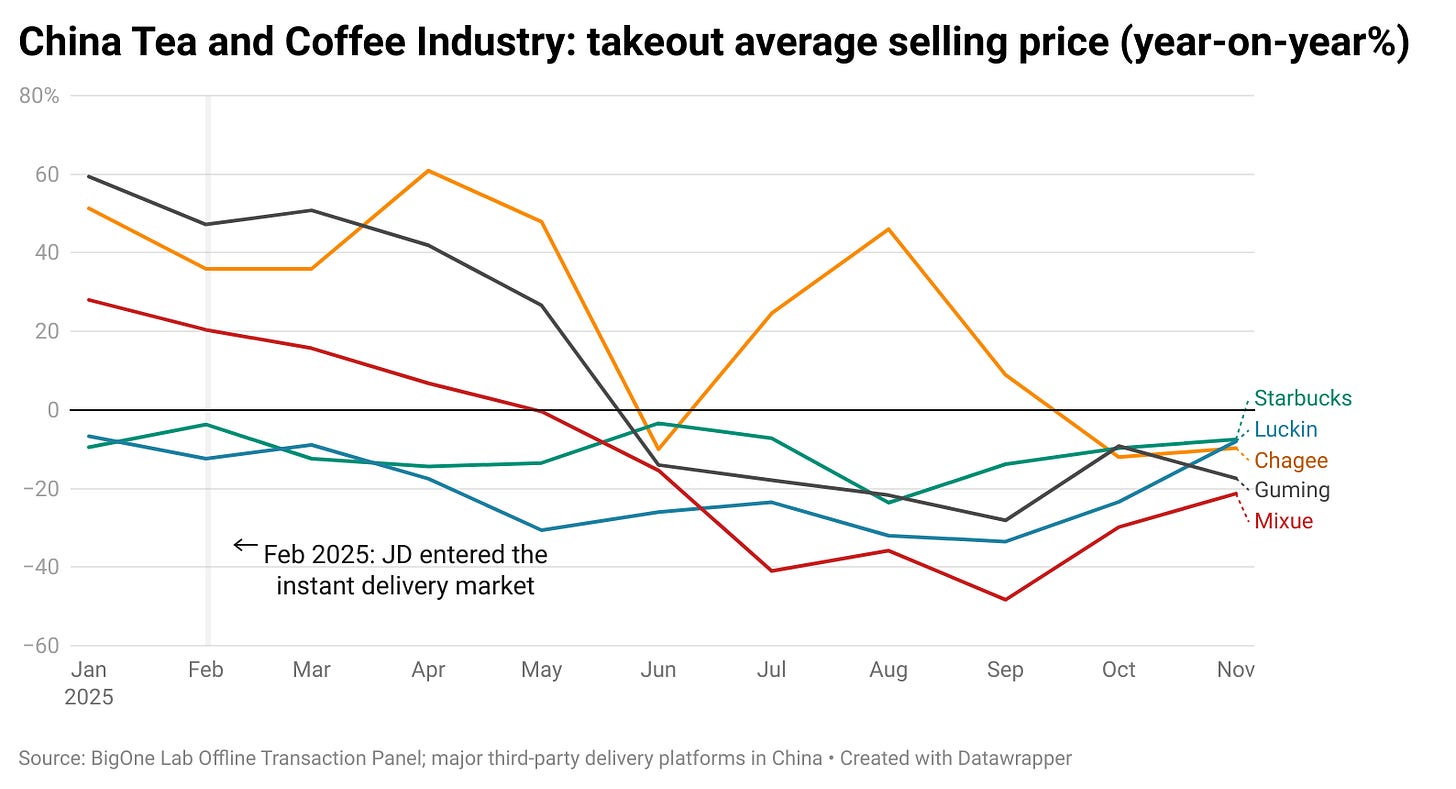

The takeout market tells a more dramatic story. Following JD’s entry, takeout ASPs for most beverage brands fell sharply. In contrast, Chagee and Starbucks largely stayed out of the subsidy war, keeping their pricing relatively stable compared with other brands.

Behind the paywall:

Chart 4: relative market share for 5 coffee & tea beverage brands (in-store)

Chart 5: relative market share for 5 coffee & tea beverage brands (take-out platforms)

Chart 6: estimated sales growth for 5 coffee & tea beverages brands (in-store)

Chart 7: estimated sales growth for 5 coffee & tea beverages brands (take-out platforms)

To get a sense of what is offered, you are welcome to check out this older post in the same series: Is Laopu Gold’s Rally Over? 6 Charts on Recent Performance — Charts of the Week. You can also get free access by sharing us.