"Going abroad": China's investment upside optionality for 2026 - Charts of the Week

Overseas exposure is the hedge for domestic "involution"

“Charts of the Week” is Baiguan’s series that features key data points to help you quickly grasp the general state of affairs in China in just a few minutes. We handpick the highlights of the data charts from a variety of sources, analyzing and delivering insights trusted by 100+ top institutional and corporate clients worldwide at BigOne Lab.

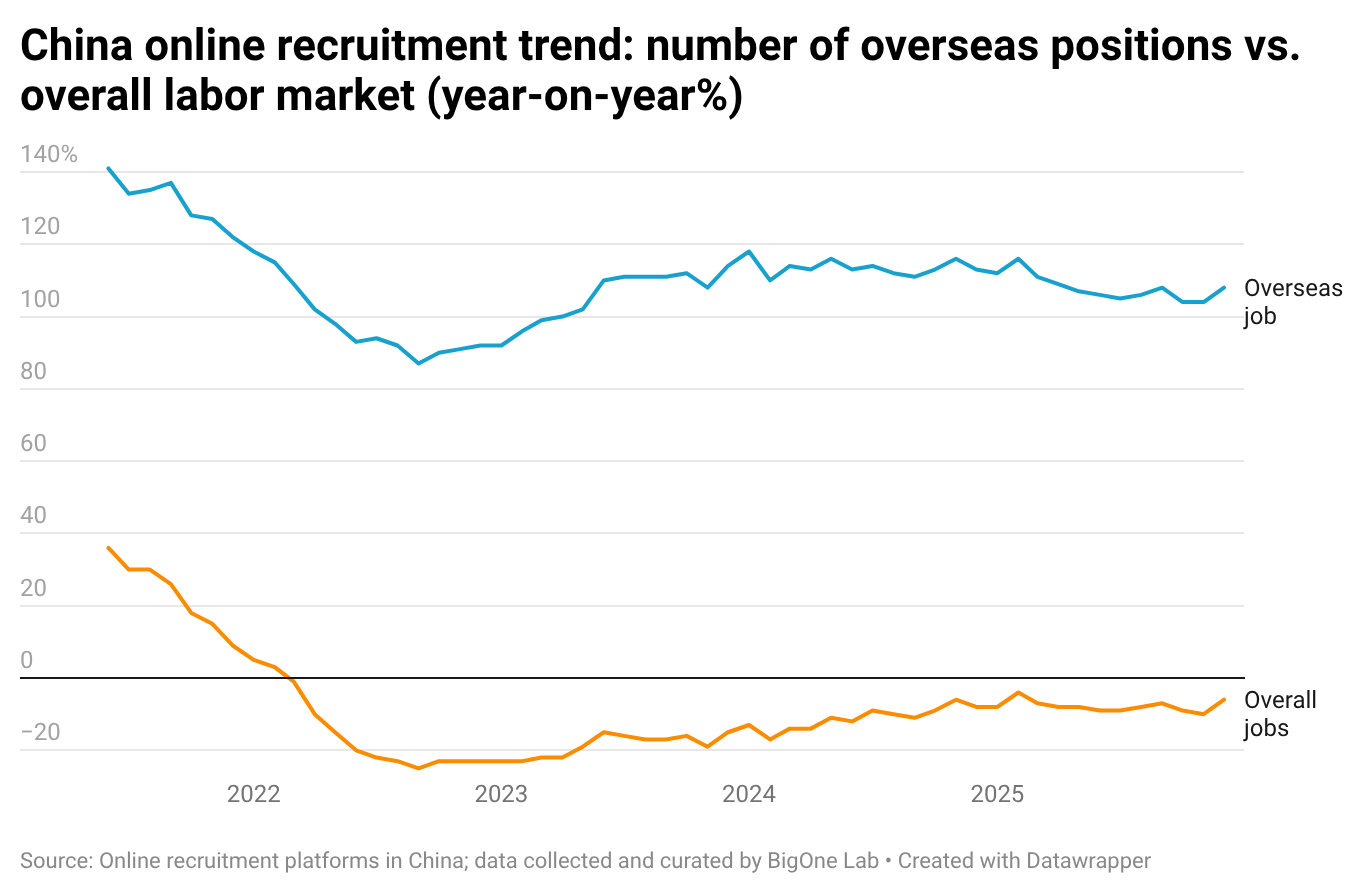

Since 2023, we have been frequently pointing out a clear trend: Chinese companies’ hiring for overseas positions has been outperforming the domestic job market, as firms actively expand abroad. “Going abroad” has been a prevailing theme among Chinese enterprises even before Trade War 2.0, and overseas hiring has only continued to gain momentum even after Trump’s second term commenced (as did China’s exports).

