We’re excited to announce that CF40 Research has officially launched their Substack, managed in partnership with Baiguan! CF40 is China's leading economic think tank, founded and participated by former and current top-level economic policy makers, advisors and researchers. Besides delivering in-depth analysis of the economy, policy and markets, CF40 also organizes several closed-door events throughout the year, including the highly consequential Bund Summit. As a special perk, all Baiguan paid subscribers can enjoy 20% off an annual CF40 Research subscription. Paid subscribers can find the coupon link in the email header. Redeem it by Oct. 31!

Last Friday, Alibaba—this year’s final and by far heaviest hitter in the food-delivery war—reported its quarterly results, offering the first clear read on how the battle played out in Q2.

The market’s verdict was swift and unequivocal. On the first trading day after the earnings deluge, the “attacker” Alibaba surged nearly 13 % on the NYSE and a stunning 18 % in Hong Kong (also thanks to its outperformance in AI and cloud computing), while the “defender” Meituan tumbled almost 13 %. JD.com slipped a modest 3 %. Investors, in effect, handed Alibaba a short-term victory. Their reasoning boiled down to two points:

All three players are burning similar amounts of money, but Alibaba can better afford it. JD.com pegged its incremental food-delivery loss at roughly RMB 13 billion. Meituan expects margin compression of about RMB 11.5 billion. Citi and J.P. Morgan estimate Taobao Flash Buy’s loss at ~RMB 11 billion (Source). Yet Alibaba sits on a far larger cash pile and a more diversified revenue mix, giving it the strongest shock absorber of the three.

Meituan’s long-touted efficiency edge—lower subsidy cost and higher ROI—is under siege. On Alibaba’s Q1 FY2026 call, Jiang Fan (CEO of Alibaba’s China Commerce division) argued that Ele.me’s gains aren’t purely market-share driven. Over the past year, he said, Ele.me has quietly upgraded its underlying infrastructure; without that, Taobao Flash Buy could not have racked up ~120 million orders so quickly while still delivering a “best-in-class” user experience. Jiang emphasized that food-delivery ROI hinges on the precise matching of merchants, riders, and consumers—something Alibaba is now executing at scale.

Today’s piece is the third installment in our running chronicle of China’s 2025 food-delivery war, picking up from our April brief on JD’s entry and our July deep-dive as Alibaba cranked the heat to full blast.

In this article, we first draw on a LatePost deep-dive to examine three questions:

How has food-delivery growth fed back into Taobao’s core e-commerce metrics?

How is Alibaba closing the gap with Meituan on rider networks and fulfillment capacity?

Which brands have emerged as the beneficiaries amid the food delivery war?

In the second half of this article, we bring in proprietary data from BigOne Lab covering Meituan, Luckin, and Yum China to surface the latest trends.

Below is Baiguan's translation of the original article, Flash Buy propels Taobao ahead of Pinduoduo; cheap food delivery war shows no signs of ending.

*Disclaimer: This newsletter post is not sponsored by Alibaba, Meituan, or JD.

Taobao Flash Buy appears to be gearing up for a prolonged campaign in the food delivery market, signaling that the subsidy war is far from over.

