Charts of Week - China E-comm giants facing new competitions; Industry leaders to watch in April

An overview of major players in e-commerce, restaurants, sportswear, cosmetics, health supplements, and online recruitment platforms

Week of Apr.24, 2023

This edition of "Charts of the Week" offers an overview of important events involving major players in various industries, using BigOne Lab's proprietary data.We have selected the top companies you should pay attention to from the 4,000+ publicly listed companies we track.

Disclaimer: The purpose of this article is to provide an overview of the industry leaders in China and is not intended to constitute individual investment advice. This is not a recommendation to buy or sell stocks.

Tickers / companies covered in this issue:

BABA

JD

Douyin

Kuaishou

Pinduoduo

Meituan

Luckin Coffee

Sportswear sector: Anta, Nike, Lululemon etc.

Cosmetics sector: Proya, L’oreal, Estee Lauder

Health supplements: By-Health, Swisse

Boss Zhipin

China's E-commerce competitive landscape

As we have previously discussed, the recent announcement of restructuring by BABA (NYSE: BABA) and JD (NASDAQ: JD) will require investors to carefully review the competitive landscape. Two significant changes are taking place in the Chinese e-commerce industry, which present challenges for e-commerce giants BABA and JD.

Threat 1: The Rise of Live-Streaming E-commerce poses threats to e-commerce giants BABA and JD, especially in Clothing, Bag & Accessories Categories

Douyin and Kuaishou (HK:1024), which originally started out as live-streaming platforms, have rapidly expanded their live-streaming e-commerce business over the past three years. As a result, the combined market share of Douyin and Kuaishou among the four e-commerce leaders has grown from 14% in Q1 2021 to over 30% in Q1 2023.

*Note on Taobao & Pinduoduo data: At BigOne Lab / Baiguan we can only provide what we can feel comfortable about. For the platforms listed here, we are able to track virtually all of the merchants on the platform. However, for Taobao we can only limit ourselves to larger merchants due to technical constraints, and we do not have reliable way to extrapolate the whole platform from this sample as we do not know how large the long tail is. That's the same reason why we do not publish data on Pinduoduo as well. However, as we do track large merchants on Taobao, we can provide merchant-level / brand-level data upon request.

Moreover, Douyin and Kuaishou have sustained healthy growth in gross merchandise sales.

In Q1 2023, the year-on-year sales growth of Douyin and Kuaishou reached 39% and 35%, respectively, while the e-commerce giants Tmall and JD reported negative growth.

Live shopping platforms have gained an edge in categories that require highly personalized marketing and branding, such as bags, accessories, clothing, jewelry, and gifts, due to their interactive ways of promoting items and interest-based recommendation algorithms.

In the first quarter of 2023, Douyin's sales surpassed Tmall in the Clothing and Bags & Accessories categories.

The gap between Douyin and Tmall is also shrinking in categories such as Jewelry & Gifts and Personal Care & Makeup, with Douyin now delivering approximately 70% of Tmall's sales in these categories.

Threat 2: JD (NASDAQ: JD) is facing threats from Pinduoduo (NASDAQ: PDD) as the latter's competitive pricing eats into China's e-commerce market

To counter this, JD launched a "10 Billion Yuan" subsidy program in March. According to BigOne Lab's data, this program contributed to around 5% of JD's overall March sales. Subsidized products are mainly concentrated in the 3C Products and Home Appliances categories, accounting for approximately 13% and 8% of the total sales of these categories, respectively.

According to data from BigOne Lab, the average net prices for JD's heavily subsidized categories, after discounts, in March were slightly higher than those of Pinduoduo's product categories.

Companies benefiting from the strong recovery of offline consumption - A highlight

Meituan (HK:3690)

Meituan posted strong growth in Q1 2023, with the number of food delivery orders increasing by 24% year-on-year.

Luckin Coffee (OTCMKTS: LKNCY) recorded a 190% year-on-year increase in Meituan orders in Q1 2023

According to data from BigOne Lab, coffee and tea shops are some of the strongest offline businesses that have bounced back from the Covid lockdown. The number of stores in operation has increased by over 20% year-on-year. Coffee giant Luckin recorded solid sales in Q1 2023, indicating a strong start to the year.

Historically, we have observed that Luckin's total sales on Meituan are highly correlated with the company's total revenue, representing an average of 12% of the total revenue.