Now, the natural question for Baiguan readers and China investors is: what do we do with this trend?

In today’s Charts of the Week issue, let’s dig into that question with some interesting data insights.

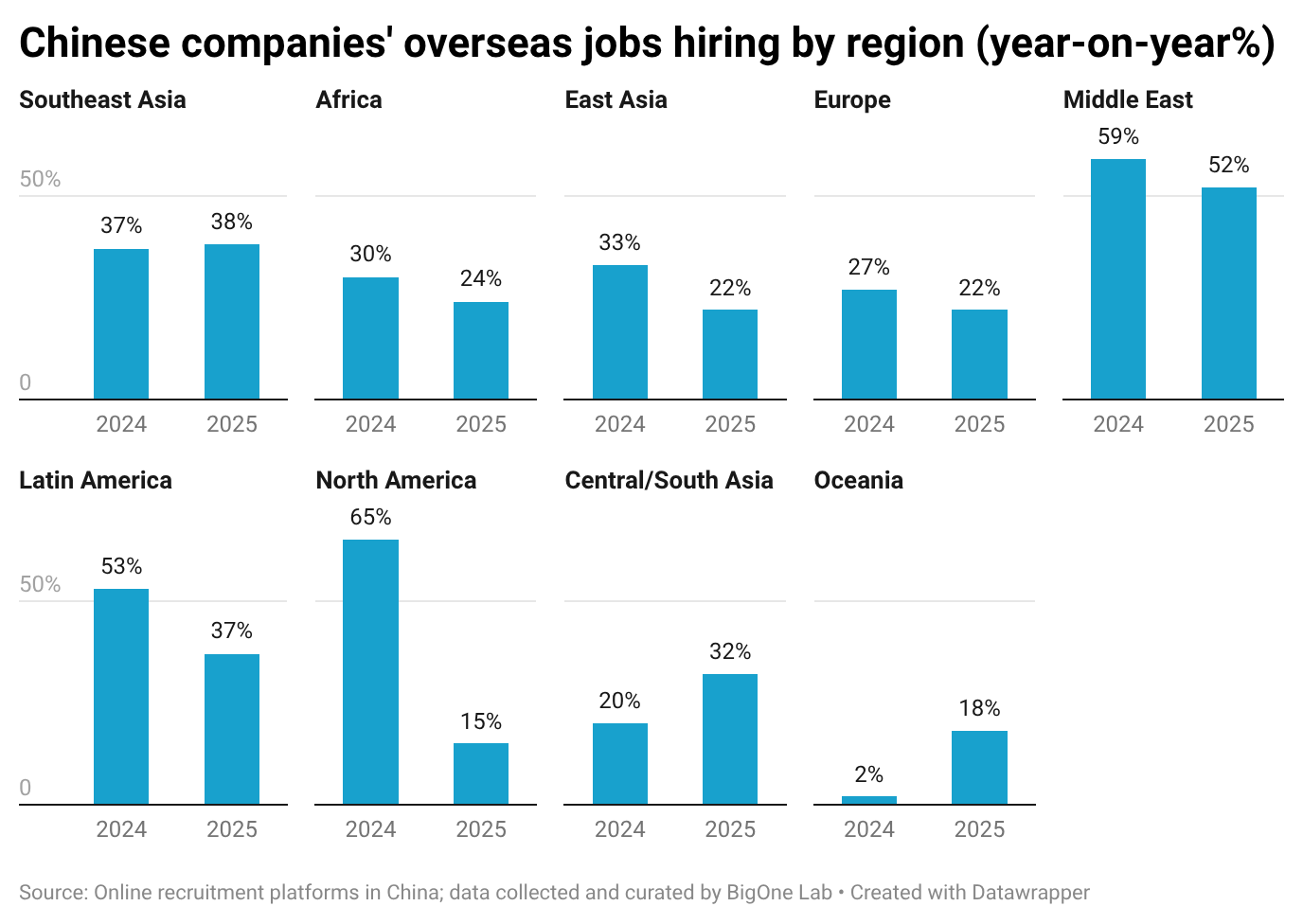

Chart of the Week: Growth in China’s overseas job recruitment slowed significantly in North America in 2025, but remained steady in almost every other region.