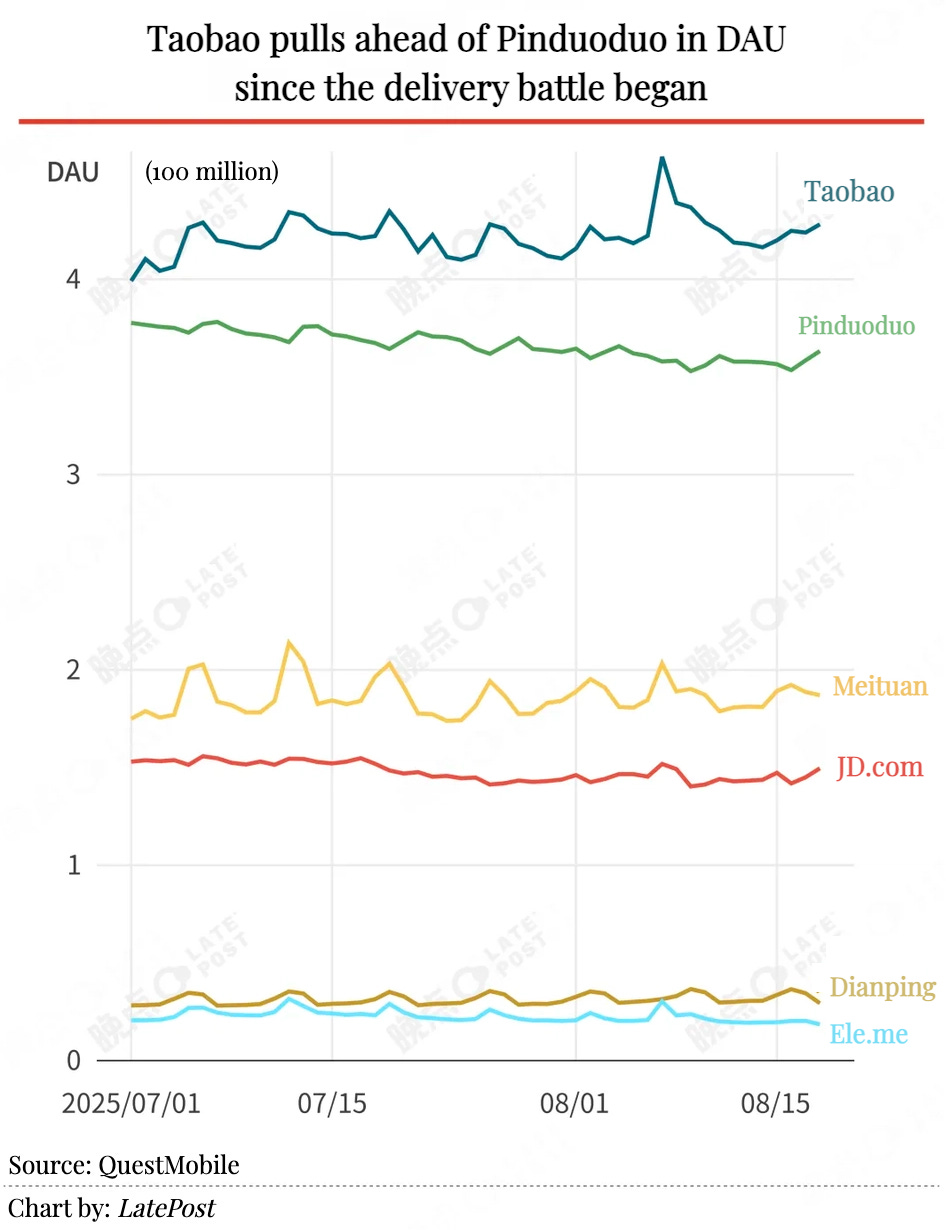

Since August 8—right after the start of “Liqiu,” the beginning of autumn—Taobao Flash buy has overtaken Meituan in daily orders for the first time. What’s more striking is how aggressive subsidies have pulled Taobao ahead in daily active users (DAU): since July, it has pulled significantly ahead of Pinduoduo.

Of course, subsidies at this level cannot be maintained indefinitely. Internally, Alibaba refers to heavy subsidy campaigns as “ascending the mountain”; now, they are preparing to “descend.”

In July alone, Taobao Flash Buy poured over RMB 10 billion into subsidies across merchants, consumers, and delivery riders. The company is now deliberating a measured tapering—shifting focus toward high-value users, rebalancing categories, and adjusting subsidy amounts.

Alibaba’s September 10 company anniversary will serve as a watershed moment—marking a strategic upgrade as the company accelerates from an e‑commerce platform toward a broader consumer platform, while leveraging its foundational capabilities to close the gap with Meituan.

What did hundreds of millions of yuan buy?

