Have China’s job postings been bottom out?

New postings decelerated after the March-April bounce, and bigger players outperformed

On Monday, we looked at the forces powering China’s latest stock market rally, and noted that the important factor for whether this surge can last is if the macro environment truly accelerates to match the pace of the market. Employment data sits right at the center of that question.

In today’s article, we bring you the freshest pulse of China’s job market, based on BigOna Lab (Baiguan's parent company)'s exclusive data on China's top 3 major online recruitment platforms.

Why should we keep a keen eye on employment data?

Stability and pay shape spending power. Job security and wage trajectories are the twin engines behind consumers’ willingness to open their wallets or take investment risks.

Winners and losers diverge by age, sector, and city. Different cohorts face distinct career realities, which in turn steer their spending patterns and the industries they favor.

Jobs drive people, and people drive growth. Where the openings are, the population flows; where the population flows, tomorrow’s economic momentum will gather.

Overall hiring market: After a noticeable rebound in new job postings on BOSS Zhipin during March–April 2025, momentum tapered off as the traditional summer lull set in

May and June saw slower growth, and July remained sluggish.

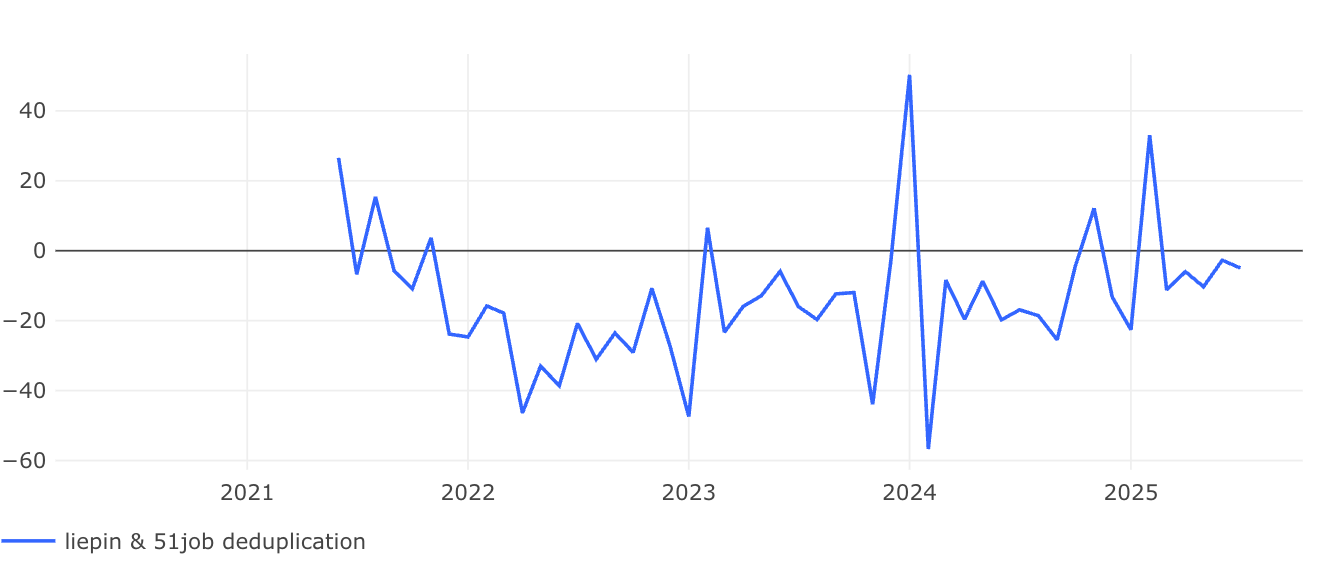

New listings have yet to find a floor, continuing to decline year-on-year.

Enterprise-size divergence

Below, we break down the currents shaping China’s labor market—by company size, graduate hiring, and city tier—then share our latest read on salary expectations. This analysis is available exclusively to paid subscribers.