In our May article China: Back to Reality, we flagged potential hurdles for China's economic rebound. Now, with May data in hand, we're back to assess the economy's strength and lingering risks.

The verdict? Risks remain. Hiring is in a seasonal slump, and macroeconomic headwinds are causing demand to shrink rapidly, hitting small and micro enterprises—the backbone of job creation—the hardest. The property market is a tale of two cities: first-tier metros are cooling off, while second-tier cities are still bustling.

On the consumption front, while numbers look surprisingly good, it's largely due to government subsidies and shopping festivals that pulled future spending forward. The economy's internal growth engine still lacks sufficient power.

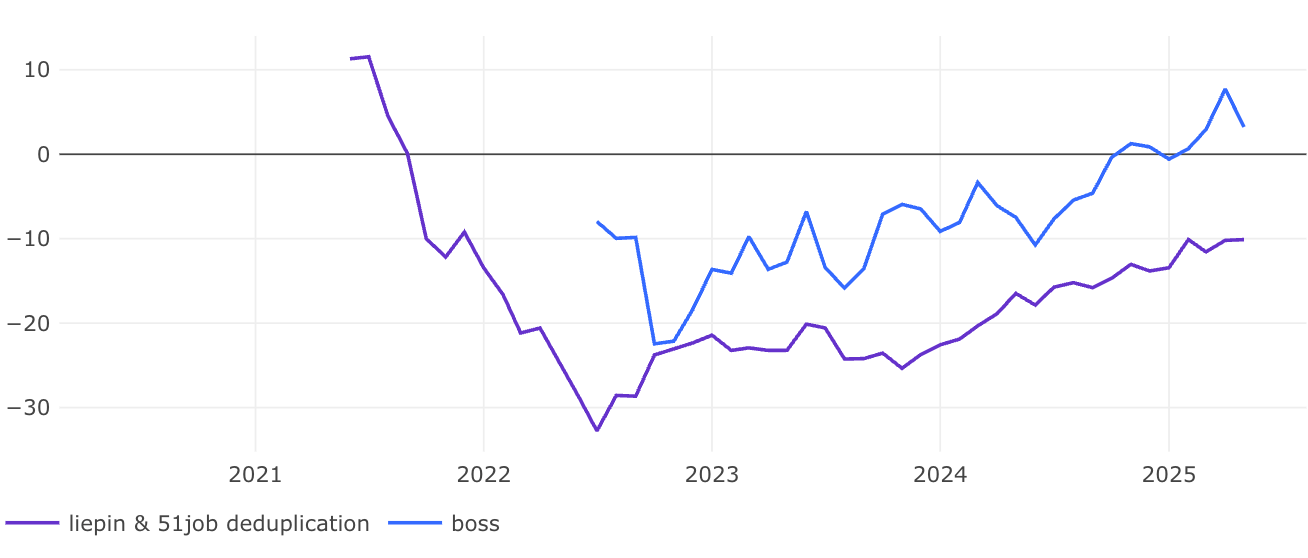

Recruitment: seasonal slowdown and diverging confidence dampen hiring

China's job market shows distinct signs of deceleration, weighed down by an off-peak hiring season and lingering macroeconomic uncertainties. Small and micro enterprises (SMEs) are the primary drag.

BigOne tracked data reveals a significant slowdown in active job listings on BOSS Zhipin in May 2024. While listings grew 5.6% year-on-year (YoY), this represents a sharp deceleration from April's robust +18.8% YoY growth. Sequentially, listings contracted 10.7% month-on-month (MoM).

Average openings per company edged up 3.2% YoY, but platform retention rates weakened, with the 6-month active employer retention rate falling 5.3 percentage points (pp) MoM to 81.3%, and the 12-month rate dropping 3.5 pp MoM to 71.7%.

Stark divergence by company size: Demand stability hinges on scale

Megacorporations (10,000+ employees): Relatively resilient, with job listings up 13.5% YoY (flat vs April) and a slight +0.8% MoM increase. Their 6-month retention rate dipped 4.2 pp MoM to 81.7%.