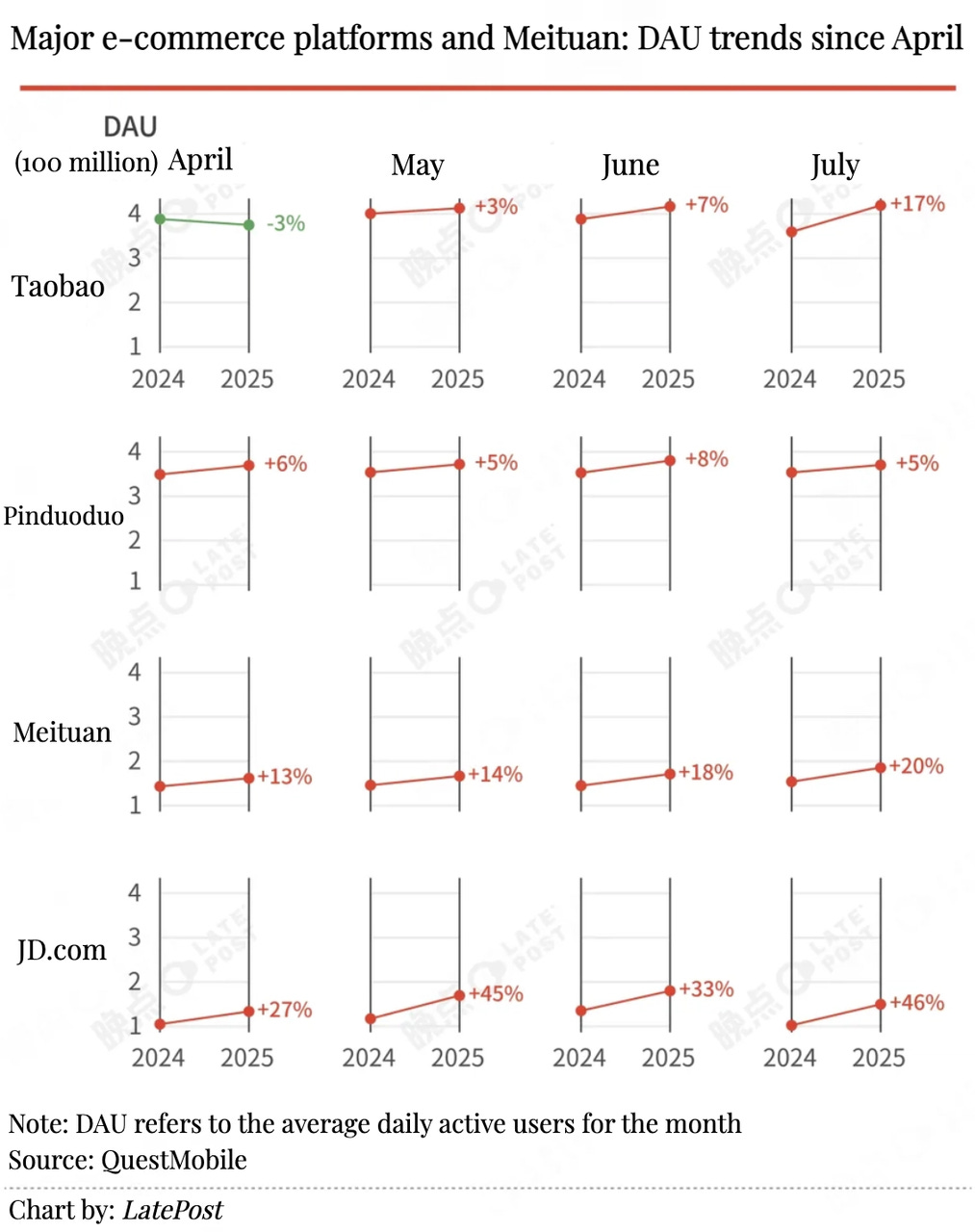

Trend 1: The integration of food-delivery services directly into the Taobao app has pushed Taobao’s daily active users (DAU) past those of PDD

In this subsidy war, Alibaba has given its in-app food-delivery feature, “Taobao Flash Buy,” prime real estate on the Taobao home screen—nestled right next to “For You” and “Following,” the two tabs users open most. This placement doesn’t merely funnel traffic to the food-delivery vertical; it also re-energizes the entire Taobao ecosystem, driving a measurable lift in daily active users.