In 2025, exports remained one of the brightest spots in China’s economy, defying the headwinds from Trade War 2.0. Amid heightened volatility in US–China relations, hiring demand for jobs in North America cooled notably after the explosive growth seen in the prior year (though it still continued to grow).

Demand in other key regions, however, remained steady. Southeast Asia and Africa continued to be the largest overseas job destinations for Chinese enterprises, with no signs of slowdown. Meanwhile, demand in the Middle East — while still not a majority destination — has seen explosive growth over the past two years.

This suggests that China’s “going abroad” blueprint has become far more diversified over time, giving Chinese companies greater resilience — and more cards in hand — amid trade tensions.

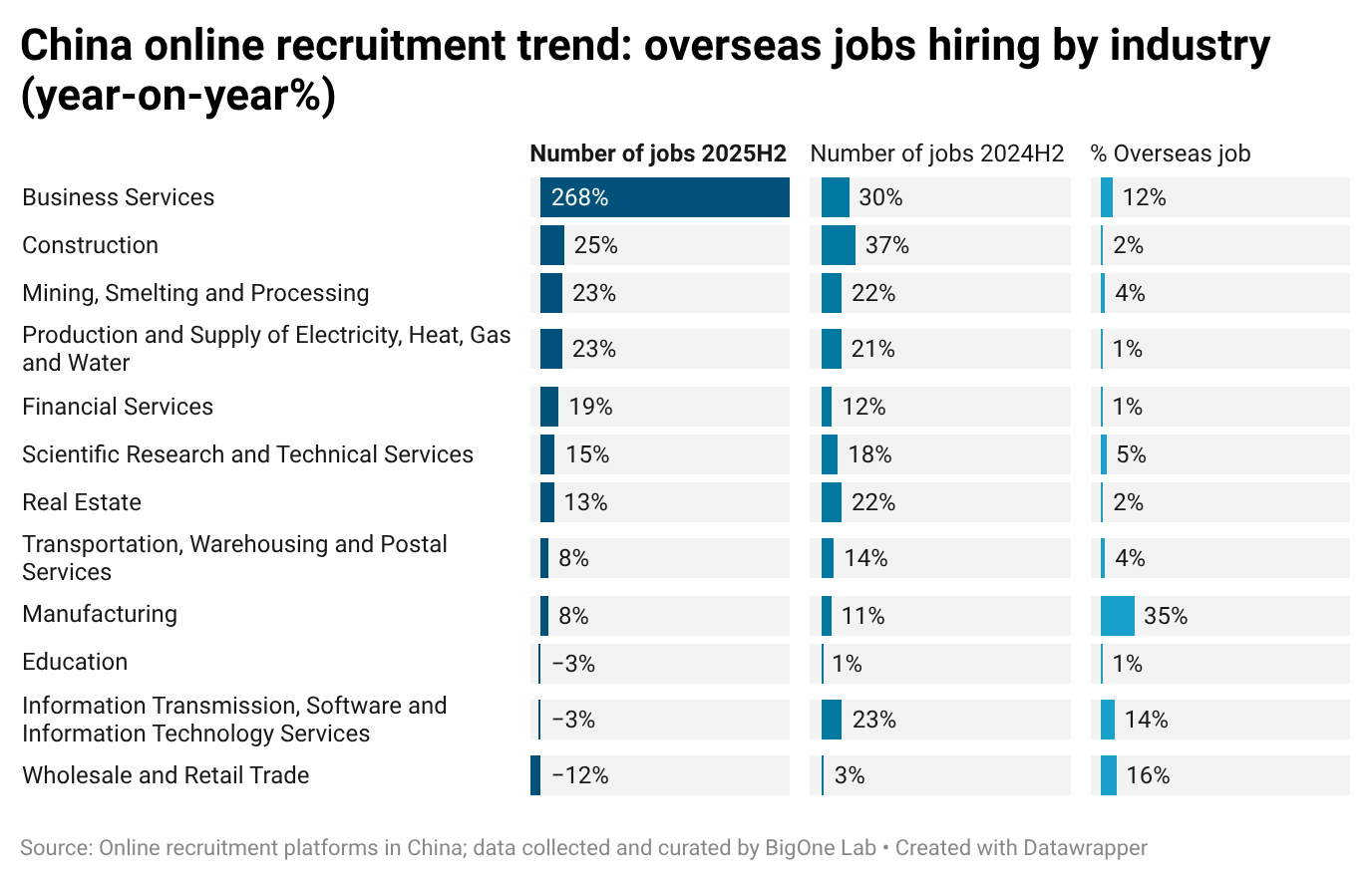

When we break down overseas job recruitment by industry, we also see an interesting pattern of rotation and diversification.