Small & Micro Firms (<100 employees): Experienced a pronounced slowdown, with job listings growing just +5.2% YoY – a steep decline from April's +20.9% YoY pace – and shrinking 12.3% MoM. Their 6-month retention rate also saw a significant decline (-5.4 pp MoM to 80.8%).

Sector-wide deceleration: Hiring momentum cooled across major industries. Despite positive YoY growth in most sectors, MoM contractions were pronounced

Manufacturing: +5.9% YoY, -10.8% MoM

Construction: -2.0% YoY, -8.9% MoM (only sector with negative YoY growth)

Accommodation & Catering: +12.9% YoY, -8.5% MoM

Wholesale & Retail: -3.1% YoY, -14.4% MoM

Education: +3.8% YoY, -11.7% MoM

Finance: +2.3% YoY, -13.0% MoM

Information Technology: +6.7% YoY, -10.9% MoM

Real Estate: +11.8% YoY, -8.8% MoM

Salary expectations: Core wages hold steady, high-pay roles in short supply

Our data confirms two divergent trends:

Core wage stability for current roles (LFL growth anchored at ~4%), suggesting employers value workforce retention.

Chronic softness in premium job creation (negative Mix Change), reflecting caution toward high-cost hires and slower expansion in tech/finance sectors.

China’s property market flashes mixed signals as stabilization plays out

(Data Source: Beike, based on the data of the week ending June 14, 2025; Data collected and curated by BigOne Lab)

Secondary home sales in Week 24 (June 8-14) rebounded 16% year-on-year (YoY), recovering from Dragon Boat Festival distortions. Yet the growth rate slowed when compared to pre-holiday momentum – the 18% YoY surge in Week 21 (May 18-24) – confirming a broad moderation trend since early May.

Notably, the rebound split sharply along city tiers: Tier-1 cities managed just +4% YoY growth, down sharply from +19% in Week 21. New Tier-1 cities held steady at +7% YoY. Tier-2 markets surged +42% YoY, accelerating from +36%

Demand visibility improved as viewing appointments jumped 13% YoY nationwide. But post-holiday normalization dragged WoW metrics down -4%, hinting at sustained caution. Tier patterns persisted: Tier-1 (+7% YoY); New Tier-1 (+8% YoY); Tier-2 (+27% YoY).

Supply & Pricing: New listings net adds across 17 key cities contracted 3% WoW. Tier-1 asking prices inched up 0.1% WoW. New Tier-1 and Tier-2 markets saw prices decline -0.2% WoW.

Consumption surprises on the upside, but lacks organic growth momentum

China’s retail sales surge 6.4% in May, defying expectations

China’s consumer sector delivered a robust rebound in May, with retail sales climbing 6.4% year-on-year – sharply exceeding market forecasts of 4.9% and marking the fastest expansion since mid-2024, according to the National Bureau of Statistics. The surprise surge, up from April’s 5.1%, reflects potent policy tailwinds and favorable calendar shifts, though underlying demand fragility lingers.

Policy engine drives demand

The national "trade-in" initiative proved instrumental in revitalizing big-ticket purchases. Household appliance sales soared 53.0% year-on-year—a 14.2 percentage point acceleration from April—while telecom equipment surged 33.0%. Furniture and stationery, buoyed by the policy, contributed 1.9 percentage points to headline growth, up 0.5 points from April.

Seasonal catalysts amplify gains

Two transient factors further lifted May’s figures, according to Huachuang Securities:

Major e-commerce platforms launched annual "618" festival promotions on May 13—earlier than historical cycles—pushing online retail growth to 8.2% year-on-year, well above the 5.8% January-April average.

Additional statutory holidays boosted consumption demand, with May containing 12 rest days versus 10 in 2024. Catering revenue growth accelerated to 5.9%, while alcohol sales increased 11.2%, both notably outperforming year-to-date trends.