In April this year—prior to Alibaba’s entry into the food delivery war, QuestMobile data shows Taobao’s daily active users (DAU) averaged 374 million—slightly down year-on-year and only about 5.5 million above Pinduoduo. By July, this gap had ballooned to nearly 50 million.

From July through August, Alibaba ramped up its food delivery subsidies, fueling a steady rise in Taobao’s daily active users (DAU), while Pinduoduo’s DAU continued to decline. The divergence reached a dramatic peak on August 7, during the viral “First Autumn Milk Tea” promotion, when Taobao’s DAU outpaced Pinduoduo’s by over 100 million in a single day.

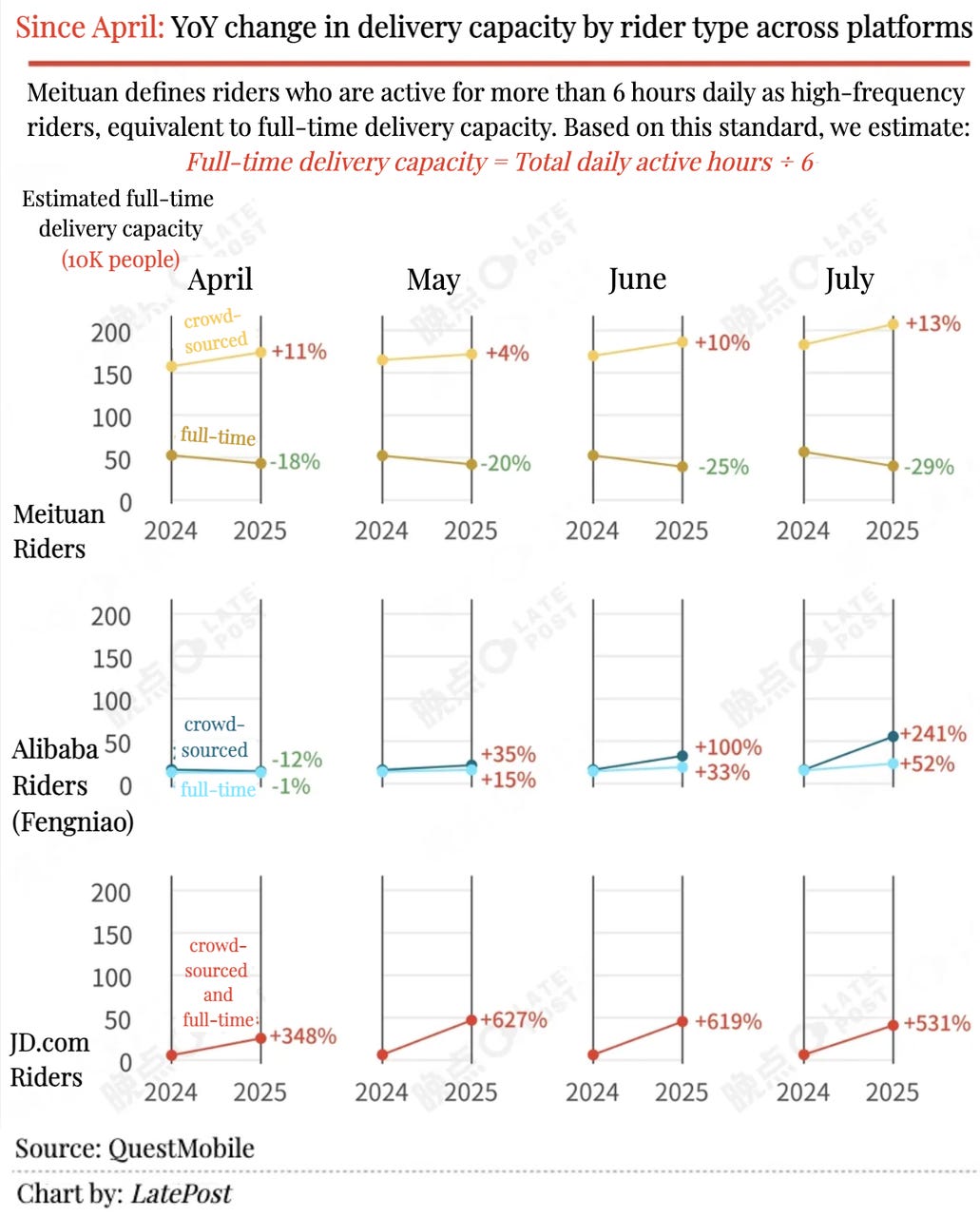

Trend 2: Alibaba is rapidly expanding its delivery rider supply

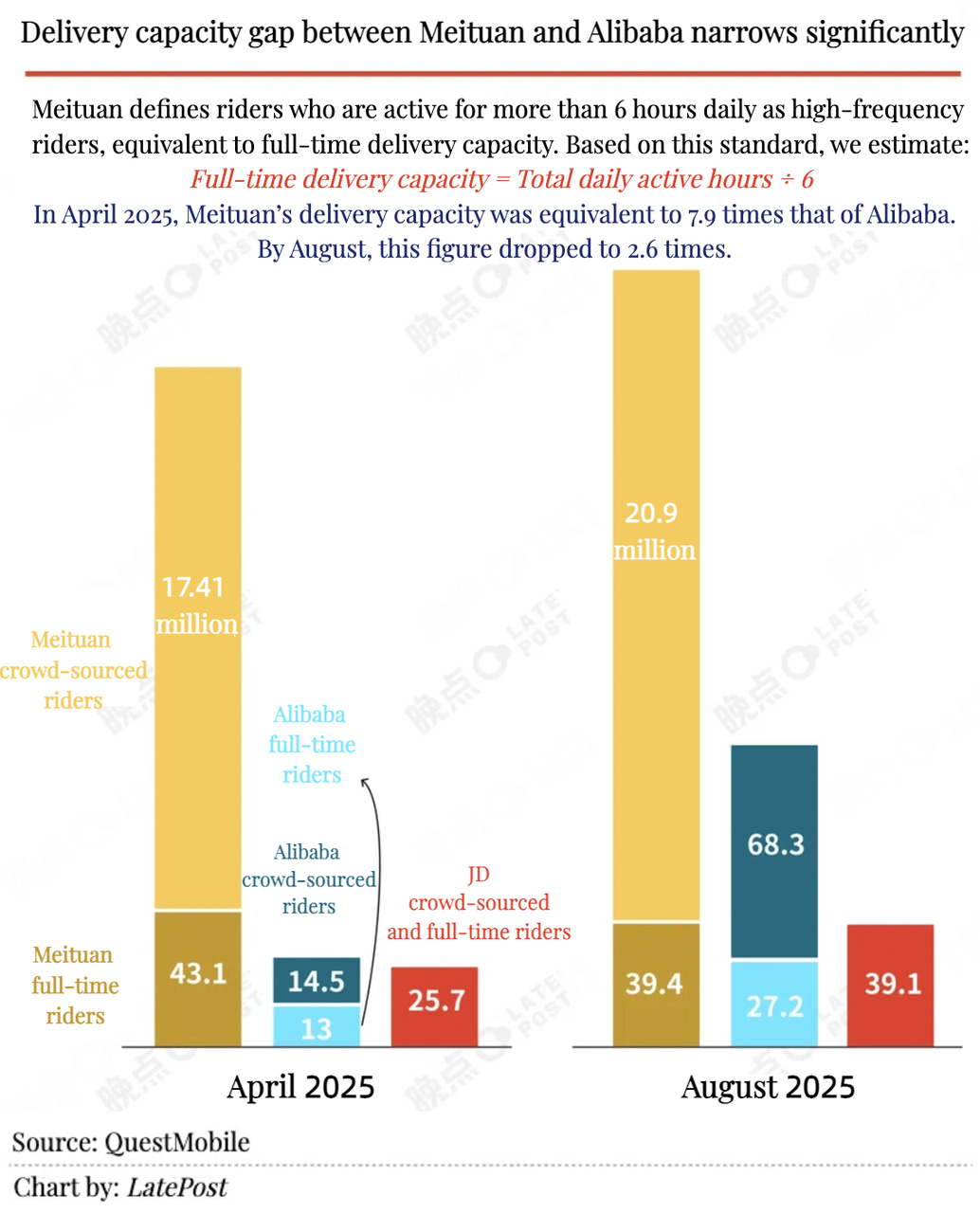

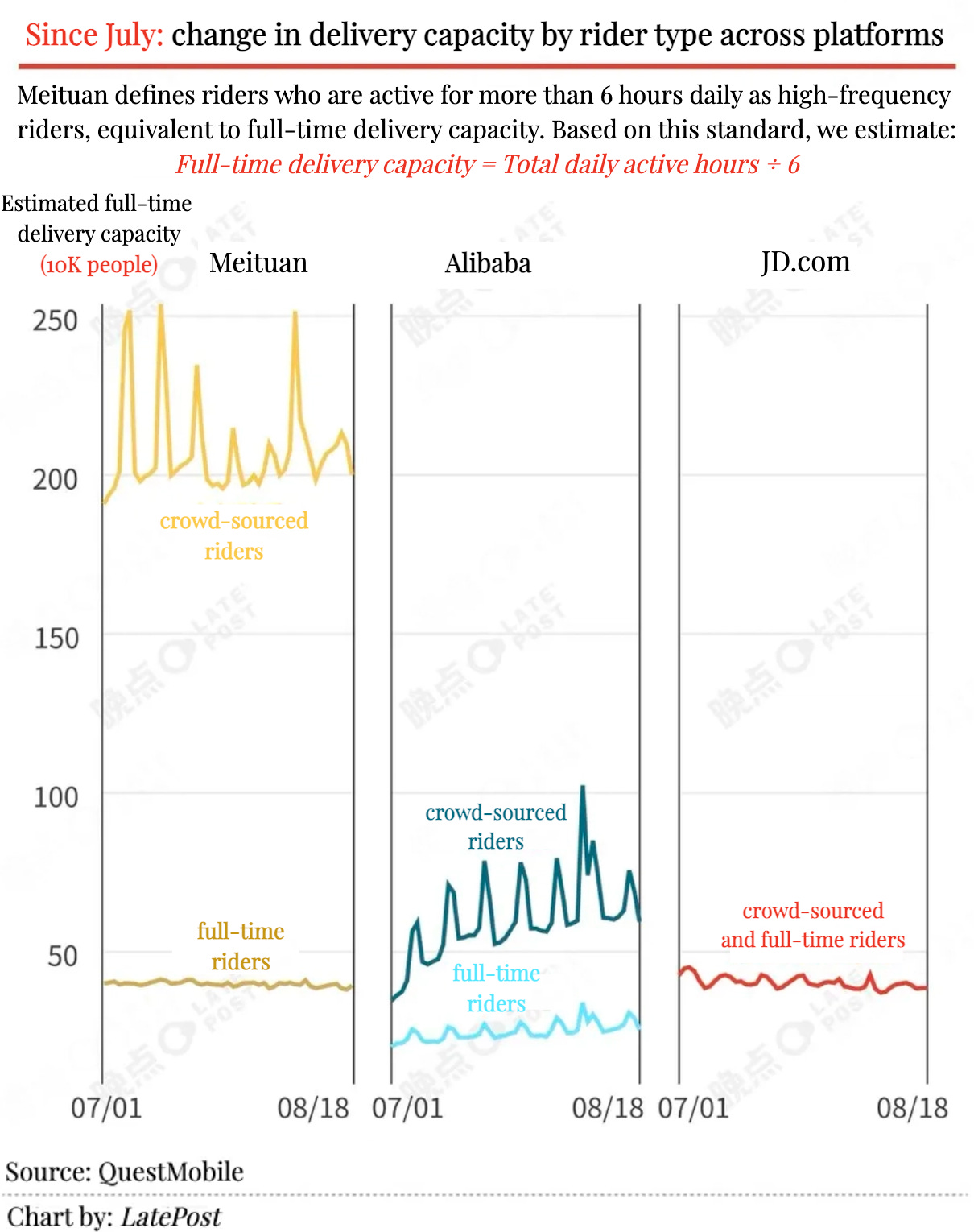

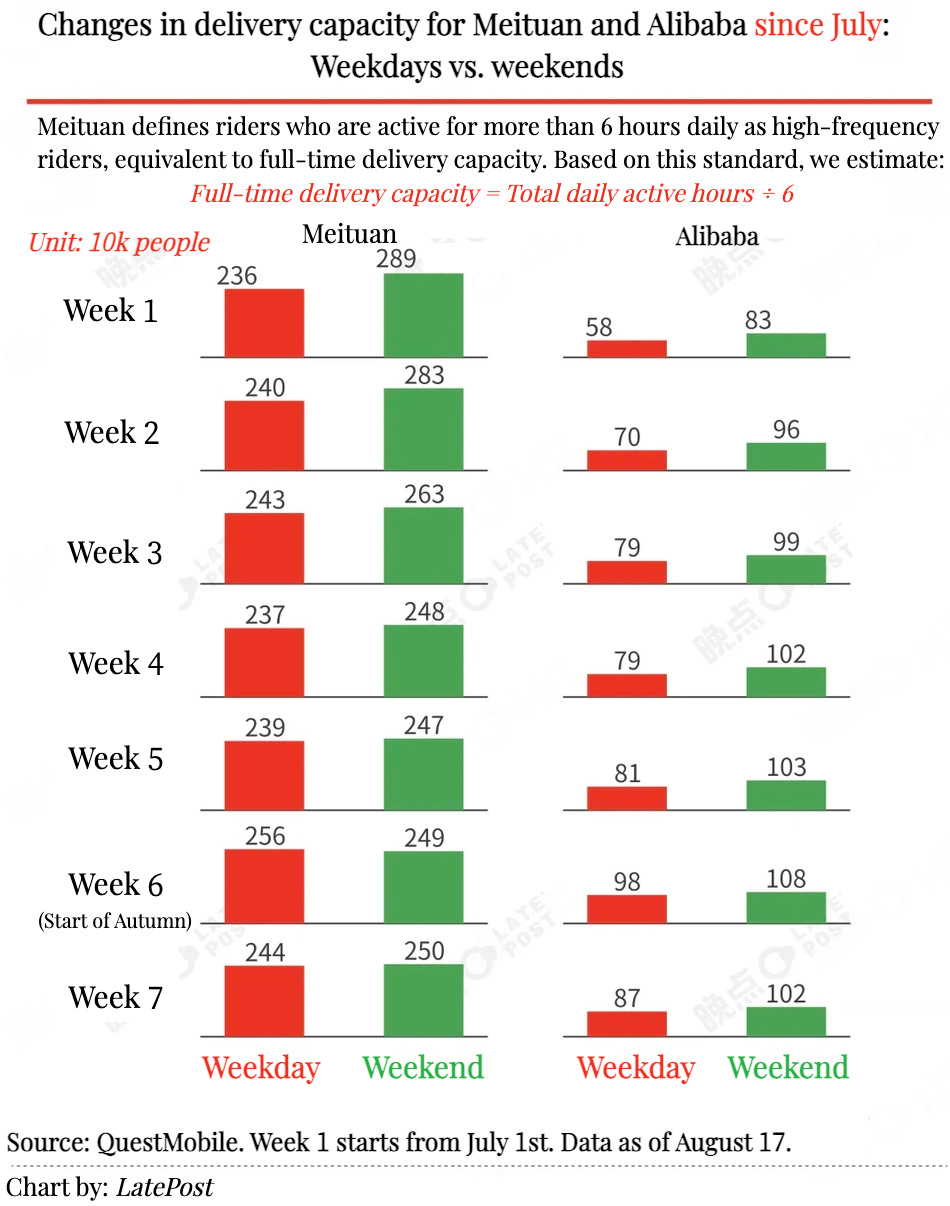