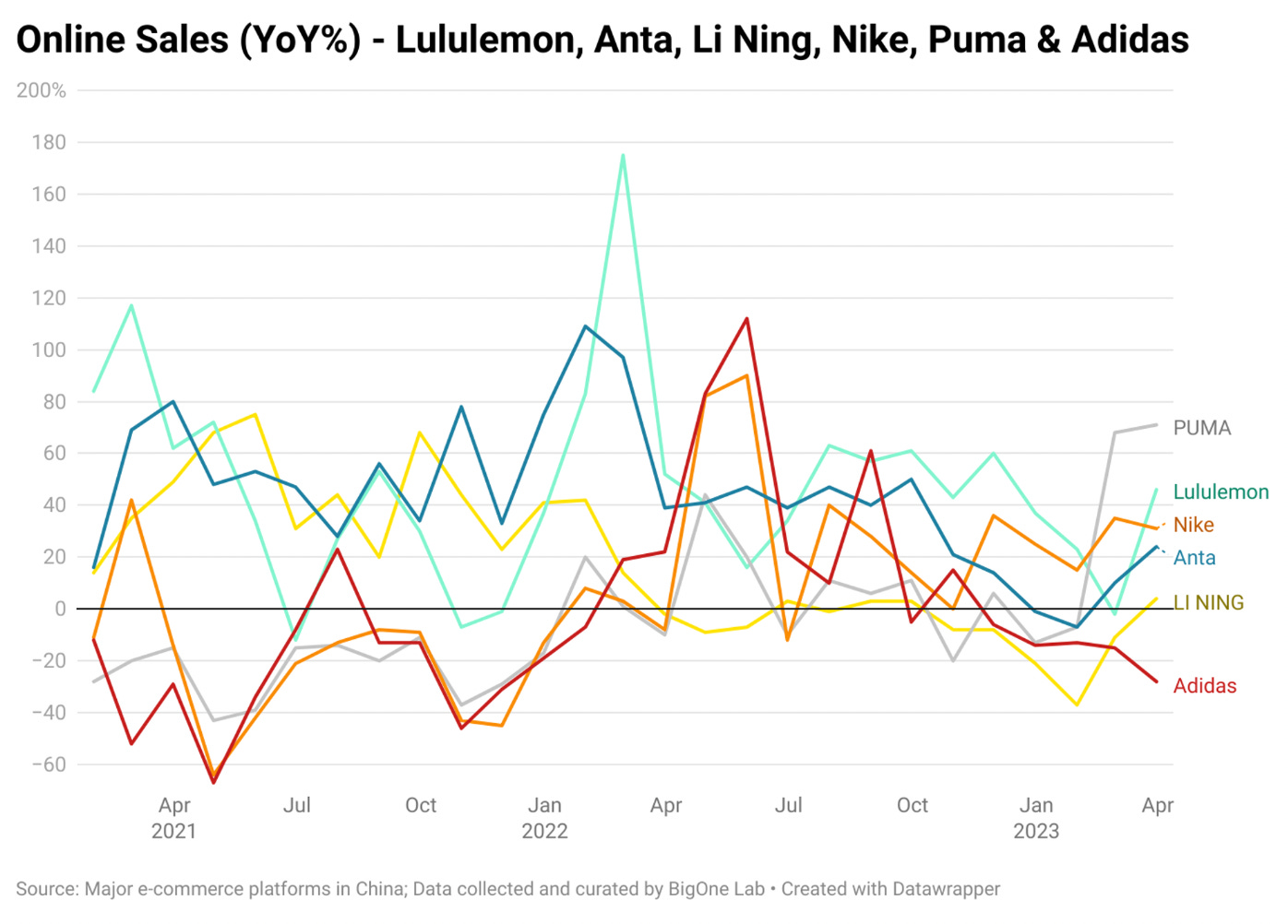

Sportswear: the strongest category to bounce back from Covid in March

According to BigOne Lab's data, the clothing category saw the fastest rebound in online consumption in March, with sales increasing 22% year-on-year. Among all subcategories, sportswear had the highest growth rate of online sales, with a 43% YoY increase.

In March, sportswear giants Anta (HK:02020) and Nike (NYSE:NKE) posted strong recovery, with their online sales increasing by 24% and 31% year-on-year, respectively. Anta, in particular, has been steadily increasing its market share over the year and has now surpassed Nike and Adidas through online channels.