In 2024, construction, business services, and information technology led the “going abroad” initiatives. (Internet and e-commerce giants such as Pinduoduo (Temu) were categorized under IT, which significantly drove the overseas hiring demand. Remember when we covered how China was exporting both merchandise and manufacturing capabilities back in 2023? Chinese companies going global: merchandise and manufacturing exports in the new era.)

In 2025, however, we are seeing a more mixed portfolio of industries ramping up overseas expansion — not just in physical products, but also in services such as financial services, research, and design. Notably, business services jobs saw explosive growth, largely driven by companies that support overseas expansion, including digital advertising, consulting, legal, and human capital services.

One interesting example: we observed that Michael Page’s China arm — a recruitment agency focused on senior and executive talent — experienced very rapid hiring itself. This suggests that Chinese companies are increasingly “settling down” abroad and investing in professional expertise and management talent. If anything, they are expanding their overseas footprint even further after Trade War 2.0 commenced.

Some companies in the spotlight

Looking ahead, 2026 is shaping up to maintain strong export momentum. One key takeaway here is that investors may want to pay close attention to companies with meaningful overseas exposure — or those actively ramping up efforts to expand international market share — as they have a higher likelihood of delivering positive earnings surprises.

This is especially relevant for industries weighed down by persistent pessimism around domestic “involution” and price wars, such as upstream raw materials, EVs, consumer electronics, and food delivery platforms. While the domestic market is unlikely to see a demand boom overnight, companies with strong overseas exposure could see overseas revenue surprises that are not yet fully priced in.

Let’s look at a few examples — companies that were hiring aggressively for overseas roles (or domestic roles targeting overseas markets) in 2H25. These are the firms positioning themselves for a much larger international footprint in 2026.

XPeng (XPEV) | Smart EVs & AI mobility

Overseas job hiring trend: +78.4% YoY

By the end of 2025, XPeng expanded its global footprint to 60 countries, with its overseas deliveries soaring 96% YoY to 45,008 units [*]. Entering 2026, XPeng will establish independent supply chain teams in Europe and Southeast Asia starting in 2026 to support localized operations [*]. One key upside is that Chinese EV makers can generate significantly higher margins in overseas markets. For instance, BYD reportedly generates three to four times more profit per vehicle overseas compared to its fiercely competitive domestic Chinese market as of late 2025. Overseas growth could therefore serve as a catalyst to lift pessimism surrounding China’s saturated EV market and shrinking margins amid ongoing price wars. (XPeng also comes with attractive autonomous driving optionality this year, which is shaping up to be an important investment theme to watch.)

Other EV makers have also ramped up overseas hiring, including Li Auto (+385%), Changan 000625.SHE (+385%), and Dongfeng 0489.HK (+180%). BYD’s overseas hiring did not expand further in 2025, largely because its hiring already surged in 2023, as BYD began building its overseas footprint well ahead of peers.

Yili Group (600887.SH) | Dairy products

Overseas job hiring trend: +408.3% YoY

This might come as a surprise to many. It’s hard to imagine a traditional dairy maker—dealing with fresh, perishable goods—successfully selling into overseas markets. Yet, Yili is doing exactly that by building actual factories on the ground. Their Indonesian production base is now the largest ever built by a Chinese dairy firm in Southeast Asia [*]. Instead of just exporting Chinese milk, they are localizing the brand; for instance, their Joyday ice cream is now the fastest-growing brand in Indonesia and has already reached over 10 countries across the Middle East and Africa. They are essentially exporting their manufacturing playbook and supply chain efficiency to high-growth emerging markets where dairy demand is still booming. I think this could bring a nice catalyst, especially given that the narrative is predominantly dominated by concerns over deflation and low birth rates in China.

Similar companies are taking the same strategy: Mengniu Dairy 2319.HK (280% YoY) and Anjoy Foods Group 603345.SHA (550% YoY) are both ramping up the hiring for the overseas market in 2025H2. Pleasant surprises may emerge from these “boring” businesses in 2026.

Continue for more examples and data points. To get a sense of what is offered, you are welcome to check out this older post in the same series: Charts of the Week. You can also get free access by sharing us. Paid subscribers enjoy a variety of benefits. Check out the benefits: exclusive benefits for Baiguan’s paid subscribers.