Beyond hitting a single-day order volume of over 100 million—surpassing Meituan for the first time—Alibaba is also rapidly expanding its delivery rider supply. Based on user time-spent data tracked by QuestMobile across platforms such as Meituan Crowdsourcing, Meituan Riders, Fengniao Crowdsourcing, and Fengniao Riders, we estimate that prior to the delivery subsidy war, Meituan’s rider base was nearly 8 times the size of Alibaba’s. That gap has now narrowed significantly to just 2.6 times.

Trend 3: “The real winner might be someone offstage”

“The real winner might be someone offstage,” said Wang Puzhong, CEO of Meituan’s Core Local Commerce division and the chief architect of its food delivery strategy.

A Luckin Coffee(LKNCY) franchisee told us that following the “Autumn Milk Tea” promotion, Alibaba’s subsidies had scaled back to levels seen in the early phase of the delivery war. Still, weekday average sales at several of his stores climbed from 400–500 cups per day to 700–800. He believes this reflects a structural shift: months of heavy subsidization have meaningfully increased the penetration of daily coffee consumption.

On August 22, premium tea chain HeyTea officially launched on Taobao Flash Buy. The brand had long resisted joining delivery platforms like Ele.me and JD, preferring instead to channel orders through its own WeChat Mini Program to retain control over customer traffic. However, as a franchise-heavy chain, many of HeyTea’s outlets rely on a steady stream of orders. With the growing reach and scale of Taobao Flash Buy, HeyTea could no longer afford to stay off the platform.

Next phase: subsidized—but smarter

Merchants tell us that after the August 7–9 “Autumn Milk Tea” subsidy peak, both platforms no longer saw dramatic single-day surges. Yet weekday subsidies via Taobao Flash Buy remain clearly evident.

“The subsidies may feel lighter than during the ‘autumn milk tea’ campaign,” the Luckin franchisee noted, “but per-cup margins have clearly improved.”