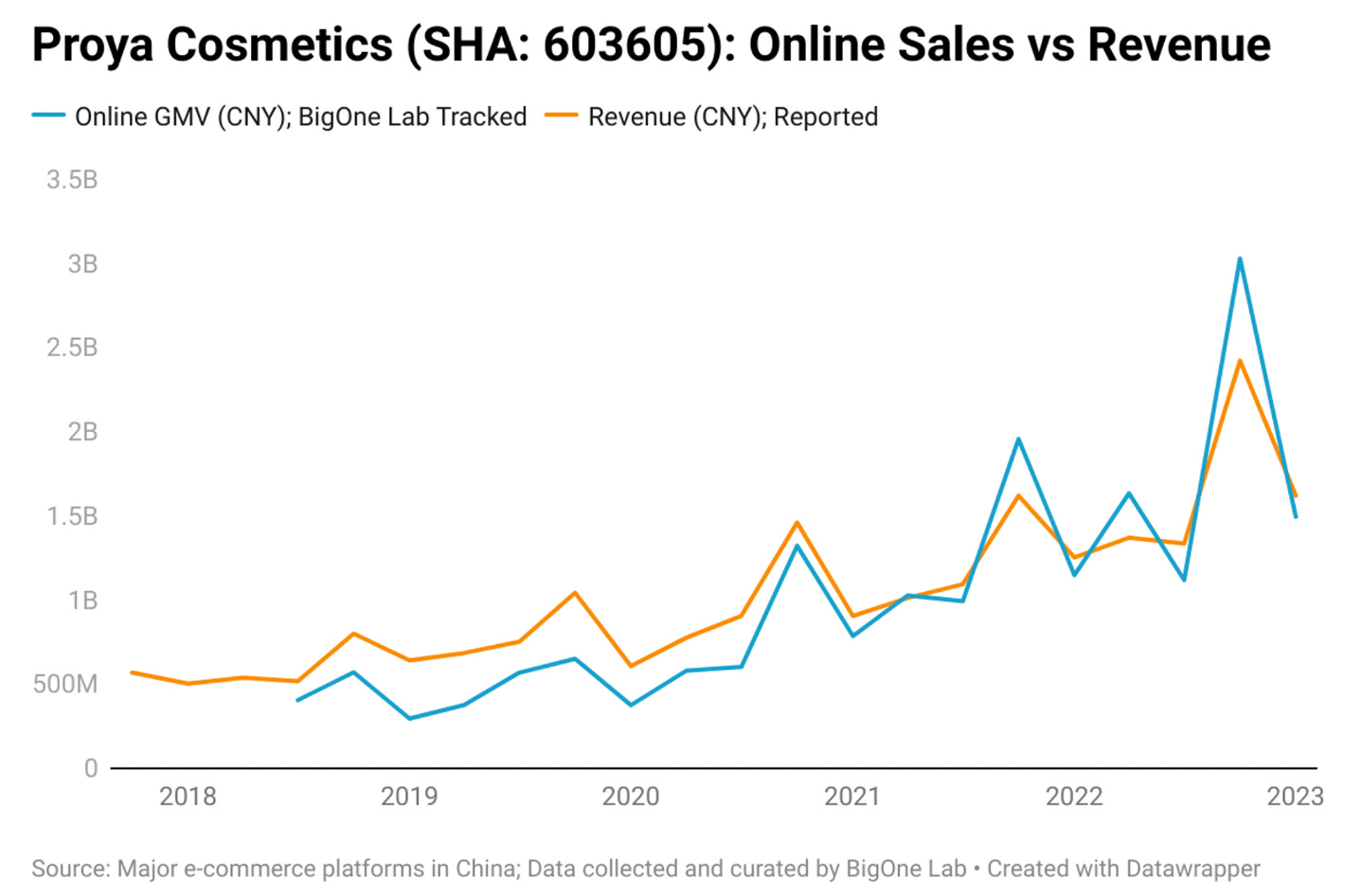

Cosmetics: Local company Proya (SHA: 603605) delivered resilient results in Q1 2023, despite an overall slow recovery

The domestic consumption for cosmetics and skincare products has yet to be unleashed. BigOne Lab’s data shows that online consumption for Skin& Makeup decreased by 3% year-on-year across major e-commerce platforms in China.

Both multinational cosmetics corporations, L'Oreal (OTCMKTS: LRLCY) and Estee Lauder (NYSE: EL), experienced negative growth in online sales in March. In contrast, local cosmetics maker Proya delivered a 30% year-on-year growth in March, continuing its strong sales momentum since the second half of 2022.

Proya, listed on the Shanghai Exchange, has achieved a return of over 760% since the company went public in 2017.

Health supplements: By-Health (SZ:300146) and Swisse (HK:1112) reported strong sales

In March, online sales for health supplement products increased by 38% year-on-year, making it the top category to recover from 2022. By-Health (SZ:300146) and SWISSE (HK:1112) both experienced strong sales growth, exceeding the category average.

Boss Zhipin (NASDAQ: BZ): The number of active companies continued to increase in 2023Q1

BOSS Zhipin (Kanzhun, NASDAQ:BZ) has lost over 20% of its value year-to-date in 2023, influenced by the overall slowdown of the Chinese job market. However, the number of active companies hiring on Boss Zhipin has been increasing rapidly, outpacing Boss’s main competitor Liepin and 51Job.com. While Boss may experience short-term pressure on the price, the stock has potential for more upside as the employment outlook improves.