Beneath the headline strength, non-subsidized segments weakened. Building materials, gold, jewelry, and other discretionary categories slowed materially. While trade-in policies drove white goods and furniture sales, the National Bureau of Statistics noted that these targeted sectors accounted for virtually all net growth contributions.

The May rebound offers temporary relief to policymakers but underscores the economy’s continued reliance on state support. "The numbers demonstrate stimulus efficacy when precisely targeted," said Zhang Wei, chief economist at Orient Securities, "but self-sustaining consumption recovery requires broader income growth and confidence building." As trade-in subsidies gradually taper and calendar effects normalize, June data will test whether China’s consumption engine can maintain momentum absent extraordinary supports.

China’s E-Commerce Festival evolution: simplification and premiumization

Trend 1: The "Decomplexification" Mandate

This year’s 618 festival marked a strategic pivot toward simplicity, replacing layered discount mechanics with a straightforward 15% instant price cut across participating products. The shift addressed systemic flaws in legacy promotion structures: Complex coupon stacking previously incentivized consumers to bundle unnecessary purchases for discounts, then return unwanted items – distorting brands’ operational metrics. Industry sources noted luxury retailer Ralph Lauren suffered a over 90% return rate during 2024’s Double 11 festival under traditional rules, severely damaging inventory efficiency and profit margins. By eliminating artificial purchase thresholds, platforms aimed to boost genuine purchase intent while reducing costly post-festival returns.

Trend 2: Douyin’s Strategic Pivot Toward Premium Brands

The short-video platform leveraged its upgraded ecosystem to capture high-value shoppers. Based on BigOne Lab's data, global beauty leads growth: International prestige labels (+21% YoY GMV) dramatically outperformed domestic brands (+12%) on Douyin in May. High-ticket leaders La Mer (+66% YoY) and SK-II (+97% YoY) drove outsized gains as Douyin prioritized exposure for luxury segments.

Per Jumeili, international beauty giants are increasingly topping charts, echoing the 2018–2020 Tmall Double 11 shift from domestic to international brands. An insider explained that as platforms stabilize, pioneers like domestic and emerging brands clear the path. Platforms and top influencers then favor big spenders—international groups with strong brand power and budgets, which proves more cost-effective and reliable amid limited traffic.

Another source noted that international brands, having learned from Chinese brands' Douyin success, are adapting to online rules and gaining traction, causing ranking shifts. Liu Bin added that Douyin's media-ad model and algorithm allow rapid brand virality and bestseller boosts, especially during promotions. With consistent investment and solid operations, international beauty giants remain highly competitive across platforms.

Trend 3: Price wars are giving way to merchant support and collaboration

Platforms are rolling out support for merchants. On May 29, Douyin announced that as of June 6, it will reduce the cost of freight insurance for eligible merchants/creators by 5%–15% below the regular price. This initiative is expected to save merchants over 10 billion yuan in operating costs over the next year. Meanwhile, during the 618 shopping festival, major platforms such as Taobao and Tmall are shifting from competition to collaboration. Taobao and Tmall have introduced a “pre-order after sold-out” feature, allowing consumers to pre-order sold-out items. Sellers can gain an additional 7–10 days for shipping based on the number of pre-orders, providing them with a longer timeline for delayed payments while ensuring consumers don’t have to wait too long during promotions.

Additionally, this year’s 618 shopping festival has seen less rivalry among major platforms, with a shift from “competition” to “collaboration”. Taobao and Tmall are deepening their integration with Xiaohongshu by adding an “ad link” feature to Xiaohongshu notes, allowing users to jump to the Taobao app for purchases. JD.com is now accepting Alipay and integrating its logistics with Taobao and Tmall systems. WeChat also enables direct link openings for Taobao and Tmall to place orders.

In the following content, I will break down the performance of the four major e-commerce platforms, including Tmall (BABA), JD.com (JD), Douyin (unlisted), and Kuaishou (1024.HK), during this year's 618 shopping festival. I'll also provide an early glimpse into the Q2 results (based on April-May data). These insights are exclusively available to our paid subscribers.