According to a source close to Alibaba, once short-term targets are met, Taobao Flash Buy will shift subsidy deployment toward off‑peak periods—particularly weekdays—and prioritize high-spending customers, while gradually shifting subsidies from tea and coffee to meals and select non-food retail categories.

A founder of a restaurant chain told us that weekly order volumes on on Taobao Flash Buy continue to climb. Compared to the subsidy peak around August 7, per-cup subsidies now are down by one or two yuan, and fixed-price promotions are being scaled back.

Meanwhile, Ele.me is promoting “tap-to-pay” hardware to merchants while recruiting sellers to join a new group-buying initiative under the Taobao Flash. The restaurant chain mentioned above has already signed a group-buying fee agreement and submitted multiple product SKUs. The founder expects Alibaba to expand subsidies for this new business line.

Having hit short-term goals in higher-tier cities, Alibaba’s next challenge is to unlock volume in lower-tier markets.

Before the current subsidy war, a Tier 2 market investor observed that in a mid-sized central Chinese city, Meituan held a dominant 90% market share compared to Ele.me’s 10%. Meituan was able to earn RMB 5–6 per order in these regions, where it faced virtually no competition.

Unlike Ele.me—which historically focused on select high-tier cities in East China and only engaged in subsidies to defend its position—Meituan had achieved near-national coverage. It dominated smaller cities with minimal competition and strategically funneled profits from these lower-tier markets into aggressive subsidy campaigns in top-tier urban centers. Now, Alibaba is pushing into those “uncontested” territories—deploying ground teams, setting up fulfillment hubs, and gradually cultivating user habits. This is not a weekend blitz, but a long-term commitment measured in quarters or even years.

Next, we unlock BigOne Lab’s proprietary data in July on Meituan, Luckin, and Yum China—available only to our paying subscribers—to spotlight the freshest shifts.